Economy

Selecting a Forex Turnkey Solution for Your Brokerage Business in 2024: Key Considerations

The exponential expansion and lucrative prospects within the Forex trading sector continue to attract numerous businesses annually. If you’re thinking of starting your own retail Forex brokerage, it’s important to understand all the unique merits offered by a Forex turnkey solution.

Let’s delve into the advantages associated with adopting such a solution and discuss pivotal factors while seeking the most fitting system tailored to your requirements in 2024.

Overview of Forex Turnkey Solutions

The concept of Forex turnkey solutions offers a comprehensive solution for enterprises aiming to establish a Forex brokerage with minimal effort and time investment. It encompasses secure payment gateways, access to modern technology, and guidance on regulatory compliance.

Within the turnkey Forex framework lie white-label platforms, social trading systems, risk management solutions, and automated trading modules, facilitating the swift establishment of an online Forex brokerage service without the need to construct it from the ground up.

Advantages of Utilising a Turnkey Solution for FX Brokerage Launch

An all-encompassing solution offers a wide variety of services and functionalities, assisting business owners in swiftly establishing their Forex brokerage with minimal initial expenses. This system offers numerous advantages during the inception of a new FX trading enterprise.

Accelerated Time-to-Market

A turnkey Forex solution is meticulously crafted to expedite your launch process. With this system, the entire setup procedures can be executed within days rather than weeks or months. This swifter setup duration can equip entrepreneurs with superiority over opponents who might still be dealing with constructing their infrastructure from scratch. Moreover, with a pre-fabricated platform boasting integrated features, you can promptly start revenue generation.

Decreased Overhead Expenses

Forex turnkey solutions effectively diminish overhead costs by supplying a pre-constructed trading platform. The necessity to recruit additional personnel, such as developers and designers, for platform creation becomes unnecessary. Risk management protocols, automated trading modules, and secure payment gateways are integrated into the system, thereby economising both time and financial resources typically expended during development.

Access to Leading-Edge Technology and Features

A Forex turnkey solution grants access to cutting-edge trading technologies, including sophisticated charting tools, automated trading robots, and analytics modules. This access helps in refining trading strategies, maintaining a competitive edge, and ensuring compliance with anti-money laundering regulations.

Enhanced Focus on Fundamental Business Operations

A turnkey system empowers business proprietors to swiftly launch their trading enterprises without delving into intricate technicalities. This enables them to concentrate on their fundamental business operations and generate revenue rather than allocating resources towards setup expenses.

Heightened Revenue Prospects and Profitability

Employing an FX turnkey system provides entrepreneurs with augmented revenue and profitability prospects by quickening time-to-market, capitalising on Forex market trends, and limiting costs through access to sophisticated tools like automated trading modules and risk management systems. When evaluating potential solutions, it’s crucial to thoroughly consider all available options to pinpoint the one that aligns best with your business requirements.

Making Your Decision in 2024

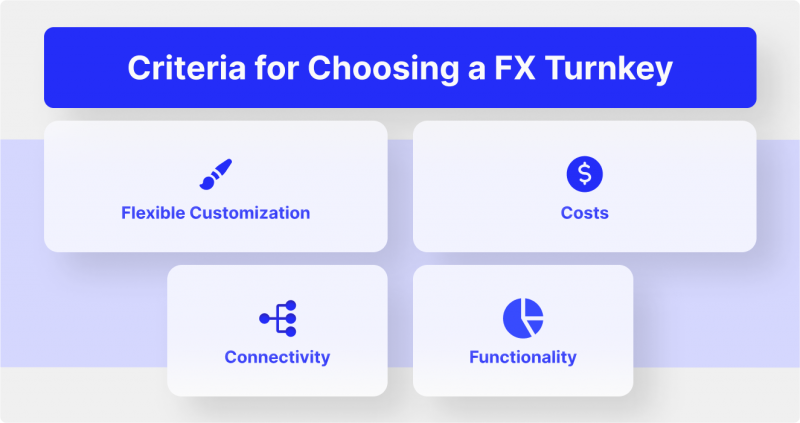

In 2024, there is a big choice of turnkey solution providers. Amidst this plethora of options, determining which features and technologies will best suit a company’s needs can be a daunting task. To ensure the selection of the most suitable option, businesses should take into account the following factors:

- The initial step in choosing a turnkey Forex broker involves defining the company’s goals and objectives. It’s imperative to consider the intended trading activities and ensure that the chosen solution possesses the necessary technology and capabilities to support them effectively.

- The alignment with the target audience is crucial when selecting a turnkey solution. Each solution caters to a different audience, emphasising the importance of choosing one that resonates well with the specific customer base.

- The evaluation of features and technology provided by a Forex broker turnkey solution is paramount. Paying particular attention to automated trading platform modules and risk management tools is crucial, as they can significantly impact trading performance and profitability.

- A dependable liquidity provider is vital for a Forex business. Therefore, understanding the available FX liquidity options and selecting the one that aligns best with business requirements is indispensable when choosing a turnkey solution.

- Compliance with relevant laws and regulations is of utmost importance. Opting for solutions licensed and regulated by reputable authorities helps ensure the business operates within legal boundaries.

- Thoroughly researching the cost and pricing structure of each turnkey solution is essential. Since options vary in features, services, and pricing, it’s crucial to select one that fits within the budget requirements.

- Choosing a reliable Forex turnkey solution that offers robust customer support and technical assistance is crucial. This ensures ongoing help in case of any system issues.

By carefully considering these factors while selecting a Forex turnkey solution in 2024, businesses can make informed decisions that align with their needs.

In Summary

Choosing the appropriate Forex turnkey solution holds immense importance for businesses in 2024. By carefully considering the key factors outlined above, companies can identify a solution that not only meets their needs but also empowers them to optimise profits. With the right turnkey system, companies can streamline their trading operations, leading to enhanced profitability and smoother overall performance.

Economy

Russia’s Lukoil Agrees to Sell International Assets in Nigeria, Others to Carlyle

By Adedapo Adesanya

US sanctioned Russian oil giant Lukoil, will sell its foreign assets, including those in Nigeria and five other countries, to the US investment firm, The Carlyle Group.

According to an announcement on Thursday, Lukoil reached an agreement with the US investment firm on the sale of Lukoil International GmbH, the holding company that owns the group’s non-Russian international assets.

These foreign assets include shares in oil fields and refineries across the globe, including in Iraq, Azerbaijan, Egypt, the United Arab Emirates (UAE), Nigeria, and Mexico.

The sale follows the US sanctions on Lukoil and Rosneft, “as a result of Russia’s lack of serious commitment to a peace process to end the war in Ukraine.”

The Donald Trump administration in October 2025 had carried out the decision to put pressure on Russia’s state finances, adding the country’s two largest oil producers, Lukoil and Rosneft, to its blacklist of sanctioned entities. The US had initially given the oil firm one month to sell the holdings before gradually extending it as negotiations dragged on.

Lukoil had announced that same month that it would sell all of its international assets, initiating a formal process to receive bids from potential buyers.

After months of negotiations with potential buyers and one preliminary agreement with Gunvor blocked by the US Treasury, which described the trading group as “the Kremlin’s puppet”, it has now signed an agreement to sell Lukoil International GmbH to Carlyle.

Companies working with the sanctioned firms risk secondary sanctions that would deny them access to US banks, traders, transporters, and insurers.

The agreement is not exclusive and is subject to conditions such as the procurement of necessary regulatory approvals, including permission from the US Department of the Treasury’s Office of Foreign Assets Control (OFAC) for the transaction with Carlyle.

Carlyle said that the agreement “has been structured to be fully compliant” with US Treasury policies and that it was “conditional upon Carlyle’s due diligence and regulatory approvals”.

Prior to the Carlyle news, other US oil and gas supermajors Chevron and ExxonMobil, and International Holding Company (IHC) of Abu Dhabi expressed interest to the US Treasury to potentially acquire Lukoil’s international assets.

The sale would further dent Russian economy which has been struggling because of its war in Ukraine and Western sanctions have increased inflation and slowed economic growth. In 2025, the country’s oil and gas revenues, which make up about a quarter of government income and help fund the war, fell to their lowest level in five years.

Economy

Eyesan Assures Investors of Transparency, Merit in Oil Licensing Bid

By Adedapo Adesanya

The chief executive of the Nigerian Upstream Petroleum Regulatory Commission (NUPRC), Mrs Oritsemeyiwa Eyesan, has assured investors of a transparent, merit-based and competitive process for Nigeria’s 2025 oil and gas licensing round.

Mrs Eyesan, gave the assurance on Wednesday while speaking at a Pre-Bid Webinar organised by the commission, noting that only applicants with strong technical, financial credentials, professionalism and credible plans would proceed to the critical stage of the bidding process.

The NUPRC in December 1, 2025 inaugurated Nigeria’s 2025 Licensing Bid Round, offering 50 oil and gas blocks across frontier, onshore, shallow water, and deepwater terrains for potential investors.

The basins included Niger Delta basin, with 35 blocks, Benin (Frontier) with three blocks, Anambra (Frontier), with four blocks, Benue (Frontier), with four blocks and Chad (Frontier) with four blocks on offer.

Mrs Eyesan explained that the licensing process would follow five stages: Registration and pre-qualification, data acquisition, technical bid submission, evaluation, and a commercial bid conference, with only bidders that meet strong technical and financial criteria progressing.

The NUPRC executive said the 2025 Licensing Round represented a deliberate effort by Nigeria to reposition its upstream petroleum sector for long-term investment, transparency, and value creation, amid increasing global competition for capital.

She said that energy security and supply resilience had become key global economic and geopolitical priorities, while investment capital was increasingly selective and disciplined.

“Our national priority is clear: to attract capital, grow reserves, and improve production in a responsible and sustainable manner.

“A structured and transparent licensing round is essential to achieving these objectives.

“The NUPRC is legally mandated to conduct licensing rounds in a periodic, open, transparent, and fully competitive manner and the entire 2025 process will be governed strictly by published rules,” she said.

The official further revealed that, with the approval of President Bola Tinubu, signature bonuses for the 2025 round have been set within a range designed to lower entry barriers and prioritise technical capability, credible work programmes, financial strength, and speed to production.

She emphasised that the bid process will fully comply with the Petroleum Industry Act (PIA) and remain open to public and institutional scrutiny through the Nigeria Extractive Industries Transparency Initiative (NEITI) and other oversight agencies.

Economy

Afriland Properties, Three Others Weaken NASD Exchange by 0.06%

By Adedapo Adesanya

Four price losers weakened the NASD Over-the-Counter (OTC) Securities Exchange by 0.06 per cent on Wednesday, January 28.

The decliners were led by Afriland Properties Plc, which lost N1.53 to close at N14.50 per share compared with the previous day’s N16.03 per share, Geo-Fluids Plc dropped 50 Kobo to end at N6.35 per unit versus Tuesday’s price of N6.85 per unit, Central Securities Clearing System (CSCS) Plc declined by 35 Kobo to N40.15 per share from N40.50 per share, and Food Concepts Plc decreased by 28 Kobo to sell at N2.72 per unit versus N3.00 per unit.

As a result, the market capitalisation of the bourse went down by N1.3 billion to N2.173 trillion from the N2.174 trillion it ended a day earlier, and the NASD Unlisted Security Index (NSI) fell by 2.17 points to 3,632.56 points from Tuesday’s 3,634.73 points.

In the midst of the profit-taking, some securities witnessed bargain-hunting, with Nipco Plc gaining N22.00 to close at N242.00 per share versus N220.00 per share of the previous session, FrieslandCampina Wamco Nigeria Plc improved by N4.00 to N68.00 per unit from N64.00 per unit, and Acorn Petroleum Plc added 8 Kobo to finish at N1.38 per share versus N1.30 per share.

At midweek, the volume of securities transacted by the market participants surged by 259.9 per cent to 4.7 million units from 1.3 million units, but the value of securities went down by 8.6 per cent to N52.4 million from N57.3 million and the number of deals shrank by 15.8 per cent to 32 deals from 38 deals.

CSCS Plc remained the most traded stock by value (year-to-date) with 15.3 million units exchanged for N622.4 million, followed by FrieslandCampina Wamco Nigeria Plc with 1.6 million units valued at N108.4 million, and Geo-Fluids Plc with 8.9 million units worth N60.3 million.

CSCS Plc was also the most traded stock by volume (year-to-date) with 15.3 million units sold for N622.4 million, followed by Geo-Fluids Plc with 8.9 million units exchanged for N60.3 million, and Mass Telecom Innovation Plc with 8.4 million units traded for N3.4 million.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn