Economy

FBN Capital Asset Mgt Becomes 3rd Largest Mutual Fund Manager in Nigeria

By Quantitative Financial Analytics

In one of our earlier analysis, we did warn that unless FBN Capital Asset Management found a way to stem the trend in redemptions taking place in its flagship fund, the FBN Money Market Fund, that the fund manager would lose their position as the second largest mutual fund manager in Nigeria.

True to our prediction, that has just happened.

Analysts at Quantitative Financial Analytics have determined that going by the data just released by the Security and Exchange Commission (SEC), FBN Capital Asset Management is now in the third position in the ranking of mutual fund managers by AUM.

The second position has been taken over by FSDH Asset Management.

FBN Capital Asset Management lost that enviable position not due to lack of performance as our analysis reveals that all the funds under its management made profits in 2016 except FBN Fixed Income Fund.

Then and Now

Per available records, on December 31, 2015, FBN Capital Asset Management was solidly at the second position with 30.83% of the total mutual funds AUM under its management, only 0.41% shy of Stanbic IBTC Asset Management’s 31.24% AUM share as the industry leader and 17.8% more than the 13.03% AUM share held by FSDH Asset Management in the 3rd place. That was then, this is now.

As at December 30th 2016, FBN Capital Asset Management controlled 14.43% of mutual funds AUM, down 16.6% from previous year.

FSDH Asset Management now holds 15.52%, up 2.49% when compared with last year’s.

The positional loss was due to redemptions from FBN Money Market fund which recorded an estimated N48 billion in net outflow.

Unfortunately, the three new funds launched by the fund manager (FBN Nigeria Smart Beta Fund, FBN Nigeria Eurobond USD Fund Retail and Institutional) could not change the dynamics.

On the other hand, FSDH Asset Management assumed the second position because of a combination of marginal performance and an estimated net inflow of about N120 million.

Blame it on Yield Hungry Investors

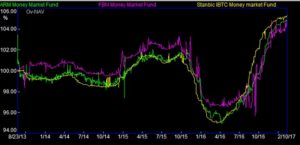

As noted in our earlier analysis, of the three largest money market mutual funds (FBN, ARM and Stanbic IBTC), FBN money market fund boasts of the lowest yield.

One thing about yield hunting Nigerian investors is that they love their yield and they go after it wherever it may be found.

Around October 2015, when FBN Money market fund offered the highest yield among money market funds and instruments, it became the largest fund in the industry by value. It was then valued at about N54 billion, but as its yield took a dive, so did its value and that of the Fund manager.

Diversification and Vulnerabilities

FBN Capital Asset Management currently manages 6 mutual funds which together represent about 14.4% of total mutual funds’ assets. 10.9% of the 14.4% is in the money market fund while FSDH Asset Management has 3 mutual funds whose total value represent 15.5% of total mutual fund asset. 13.8% of the 15.5% is in the UPDC Real Estate Investment fund. These two fund managers are therefore very vulnerable to the fortunes or otherwise of the single funds that make up a considerable portion of their AUM.

Reversal in Sight

The “tug of war” between FBN Capital Asset Management and FSDH Asset Management is not new. History has it that on March 27th 2015, FSDH was at the second position with 18.61% of mutual funds’ Assets while FBN held the 3rd position with 17.58% but by April 30th 2015, FBN had taken the second position.

It will not be a thing of surprise if FBN Capital Asset Management regains its second position in no distant time. We are watching.

Economy

MTN to Acquire Additional 75% Stake in IHS Holdings for Full Control

By Adedapo Adesanya

MTN Group, Africa’s largest mobile network operator, has entered advanced discussions to buy approximately 75 per cent of shares in IHS Holding Limited (IHS Towers) that it does not already own.

The move would give the South African telco full control of IHS, which is the leading independent tower operator in several of its key markets, providing colocation services and supporting the expansion of mobile networks in regions with growing demand for digital connectivity.

In a cautionary announcement to investors on Thursday, MTN confirmed it is considering a transaction to acquire the remaining stake in the New York Stock Exchange-listed IHS, following recent market speculation.

The potential offer price would be “at a level near the last trading price” of IHS shares on the NYSE as of February 4, 2025, a period when the stock has seen a sharp rise in recent months, reflecting renewed investor confidence in the sector.

No binding agreement has been reached, and MTN emphasised there is no certainty that the deal will proceed.

However, if completed, the transaction could materially impact MTN’s share price, prompting the company to advise shareholders to exercise caution in trading until further updates.

MTN already holds a significant stake in IHS and maintains a deep operational partnership across multiple African markets.

Over the past decade, MTN has sold thousands of passive network sites to IHS through sale-and-leaseback deals, including a major transaction in South Africa in 2022 involving over 5,700 towers.

These arrangements allowed MTN to free up capital from infrastructure while securing long-term tower access via master lease agreements.

A full buyout would represent a dramatic strategic pivot for MTN, effectively bringing tower infrastructure back in-house after years of outsourcing to specialised operators like IHS.

MTN has previously voiced concerns about corporate governance at IHS, adding context to its cautious approach in the announcement.

If the deal falls through, MTN said it would continue exploring options to unlock value from its IHS investment, consistent with its disciplined capital allocation strategy.

The potential acquisition underscores the evolving dynamics in Africa’s telecom infrastructure sector, where operators weigh the benefits of owning versus leasing critical assets amid rising data demands and economic pressures.

Economy

NASD Exchange Moves Higher by 0.77%

By Adedapo Adesanya

For the third consecutive trading session, the NASD Over-the-Counter (OTC) Securities Exchange ended in the green territory, rising further by 0.77 per cent on Thursday, February 5.

Two price gainers helped the bourse to rally during the session, with the market capitalisation up by N16.87 billion to N2.197 trillion from N2.180 trillion and the NASD Unlisted Security Index (NSI) up by 3.18 points to 3,672 points from the 3,644.48 points in the midweek session.

The advancers’ group was led by Central Securities Clearing System (CSCS), which added N3.70 to sell at N48.67 per share versus the previous day’s N44.97 per share, and Afriland Properties Plc expanded by N1.01 to N15.01 per unit from N14.01 per unit.

It was observed that the alternative stock exchange recorded two price losers led by Geo-Fluids Plc, which further lost 51 Kobo to sell at N4.75 per share versus Wednesday’s closing price of N5.26 per share, and Industrial and General Insurance (IGI) declined by 6 Kobo to 59 Kobo per unit from 65 Kobo per unit.

During the session, the volume of securities transacted by investors slid by 51.9 per cent to 1.2 million units from 2.5 million units, the value of securities went down by 32.0 per cent to N12.0 million from N17.7 million, and the number of deals increased by 27.8 per cent to 23 deals from 18 deals.

At the close of trades, CSCS Plc was the most traded stock by value on a year-to-date basis with 16.2 million units exchanged for N659.9 million, followed by FrieslandCampina Wamco Nigeria Plc with 1.7 million units traded for N117.8 million, and Geo-Fluids Plc with 12.3 million units valued at N79.1 million.

CSCS Plc remained the most active stock by volume on a year-to-date basis with 16.2 million units sold for N659.9 million, trailed by Mass Telecom Innovation Plc with 13.6 million units valued at N5.5 million, and Geo-Fluids Plc with 12.3 million units worth N79.1 million.

Economy

NGX Index Crosses 170,000 Points as Investors Sustains Buying Pressure

By Dipo Olowookere

The Nigerian Exchange (NGX) Limited recorded another milestone after it further closed higher by 1.18 per cent on Thursday amid renewed confidence in the market.

The All-Share Index (ASI) crossed the 170,000-point threshold during the session as it added 1,975.18 points to the preceding day’s 168,030.18 points to settle at 170,005.36 points.

Also yesterday, the market capitalisation of Customs Street was up by 1,268 trillion to N109.129 trillion from the N107.861 it ended a day earlier.

The growth recorded during the session was powered 55 equities, which outweighed the losses recorded by 19 other equities.

Guinea Insurance expanded by 10.00 per cent to N1.43, Seplat Energy grew by 10.00 per cent to N7,370.00, RT Briscoe increased by 9.95 per cent to N11.49, Neimeth chalked up 9.90 per cent to close at N11.10, and Zichis rose by 9.89 per cent to N6.11.

At the other side, Deap Capital lost 9.62 per cent to trade at N6.20, Universal Insurance slipped by 9.43 per cent to N1.44, Haldane McCall declined by 9.09 per cent to N4.00, Red Star Express went down by 9.04 per cent to N15.60, and UPDC depreciated by 7.02 per cent to N5.30.

Business Post reports that the energy index was up by 4.68 per cent, the industrial goods improved by 0.79 per cent, the banking space grew by 0.64 per cent, and the consumer goods sector soared by 0.11 per cent, while the insurance counter lost 0.31 per cent.

Yesterday, market participants traded 713.0 million stocks valued at N22.3 billion in 46,104 deals versus the 694.8 million stocks worth N20.6 billion transacted in 42,095 deals on Wednesday, showing a spike in the trading volume, value, and number of deals by 2.62 per cent, 8.25 per cent, and 9.52 per cent, respectively.

Access Holdings sold 106.6 million shares valued at N2.5 billion, Chams transacted 44.5 million equities worth N201.3 million, Champion Breweries traded 44.5 million stocks for N774.3 million, Universal Insurance exchanged 34.8 million shares worth N53.6 million, and Deap Capital sold 22.7 million equities valued at N141.9 million.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn