Economy

Unveiling The Best Forex Traders In Nigeria: Who Tops The List In 2023?

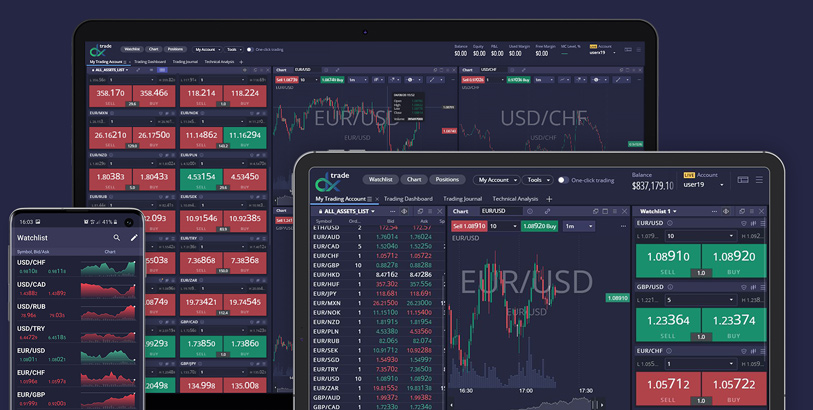

Forex trading has become a big deal in Nigeria over recent years, with many seeing it as a good way to make money. With Nigeria’s large population, there are a lot of people who might want to try their hand at it. Already, over two million Nigerians are involved in trading on this huge global market where trillions of dollars change hands daily. For those looking to get into it, following the lead of the best Forex traders in Nigeria can be super helpful. That’s why the folks at Traders Union (TU) have put together a list of the best Forex traders in Nigeria for you to check out.

Nigeria’s top Forex millionaires

TU’s experts have identified the big players in Nigeria’s Forex scene, and here’s a quick rundown:

- Uche Paragon – this top trader from Lagos is worth over $20 million and even runs his own trading businesses.

- Dapo Willis – a $10 million net worth and a connection with billionaire Aliko Dangote.

- Ejimi Adegbeye – young and talented, Ejimi started trading at 19 and now boasts $5 million to his name.

- Damilare Ogundare – also known as HabbyFX, Dami’s trading genius is worth a cool $5 million.

- Jeffrey Benson – this law graduate turned trader has a net worth of $1.5 million.

- Patrick Ogagbor – from bank worker to Forex pro, Patrick turned his $200 start to a current worth of $600,000.

If you’re inspired by Forex trading in Nigeria, these are the names to know!

Top tips for Forex’s success in Nigeria

To master Forex trading in Nigeria, check out a simple guide from the Syndicate’s experts to start your journey:

- Choose a regulated broker: it keeps your money safe and your trading honest.

- Practice first: use a demo account to refine your strategy without risks.

- Be wise with leverage: high leverage can mean big profits or big losses. Start low.

- Focus on major pairs: pairs like EUR/USD and USD/JPY are among the most traded and reliable.

- Set a stop-loss: decide beforehand how much you’re willing to lose on a trade and set an automatic exit point.

Remember, patience and smart strategies pave the way to Forex’s success!

Common beginner trading blunders

Stepping into the trading world? Here’s a quick heads-up! TU’s analysts have highlighted some typical slip-ups newbie traders often fall into:

- No clear plan – trading without a roadmap can lead you astray.

- Holding onto losses – don’t wait forever hoping the market will turn.

- Misusing leverage – it can boost profits but can also intensify losses.

- Ignoring risk-to-reward – always weigh if potential earnings justify the risks.

- Being overly emotional – letting feelings guide trades often leads to rash decisions.

Remember, everyone makes mistakes. The key is to learn from them and trade wisely!

Forex trading in Nigeria

Forex trading is allowed in Nigeria. But, experts at Traders Union point out that it’s not as regulated as one might hope. While the Central Bank of Nigeria keeps an eye on financial markets, online retail trading often slips through the cracks. This means traders need to be extra careful and watch out for dodgy brokers or scams.

Conclusion

Forex trading in Nigeria is a world where seasoned professionals like Uche Paragon and Ejimi Adegbeye have carved niches for themselves, setting standards for newcomers. But as with any high-reward venture, the risks are equally potent. TU, through its diligent analysts and experts, sheds light on both the promises and risks of Nigeria’s Forex market. From highlighting the champions of one to laying out foundational trading tips to sounding alarms on potential risks, the experts provide a comprehensive lens to navigate this dynamic domain. Aspiring traders would do well to heed this advice, ensuring they tread with caution and strategy, always prioritizing knowledge over impulse.

Economy

FG, States, Local Councils Share N1.969trn FAAC Allocation

By Adedapo Adesanya

A total of N1.969 trillion was shared to the federal government, the 36 state governments and the 774 local government councils from the gross revenue of N2.585 trillion generated by the nation in December 2025.

The money was disbursed to the three tiers of government at the January 2026 Federation Account Allocation Committee (FAAC) meeting held in Abuja.

In a statement issued on Monday by the Director of Press and Public Relations in the Office of the Accountant-General of the Federation (OAGF), Mr Bawa Mokwa, it was stated that the FAAC allocation comprised statutory revenue of N1.084 trillion, distributable Value Added Tax (VAT) revenue of N846.507 billion, and Electronic Money Transfer Levy (EMTL) revenue of N38.110 billion.

“Total deduction for cost of collection was N104.697 billion, while total transfers, refunds, and savings were N511.585 billion,” the statement partly read.

It was also revealed that from the N1.969 trillion total distributable revenue, the federal Government received the sum of N653.500 billion, and the state governments received N706.469 billion, the local government councils received N513.272 billion, and the sum of N96.083 billion was shared with the benefiting state as 13 per cent derivation revenue.

He said of the N1.084 trillion distributable statutory revenue, the central government received N520.807 billion, the state governments got N264.160 billion, the local councils were given N203.656 billion, and N96.083 billion was shared to the benefiting states as 13 per cent derivation revenue.

FAAC noted that from the N846.507 billion distributable VAT earnings, the federal government got N126.976 billion, the state governments received N423.254 billion, and the local government councils got N296.277 billion.

From the revenue from EMTL, Mr Mokwa explained that the national government was given N5.717 billion, the state governments got N19.055 billion, and the councils collected N13.338 billion.

He added that the companies’ Income Tax (CIT)/CGT and STD, Import Duty and Value Added Tax (VAT) increased significantly in December, while oil and gas royalty, CET levies and fees increase marginally, with excise duty, Petroleum Profit Tax (PPT)/Hydrocarbon Tax (HT), and EMTL considerably down.

Economy

Oil Exports to Drop as Shell Commences Maintenance on Bonga FPSO

By Adedapo Adesanya

Nigeria’s oil exports will drop in February following the shutdown of the Bonga Floating Production Storage and Offloading (FPSO) vessel scheduled for turnaround maintenance.

Shell Nigeria Exploration and Production Company (SNEPCo) Limited confirmed the development in a statement issued, adding that gas output will also decline during the maintenance period.

This comes as SNEPCo begun turnaround maintenance on the Bonga FPSO, the statement signed by its Communications Manager, Mrs Gladys Afam-Anadu, said, describing the exercise as a statutory integrity assurance programme designed to extend the facility’s operational lifespan.

SNEPCo Managing Director, Mr Ronald Adams, said the maintenance would ensure safe, efficient operations for another 15 years.

“The scheduled maintenance is designed to reduce unplanned deferments and strengthen the asset’s overall resilience.

“We expect to resume operations in March following completion of the turnaround,” he said.

Mr Adams said the scope included inspections, certification, regulatory checks, integrity upgrades, engineering modifications and subsea assurance activities.

“The FPSO, about 120 kilometres offshore in over 1,000 metres of water, can produce 225,000 barrels of oil daily.

“It also produces 150 million standard cubic feet of gas per day,” he said.

He said maintaining the facility was critical to Nigeria’s production stability, energy security and revenue objectives.

Mr Adams noted that the 2024 Final Investment Decision on Bonga North increased the importance of the FPSO’s reliability. He said the turnaround would prepare the facility for additional volumes from the Bonga North subsea tie-back project.

According to him, the last turnaround maintenance was conducted in October 2022.

“On February 1, 2023, the asset produced its one billionth barrel since operations began in 2005,” Mr Adams said.

SNEPCo operates the Bonga field in partnership with Esso Exploration and Production Nigeria (Deepwater) Limited and Nigerian Agip Exploration Limited, under a Production Sharing Contract with the Nigerian National Petroleum Company (NNPC) Limited.

The last turnaround maintenance activity on the FPSO took place in October 2022. On February 1, the following year, the asset delivered its 1 billionth barrel of oil since production commenced in 2005.

Economy

Nigeria Earns N1.17trn from Petroleum Sector in November 2025

By Adedapo Adesanya

Nigeria earned N1.17 trillion from the oil and gas industry in November 2025, lower than the N1.396 trillion generated in October 2025 by 16.2 per cent, according to data presented to the Federation Account Allocation Committee (FAAC) by the Central Bank of Nigeria (CBN).

The CBN, in the latest data available, noted that the N1.17 trillion earnings from the petroleum industry in November 2025 represented 96.4 per cent of the N1.214 trillion revenue budgeted for the sector for the month under review.

In comparison, revenue from the petroleum industry in October 2025 represented 94.71 per cent of the N1.474 trillion budgeted for the sector in the month.

In its breakdown of revenue from the oil and gas industry in November 2025, the central bank stated that the country earned N37.134 billion from crude oil sales, climbing by 395.58 per cent from N7.493 trillion recorded in the previous month; while revenue from gas sales appreciated by 25.22 per cent to N7.265 billion in November, compared with N5.802 billion recorded in October 2025.

Furthermore, the CBN noted that revenue from crude oil royalties dipped by 25.6 per cent, from N790.086 billion in October 2025 to N587.865 billion in November; while miscellaneous oil revenue more than doubled to N1.356 billion, from N447.279 million in October 2025.

Also, it stated that royalties from gas dipped by 38.1 per cent to N9.405 billion in November, from N15.195 billion in October, while the country earned N51.842 billion from gas flare penalties in November 2025, down from N61.898 billion recorded in the previous month.

The apex bank added that revenue from companies’ income tax (CIT) from upstream oil industry operations stood at N106.106 billion in the month under review, as against N73.025 billion in October 2025.

It also stated that revenue from Petroleum Profit Tax (PPT) stood at N301.471 billion; rentals – N775.162 million; while taxes stood at N67.242 billion in November 2025; as against N242.621 billion, N3.197 billion, and N196.277 billion in October 2025.

In addition, the apex bank reported that from the country’s oil earnings in November 2025, N18.163 billion was deducted for 13 per cent refund on subsidy, priority projects and Police Trust Fund from 1999 to 2021; while N2.872 billion was deducted by the Nigerian National Petroleum Company (NNPC) Limited in respect of its 13 per cent management fee and frontier exploration fund.

It added that N26.401 billion was deducted and collected by the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) in October 2025, being four per cent cost of collection; while N49.768 billion was transferred to the Midstream and Downstream Gas Infrastructure Fund from gas flare penalties in the same month.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn