Media OutReach

Unlocking trading flexibility: the power of Octa Broker’s swap-free accounts

Swap points explained

When opening a Forex trade, a trader essentially borrows one currency to buy another. However, each currency has an associated interest rate, set by the respective central bank. The difference between these two interest rates in a Forex pair is what makes a ‘swap point’. In essence, a Forex swap point (also known as a ‘rollover fee’, ‘overnight interest’ or ‘holding cost’) is the interest rate differential between the two currencies. It is applied to positions held open overnight and is credited or debited automatically while being reflected in the final profitability of a trade.

Let’s consider an example with a transaction involving two currencies with significantly different interest rates: the Australian dollar (AUD) and the Japanese yen (JPY). The Reserve Bank of Australia (RBA) has set its policy rate at 3.85%, and the Bank of Japan (BoJ) at 0.5%.

Suppose you want to short (sell) AUDJPY at a 97.00 exchange rate and you initiate a full 1.0 lot position. A short one lot position means you sell 100,000 Australian dollars (AUD) against the Japanese yen (JPY). In order to sell something that you do not own, you need to borrow it first. So, you borrow 100,000 AUD and pay interest (cost). Then, you place the Japanese yen (that you bought) in a bank deposit for one day (overnight) and receive interest (income). If the interest rate on the Australian dollar loan is 3.85%, then you pay 10.55 Australian dollars per day (100,000 x 3.85% / 365). If the interest rate on the yen deposit is 0.5%, you will receive 132.9 yen per day (100,000 x 97 x 0.5% / 365), or just 1.37 Australian dollars at an exchange rate of 97.00. Thus, at the end of the day, the trader will incur a swap loss of 9.18 Australian dollars. And this will be a recurring cost every 24 hours. Not a very comfortable situation to be in, is it?

Furthermore, even if a trader decides to trade currencies with relatively similar rates of interest and buy a higher-yielding currency against a lower-yielding currency, the swap rate may still be negative as brokers often add their markup or discount to the interbank swap rates.

Why the absence of swap points at Octa Broker is so convenient

For many Forex traders, particularly those employing mid-term to long-term strategies, the accumulation of swap points can significantly eat into potential profits or exacerbate losses. This is where Octa Broker’s ‘0% swaps’ policy becomes a game-changer. Indeed, Octa Broker has been trusted by millions of traders around the world precisely for its transparent trading conditions, no hidden tricks, and honest and convenient trading without swap points.

Here are the benefits of having a 0% swap rate:

- Reduced trading costs

The most obvious benefit is the elimination of recurring overnight fees. For traders who hold positions for days, weeks, or even months, these small daily charges can quickly add up to a substantial amount, impacting overall profitability. By removing swaps, Octa Broker helps traders keep more of their earnings.

- Flexibility in trading strategies

Traders aiming to capitalise on longer-term market trends no longer have to worry about the mounting cost of holding positions overnight. 0% swap rate frees them and allows them to focus solely on market analysis and price action without the added pressure of daily swap calculations.

- Simpler profit/loss calculation

Without swap points, calculating your net profit or loss on a trade becomes much more straightforward. You only need to consider the entry price, exit price, and any commissions or spreads, removing a variable that can complicate financial planning and risk management.

- No unpleasant surprises

Swap rates can fluctuate based on central bank decisions and even market liquidity. Octa Broker’s swap-free offering removes this element of uncertainty, providing a more predictable trading environment.

- Accessibility for all traders

For new traders, understanding and factoring in swap points can be an additional layer of complexity. Swap-free accounts simplify the learning curve, allowing them to focus on core trading principles. Furthermore, for traders whose religious beliefs prohibit earning or paying interest, swap-free accounts offer an ethical and compliant way to participate in the Forex market.

Octa Broker’s commitment to offering 0% swaps on its trading instruments aligns with a trader-centric approach. This transparency is a cornerstone of how Octa builds trust with clients, empowering them with greater control over their trading costs and fostering more flexible strategy implementation. Ultimately, this contributes to a more transparent and convenient trading experience where traders can trust their broker to prioritise their success. For anyone considering holding forex positions for more than a day, the absence of swap points is a compelling advantage worth serious consideration. Along with other conditions benefiting traders, the zero-swap policy is one of the crucial tools that reliable brokers offer their clients to help them successfully navigate the markets.

___

Disclaimer: This press release does not contain or constitute investment advice or recommendations and does not consider your investment objectives, financial situation, or needs. Any actions taken based on this content are at your sole discretion and risk—Octa does not accept any liability for any resulting losses or consequences.

Hashtag: #Octa

The issuer is solely responsible for the content of this announcement.

Octa

![]() Octa is an international CFD broker that has been providing online trading services worldwide since 2011. It offers commission-free access to financial markets and various services used by clients from 180 countries who have opened more than 52 million trading accounts. To help its clients reach their investment goals, Octa offers free educational webinars, articles, and analytical tools.

Octa is an international CFD broker that has been providing online trading services worldwide since 2011. It offers commission-free access to financial markets and various services used by clients from 180 countries who have opened more than 52 million trading accounts. To help its clients reach their investment goals, Octa offers free educational webinars, articles, and analytical tools.

Media OutReach

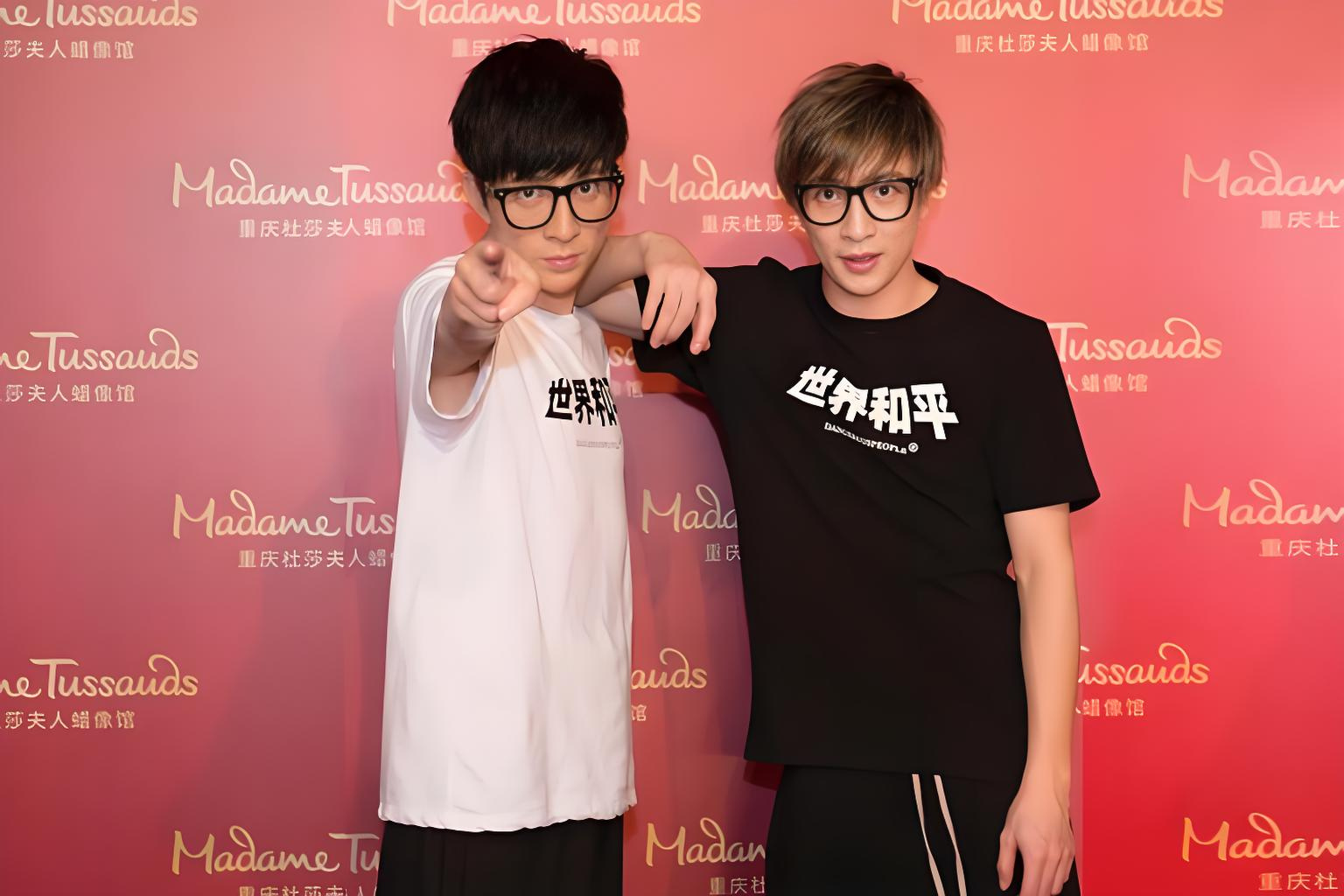

Ring in Fortunate Beginnings with Joker Xue (Xue Zhiqian) at Madame Tussauds Singapore This Lunar New Year

Joker Xue is widely regarded as one of the most influential artists within the Mandopop industry. Known for his emotionally driven songwriting and distinctive vocal style, Xue has released multiple chart-topping albums and consistently sold out large-scale tours across Asia. In recent years, he has maintained active engagement with fans through concerts and social media platforms, reinforcing his reputation as a leading voice in contemporary Chinese pop music.

Meticulously crafted to capture his signature style, the figure features a casual yet instantly recognisable look – complete with his trademark glasses, a relaxed white T-shirt, and a playful pointing pose that reflects his charismatic stage presence. During the Lunar New Year period, fans to Madame Tussauds Singapore will be able to get up close with this lifelike figure as if he were standing right before and enjoy an immersive experience that blends pop culture with festive celebration.

“We hope Joker Xue’s wax figure brings an added sense of excitement and festive cheer to our Lunar New Year celebrations,” said Steven Chung, General Manager of Madame Tussauds Singapore. “The Lunar New Year is a special time for joy, reunion, and fresh beginnings, and we look forward to welcoming guests to celebrate the season with us in a fun, immersive, and meaningful way.”

The time-limited festive activities include:

| 1) FREE Fortune Telling with Any Ticket Purchase Enjoy complimentary fortune telling sessions by booking a slot via Madame Tussauds Singapore website (first-come, first-served). Valid for ticket holders only. Get your tickets here. |

14–22 February, 11:00am–2:00pm |

| 2) FREE Sure-Win Lucky Dip with Every $88 Spent at the Retail Store

Spend $88 or more in the retail store to gain a complimentary sure-win lucky dip, with attractive prizes to be won. |

14–22 February |

| 3) CNY Pussy Willow Wishing Tree Pen down your wishes and hang them on the festive pussy willow wishing tree, symbolising blessings, prosperity, and new beginnings. |

15–18 February |

| 4) Distribution of Fortune Cookies & Chocolate Gold Coin Red Packets

Receive festive treats and auspicious surprises while soaking in the CNY décor and warm atmosphere. |

15–18 February |

Madame Tussauds Singapore continues to be a platform where fans can connect with global icons through unique, real-life experiences, blending entertainment, storytelling, and celebrity culture.

Join us this festive season to celebrate the Lunar New Year with Joker Xue and other international celebrities, and start the year with joy, luck, and unforgettable memories.

For more information about booking tickets to visit Joker Xue at Madame Tussauds Singapore, please visit www.madametussauds.com/singapore/

Hashtag: #MerlinEntertainments #MadameTussaudsSingapore

The issuer is solely responsible for the content of this announcement.

Madame Tussauds Singapore

Madame Tussauds has been inviting people to walk the red carpet and get closer to the revered – and feared – for over 250 years. With 22 attractions in the world’s top destination cities, we are dedicated to giving millions of visitors the opportunity to mingle with the mighty from A-listers to music legends, heroes of sport, to infamous world leaders. Today, we continue to partner with the global icons of a generation to create astonishing lifelike figures from sittings and offer exciting and interactive experiences to ensure guests have never felt closer to fame.

About Merlin Entertainments

Merlin Entertainments is a world leader in branded entertainment destinations, offering a diverse portfolio of resort theme parks, city-centre gateway attractions and LEGOLAND Resorts which span across UK, US, Western Europe, China and Asia Pacific. Dedicated to creating experiences that inspire joy and connection, Merlin welcomes more than 62 million guests annually to its growing estate, with over 140 sites across 23 countries. An expert in bringing world-famous entertainment brands to life, Merlin works with partners including the LEGO Group, Sony Pictures Entertainment, Peppa Pig, Dreamworks and Ferrari to create destinations where guests can immerse themselves in a wide array of brand-driven worlds, rides, and uplifting learning experiences. See ![]() www.merlinentertainments.biz for more information.

www.merlinentertainments.biz for more information.

Media OutReach

TAT partners with Lalisa ‘LISA’ Manobal, Amazing Thailand Ambassador, to invite Tourists to discover the Multitude of Feelings upon travelling in Thailand, unveiling the New TVC “Feel All The Feelings”

Reinforcing Thailand’s position as a trusted, high-quality destination through emotion-driven storytelling

BANGKOK, THAILAND –

The film sets to entice tourists to experience and discover the multitude of feelings to be gained from travelling in Thailand, including happiness, serenity, excitement, challenge, and warmth, to establish Thailand as a valuable and unforgettable travel destination.

Ms Thapanee Kiatphaibool, Governor of the TAT, revealed, “This year, the TAT remains committed to reinforcing Thailand’s image through the ‘Trusted Thailand’ strategy to warmly welcome tourists, while continuing its push to establish Thailand as a ‘Quality Leisure Destination.’ This is to build confidence among tourists who want to create valuable, unforgettable memories at every step of their journey. Recently, we launched the ‘Feel All The Feelings’ campaign, building widespread communication and awareness across various channels. We are kicking off the year with a new commercial featuring ‘Lalisa LISA Manobal’ as the Amazing Thailand Ambassador, who will showcase Thailand’s tourist attractions and the feelings evoked on each visit. The campaign aims to ‘enhance quality’ while distributing revenue and tourists to new potential areas. TAT cordially invites all Thais to be ‘good hosts’ and share memorable Thai travel experiences.

TVC ‘Feel All The Feelings‘ by TAT portrays unseen attractions and diverse emotions awaiting tourists to discover and experience in Thailand. The story’s inception was inspired by tourists’ desire to seek a range of experiences that fulfil them emotionally and spiritually, helping them ‘Feel Alive’ again. TAT is confident that Thailand can be the answer and add vivid hues to tourists’ lives, as we are a land of diversity, colour, and vitality, ready to offer an exceptional experience for visitors to feel every emotion, from happiness, serenity, excitement, and challenge, to the warmth of smiles and hospitality, the intriguing mystery of new places, and the wonder of unseen locations. We believe that every area and every journey in Thailand will not only create impressive memories but also deliver ‘feelings’ that greatly enrich the travel experience.”

In this ad, Lalisa ‘LISA’ Manobal, in her role as the Amazing Thailand Ambassador, invites everyone to experience the ‘feelings within Thailand’. LISA is often asked, “What does Thailand feel like?” and she reveals the feelings she experiences while resting and recharging in Thailand in the commercial, through every emotion, every feeling, and every rhythm of Thailand’s beauty, which is unlike anywhere else in the world. The production also features renowned stars and actors such as Win – Metawin Opas–iamkajorn, Gulf – Kanawut Traipipattanapong, and Blue – Pongtiwat Tangwancharoen, who join the journey and convey these feelings together.

The TVC showcases beautiful locations nationwide, starting with the captivating beauty of the Lanna Candle Ceremony (Phang Prateep) at Wat Chedi Luang in Chiang Mai province, followed by a spectacular view of the ‘floating pagodas’ in Lampang province. Viewers can marvel at the sea of mist at Phu Langka in Phayao province. The ads also features attractions in other regions to show that, wherever you are, there is always something to discover. Examples include experiencing the beauty of the first light of dawn at Wat Arun in Bangkok, the splendour of the Red Lotus Sea in Udon Thani province, or experiencing the sound of the cascading waters of

Thi Lo Su Waterfall in Tak province.

Furthermore, the “Feel All the Feelings“ campaign aims is to shift tourists from popular landmarks to hidden-gem destinations, increasing the quality of their spending and the value per trip, in line with the “Value over Volume” strategy.

Join “LISA“ on her journey as the Amazing Thailand Ambassador and discover feelings awaiting tourists in Thailand with the “Feel All The Feelings“ campaign. The “Feel All The Feelings“ TVC is currently available at official Amazing Thailand channels:

Youtube: https://youtu.be/wDMv1KujSGc

X (@AmazingThailand) : https://x.com/AmazingThailand/status/2016507144783487483?s=20

Facebook: https://web.facebook.com/share/v/14RnwfmwTTW/

Instagram: https://www.instagram.com/reel/DUDnoOziPCp/?utm_source=ig_web_copy_link&igsh=MzRlODBiNWFlZA==

TikTok: https://www.tiktok.com/@amazingthailand/video/7600405546558131476

Contact Information

International Public Relations Division

Tourism Authority of Thailand

Tel: +66 (0) 2250 5500 ext. 4545-48

Fax: +66 (0) 2250 0246

E-mail: [email protected]

Website: www.tatnews.org

Media contacts:

- Khianthong Ngernphum (Thonghom) PR Executive, VERVE Public Relations | E-mail: [email protected] | Tel: +66 80 561 9511

- Jirachaya Jaiyen (Linda) Senior PR Executive, VERVE Public Relations | E-mail: [email protected] | Tel: +66 94 876 4938

Hashtag: #AmazingThailand #AmazingThailandAmbassador #AmazingThailandxLISA #FeelAllTheFeelings #FeelAllTheFeelings_TVC

The issuer is solely responsible for the content of this announcement.

Media OutReach

ONYX Hospitality Group named Seventh Best Place to Work in Asia-Pacific for 2025

The Group was also ranked third in Thailand under the international “Best Place to Work in Thailand 2025” certification, reinforcing ONYX’s commitment to sustainable people management and a strong corporate culture.

BANGKOK, THAILAND – Media OuReach Newswire – 30 January 2026 – ONYX Hospitality Group has been recognised as the seventh Best Place to Work in the Asia-Pacific region for 2025, awarded by Best Places to Work, an internationally recognised organisation specialising in workplace assessment and employee experience benchmarking. The recognition reflects the Group’s people-centric workplace practices and a culture that places equal emphasis on employee development and service excellence, and is further reinforced by ONYX’s third-place ranking in Thailand under the “Best Place to Work in Thailand 2025” certification, highlighting the Group’s long-standing focus on sustainable people management and a strong, values-driven corporate culture.

With a diverse portfolio spanning hotels, resorts, serviced apartments, and luxury residences under well-established brands including Amari, OZO, Shama, and Oriental Residence, ONYX Hospitality Group continues to strengthen its position across key strategic markets in the region. As the Group approaches its 60th anniversary in 2026, these accolades further highlight ONYX’s long-standing commitment to building a resilient organisation powered by engaged and capable people.

The “Best Places to Work” certification is an internationally recognised programme that benchmarks organisational excellence in human resource practices and employee engagement. Certification is awarded through a comprehensive evaluation covering employee engagement, employee experience, and the effectiveness of HR policies and practices. In this year’s assessment, ONYX Hospitality Group demonstrated strong performance across multiple dimensions, including a supportive work environment, an open and inclusive corporate culture, and a people development strategy closely aligned with the Group’s regional business direction.

One of the key pillars supporting ONYX’s evolution as a trusted workplace is ONYX Academy, the Group’s comprehensive learning and development institute. ONYX Academy delivers structured programmes spanning foundational skills training, advanced role-specific competency development, and clearly defined career pathways for employees at all levels. By prioritising both future-ready capabilities and practical, applicable skills, the Academy equips team members for sustainable personal and professional growth.

The effectiveness of ONYX Academy has also been recognised at an industry level through multiple honours at the EXA: Employee Experience Awards 2025, including awards for the General Manager Development Programme (GM Track), the NextYou Initiative, the HR Leadership Enhancement Programme, and the Group’s ESG initiatives. These accolades further underscore ONYX Hospitality Group’s long-term and focused commitment to meaningful employee development.

Alongside capability building, ONYX Hospitality Group continues to foster a corporate culture rooted in openness and dynamism, encouraging employees to think creatively, experiment, and contribute new ideas. The Group actively supports agility and adaptability by creating space for diverse voices across the organisation. Employee well-being is also prioritised through the ONYX Cares programme, which holistically supports physical and mental health, relationships, and team engagement—contributing to a work environment that nurtures both individual fulfilment and organisational growth.

Saranya Watanasirisuk, Senior Vice President, Corporate Human Resources, commented: “At ONYX Hospitality Group, we believes that our people are the foundation for delivering exceptional experiences and service. Our success in human resource management is driven by strong leadership support at every level, enabling employees to grow across all dimensions. This commitment spans from recruitment and holistic learning systems to cultivating an environment that encourages creativity, experimentation, and the full expression of individual potential. These efforts have positioned ONYX not only as an employer of choice, but also as an organisation trusted by partners and guests alike.”

Receiving the “Best Place to Work” Certification at both national and regional levels marks another significant milestone for ONYX Hospitality Group. The achievement reinforces its commitment not only to being a regional leader in hospitality management, but also to being an organisation that genuinely values its people.

Looking ahead, ONYX remains dedicated to continuously enhancing the workplace environment and delivering meaningful employee experiences that support long-term growth and sustained competitiveness.

For more information about ONYX Hospitality Group, please visit www.onyx-hospitality.com.

Hashtag: #ONYXHospitalityGroup

![]() https://www.linkedin.com/company/onyx-hospitality-group/

https://www.linkedin.com/company/onyx-hospitality-group/![]() https://www.facebook.com/ONYXHospitalityGroup

https://www.facebook.com/ONYXHospitalityGroup![]() https://www.instagram.com/onyxhospitalitygroup/

https://www.instagram.com/onyxhospitalitygroup/

The issuer is solely responsible for the content of this announcement.

About ONYX Hospitality Group:

ONYX Hospitality Group, a reputable force in Southeast Asia’s hospitality industry, operates a collection of comprehensive yet complementary brands – Amari, OZO, Shama and Oriental Residence – catering to the distinctive needs of discerning business and leisure travellers in Southeast Asia where their expertise lies. In addition to its brand portfolio, ONYX Hospitality Group also operates additional hospitality services across spa and food and beverage. With over five decades of management experience, the company extends its innovative solutions throughout the region, upholding internationally recognised standards and ensuring optimal operational manoeuvrability. By fostering enduring relationships with like-minded business partners, ONYX Hospitality Group delivers unparalleled experiences in a dynamic and competitive market, meeting the ever-evolving demands of travellers.

More information: ![]() www.onyx-hospitality.com

www.onyx-hospitality.com

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn