Banking

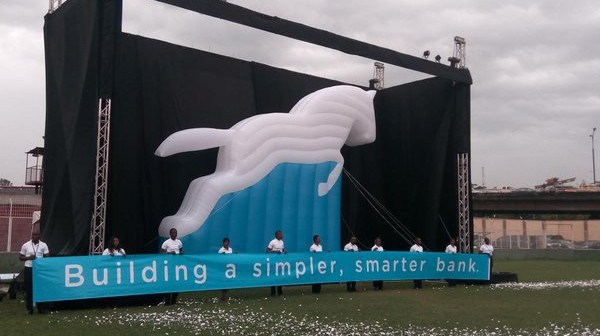

Titan Trust Bank Ceases to Exist After Merger With Union Bank

By Aduragbemi Omiyale

The merger between Union Bank of Nigeria and Titan Trust Bank Limited has been concluded after securing approval from the Central Bank of Nigeria (CBN).

Under the terms of the merger, Union Bank has fully absorbed Titan Trust Bank’s operations and assets. The combined institution will continue to operate under the Union Bank brand, while Titan Trust Bank ceases to exist as a separate entity.

The chief executive of Union Bank, Mrs Yetunde Oni, described the development as “a pivotal moment in our 108-year journey, and a launchpad for delivering greater value to our customers.”

According to her, “By blending stability with innovation, we are better positioned to meet the evolving needs of Nigerians and to be their most trusted financial partner.”

Also, the chairman of the board of Union Bank, Mr Bayo Adeleke, described it as “a new era of growth, collaboration, and shared prosperity.”

He noted that, “By bringing together the strengths of both institutions, we are committed to creating lasting value for our customers, shareholders, and communities while advancing Nigeria’s financial inclusion agenda.”

The lender has assured customers that there would be no disruption to existing services, adding that account details remain unchanged, and customers will continue to access a full suite of products and services seamlessly, with an accelerated push towards enhanced digital solutions.

This strategic consolidation strengthens Union Bank’s market position, unlocks operational synergies, and underscores its ambition to deliver a modern, robust, and inclusive banking experience for all, especially with an expanded footprint of over 293 service centres and 937 ATMs nationwide, supported by strengthened digital channels.

Union Bank believes these numbers will inspire it to deliver enhanced value across retail, SME, and corporate segments, as the merger combines its trusted heritage with Titan Trust Bank’s agility and innovation, creating a platform for sustainable growth and broader financial inclusion.

Recall that the process of the merger between the two organisations began with the signing of a share sale agreement in 2021 and positions Union Bank as an even stronger force within Nigeria’s financial services sector.

Banking

UBA Taps $100bn Annual Diaspora Flows With New Platform

By Modupe Gbadeyanka

United Bank for Africa (UBA) Plc has introduced a diaspora platform designed to connect global Africans with investment and wealth opportunities.

This platform, according to the lender’s Head of Diaspora Banking, Mr Anant Rao, would be used to tap into the $100 billion diaspora remittance flows to Africa annually.

Mr Rao stated that the objective is to provide a platform that brings together offerings across the numerous needs of the global African, including banking and payments, investments, securities services, asset management, insurance, pensions, and real estate.

“Diaspora capital is not just a flow of funds — it is a strategic growth partner for Africa.

“Our role is to provide a trusted platform that converts capital into structured investment and shared prosperity across the continent,” he stated at the unveiling of this platform in Lagos recently.

Business Post gathered that this diaspora banking and investment platform will serve Africans living and working across the world and within the continent.

It was launched in collaboration with leading ecosystem partners, including United Capital, Africa Prudential, UBA Pensions, Afriland Properties, Heirs Insurance Group, and Avon Healthcare Limited.

“For decades, Africa’s engagement with its diaspora has focused largely on remittances. Today, we are moving beyond that. This platform represents a transition from simple money transfers to a financial ecosystem where Africans globally can bank, make payments, invest, protect their families, and build long-term wealth seamlessly,” Mr Rao further said.

It was learned that through this coordinated ecosystem, diaspora customers can access financial solutions across multiple sectors through a single trusted platform, enabling them to manage their financial lives and family commitments across borders with ease and transparency.

Also speaking, the Head of Marketing and Corporate Communications for UBA, Ms Alero Ladipo, noted that, “The modern African is a global citizen, mobile, ambitious, and deeply connected to home. Whether living in Africa, Europe, the Americas, or the Middle East, there must be a structured and secure financial connection back home. This platform ensures that Africans everywhere can remain economically connected to the continent with confidence and transparency.”

Partners within the ecosystem highlighted growing demand among diaspora Africans for structured investment opportunities, secure property ownership, insurance protection, and long-term financial planning.

United Capital showcased globally accessible investment products designed to deliver professionally managed and transparent wealth creation opportunities.

Afriland Properties emphasised structured and well-governed real estate investment pathways for diaspora clients.

Heirs Insurance highlighted protection solutions for life and assets, while Avon Healthcare Limited demonstrated healthcare access and insurance solutions for families across borders.

Africa Prudential and UBA Pension reinforced digital investment management and long-term pension savings solutions designed to support diaspora participation in African capital markets.

They all underscored a shared commitment to providing diaspora Africans with credible, transparent, and professionally managed financial pathways.

Banking

Polaris Bank Embeds Gift Card Feature in VULTe

By Aduragbemi Omiyale

A new Gift Card feature has been added to the digital lifestyle platform of Polaris Bank Limited, known as VULTe.

The gift card catalogue includes leading brands and platforms such as Amazon, SureGift, Visa and MasterCard Prepaid Cards, iTunes and Apple, Google Play, Steam, Razer Gold, Netflix, Spotify, Starbucks, and PaySafeCard, covering everything from physical goods and digital content to subscriptions, gaming, and everyday essentials.

This feature allows for a faster and smarter way for users to send love, appreciation, and rewards across borders, enabling customers to deliver global brand gift cards to family and friends anywhere in the world in seconds.

Designed for speed, security, and everyday relevance, the feature allows users to choose from a wide range of international and local brands spanning groceries, beauty and wellness, fashion, electronics, entertainment, gaming, and lifestyle services, all seamlessly accessible on VULTe.

Whether it is paying for a Netflix subscription in London, sending Spotify Premium to a friend in Accra, gifting a Starbucks coffee in New York, or helping a loved one shop at Amazon or Shoprite, VULTe’s Gift Card feature transforms digital transfers into meaningful real-world experiences, powered by Polaris Bank’s secure digital infrastructure.

Users log in to VULTe, select Lifestyle, choose Gift Card, pick a preferred brand, enter the amount and recipient’s email, confirm the transaction, and authorise with their PIN. The gift card is delivered instantly, removing shipping delays, currency barriers, and geographic limitations.

With this feature on VULTe, Polaris Bank reinforces its commitment to digital innovation and lifestyle banking, positioning VULTe as a bridge between financial services and everyday global experiences, enabling customers to turn simple moments into meaningful connections delivered instantly, securely, and without borders.

Banking

Sterling Bank, AltBank Meet Full Recapitalisation After N153bn Injection

By Modupe Gbadeyanka

The banking subsidiaries of Sterling Financial Holdings Company Plc, Sterling Bank and The Alternative Bank (AltBank), have met the full recapitalisation requirements of the Central Bank of Nigeria (CBN).

The chief executive of Sterling Holdings, Mr Yemi Odubiyi, said the recapitalisation strengthens the group’s ability to support economic activity while maintaining financial resilience.

“This exercise goes beyond regulatory compliance. It positions us to expand credit responsibly, accelerate innovation, and provide sustained support to businesses and households, while maintaining the discipline required in a challenging operating environment,” he said.

Mr Odubiyi noted that fully capitalising both Sterling Bank and The Alternative Bank reinforces the organisation’s dual-bank structure and its ability to serve conventional and non-interest segments.

“Our structure enables efficient deployment of capital across complementary markets and positions us to respond with agility to evolving customer needs,” he said, adding that strong investor participation across the capital programmes reflects confidence in the group’s governance and long-term strategy.

He further pointed out that the strengthened balance sheet provides a platform for the company’s next phase of growth.

“We are entering this phase from a position of significant financial strength, with the capacity to scale non-banking businesses, deepen digital capabilities, and pursue disciplined expansion opportunities while delivering sustainable value for shareholders,” Mr Odubiyi said.

Sterling Holdings achieved this feat after raising fresh capital between December 2024 and October 2025, positioning itself well ahead of the 2026 industry deadline.

In December 2024, it completed a N75 billion private placement, raising N73.86 billion in net proceeds. Of this amount, N68.8 billion was allocated to Sterling Bank and N5 billion to The Alternative Bank, strengthening the capital base of both institutions.

This was followed by a N28.79 billion rights issue, which was oversubscribed by N10.29 billion. Regulatory approvals in May 2025 enabled the allotment of N26.639 billion under the rights issue, with the oversubscription restructured into a private placement, enabling AltBank to meet the capital requirement for non-interest banks with national licences.

Sterling HoldCo further strengthened its capital position through an N88 billion public offer in October 2025, which recorded an oversubscription. The CBN has cleared the full amount of N96.69 billion for recognition as additional capital, while the Securities and Exchange Commission (SEC) approved the allotment of 13,812,239,000 shares.

In total, the group injected N153 billion into Sterling Bank and The Alternative Bank, bringing both institutions into full compliance with the revised capital requirements.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn