Economy

How Does The Software for Copy Trade MT5 Operate?

Trading systems have evolved over time, allowing for the buying and selling of various financial instruments with fewer interactions. As a result, processing time has been reduced, and efficiency has improved.

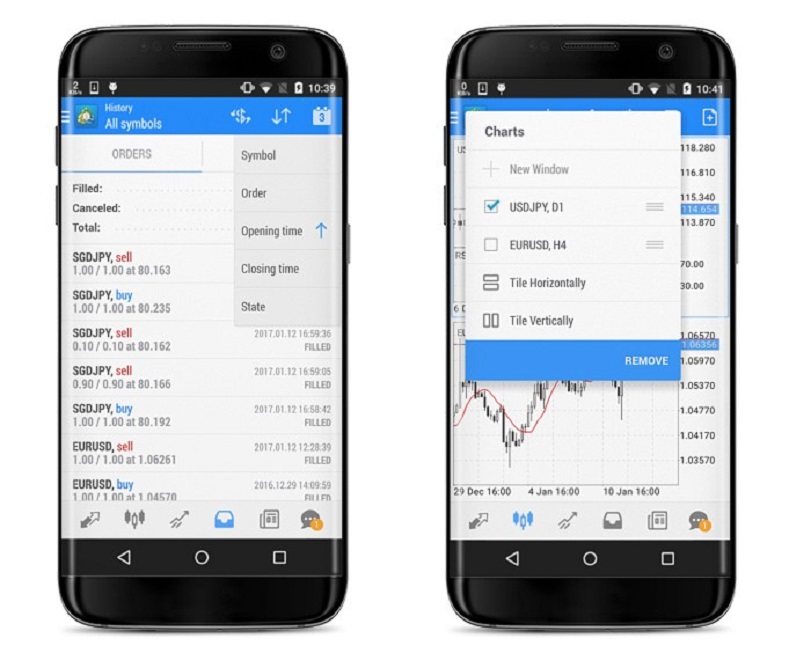

Investors can use digital trading platforms to engage with financial markets and discover different profit-generation methods. Additionally, using strategy copiers has made trading more efficient and automated.

MetaTrader is a well-known platform for managing investment portfolios and tracking successful traders. In this guide, we will explain the functionality of MT5 copy trade software and how to utilise it effectively.

Copy Trading Strategy Concept

Investors can utilise copy trading to explore various investment models and select the one that aligns with their preferences, trading style, and risk tolerance. Users can customise the parameters to suit their portfolio and objectives by choosing a particular strategy.

Different trading systems have their own unique approach, as well as markets and assets, providing diverse opportunities to optimise this sophisticated strategy.

Copy trading is a popular choice among beginners who want to avoid the risks of creating an imperfect trading strategy due to inexperience. Additionally, traders can pick a specific trading style and gradually improve it as they gain more knowledge and adapt to market fluctuations.

Why is MetaTrader 5 considered a Dependable Trading Platform?

Copy trading can be found on trading software other than MetaTrader, but other programs offer similar services. Despite this, there are several advantages to using MT5, such as the following:

Various Technical Indicators

Utilising technical indicators can be highly beneficial in comprehending past price fluctuations and predicting the future. Some of these indicators can be used to determine the optimal timing for entering or exiting the market concerning your trading position.

MT5 has 80 indicators that are already included in the system. An example of such an indicator is the RSI index, which can help determine an asset’s price momentum. It can also indicate whether an asset is being overbought or oversold.

Multiple Trading Signals

Traders receive notifications through signals that tell them when to execute specific orders, like buying or selling, based on market fluctuations. Signals can indicate noteworthy price changes or entry points that offer significant opportunities for gain.

Advanced Analysis Tools

Traders can benefit from the numerous charting options available in MetaTrader 5, which total around 100. These charts can provide valuable insights into past and current market movements and help predict future prices with precision.

MT5 also integrates modern technology trends like automation and algorithmic trading, simplifying the concurrent management of multiple positions.

Cross-device Compatibility

MetaTrader 5 can be accessed on various devices and operating systems. Opening a trading session is easy and convenient if you sign in through the web browser or download the program onto your mobile phone or laptop.

Verdict

Opting for copy trading software on MT5 is an intelligent approach to participating in financial markets and placing buy/sell orders by mimicking the actions of proficient investors.

MetaTrader 5 is a program well-suited for copy trading for various reasons. It is compatible with multiple devices and offers a wide range of signals and indicators that can help you achieve success in the financial

Economy

Customs to Fast-Track Cargo Clearance at Lekki Deep Sea Port

By Adedapo Adesanya

The Comptroller-General of the Nigeria Customs Service (NCS), Mr Adewale Adeniyi, has unveiled a Green Channel initiative at the Lekki Deep Sea Port as part of efforts to simplify cargo clearance, reduce delays, and improve operational efficiency for port users.

The launch marks a major step in customs’ drive to enhance trade facilitation through technology and stakeholder collaboration.

Speaking at the event in Lagos, Mr Adeniyi said the initiative was introduced by the Lekki Deep Sea Port and approved by NCS management to address persistent challenges in container stacking and examination at major ports, which often slow cargo processing.

“This particular intervention helps to move containers right from the vessel into a dedicated place where customers can have access. And between the time the container moves from the vessel to this particular place, it is tracked,” he said.

The customs boss explained that the Green Channel is designed to ensure seamless cargo movement through a dedicated corridor with minimal bureaucratic obstacles, enabling faster turnaround time for importers and other stakeholders.

He described the initiative as a product of mutual trust between the agency and its stakeholders, stressing that compliance and cooperation are essential to its success.

“What we have done today is a product of the kind of trust that we have invested in our stakeholders and the confidence that we also have in them, that they would do this in the spirit of compliance and trade facilitation,” he said.

Mr Adeniyi added that beyond easing port operations, the Green Channel supports Nigeria’s broader economic objective of building a more competitive trade environment, noting that the initiative is expected to reduce the cost and time required to do business, ultimately boosting revenue generation for the service.

Economy

Jim Ovia Denies Knowledge of Wealth Bridge Investment Scheme

By Aduragbemi Omiyale

The chairman of Zenith Bank Plc, Mr Jim Ovia, has dissociated himself from a video making the rounds, purporting that he has endorsed an investment scheme put together by Wealth Bridge.

In a statement, it was emphasised that the video of the businessman is fake, as he has no link with Wealth Bridge, which urged Nigerians to invest in the business.

The management of Zenith Bank has, therefore, advised the public to disregard videos circulated through the Greece Island Facebook handle.

The promoters of the investment scheme promised prospective customers up to N2 million in weekly returns on a contribution of N380,000.

But Zenith Bank stressed that any member of the public who conducts business with the entity does so at his or her risk, as claims in the video that the investment has the backing of the Central Bank of Nigeria (CBN) are untrue.

“The video redirects unsuspecting members of the public to an alleged Arise News webpage with the details of this scheme and an embedded registration portal for signups. This claim is also entirely false and has no connection whatsoever to the bank or its group chairman.

“For the avoidance of doubt, all the videos and promotional materials referenced above are FAKE and have nothing to do with Zenith Bank Plc or Dr Jim Ovia. The Group Chairman of Zenith Bank and the bank have no knowledge of the said investment scheme and have not entered into any partnership with the companies, individuals, or platforms behind these schemes.

“The general public is hereby advised to disregard these fraudulent communications. Anyone who engages with the Greece Island handle, Wealth Bridge, delicious sitee, AfriQuantumX, Stock market analyst 1, or any other entity on the basis of these fake videos and images published by impostors does so strictly at his or her own risk,” parts of the statement read.

Economy

FG to Review Six-Month Shea Export Ban

By Adedapo Adesanya

The federal government has assured stakeholders in the shea value chain that it would review the export ban on shea nuts, citing concerns over its impact on local producers, exporters and foreign exchange (FX) earnings.

On August 26, 2025, President Bola Tinubu directed a six-month temporary ban on the export of raw shea nuts.

According to NAN, the Minister of Industry, Trade and Investment, Mrs Jumoke Oduwole, at a stakeholders’ validation session on the ban on raw shea nuts exports in Nigeria on Thursday, said the ministry would brief the president after consultations across the value chain.

The Minister, at the gathering in Abuja, said the government recognises the right of citizens to earn a living and contribute to national development, adding that all inputs from stakeholders would be carefully reviewed and consolidated.

“All inputs from stakeholders will be carefully reviewed and consolidated before a decision is made on whether the ban should be extended immediately or deferred,” the Minister said, adding that, “The ministry will provide the president with factual and balanced information to guide further action.”

Mrs Oduwole said the ministry engaged widely with stakeholders to ensure all perspectives were considered in the ongoing policy deliberations.

The ministry, she said, received formal submissions from the umbrella association and held engagement sessions attended by various industry representatives.

The minister said the submissions were reproduced and circulated at the meeting to promote transparency and shared understanding.

“Relevant departments within the ministry worked jointly on the matter, and I personally reviewed the submissions to assess our position ahead of broader consultations,” she said.

In his remarks, the Minister of Agriculture and Food Security, Mr Abubakar Kyari, said the meeting was convened to review the ban objectively, underscoring the need for verified facts and transparency.

Mr Kyari said government decisions intend to protect jobs and encourage local value addition, adding that policies should be assessed holistically based on evidence and measurable impact.

Rationalising the ban last August, the Vice President, Mr Kashim Shettima, said while Nigeria produces nearly 40 per cent of the global Shea product, it accounts for only 1 per cent of the market share of $6.5 billion.

“This is unacceptable. We are projected to earn about $300 million annually in the short term, and by 2027, there will be a 10-fold increase. This is our target,” the VP stated.

He explained that the ban was a collective decision involving the sub-nationals and the federal government with clear directions for economic transformation in the overall interest of the nation, stressing that the “government is not closing doors; we are opening opportunities.”

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn