Economy

The Evolution of Fast Trading Techniques

Within the last few decades, the world of stock trading has radically evolved—from a pace of execution measured in minutes to milliseconds. As traders strive to capitalize on market opportunities that may only exist for a few seconds, they will continue to evolve rapid trading techniques to meet the demands of today’s fast-moving financial markets. As technology continues to reshape the contours of financial markets, traders entertain ever-innovative ways that truly equip them to engage in rapid trading at unmatched speeds.

Staying abreast of developments is thus paramount to success. Resources such as Exness Insights help them get all the information they need on the latest trends and technologies in rapid trading—to afford them a deeper understanding of the mechanics behind trading today.

This article looks at the evolution of high-speed trading practices—from the manual handling that first inspired speed traders to today’s high-frequency trading, plus other common techniques.

The Early Days of Rapid Trading

Until the technological revolution, stock trading was entirely manual in nature, wherein traders needed to be physically present on the floor of the exchange and call out orders. It would take minutes or more at times to execute the trades, often depending on the trader’s capability of moving fast and viewing emerging opportunities in real time.

It was only natural that once computers came into use in the 1970s and 1980s, the first automatic trading systems should have begun to make their appearance.

Developers created the early generations of automatic trading systems to assist traders by processing orders electronically, which increased speed and efficiency.

The Emergence of High-Frequency Trading

High-frequency trading as a major innovation came into being through the late 1990s. Algorithms and super-fast technology form the basis of systems that can execute thousands of trades in just a second. High-frequency trading systems generally hunt for minute price disparities in the market. A well-designed, super-fast computer-based high-frequency trading system can process gargantuan amounts of data with order executions in milliseconds.

Using very small changes in price, high-frequency traders take advantage by executing trades faster than human traders could react to. That, in turn, uses a sophisticated infrastructure of low-latency data connections and colocated servers near the stock exchanges for the least possible delay. It is because of this that HFTs are so speedy; traders can exploit opportunities across multiple markets simultaneously, creating more liquidity and therefore a more efficient market altogether.

With great power comes great controversy, though, as the rise of HFT has brought with it a number of concerns regarding market volatility. The sheer number of trades in such a short span can create wild variances in stock prices.

Algorithmic Trading and Scalping Strategies

The most widespread algorithmic trading style is scalping, whereby the trader executes numerous trades throughout the day, each intended to take advantage of tiny movements in prices. Scalpers rely on fast execution and high levels of liquidity to enter positions that could last several minutes or even mere seconds while collecting minuscule profits on each trade.

Algorithmics and scalping trading have both become indispensable parts of rapid trading strategies. Those traders who will be able to master this technique stand to gain from the fast pace of today’s financial markets, where speed and precision are of essence.

The Future of Rapid Trading Technique

As technology progresses, the forward motions of rapid trading will only continue to accelerate and evolve further. Today, artificial intelligence and machine learning are already embedded in trading algorithms, enabling traders to predict market movements with far greater accuracy than ever before. Consequently, through vast amounts of historical data, pattern identification provides AI-powered trading systems with real-time decisions unreachable by humans.

Another sphere that might highly influence the increasing speed—and therefore effectiveness—of rapid trading is quantum computing. Quantum computers can process information at speeds that are exponentially higher compared to conventional computers, which means that the execution speed of the trade will go up, and traders will be in a position to analyze market conditions in great depth until now not achieved.

Outpacing the Competition in Rapid Trading

In rapid trading, an individual’s success largely depends on how informed and flexible they can be. With the continuous evolution in technology, it means that traders have to keep innovating strategies to compete with the increasingly rapid motion of the markets. Properly understanding the history of rapid trading, from the purely manual processes through to today’s sophisticated algorithms, gives a number of insights helpful for traders to keep their efficiency high in a competitive, swift environment.

This would require the proper tools and timely updates on development so that traders could stay ahead of the game and take advantage of the possibilities of rapid trading.

Economy

LIRS Shifts Deadline for Annual Returns Filing to February 7

By Aduragbemi Omiyale

The deadline for filing of employers’ annual tax returns in Lagos State has been extended by one week from February 1 to 7, 2026.

This information was revealed in a statement signed by the Head of Corporate Communications of the Lagos State Internal Revenue Service (LIRS), Mrs Monsurat Amasa-Oyelude.

In the statement issued over the weekend, the chairman of the tax collecting organisation, Mr Ayodele Subair, explained that the statutory deadline for filing of employers’ annual tax returns is January 31, every year, noting that the extension is intended to provide employers with additional time to complete and submit accurate tax returns.

According to him, employers must give priority to the timely filing of their annual returns, noting that compliance should be embedded as a routine business practice.

He also reiterated that electronic filing through the LIRS eTax platform remains the only approved method for submitting annual returns, as manual filings have been completely phased out. Employers are therefore required to file their returns exclusively through the LIRS eTax portal: https://etax.lirs.net.

Describing the platform as secure, user-friendly, and accessible 24/7, Mr Subair advised employers to ensure that the Tax ID (Tax Identification Number) of all employees is correctly captured in their submissions.

Economy

Airtel on Track to List Mobile Money Unit in First Half of 2026—Taldar

By Adedapo Adesanya

The chief executive of Airtel Africa Plc, Mr Sunil Kumar Taldar, has disclosed that the company is still on track to list its mobile money business, Airtel Money, before the end of June 2026.

Recall that Business Post reported in March 2024 that the mobile network operator was considering selling the shares of Airtel Money to the public through the IPO vehicle in a transaction expected to raise about $4 billion.

The firm had been in talks with possible advisors for a planned listing of the shares from the initial public offer on a stock exchange with some options including London, the United Arab Emirates (UAE), or Europe.

However, so far no final decisions have been made regarding the timing, location, or scale of the IPO.

In September 2025, the telco reportedly picked Citigroup Incorporated as advisors for the planned IPO which will see Airtel Money become a standalone entity before it can attain the prestige of trading on a stock exchange.

Mr Taldar, noted that metrics continued to show improvements ahead of the listing with its customer base hitting 52 million, compared to around 44.6 million users it had as of June 2025.

He added that the subsidiary processed over $210 billion in a year, according to the company’s nine-month financial results released on Friday.

“Our push to enhance financial inclusion across the continent continues to gain momentum with our Mobile Money customer base expanding to 52 million, surpassing the 50 million milestone. Annualised total processed value of over $210 billion in Q3’26 underscores the depth of our merchants, agents, and partner ecosystem and remains a key player in driving improved access to financial services across Africa.

“We remain on track for the listing of Airtel Money in the first half of 2026,” Mr Taldar said.

Estimating Airtel Money at $4 billion is higher than its valuation of $2.65 billion in 2021. In 2021, Airtel Money received significant investments, including $200 million from TPG Incorporated at a valuation of $2.65 billion and $100 million from Mastercard. Later that same year, an affiliate of Qatar’s sovereign wealth fund also acquired an undisclosed stake in the unit.

The mobile money sector in Africa is expanding rapidly, driven by a young population increasingly adopting technology for financial services, making the continent a key market for fintech companies.

Economy

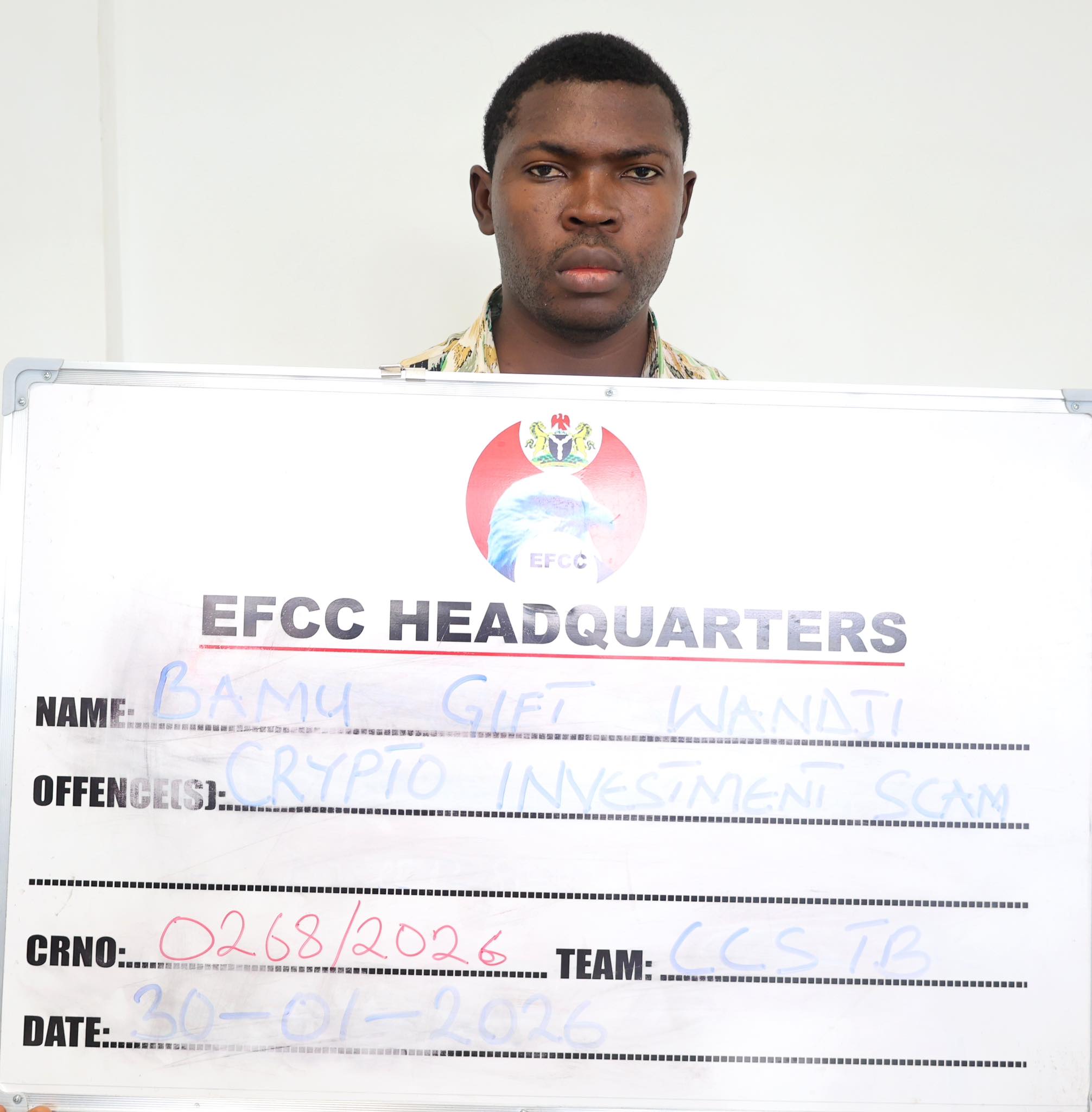

Crypto Investor Bamu Gift Wandji of Polyfarm in EFCC Custody

By Dipo Olowookere

A cryptocurrency investor and owner of Polyfarm, Mr Bamu Gift Wandji, is currently cooling off in the custody of the Economic and Financial Crimes Commission (EFCC).

He was handed over to the anti-money laundering agency by the Nigerian Security and Civil Defence Corps (NSCDC) on Friday, January 30, 2026, after his arrest on Monday, January 12, 2026.

A statement from the EFCC yesterday disclosed that the suspect was apprehended by the NSCDC in Gwagwalada, Abuja for running an investment scheme without the authorisation of the Securities and Exchange Commission (SEC), which is the apex capital market regulator in Nigeria.

It was claimed that Mr Wandji created a fraudulent crypto investment platform called Polyfarm, where he allegedly lured innocent Nigerians to invest in Polygon, a crypto token that attracts high returns.

Investigation further revealed that he also deceived the public that his project, Polyfarm, has its native token called “polyfarm coin” which he sold to the public.

In his bid to promote the scheme, the suspect posted about this on social media platforms, including WhatsApp, X (formally Twitter) and Telegram. He also conducted seminars in some major cities in Nigeria including Kaduna, Lagos, Port Harcourt and Abuja where he described the scheme as a life-changing programme.

Further investigation revealed that in October, 2025, subscribers who could not access their funds were informed by the suspect that the site was attacked by Lazarus group, a cyber attacking group linked to North Korea.

Further investigations showed that Polyfarm is not registered and not licensed with SEC to carry out crypto transactions in Nigeria. Also, no investment happened with subscribers’ funds and that the suspect used funds paid by subscribers to pay others in the name of profit.

Investigation also revealed that native coin, polyfarm coin was never listed on coin market cap and that the suspect sold worthless coins to the general public.

Contrary to the claim of the suspect that his platform was attacked, EFCC’s investigations revealed that the platform was never attacked or hacked by anyone and that the suspect withdrew investors’ funds and utilized the same for his personal gains.

The EFCC, in the statement, disclosed that Mr Wandji would be charged to court upon conclusion of investigations.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn