Economy

Insightful IronFX Broker Review 2023 Compiled By Experts

IronFX, a renowned company in the online trading industry, has garnered a strong client base spanning 180 countries. It caters to both individual and corporate clients and is highly regarded for its cutting-edge technological advancements in trading platforms and tools. Being a prominent player in the field, IronFX offers global online trading facilities, featuring an extensive selection of more than 300 instruments spanning across six asset categories, all accessible through the state-of-the-art MT4 platform.

The recently published 2023 IronFX broker review by Traders Union showcases the company’s remarkable growth since its establishment in 2010 by a team of experts in finance and software development. These advancements serve as a testament to IronFX’s unwavering dedication to excellence and continuous innovation, solidifying its position as a leading force in the global online trading arena.

TU expert review of IronFX

According to experts from Traders Union, their longstanding partnership with IronFX has solidified the broker’s reputation as a reliable and trustworthy entity that consistently fulfills its obligations. IronFX caters to a diverse clientele, offering account options that suit both inexperienced traders and seasoned professionals. The broker’s website is designed with user-friendliness in mind, featuring a multilingual interface and providing extensive and detailed information about trading conditions. As a component of the trading journey with IronFX, customers gain entry to a diverse array of financial instruments encompassing currencies, metals, indices, commodities, futures, and stocks.

In-depth analysis of IronFX

According to TU analysts, their review of IronFX showcases the broker’s dedication to providing favorable trading conditions on a global scale. Here are the key points highlighted:

- IronFX has attracted a substantial customer base, with over 1.2 million traders having established accounts with the broker.

- The company offers round-the-clock customer support and personalized assistance from dedicated account managers.

- IronFX has received recognition in the form of more than 30 local and international awards during its 10 years of operation.

- By utilizing IronFX, traders unlock a varied selection of trading instruments, encompassing both standard and exotic currency pairs, as well as stocks, metals, and commodities.

- The platform offers a wide selection of over 300 trading assets for clients to choose from.

- IronFX caters to active traders and provides comprehensive functionality and comfortable trading conditions suitable for both beginners and professionals.

- IronFX offers a wide array of account options tailored to different needs and preferences. These include a demo account for practice purposes, micro-accounts designed for beginners, and classic and professional accounts equipped with an STP/ECN mechanism to ensure swift order execution.

Best alternatives to IronFX

Traders Union has conducted an analysis and identified several viable alternatives to IronFX, offering a diverse range of trading options for interested traders.

RoboForex

RoboForex is a highly regarded broker known for its extensive selection of assets, encompassing forex, stocks, indices, and cryptocurrencies. The broker accommodates traders of all skill levels, thanks to its low minimum deposit requirement. In addition, RoboForex stands out by offering copy trading services, allowing novice traders to benefit from the expertise of experienced traders and learn from their strategies.

Pocket Option

Pocket Option is a regulated broker recognized for its attractive low market entry, enabling traders to start with a minimum deposit of just $5. The broker places emphasis on social trading, providing avenues for passive income generation by allowing traders to copy successful trading strategies. Pocket Option is regulated by FMRRC, ensuring a certain level of security and reliability for traders.

Pepperstone

It is to be noted that, experts at Traders Union recommend exploring Pepperstone as a reputable broker, known for providing investors with competitive trading conditions and an extensive range of financial instruments. The broker operates under the strong regulation of reputable authorities such as ASIC and FCA, ensuring a secure trading environment for clients. Traders can take advantage of tight spreads, fast execution, and gain access to advanced trading platforms such as MetaTrader and cTrader when choosing Pepperstone as their broker.

Conclusion

Traders Union’s 2023 IronFX review showcases the broker’s growth, innovative platforms, and commitment to excellence. IronFX offers a wide range of instruments, multilingual support, and favorable ratings. Alternatively, RoboForex, Pocket Option, and Pepperstone provide diverse options with unique features. For more details, visit Traders Union’s official website.

Economy

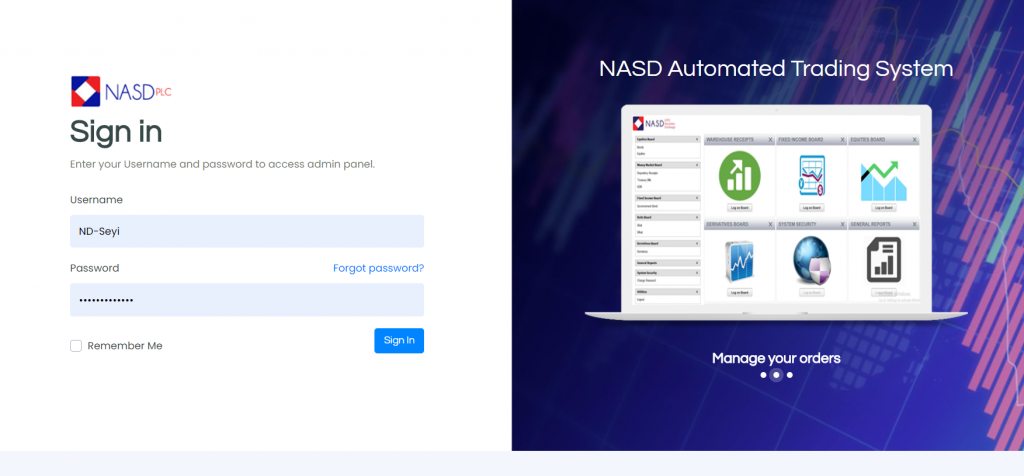

NASD Exchange in Red for Third Straight Session After 0.15% Fall

By Adedapo Adesanya

For the third straight session, the NASD Over-the-Counter (OTC) Securities Exchange closed bearish, further losing 0.15 per cent on Thursday amid weak demand for unlisted stocks.

During the session, the NASD Unlisted Security Index (NSI) declined by 5.70 points to 3,908.67 points from 3,914.37 points, and the market capitalisation lost N3.41 billion to end N2.338 trillion compared with the N2.342 trillion it ended on Wednesday.

The alternative stock exchange suffered a loss despite having more price gainers than price losers, with five for the former and four for the latter.

Okitipupa Plc lost N10.00 to close at N250.00 per unit versus midweek’s N260.00 per unit, Central Securities Clearing System (CSCS) Plc depreciated by N4.98 to N64.92 per share from N69.90 per share, Industrial and General Insurance (IGI) Plc dropped 4 Kobo to sell at 50 Kobo per unit compared with the previous day’s 54 Kobo per unit, and Acorn Petroleum Plc moderated by 1 Kobo to N1.32 per share from N1.33 per share.

Conversely, 11 Plc gained N13.65 to quote at N276.55 per unit versus the preceding session’s N263.00 per unit, FrieslandCampina Wamco Nigeria Plc appreciated by N6.10 to N84.15 per share from N78.05 per share, Food Concepts Plc expanded by 32 Kobo to N3.60 per unit from N3.28 per unit, Geo-Fluids Plc improved by 30 Kobo to N3.60 per share from N3.30 per share, and First Trust Mortgage Bank Plc increased by 10 Kobo to N1.09 per unit from 99 Kobo per unit.

Yesterday, the volume of transactions surged 2,797.1 per cent to 45.8 million units from 1.6 million units, the value of transactions jumped 315.2 per cent to N208.2 million from N50.1 million, and the number of deals soared 18.2 per cent to 39 deals from 33 deals.

At the close of business, CSCS Plc remained the most active stock by value (year-to-date) with 32.6 million units worth N1.9 billion, followed by Geo-Fluids Plc with 117.4 million units valued at N463.1 million, and Resourcery Plc with 1.05 billion units exchanged for N408.6 million.

Resourcery Plc ended the session as the most traded stock by volume (year-to-date) with 1.05 billion units sold for N408.6 million, trailed by Geo-Fluids Plc with 117.4 million exchanged for N463.1 million, and CSCS Plc with 32.6 million units traded for N1.9 billion.

Economy

Bulls Reaffirm Control of Nigeria’s Stock Exchange With 1.39% Surge

By Dipo Olowookere

Sell-offs in energy stocks could not bring down Nigeria’s stock exchange on Thursday, as the gains recorded by the others sustained the upward momentum.

Yesterday, the Nigerian Exchange (NGX) Limited further appreciated by 1.39 per cent on the back of a strong appetite for domestic equities, which are gaining traction among investors.

The banking index grew by 2.63 per cent, the consumer goods sector appreciated by 054 per cent, the insurance counter improved by 0.50 per cent, and the industrial goods space rose by 0.29 per cent, while the energy industry fell by 0.11 per cent.

When the bourse closed for the day, the All-Share Index (ASI) pointed northwards by 2,645.61 points to settle at 193,073.57 points compared with the previous day’s 190,427.96 points, and the market capitalisation soared by N1.698 trillion to N123.934 trillion from N122.236 trillion.

The trio of Deap Capital, Okomu Oil, and Fortis Global Insurance appreciated by 10.00 per cent each to N6.93, N1,459.70, and 55 Kobo apiece, while the duo of Infinity Trust Insurance and Zichis gained 9.96 per cent each to settle at N14.35, and N15.79, respectively.

On the flip side, the quartet of Tripple G, Multiverse, Secure Electronic Technology, and McNichols lost 10.00 per cent each to quote at N5.40, N25.20, N1.80, and N8.28, respectively, while Meyer declined by 9.80 per cent to N20.70.

Business Post reports that there were 52 appreciating equities and 26 depreciating equities on Thursday, showing a positive market breadth index and strong investor sentiment.

The busiest stock yesterday was Japaul with 80.1 million units valued at N293.3 million, Secure Electronic Technology sold 71.8 million units worth N136.5 million, Mutual Benefits transacted 58.7 million units for N277.6 million, Zenith Bank exchanged 53.2 million units valued at N4.5 billion, and GTCO traded 52.6 million units worth N6.2 billion.

Unlike the preceding session, the activity chart was in red after market participants transacted 898.5 million shares for N38.5 billion in 61,953 deals compared with the 3.7 billion shares worth N61.9 billion traded in 68,693 deals at midweek, implying a decline in the trading volume, value, and number of deals by 75.72 per cent, 37.80 per cent, and 9.81 per cent apiece.

Economy

Naira Fall 0.24% to N1,341/$1 at Official FX Window

By Adedapo Adesanya

The Naira depreciated further against the Dollar in the Nigerian Autonomous Foreign Exchange Market (NAFEX) on Thursday, February 19, by N3.24 or 0.24 per cent to N1,341.35/$1 from the N1,338.11/$1 it was traded a day earlier.

However, it improved its value against the Pound Sterling in the official market during the session by N11.16 to sell for N1,805.86/£1 compared with the previous day’s N1,817.02/£1, and gained N7.83 against the Euro to close at N1,577.29/€1 versus Wednesday’s closing price of N1,585.12/€1.

At the GTBank forex counter, the Naira lost N2 against the greenback to settle at N1,349/$1 compared with the N1,347/$1 it was exchanged at midweek, and at the black market, the exchange rate remained unchanged at N1,370/$1.

The performance of the domestic currency in the spot market was weak yesterday amid prevailing dynamics of supply and demand, as the Central Bank of Nigeria (CBN) maintains its efforts to stabilise the foreign exchange market. The exchange rate remained within the expected range, lifted by strong forex inflows and central bank dollar sales to Bureaux de Change (BDC) operators.

Meanwhile, the cryptocurrency market remained bearish, as there was continued caution in coins amid shaky interest in the digital assets.

On the policy front, there were tentative signs of progress on the digital asset market structure bill. The White House hosted talks between crypto industry representatives and bankers, which yielded incremental movement, though no compromise has yet emerged.

Ripple (XRP) declined by 1.7 per cent to $1.39, Litecoin (LTC) went down by 1.3 per cent to $52.46, Cardano (ADA) dropped 0.8 per cent to trade at $0.2715, Dogecoin (DOGE) retreated by 0.7 per cent to $0.0978, and Ethereum (ETH) contracted by 0.2 per cent to $1,943.30.

On the flip side, Solana (SOL) appreciated by 0.8 per cent to $82.12, Bitcoin improved its value by 0.7 per cent to $66,854.86, and Binance Coin (BNB) chalked up 0.1 per cent to sell for $605.58, while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) closed flat at $1.00 each.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn