General

Abuja Disco Transitions to Holdco Structure, Forms Two New Subsidiaries

By Adedapo Adesanya

Abuja Electricity Distribution Plc has announced its transition into a Holding Company structure, effectively breaking into two subsidiaries.

This is part of moves aimed at strengthening its capacity to operate effectively within Nigeria’s evolving electricity market and the newly decentralised regulatory environment.

In a statement, the Holdco said restructuring followed the enactment of the Electricity Act of 2023, which empowers state governments to establish independent electricity markets and regulatory commissions.

AEDC said it had realigned its corporate structure to enhance operational agility, improve governance, and support efficient service delivery across its franchise areas.

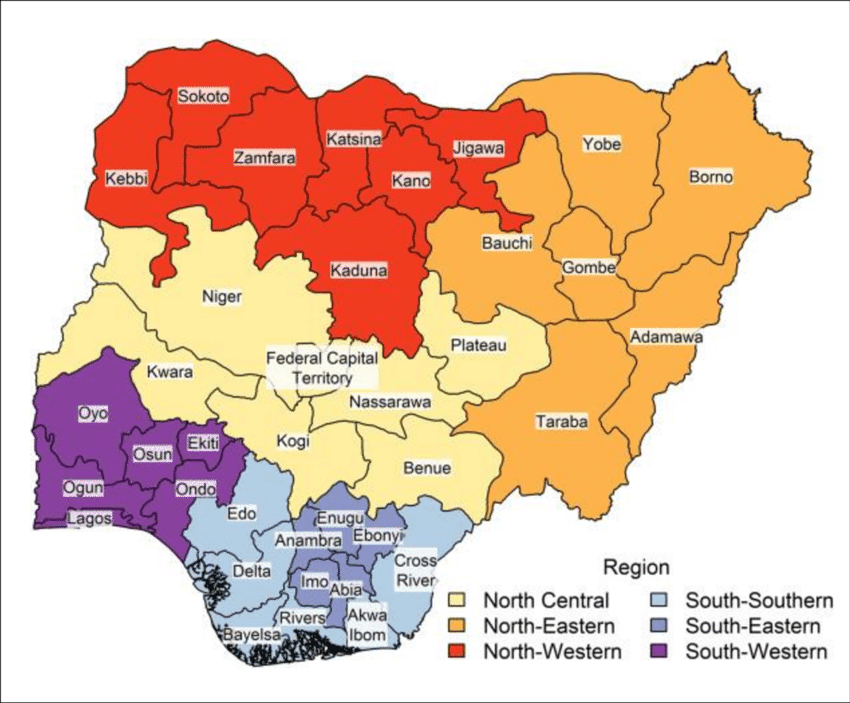

As part of the transformation, AEDC incorporated two new subsidiary companies — Niger Electricity Distribution Company and Kogi Electricity Distribution Company.

Prior to the new development, AEDC distributes electricity to the Federal Capital Territory (FCT) and parts of Niger, Kogi, and Nasarawa states.

As a result, the new subsidiaries will operate under the Niger State Electricity Regulatory Commission and the Kogi State Electricity Regulatory Commission, respectively, while remaining integral members of the wider AEDC Group.

It added that plans were underway to commence operations in Nasarawa State, with the transition process expected to begin soon.

The company also announced key executive appointments, naming Mr Sam Odekina as Chief Business Officer and Acting Managing Director of Niger Electricity Distribution Company, and Mr Desmond Eboh as Chief Business Officer and Acting Managing Director of Kogi Electricity Distribution Company.

The Managing Director/Chief Executive Officer of AEDC, Mr Chijioke Okwuokenye, said the HoldCo structure positions the company to respond to state-specific regulatory requirements while preserving the Group’s unified identity, shared values, and commitment to operational excellence and customer service.

According to him, all subsidiaries will operate as one integrated AEDC family, with uniform Conditions of Service for employees to ensure workforce stability and fairness.

“The HoldCo structure aligns perfectly with our goal to enhance operational efficiency and adapt to Nigeria’s evolving energy landscape while exploring new opportunities, driving growth, and contributing to Nigeria’s energy sector development,” Mr Okwuokenye said.

“We are committed to maintaining our high standards of service, innovation, and customer focus, even as we evolve into a new structure,” he added.

The company also noted that the recently executed Conditions of Service apply uniformly to all employees across the parent company and its subsidiaries, underscoring its commitment to workforce stability, fairness, and alignment during the transition.

AEDC also reaffirmed its commitment to supporting the development of sustainable, state-regulated electricity markets and setting benchmarks for efficiency, reliability, and customer experience across its operations.

General

FG Dismisses Northern Elders Claim of State-Owned Gold Refinery in Lagos

By Adedapo Adesanya

The federal government has dismissed claims by the Northern Elders Forum (NEF) that it violated the principle of federal character by siting a gold refinery in Lagos.

This was contained in a statement signed by Mr Segun Tomori, the Special Adviser on Media to the Minister of Solid Minerals Development, Mr Dele Alake, in Abuja.

The statement clarified that the refinery is a wholly private-sector initiative and not a federal government project, describing the allegation as entirely false and based on a misrepresentation of facts.

According to the statement, the proposed gold refinery is the initiative of Kian Smith, a 100 per cent privately owned mining company established to promote the development of Nigeria’s local gold industry through innovative practices.

The statement stressed that at no time did the Minister of Solid Minerals Development. announced the establishment or ownership of any gold refinery by the federal government in Lagos or any other part of the country.

It added that the minister was clear that the refinery is privately owned, noting that more gold refineries are also being developed in other parts of Nigeria by private investors.

It congratulated the founder and managing director of Kian Smith, Mrs Nere Emiko, describing the project as the result of years of perseverance, enterprise, and leadership.

The statement explained that the refinery aligns with the federal government’s value-addition policy, which discourages the export of raw minerals and promotes local processing and manufacturing.

It noted that the policy has attracted major investments, including lithium and rare-earth processing plants in Nasarawa State and Abuja, generating foreign capital inflow and thousands of jobs for Nigerians.

It expressed concern over what it described as a decline in the quality of the group’s interventions on national issues, questioning how the federal government can compel a private company to locate its business in any particular part of the country, noting that such decisions are based on operational and marketing strategies.

The statement reaffirmed the government’s commitment to creating an enabling environment for private-sector investment in the mining sector and called on the Northern Elders Forum to support national economic development efforts.

General

SERAP Sues Governors, Wike Over Security Votes Spending

By Adedapo Adesanya

The Socio-Economic Rights and Accountability Project (SERAP) has filed a lawsuit against Nigeria’s governors and the Minister of the Federal Capital Territory, Abuja (FCT), Mr Nyesom Wike, over their failure to account for security votes spending since May 29, 2023.

According to the organisation, the suit followed reports of the Benue massacre and well-documented ongoing cases of insecurity in several states and FCT, despite the over N400 billion budgeted yearly as ‘security votes.’ 10 governors reportedly budgeted about N140 billion as security votes in 2026.

In the suit number FHC/ABJ/CS/95/2026 filed last Friday at the Federal High Court in Abuja, SERAP is asking the court to “direct and compel the governors and Mr Wike to disclose the details of the spending of security votes by them since 29 May 2023 to date, which are intended to ensure the security of life and property of Nigerians.”

It asked the court to compel the governors and Mr Wike to provide detailed reports on the allocation and spending of security votes by their states and the FCT, including the information on implementation status and completion reports, and the plans, if any, for improving the security infrastructure in the states and FCT.

In the suit, SERAP is arguing that, “Nigerians ought to know in what manner public funds including security votes meant to ensure the security of life and property of Nigerians, are spent by the governors and FCT minister.”

It noted that escalating insecurity in several states and FCT is taking a devastating toll on socially and economically vulnerable Nigerians, driving up extreme poverty, intensifying hunger and leading to other grave human rights violations.

SERAP also noted that, “Citizens’ right to know promotes openness, transparency, and accountability that is in turn crucial for the country’s democratic order.”

The suit filed on behalf of SERAP by its lawyers Ms Oluwakemi Agunbiade, Mr Andrew Nwankwo, and Ms Valentina Adegoke, read in part: “There is a significant risk of embezzlement, misappropriation or diversion of public funds collected by the states and FCT as security votes.

“Despite the billions of naira yearly budgeted as security votes, many governors and FCT ministers are grossly failing to guarantee and ensure the security and welfare of the Nigerian people, contrary to section 14(2)(b) of the Nigerian Constitution.

“Directing the governors and FCT minister to account for security votes spending would serve to engage Nigerians in an honest conversation about the security problems and what the governors and minister are doing to respond to them.”

No date has been fixed for the hearing of the suit.

General

Excitement as Nigeria Exits EU’s High-Risk Financial List

By Adedapo Adesanya

The European Union (EU) has officially removed Nigeria from its list of High-Risk Third Country Jurisdictions.

This decision follows Nigeria’s successful exit from the Financial Action Task Force (FATF) “grey list” in late 2025, signaling international recognition of the country’s improved anti-money laundering and counter-terrorism financing (AML/CFT) frameworks.

The development is expected to ease trade, payments and investment flows between the country and Europe

The European Commission confirmed that Nigeria, alongside South Africa, Burkina Faso, Mali, Mozambique and Tanzania, had strengthened its AML/CFT regimes and no longer posed “strategic deficiencies” under EU assessment standards.

The commission noted that the affected countries had implemented reforms that brought their financial systems in line with international standards set by the FATF.

Reacting to the development, the Minister of State for Finance, Mrs Doris Uzoka-Anite, described Nigeria’s removal from the list as a major boost to investor confidence.

On a post on X on Thursday, she wrote, “Big win for Nigeria! Removed from EU’s financial ‘high-risk’ list!Congrats to President @officialABAT on this achievement. As Minister of State for Finance, I’m proud of this boost to trade and investor confidence.”

Being on the EU’s high-risk list previously meant that transactions with European partners required enhanced due diligence, stricter documentation, and additional oversight.

Nigerian businesses and banks faced increased scrutiny, which slowed cross-border trade and complicated investment flows.

The lifting of enhanced due diligence requirements is scheduled to take effect on January 29, 2026, following confirmation by the Commission confirmed that Nigeria has addressed strategic deficiencies and strengthened its financial governance through critical legislative reforms, such as the Money Laundering (Prevention and Prohibition) Act.

The development could have a series of positive impact including the provision of several immediate and long-term benefits as well as reduction of compliance costs.

As a result, EU financial institutions will no longer be legally required to apply “enhanced due diligence” to transactions involving Nigeria, which previously involved more intrusive checks and rigorous documentation.

It will also enhance smoother cross-border trade by simplifying trade and payment flows between Nigeria and European partners, reducing the complexity and time required for transactions.

Nigerian officials, including the Minister of State for Finance, have highlighted this as a “major boost” to investor confidence, positioning Nigeria as a more credible destination for international capital.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn