Economy

Alta Semper Quits Egypt’s Macro Group Pharmaceuticals

By Aduragbemi Omiyale

After the successful competition of its initial public offering (IPO), Alta Semper Capital has exited Macro Group Pharmaceuticals, a leading cosmeceuticals manufacturer in Egypt.

Since Macro Group became a portfolio holding of Alta Semper in 2017, the latter has supported the former in nearly doubling its market share.

Today, its diversified portfolio encompasses 112 products across a variety of high-growth therapeutic areas, with Alta Semper boosting Macro’s top line to $27 million by the end of 9 months of 2021, three times its 2017 revenues, while ensuring profitability and increasing its EBITDA and bottom-line to $11 million and $10 million respectively during the same period, nearly 3x its 2017 levels.

It was learned that shares of Macro Group began trading on February 10, 2022, in a Reg S, 144 A initial public offering under the symbol MCRO:CA on the Egyptian Exchange and the final offer price stood at EGP 4.85 per ordinary share or 2.8 bn EGP (equivalent to $178 million).

The co-founder and CEO of Alta Semper, Afsane Jetha, while commenting on the development, stated that, “We are proud of our successful journey with Macro Pharmaceuticals and its tremendous growth on the financial, operational, organizational and social impact level during the tenor of our partnership.

“It has been a pleasure working alongside such a skilled and motivated management team as they established a leadership position in Egypt’s burgeoning cosmeceutical space, and we congratulate them on their continued success.”

On his part, the Managing Director and Head of North Africa for Alta Semper, Mr Ahmed Rady, who also serves as Vice Chairman of Macro Group, disclosed that, “Since our investment in 2017, we have worked alongside Macro’s relentless management team to supercharge sustainable growth, expand operating margins, and lay the foundations for a more impressive future.

“We have successfully grown gross profit margin from 63% in 2018 to 80% in 9M 2021, grown EBITDA margin from 21% in 2018 to 41% in 9M 2021, and have achieved an impressive EBITDA CAGR of 89% over the period of 2018 to 2020. In an industry that is witnessing transformational growth, we believe Macro Group will continue to shape what is a thriving and rapidly expanding market.”

Alta Semper’s shareholder base has played a strategic role in improving Macro Group’s financial capabilities, as well as its sustainability and governance practices.

The firm’s investors include institutions such as the International Finance Corporation, the investment arm of the World Bank, IDI Emerging Markets, and Mbuyu Capital Partners, in addition to expert individuals such as former Citigroup Chairman Richard Parsons and businessman and philanthropist Ronald Lauder, heir to the Estée Lauder cosmetics company.

“It is gratifying to see this positive investment outcome for a company dedicated to improving quality of life for millions of Egyptians,” said Richard Parsons, Founding Shareholder and Chairman of the Investment Committee of Alta Semper. “We have a longstanding commitment to investing on the African continent for positive change. The success of Macro Group is emblematic of the type of outcome we seek.”

Ronald Lauder, a Founding Shareholder of Alta Semper, added that “Our mission as investors is to advance entrepreneurial activity across Africa in a manner that serves as a catalyst for sustainable development and broadly improves the quality of life on the continent.”

Macro Chairman and Co-founder, Dr. Ahmed El Nayeb, concluded “I am extremely proud of the organization we have built over the last 18 years, from its humble beginnings to becoming the market leader in Egypt’s cosmeceutical space and the first of its kind to go public in Egypt. The IPO marks yet another significant milestone for our business and we will continue to deliver on our vision of regional leadership within the cosmeceuticals and nutraceuticals space.”

Alta Semper has overseen Macro Group’s Environmental, Social and Governance enhancements, which has resulted in increased female workforce representation with women comprising 42% of total staffing and occupying 18% of senior management positions.

Community outreach through Medical Convoys in collaboration with the Egyptian Ministry of Health has directly benefitted over 8,000 patients since 2017. With an eye on Sustainable Development Goals, the Company has been able to deploy training programs outside of the urban centre of Cairo, across more rural areas in Upper Egypt and the Delta.

In tandem, Environmental practices have been improved through energy efficiency initiatives, waste minimization and switching to raw materials with a lower environmental impact. Macro remains committed to enhancing its ESG practices as well as striving to contribute to the enhanced achievement of the Sustainable Development Goals in the years to come.

Learn more at www.altasemper.com.

Economy

Subscription for FGN Savings Bonds Opens for March 2026 at 13.9%

By Aduragbemi Omiyale

The Debt Management Office (DMO) has asked retail investors interested in investing in the FGN savings bonds to begin to talk to their financial advisers.

This is because subscription for the retail bonds for March 2026 has commenced and will close on Friday, March 6, according to a circular issued by the agency on Monday.

The debt office is selling two tenors of the debt instrument, with the shorter note maturing in two years’ time and the longer maturing a year later.

Details of the notice showed that the two-year paper is being offered at a coupon of 12.906 per cent, and the three-year paper at 13.906 per cent.

Both notes are sold at a unit price of N1,000, with a minimum subscription of N5,000 and in multiples of N1,000 thereafter, subject to a maximum subscription of N50 million. They can be purchased via approved stockbroking firms in Nigeria.

The FGN savings bond qualifies as a security in which trustees may invest under the Trustee Investment Act. It also serves as government securities within the meaning of the Company Income Tax Act (CITA) and the Personal Income Tax Act (PITA) for tax exemption for pension funds, amongst other investors.

It can be used as a liquid asset for liquidity ratio calculation for banks, and is listed on the Nigerian Exchange (NGX) Limited for trading at the secondary market.

The bond is backed by the full faith and credit of the Federal Government of Nigeria (FGN) and charged upon the general assets of the country.

Economy

Nigeria Splits OPL 245 into Four Blocks for Eni, Shell

By Adedapo Adesanya

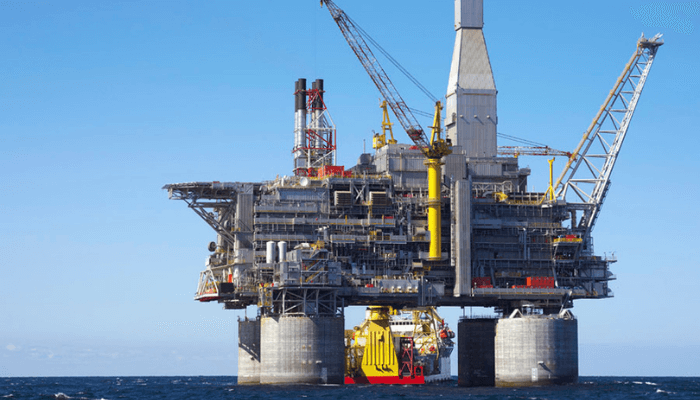

Nigeria has broken up the OPL 245 oil block into four new assets to be operated by Eni and Shell, potentially settling the future of the field at the centre of one of the oil industry’s biggest historic corruption trials.

According to Reuters, the agreement clears the way for the development of OPL 245, one of Nigeria’s biggest deepwater reserves that has remained untapped for almost three decades amid overlapping lawsuits in multiple countries.

The final contracts are expected to be signed starting Monday, the report said, citing a source familiar with the situation.

The Nigerian government had signalled for years that it was keen to find a solution that would bring the block into production. The source wished to remain anonymous as they are not authorised to comment on government policy before an official announcement.

Located in the Niger Delta’s deepwaters, the field has languished since its initial award in 1998 to Malabu Oil and Gas, a shadowy firm controlled by Mr Dan Etete, Nigeria’s oil minister at the time. The block is estimated to hold up to 9 billion barrels of oil equivalent in reserves—enough to rival Nigeria’s entire proven reserves if fully developed.

Mr Etete controversially awarded the lucrative licence to his own company for a nominal $20 million fee, sparking immediate controversy over conflicts of interest.

The saga escalated in 2011 when Malabu sold its rights to a Shell-Eni joint venture for $1.3 billion.

Italian and Nigerian prosecutors alleged that over $1 billion of that sum was siphoned off through bribes to politicians, middlemen, and Mr Etete himself, including hefty payments to then-President Goodluck Jonathan’s associates.

The two European energy giants and some of their former and current executives, including Eni CEO, Mr Claudio Descalzi, faced trial in Italy but all were acquitted in 2021, having denied all wrongdoing.

Shell and Eni have consistently denied wrongdoing, insisting the payments complied with due diligence.

The anti-graft agency, the Economic and Financial Crimes Commission (EFCC), has pursued parallel probes, recovering over $200 million in frozen funds, but progress stalled amid political shifts.

Operations at the Nigerian oil block have been halted for more than a decade by a series of trials and competing legal claims.

In 2023, the federal government withdrew civil claims totalling $1.1 billion against Eni, ending the long battle.

Economy

Dangote Refinery, NNPC Raise Petrol Pump Price by N100

By Modupe Gbadeyanka

The price of Premium Motor Spirit (PMS), otherwise known as petrol, has been increased by at least N100 per litre at the pump.

This followed the recent increase in the price of crude oil in the global market as a result of the bombardment of Iran by the United States and Israel over the weekend.

The air strikes killed the Supreme Leader of Iran, Mr Ayatollah Ali Khamenei, and several others.

Iran has responded by firing missiles at US facilities in some Gulf countries, including Saudi Arabia, Qatar, Kuwait, Bahrain, the UAE, and others.

Crude oil prices rose to about $80 per barrel on the market from about $70 per barrel before the Middle East crisis.

Oil marketers in Nigeria have responded to the tension and have raised the prices of petroleum products.

At most MRS Oil retail stations in Lagos, the new price notice showed an increase of about N100 per litre.

As of Monday, the price of PMS was N837 per litre, but on Tuesday morning, it had changed to N938 per litre, while at NNPC retail stations, it was N930 per litre instead of the previous N830 per litre.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn