Banking

CBN Fixes N100,000 as Maximum Daily Cash Withdrawal Via POS

By Modupe Gbadeyanka

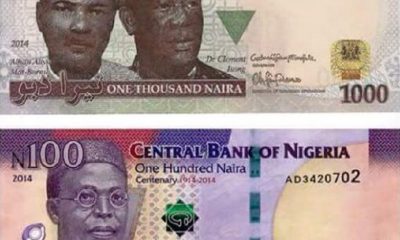

As part of measures to promote its cashless policy, the Central Bank of Nigeria (CBN) has directed Point-of-Sale (POS) agents not to pay more than N100,000 as cash to each customer per day.

The banking sector regulator also restricted the POS operators not to pay more than N1.2 million per day as cash to customers, adding that customers may not withdraw more than N500,000 per week as cash.

To ensure accountability, the CBN has mandated that all agency banking transactions must be conducted exclusively through float accounts maintained with the principal institutions.

It also directed that agent banking services be separated from other merchant activities, with agents required to use the approved Agent Code 6010 for transactions.

In a circular dated December 17, 2024, the central bank noted these efforts are to ensure uniform operational standards, combat fraud, and enhance the use of electronic payment systems in agency banking operations.

The CBN ordered that, “All principals of agents are to comply with the following directives immediately,” in the circular signed on behalf of its Director of the Payments System Management Department, Mr Oladimeji Taiwo, and directed at Deposit Money Banks, Microfinance Banks, Mobile Money Operators, and Super-Agents.

“Issuers shall set a cash withdrawal limit (cash-out) per customer (regardless of channel) to N500,000.00 per week; Ensure that all agent banking terminals are set to a daily maximum transaction cash-out limit of N100,000.00 per customer; Ensure that each agent’s daily cumulative cash-out limit shall not exceed N1,200,000.00,” the notice added.

The central bank advised all stakeholders to adhere strictly to the directives to ensure the smooth implementation of the policy and contribute to the advancement of Nigeria’s cashless economy.

Banking

SERAP Sues CBN Over Alleged Missing N3trn

By Adedapo Adesanya

The Socio-Economic Rights and Accountability Project (SERAP) has filed a lawsuit against the Central Bank of Nigeria (CBN) for failing to account for N3 trillion in public funds, alleged to be missing or diverted.

The lawsuit followed the grave allegations contained in the latest annual report by the Auditor-General of the Federation, published on September 9, 2025. It includes over N629 billion paid to ‘unknown beneficiaries’ as part of the Anchor Borrowers’ Programme.

In the suit number FHC/ABJ/CS/250/2026 filed last week at the Federal High Court in Abuja, SERAP is seeking: “an order of mandamus to direct and compel the CBN to account for and explain the whereabouts of the missing or diverted N3 trillion of public funds, including detailed reports of how exactly the funds were spent.”

In the suit, SERAP argued that, “These grim allegations by the Auditor-General suggest grave violations of the public trust, the provisions of the Nigerian Constitution 1999 [as amended], the CBN Act, and anticorruption standards.”

SERAP is arguing that, “These grave violations also reflect a failure of CBN accountability more generally and are directly linked to the institution’s persistent failure to comply with its Act and to uphold the principles of transparency and accountability.”

According to SERAP, “These violations have seriously undermined the ability of the CBN to effectively discharge its statutory functions and the public trust and confidence in the bank. The CBN ought to be committed to transparency and accountability in its operations.”

SERAP is also arguing that, “Nigerians have the right to know the whereabouts of the missing or diverted public funds. Granting the reliefs sought would advance the right of Nigerians to restitution, compensation and guarantee of non-repetition.”

The suit filed on behalf of SERAP by its lawyers: Ms Oluwakemi Agunbiade and Ms Valentina Adegoke, read in part: “According to the Auditor-General, the CBN in 2022 failed to remit over N1 trillion [N1,445,593,400,000.00] of ‘the Federal Government’s portion of operating surplus’ into the Consolidated Revenue Fund (CRF) account.”

“The Auditor-General fears that the money may have been ‘diverted.’ He wants the money recovered and remitted to the treasury.”

“The CBN also failed to recover over N629 billion [N629,040,000,000.00] paid to ‘unknown beneficiaries’ as part of the Anchor Borrowers’ Programme, a programme ‘meant to support farmers to ensure sustainable food production in the country,’” it said.

SERAP noted that the Auditor-General raised serious concerns over financial management at the apex bank, citing unaccounted intervention funds and unrecovered loans running into hundreds of billions of naira.

The report noted that the number of beneficiaries who collected certain disbursed funds remains unknown and that efforts to recover the money have been inadequate. Over N784.4 billion in unpaid and overdue loans issued between 2018 and May 2022 remain outstanding, with fears that diversion of funds may have worsened food security challenges. The Auditor-General has called for full recovery and remittance of the funds to the treasury.

Banking

We Now Pay Depositors of Failed Bank Within Days—NDIC

By Adedapo Adesanya

The Nigeria Deposit Insurance Corporation (NDIC) says depositors of failed banks in Nigeria can now access their insured funds within days.

The corporation said the development is a part of ongoing reforms aimed at strengthening confidence in the country’s financial system.

The chief executive of NDIC, Mr Thompson Sunday, disclosed this on Thursday at the NDIC Special Day of the 47th Kaduna International Trade Fair, noting that recent interventions had significantly improved the speed and efficiency of depositor compensation.

Represented by Mrs Regina Dimlong, the Assistant Director of Communications and Public Affairs, Mr Sunday said the corporation had successfully deployed the Bank Verification Number (BVN) system to facilitate prompt payments to customers of recently failed banks, including Heritage Bank Limited, Union Homes Plc and Aso Savings and Loans Plc.

“Depositors were paid within days of closure without the need to fill physical forms or visit NDIC offices.

“This is a part of our reform efforts to make depositor protection faster, simpler and more transparent,” he said.

According to him, the reforms were designed to restore public confidence in the banking system and prevent panic withdrawals, especially during periods of financial stress.

Mr Sunday explained that NDIC’s mandate spans deposit insurance, bank supervision, distress resolution and liquidation of failed banks, adding that the Corporation works closely with the Central Bank of Nigeria (CBN) to ensure early detection of risks in insured institutions.

He disclosed that in 2024, NDIC reviewed its deposit insurance framework, increasing coverage for depositors of Deposit Money Banks, Mobile Money Operators and Non-Interest Banks to N5 million, while customers of Microfinance Banks, Primary Mortgage Banks and Payment Service Banks are now covered up to N2 million.

He noted that the revised thresholds now guarantee full protection for about 99 per cent of depositors nationwide, particularly small savers and low-income earners.

The NDIC boss urged Nigerians to ensure their BVNs are properly linked to their bank accounts, stressing that this had become the primary channel for accessing insured deposits in the event of bank failure.

Banking

Nigeria Gets Permanent Seat on African Central Bank Board

By Adedapo Adesanya

Nigeria has secured a major strategic gain at the ongoing 39th African Union Summit, after securing a permanent seat on the board of the African Central Bank.

The Minister of Foreign Affairs, Mr Yusuf Tuggar, confirmed this at the summit on Friday, highlighting it as a significant milestone for both Nigeria and the West African region.

The African Central Bank (ACB) is one of the original five financial institutions and specialised agencies of the African Union (AU).

“Importantly, Nigeria has been given the hosting of the African Monetary Institute and the African Central Bank. Not only that, in today’s plenary, Nigeria was confirmed a seat on the board of the African Central Bank. This is huge,” he said.

He stated that the development represents a diplomatic breakthrough, mentioning that the move faced initial opposition from some member states.

“It is something that was initially resisted by some countries, so now we have a permanent seat on the African Central Bank board. It’s a major success,” he added.

This year’s summit carries the theme Assuring Sustainable Water Availability and Safe Sanitation Systems to Achieve the Goals of Agenda 2063, the sessions will focus on advancing continental commitments to sustainable water management and improved sanitation, critical pillars for health, agricultural productivity, and the broader development aspirations of the AU’s Agenda 2063 framework.

Beyond financial governance, Nigeria and the West African bloc also recorded progress in elections to the Peace and Security Council, the African Union’s highest decision-making body on conflict and security matters.

The delegation announced that “Côte d’Ivoire, Sierra Leone, and the Republic of Benin have been elected,” with Benin securing a fresh term while the other two countries were re-elected.

The Peace and Security Council also convened to deliberate on the situations in Sudan and Somalia. Nigeria voiced strong reservations over Sudan’s potential readmission into the continental body.

“Nigeria voiced its reservations about Sudan being readmitted because, as you know, there are two warring factions in Sudan,” Tuggar stated.

“We reminded the Peace and Security Council that we have to abide by the rules and regulations of the African Union. If there has been an unconstitutional change of government, then the country should not be allowed to participate, and that was carried.”

The summit also outlined its 2026 theme: water sustainability. The Nigerian representative underscored the country’s strategic and demographic significance in advancing that agenda.

“Nigeria was created out of the confluence of the River Niger and the River Benue. So water is very important,” he said.

“We are the largest country in Africa, with a population of 230 million people. We’re going to be 400 million in the next 24 years. So water is a source of life. It’s very important, and we’re playing a very pivotal role in implementing the programs that are being set for the theme of the year.”

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn