World

Insights into SPIEF 2024: Shifting Pathways Towards Global South

By Kestér Kenn Klomegâh

Conceptually, the idea of holding every year an international economic forum is unique to explore and navigate available potential opportunities generally for development and specifically for investment and trade. Established several years ago, the St. Petersburg International Economic Forum (SPIEF) has earned its unique achievements through organisational strategy and consistent approach toward this serious gathering.

While analysing several emerging reports, first and foremost it offers us to understand the significance of this platform. It provides a unique opportunity for politicians, investors and corporate business executives as well as the young generation to interact network and ask questions to opinion leaders or trade experts, and to get better acquainted with the changing trends, investment climate adherence to traditional values, and adapting to diversities in business culture on the global landscape.

At the initial formative stages, SPIEF’s focus was largely on the United States and Europe as conceptualized, the nucleus results must harmonise trade and financial flows, and reflect on economic growth. After the Soviets crumbled and what else, the rising frequency of shuttling to the United States and Europe – Russia’s dream of becoming part of Europe. But that has changed during the past few years primarily due to the ‘special military operation’ in Ukraine and due to the sudden geopolitical shift, the urge to move away from Global North to Global South. Without mincing words here, that is the undeniable reality.

President of the Russian Federation Vladimir Putin posted a greeting on his official website to the participants, organizers and guests underscoring the fact that the time has arrived to make the necessary departure away from the United States and Europe, and that “Russia is open to constructive dialogue and interaction with friendly partners” and strictly based on the principles of true equality, the consideration of each other’s legitimate interests, and respect for the cultural and civilizational diversity of states and peoples.

Putin has previously used his address to share his assessment of the global economy and highlight issues on the domestic business agenda. He pointed to the fact that it is not only essential to maintain a stable trajectory of qualitative growth but also to capitalize on emerging opportunities, effectively develop competitive advantages, and boost potential in the fields of science and technology. Given this, it is crucial to preserve and strengthen business and investment ties between countries within the context of multipolar conditions.

The fact remains that Putin’s position overwhelmingly reflects the shift away from the post-Soviet dream of becoming part of prestigious Europe. As evolving developments show, the only alternative left for Russia is to become an indivisible part of Asia, an integral constituent of the Global South. Russia has invited Asian and African countries under the tagline: ‘The Foundation of New Areas of Growth as the Cornerstone of a Multipolar World’ at the 27th gathering June 6 to 8 in St. Petersburg, the second largest city in the Russian Federation.

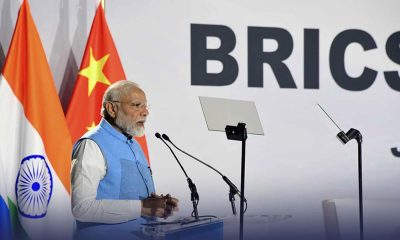

By Russia’s BRICS chairmanship, much of the business programme is devoted to issues related to long-term cooperation in spheres such as the financial and banking sectors, investment and trade, development of high technologies and pharmaceutical industry between BRICS members. China and India, the United Arab Emirates and Iran are prominent on the agenda. Ethiopia, Egypt and South Africa have their positions and expectations from SPIEF.

Currently, due to global rivalries combined with political and economic tensions, Russia faces new ambitious tasks, including perceptions over the development of a ‘public-private partnership’ as the macroeconomic situation remains the practical key mechanism of interaction between the state and business. Here, Russia is relatively lost in the standard practice of private businesses, after its century-long under socialism and communism. In an assessment, corporate businesses are still centrally controlled under the ministries and in the Kremlin. The learning process of analytical and the importance of ‘public-private partnership’ for now is just a daily business slogan and a theory being frequently chuckled in the Russian Federation.

The biggest obstacle is related to the analysis of legal rules and regulations, and now Russia’s relations with the Global South, its characteristic efforts in creating the necessary conditions for advancing and attracting investments and promoting trade between Russia and potential countries in Asia-Pacific and Africa. Beyond business networking and participating in practical seminars and masterclasses, ultimately results in signing agreements. On the other hand, according to expert analysts, multiple agreements highlight distinctive achievements by the St. Petersburg International Economic Forum.

“Stability and justice in a multipolar world are only possible if new centres of influence emerge, capable of offering their view on world problems and participating in the formation of a new world order. The development of new points of growth requires the active participation of different countries and regions that are ready to take responsibility for their future. The St. Petersburg International Economic Forum creates opportunities for discussions at the highest level, scaling ideas, solutions and initiatives to all spheres of social life and activities of the countries participating in its work,” said Anton Kobyakov, Adviser to the President of the Russian Federation, Executive Secretary of the SPIEF Organizing Committee.

According to Anton Kobyakov, about “6,000 people from more than 110 countries and territories have already confirmed their intention to participate in the forum. The international cooperation that occurs at SPIEF plays a key role in the development of mutually beneficial relations between countries and organizations. Participants share their experiences and make new connections. This builds trust between nations, expands markets, attracts investment, and creates a more favourable international economic environment. SPIEF is a platform for structured, focused dialogue between global business participants and government officials who contribute to the development of effective international cooperation.”

The programme consists of four (4) thematic tracks: “The Transition to a Multipolar World Economy”, “Goals and Objectives of Russia’s New Economic Cycle”, “Technologies for Leadership”, “A Healthy Society, Traditional Values and Social Development: The Priority of the State”. Roscongress Foundation, the organizer, has listed an international track which includes more than 10 business dialogues: EAEU–ASEAN, Russia–Africa, Russia–Latin America, Russia–China, Russia– South Africa, and other bilateral meetings.

More than 6,000 representatives of Russian and foreign businesses from over 3,000 companies located in 75 countries and territories took part in SPIEF 2023. More than 900 agreements worth a total of RUB 3,860 billion were signed (including 43 agreements with representatives of foreign companies, among them two with Italy and Spain.

In contrast, the SPIEF 2021 saw an unprecedented 890 agreements signed, eclipsing 2019’s 745 agreements worth a total of RUB 3.271 trillion. In addition, more than 150 international agreements were signed. That year, the total value of signed agreements not classed as confidential exceeded RUB 4.2666 trillion. Before Covid-19 was declared a pandemic in December, the SPIEF 2019 recorded 745 agreements signed totalling 3.271 trillion roubles.

The main theme of this year’s forum is “The Formation of New Areas of Growth as the Cornerstone of a Multipolar World” and the SPIEF 2024, as always, the business programme includes panel discussions, round tables, public talks, and speeches. President Vladimir Putin delivers the keynote address full of all directions, including establishing trends and external economic relations. The St. Petersburg International Economic Forum will be held on 5–8 June at the ExpoForum Convention and Exhibition Centre.

World

Ukraine Reveals Identities of Nigerians Killed Fighting for Russia

By Adedapo Adesanya

The Ukrainian Defence Intelligence (UDI) has identified two Nigerian men, Mr Hamzat Kazeem Kolawole and Mr Mbah Stephen Udoka, allegedly killed while fighting as Russian mercenaries in the war between the two countries ongoing since February 2022.

The development comes after Russia denied knowledge of Nigerians being recruited to fight on the frontlines.

Earlier this week, the Russian Ambassador to Nigeria, Mr Andrey Podyolyshev, said in Abuja that he was not aware of any government-backed programme to recruit Nigerians to fight in the war in Ukraine.

He said if at all such activity existed, it is not connected with the Russian state.

However, in a statement on Thursday, the Ukrainian Defence released photographs of Nigerians killed while defending Russia.

“In the Luhansk region, military intelligence operatives discovered the bodies of two citizens of the Federal Republic of Nigeria — Hamzat Kazeen Kolawole (03.04.1983) and Mbah Stephen Udoka (07.01.1988),” the statement read.

According to the statement, both men served in the 423rd Guards Motor Rifle Regiment (military unit 91701) of the 4th Guards Kantemirovskaya Tank Division of the armed forces of the Russian Federation.

UDI said that they signed contracts with the Russian Army in the second half of 2025 – the deceased Mr Kolawole on August 29 and Mr Udoka on September 28.

“Udoka received no training whatsoever — just five days later, on October 3, he was assigned to the unit and sent to the temporarily occupied territories of Ukraine,” the report read.

It added that no training records for Mr Kolawole have been preserved; however, it is highly likely that he also received no military training, but his wife and three children remain in Nigeria.

Both Nigerians, the report added, were killed in late November during an attempt to storm Ukrainian positions in the Luhansk region.

“They never engaged in a firefight — the mercenaries were eliminated by a drone strike,” UDI stated, warning foreign citizens against travelling to the Russian Federation or taking up any work on the territory of the “aggressor state”.

“A trip to Russia is a real risk of being forced into a suicide assault unit and, ultimately, rotting in Ukrainian soil,” the statement read.

In an investigation earlier this month, CNN reported that hundreds of African men have been enticed to fight for Russia in Ukraine with the promise of civilian jobs and high salaries. However, the media organisation uncovered that they are being deceived or sent to the front lines with little combat training.

CNN said it reviewed hundreds of chats on messaging apps, military contracts, visas, flights and hotel bookings, as well as gathering first-hand accounts from African fighters in Ukraine, to understand just how Russia entices African men to bolster its ranks.

World

Today’s Generation of Entrepreneurs Value Flexibility, Autonomy—McNeal-Weary

By Kestér Kenn Klomegâh

The Young African Leaders Initiative (YALI) is the United States’ signature step to invest in the next generation of African leaders. Since its establishment in 2010 by Obama administration, YALI has offered diverse opportunities, including academic training in leadership, governance skills, organizational development and entrepreneurship, and has connected with thousands of young leaders across Africa. This United States’ policy collaboration benefits both America and Africa by creating stronger partnerships, enhancing mutual prosperity, and ensuring a more stable environment.

In our conversation, Tonya McNeal-Weary, Managing Director at IBS Global Consulting, Inc., Global Headquarters in Detroit, Michigan, has endeavored to discuss, thoroughly, today’s generation of entrepreneurs and also building partnerships as a foundation for driving positive change and innovation in the global marketplace. Here are the excerpts of her conversation:

How would you describe today’s generation of entrepreneurs?

I would describe today’s generation of entrepreneurs as having a digital-first mindset and a fundamental belief that business success and social impact can coexist. Unlike the entrepreneurs before them, they’ve grown up with the internet as a given, enabling them to build global businesses from their laptops and think beyond geographic constraints from day one. They value flexibility and autonomy, often rejecting traditional corporate ladders in favor of building something meaningful on their own terms, even if it means embracing uncertainty and financial risk that previous generations might have avoided.

And those representing the Young African Leaders Initiative, who attended your webinar presentation late January 2026?

The entrepreneurs representing the Young African Leaders Initiative are redefining entrepreneurship on the continent by leveraging their unique perspectives, cultural heritage, and experiences. Their ability to innovate within local contexts while connecting to global opportunities exemplifies how the new wave of entrepreneurs is not confined by geography or conventional expectations.

What were the main issues that formed your ‘lecture’ with them, Young African Leaders Initiative?

The main issues that formed my lecture for the Young African Leaders Initiative were driven by understanding the importance of building successful partnerships when expanding into the United States or any foreign market. During my lecture, I emphasized that forming strategic alliances can help entrepreneurs navigate unfamiliar business environments, access new resources, and foster long-term growth. By understanding how to establish strong and effective partnerships, emerging leaders can position their businesses for sustainable success in global markets. I also discussed the critical factors that contribute to successful partnerships, such as establishing clear communication channels, aligning on shared goals, and cultivating trust between all parties involved. Entrepreneurs must be proactive in seeking out partners who complement their strengths and fill gaps in expertise or resources. It is equally important to conduct thorough due diligence to ensure that potential collaborators share similar values and ethical standards. Ultimately, the seminar aimed to empower YALI entrepreneurs with practical insights and actionable strategies for forging meaningful connections across borders. Building successful partnerships is not only a pathway to business growth but also a foundation for driving positive change and innovation in the global marketplace.

What makes a ‘leader’ today, particularly, in the context of the emerging global business architecture?

In my opinion, a leader in today’s emerging global business architecture must navigate complexity and ambiguity with a fundamentally different skill set than what was previously required. Where traditional leadership emphasized command-and-control and singular vision, contemporary leaders succeed through adaptive thinking and collaborative influence across decentralized networks. Furthermore, emotional intelligence has evolved from a soft skill to a strategic imperative. Today, the effective modern leader must possess deep cross-cultural intelligence, understanding that global business is no longer about exporting one model worldwide but about genuinely integrating diverse perspectives and adapting to local contexts while maintaining coherent values.

Does multinational culture play in its (leadership) formation?

I believe multinational culture plays a profound and arguably essential role in forming the kind of leadership required in today’s global business environment. Leaders who have lived, worked, or deeply engaged across multiple cultural contexts develop a cognitive flexibility that’s difficult to replicate through reading or training alone. More importantly, multinational exposure tends to dismantle the unconscious certainty that one’s own way of doing things is inherently “normal” or “best.” Leaders shaped in multicultural environments often develop a productive discomfort with absolutes; they become more adept at asking questions, seeking input, and recognizing blind spots. This humility and curiosity become strategic assets when building global teams, entering new markets, or navigating geopolitical complexity. However, it’s worth noting that multinational experience alone doesn’t automatically create great leaders. What matters is the depth and quality of cross-cultural engagement, not just the passport stamps. The formation of global leadership is less about where someone has been and more about whether they’ve developed the capacity to see beyond their own cultural lens and genuinely value differences as a source of insight rather than merely tolerating them as an obstacle to overcome.

In the context of heightening geopolitical situation, and with Africa, what would you say, in terms of, people-to-people interaction?

People-to-people interaction is critically important in the African business context, particularly as geopolitical competition intensifies on the continent. In this crowded and often transactional landscape, the depth and authenticity of human relationships can determine whether a business venture succeeds or fails. I spoke on this during my presentation. When business leaders take the time for face-to-face meetings, invest in understanding local priorities rather than imposing external agendas, and build relationships beyond the immediate transaction, they signal a different kind of partnership. The heightened geopolitical situation actually makes this human dimension more vital, not less. As competition increases and narratives clash about whose model of development is best, the businesses and nations that succeed in Africa will likely be those that invest in relationships characterized by reciprocity, respect, and long-term commitment rather than those pursuing quick wins.

How important is it for creating public perception and approach to today’s business?

Interaction between individuals is crucial for shaping public perception, as it influences views in ways that formal communications cannot. We live in a society where word-of-mouth, community networks, and social trust areincredibly important. As a result, a business leader’s behavior in personal interactions, their respect for local customs, their willingness to listen, and their follow-through on commitments have a far-reaching impact that extends well beyond the immediate meeting. The geopolitical dimension amplifies this importance because African nations now have choices. They’re no longer dependent on any single partner and can compare approaches to business.

From the above discussions, how would you describe global business in relation to Africa? Is it directed at creating diverse import dependency?

While it would be too simplistic to say global business is uniformly directed at creating import dependency, the structural patterns that have emerged often produce exactly that outcome, whether by design or as a consequence of how global capital seeks returns. Global financial institutions and trade agreements have historically encouraged African nations to focus on their “comparative advantages” in primary commodities rather than industrial development. The critical question is whether global business can engage with Africa in ways that build productive capacity, transfer technology, develop local talent, and enable countries to manufacture for themselves and for export—or whether the economic incentives and power irregularities make this structurally unlikely without deliberate policy intervention.

World

Russia Expands Military-Technical Cooperation With African Partners

By Kestér Kenn Klomegâh

Despite geopolitical complexities, tensions and pressure, Russia’s military arms and weaponry sales earned approximately $15 billion at the closure of 2025, according to Kremlin report. At the regular session, chaired by Russian President Vladimir Putin on Jan. 30, the Commission on Military and Technical Cooperation with Foreign Countries analyzed the results of its work for 2025, and defined plans for the future.

It was noted that the system of military-technical cooperation continued to operate in difficult conditions, and with increased pressure from the Western countries to block business relations with Russia. The meeting, however, admitted that export contracts have generally performed sustainably. Russian military products were exported to more than 30 countries last year, and the amount of foreign exchange exceeded $15 billion.

Such results provide an additional opportunity to direct funds to the modernization of OPC enterprises, to the expansion of their production capacities, and to advanced research. It is also important that at these enterprises a significant volume of products is civilian products.

The Russian system of military-technical cooperation has not only demonstrated effectiveness and high resilience, but has created fundamental structures, which allow to significantly expand the “geography” of supplies of products of military purpose and, thus strengthen the position of Russia’s leader and employer advanced weapons systems – proven, tested in real combat conditions.

Thanks to the employees of the Federal Service for Military Technical Cooperation and Rosoboronexport, the staff of OPC enterprises for their good faith. Within the framework of the new federal project “Development of military-technical cooperation of Russia with foreign countries” for the period 2026-2028, additional measures of support are introduced. Further effective use of existing financial and other support mechanisms and instruments is extremely important because the volumes of military exports in accordance with the 2026 plan.

Special attention would be paid to the expansion of military-technological cooperation and partnerships, with 14 states already implementing or in development more than 340 such projects.

Future plans will allow to improve the characteristics of existing weapons and equipment and to develop new promising models, including those in demand on global markets, among other issues – the development of strategic areas of military-technical cooperation, and above all, with partners on the CIS and the CSTO. This is one of the priority tasks to strengthen both bilateral and multilateral relations, ensuring stability and security in Eurasia.

From January 2026, Russia chairs the CSTO, and this requires working systematically with partners, including comprehensive approaches to expanding military-technical relations. New prospects open up for deepening military-technical cooperation and with countries in other regions, including with states on the African continent. Russia has been historically strong and trusting relationships with African countries. In different years even the USSR, and then Russia supplied African countries with a significant amount of weapons and military equipment, trained specialists on their production, operation, repair, as well as military personnel.

Today, despite pressure from the West, African partners express readiness to expand relations with Russia in the military and military-technical fields. It is not only about increasing supplies of Russian military exports, but also about the purchase of other weapons, other materials and products. Russia has undertaken comprehensive maintenance of previously delivered equipment, organization of licensed production of Russian military products and some other important issues. In general, African countries are sufficient for consideration today.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn