Economy

Aiteo Insists Benedict Peters Not Diezani’s Frontman

By Modupe Gbadeyanka

Aiteo Group has reacted to online reports that its Executive Vice Chairman (EVC), Mr Benedict Peters, acted as a frontman for the immediate past Minister of Petroleum Resources, Mrs Diezani Allison-Madueke, to purchase posh property in England and luxury furnishings in return for contracts from the Nigerian National Petroleum Corporation (NNPC).

In a statement issued by the oil firm this week, it said, “The publication contains several untrue and malicious allegations against our EVC and the Aiteo Group.”

“It is obviously directed against the image, reputation and integrity of our EVC and the company in what we have identified as an orchestrated large-scale campaign of calumny which is sponsored and designed to tarnish our image,” it said.

The company noted that, “We have responded to most of the baseless allegations in previous publications but global best practice demands that we tender this rebuttal for the sake of our shareholders, stakeholders, host communities, the many thousands directly or indirectly deriving their livelihood from the company and the public at large.

“It is well known in the Oil, Gas and wider Energy sectors that the Aiteo Group comprises a number of separate, legal and corporate entities whose asset base includes OML 29 and NCTL upstream, and other substantial assets downstream, developed more than 16 years ago.

“The company became a major player in the oil and gas industry especially in importing and exporting petroleum products in Nigeria and was flourishing as a prosperous corporate entity, by any standards, long before Mrs Alison-Madueke was appointed as Minister for Petroleum Resources.

“It is indisputable that our EVC is “experienced” in the oil and gas industry, having worked in the industry in the topmost positions for more than 23 years.

“Similarly, Aiteo Group is neither an inexperienced nor “newly minted” company and we note that while the publication impliedly recognises this position, it does not provide express clarification as should have been done.

“Already, Mr Peters, through his lawyers, has challenged the veracity of the claims made in the article in court. There is a related civil case in the United States which recites matters relevant to the UK and Nigerian court cases in respect of which further comment cannot also be made for the same reason.

“Neither our company nor EVC is a party to the US proceedings. We need hardly remind the publishers that in Nigeria, discussing facts of cases that are pending in court and making prejudicial statements pertaining thereto is a criminal offence. Section 133 of the Criminal Code Act, Cap C38 of the Laws of the Federation of Nigeria 2004, which broadly, defines contempt of court and prescribes punishment for same, provides in Section 133(1&9) that: ‘Any person, who while a judicial proceeding is pending, makes use of any speech or writing, misrepresenting such proceeding, or capable of prejudicing any person in favour of or against any party to such proceeding, or calculated to lower the authority of any person before whom such proceeding is being heard or taken; or commits any other act of intentional disrespect to any judicial proceeding or to any person before whom such proceeding is being heard or taken’ is guilty of an offence.

“In summary, all allegations of impropriety contained in the said publication are expressly and categorically denied. Mr Peters has not been charged with any criminal offence in Nigeria or any other jurisdiction with respect to any of the matters stated in the publication. Like every major player in the oil and gas sector, including international oil companies (IOCs), Mr Peters and the Aiteo Group’s interactions with the Minister of Petroleum Resources as with other Ministers before her, were in accordance to acceptable corporate practice in Nigeria. Other than such interaction, there is no commercial link between them and there is no basis for inferring any.

“We add that our Group’s contribution to the overall financial capacity of the country, over several years predating her appointment as Minister cannot be overemphasised. Aiteo has created significant direct and indirect employment, contributed billions of Naira and millions of US Dollars to the nation’s treasury and led to direct foreign investment worth more than US$4 billion. In addition, the company engages in several other corporate social investment programmes in its host communities and the nation generally.

“The case in the United Kingdom is a civil case. An application has already been made to discharge the restraint order which is a mirror order of, and largely relies for its authority on, interim forfeiture orders granted by a Nigerian Court with respect to the same properties. There is incontrovertible evidence in the form of provenance of funds utilised to acquire the property or properties concerned; legal documents of title and documentary proof of rights of ownership from purchase to date that completely confirm that the material purchases were transacted solely by our EVC and his companies; that he irrefutably owns the material property or properties. It is therefore ridiculous, false and highly defamatory to suggest or infer that properties were ‘bought for Mrs Alison-Madueke’. The matters in Nigeria and United Kingdom remain active and extant.

“The US proceedings which refer to United Kingdom properties does not substantiate any wrongdoing on our EVC part. He purchased furniture for one of his United Kingdom properties. This furniture was delivered to and placed in that property. The furniture was for his own use and not purchased for Mrs Alison-Madueke as stated in the publication; and is entirely consistent with his status, stature and financial compass as well as the value and location of the property for which the furniture was bought.

“These comments seem unquestionably designed to injure and damage our EVC and our reputation; destroy the fabric of our commercial objectives and outlook; divert business away from us and create such opprobrium that our entire business is severely prejudiced and undermined.

“We note that the publishers did not seek any verification of the account set out in the publication from us prior to publishing same. Aiteo has a Media and Communications Department, fully staffed by professionals who deal with matters of this nature. It is easy to contact us either through contact details on our website or by phone. But the publishers chose not to do so. Instead, they elected to publish defamatory material in a most irresponsible, reckless and malicious exercise of journalistic licence.

“Finally, we are aware that a certain group has committed considerable resources to this global campaign of hate and denigration. The reason for this mindless and incomprehensible offensive is unclear, but we are confident that sooner than later, our investigations shall reveal the irrepressible truth.

“Regardless of the stories being bandied around by detractors, the facts of this matter are in the public domain and accessible in the courts of law for everyone to see. However, given the potential consequences of this publication, we are considering all options to protect the personal and professional integrity of our company and our Executive Vice Chairman.”

Economy

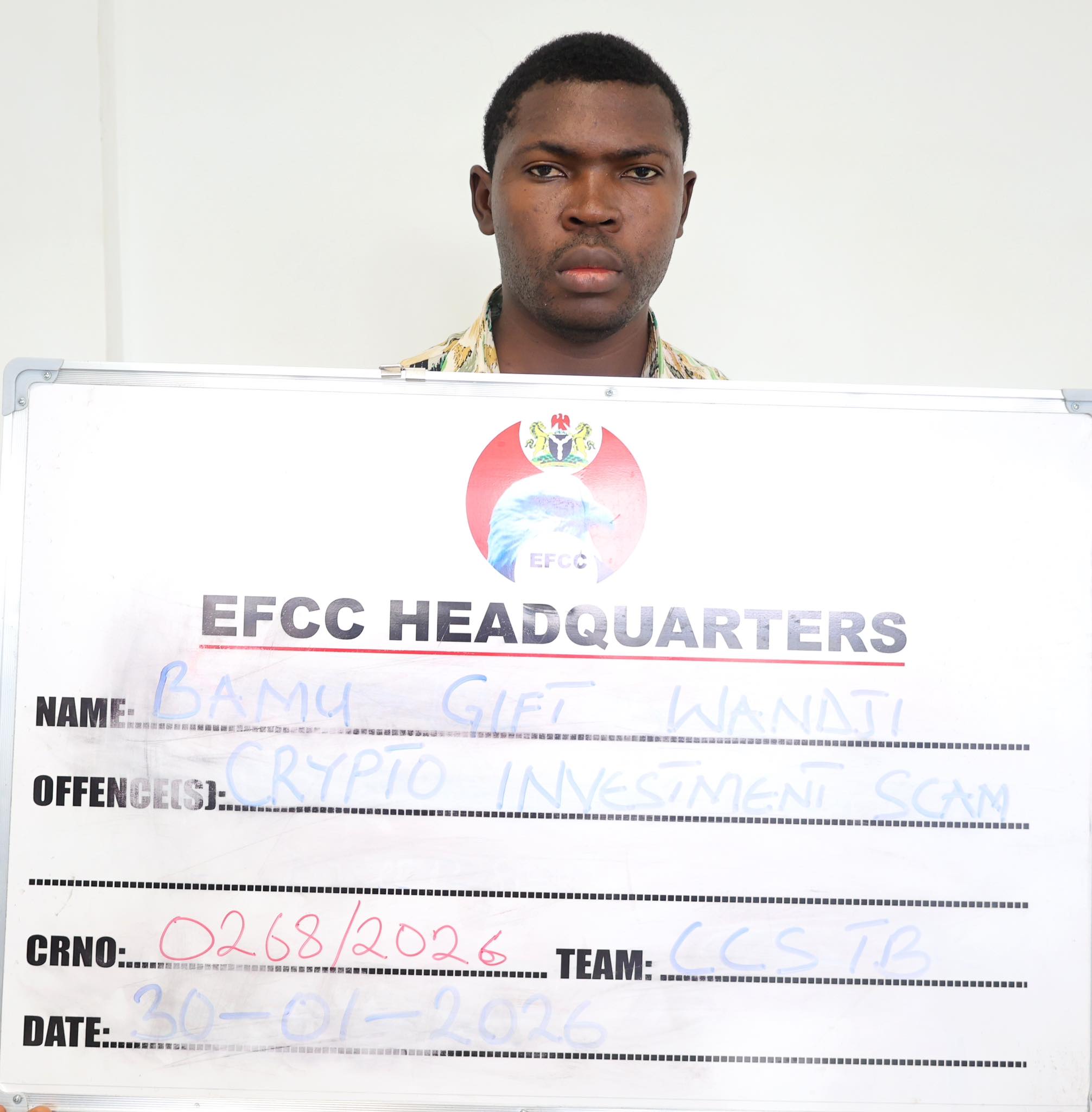

Crypto Investor Bamu Gift Wandji of Polyfarm in EFCC Custody

By Dipo Olowookere

A cryptocurrency investor and owner of Polyfarm, Mr Bamu Gift Wandji, is currently cooling off in the custody of the Economic and Financial Crimes Commission (EFCC).

He was handed over to the anti-money laundering agency by the Nigerian Security and Civil Defence Corps (NSCDC) on Friday, January 30, 2026, after his arrest on Monday, January 12, 2026.

A statement from the EFCC yesterday disclosed that the suspect was apprehended by the NSCDC in Gwagwalada, Abuja for running an investment scheme without the authorisation of the Securities and Exchange Commission (SEC), which is the apex capital market regulator in Nigeria.

It was claimed that Mr Wandji created a fraudulent crypto investment platform called Polyfarm, where he allegedly lured innocent Nigerians to invest in Polygon, a crypto token that attracts high returns.

Investigation further revealed that he also deceived the public that his project, Polyfarm, has its native token called “polyfarm coin” which he sold to the public.

In his bid to promote the scheme, the suspect posted about this on social media platforms, including WhatsApp, X (formally Twitter) and Telegram. He also conducted seminars in some major cities in Nigeria including Kaduna, Lagos, Port Harcourt and Abuja where he described the scheme as a life-changing programme.

Further investigation revealed that in October, 2025, subscribers who could not access their funds were informed by the suspect that the site was attacked by Lazarus group, a cyber attacking group linked to North Korea.

Further investigations showed that Polyfarm is not registered and not licensed with SEC to carry out crypto transactions in Nigeria. Also, no investment happened with subscribers’ funds and that the suspect used funds paid by subscribers to pay others in the name of profit.

Investigation also revealed that native coin, polyfarm coin was never listed on coin market cap and that the suspect sold worthless coins to the general public.

Contrary to the claim of the suspect that his platform was attacked, EFCC’s investigations revealed that the platform was never attacked or hacked by anyone and that the suspect withdrew investors’ funds and utilized the same for his personal gains.

The EFCC, in the statement, disclosed that Mr Wandji would be charged to court upon conclusion of investigations.

Economy

Nigerian Stocks Shed 0.09% on Mild Profit-Taking

By Dipo Olowookere

Profit-takers pounced on the Nigerian Exchange (NGX) Limited on Friday, weakening it by 0.09 per cent at the close of transactions.

Investors toned down on their hunger for Nigerian stocks during the last trading session of the week, with selling pressure mainly on the banking space, which shed 0.78 per cent.

The bourse crumbled despite the other sectors closing green, with the consumer goods up by 0.10 per cent, and the energy index up by 0.02 per cent, while the industrial index closed flat.

Livestock Feeds depreciated by 10.00 per cent to sell for N6.30, Learn Africa declined by 10.00 per cent to N8.10, Living Trust Mortgage Bank also slipped by 10.00 per cent to N4.05, Deap Capital gave up 9.97 per cent to trade at N9.39, and Industrial and Medical Gases lost 9.61 per cent to finish at N31.50.

On the flip side, Zichis appreciated by 9.97 per cent to N4.19, Abbey Mortgage Bank gained 9.94 per cent to quote at N9.40, RT Briscoe jumped by 9.93 per cent to N7.86, Haldane McCall grew by 9.90 per cent to N4.33, and Omatek increased by 9.87 per cent to N3.00.

Business Post reports that the market breadth index was positive despite the poor outcome, recording 33 price gainers and 31 price losers, representing strong investor sentiment.

The All-Share Index was down by 156.91 points during the session to 165,370.40 points from the 165,527.31 points achieved a day earlier, and the market capitalisation depleted by N184 billion to N106.153 trillion from N105.969 trillion.

Trading data showed that 687.4 million equities valued at N15.0 billion exchanged hands in 41,553 deals yesterday compared with the 691.4 million equities worth N15.4 billion traded in 38,665 deals on Thursday, implying a jump in the number of deals by 7.47 per cent, and a slip in the trading volume and value by 2.60 per cent, respectively.

The busiest stock on Friday was Veritas Kapital with 80.5 million units worth N197.0 million, Secure Electronic Technology transacted 79.3 million units valued at N87.5 million, Deap capital transacted 33.3 million units for N340.5 million, Access Holdings sold 31.0 million units valued at N703.0 million, and Zenith Bank exchanged 30.6 million units worth N2.2 billion.

Economy

NASD Exchange Rises 0.20%

By Adedapo Adesanya

The NASD Over-the-Counter (OTC) Securities Exchange appreciated by 0.20 per cent on Friday, January 30, supported by the gains achieved by two securities on the platform.

During the session, Okitipupa Plc went up by N15.70 to finish at N234.60 per share versus the previous day’s N218.90 per share and Paintcomm Investment Plc expanded by 5 Kobo to close at N11.05 per unit compared with the previous day’s N11.00 per unit.

It was observed that yesterday, there were three price losers led by Geo-Fluids Plc, which dropped 60 Kobo to sell at N5.75 per share versus N6.35 per share, Afriland Properties Plc declined by 35 Kobo to close at N13.65 per unit compared with Thursday’s closing price of N14.00 per unit, and Industrial and General Insurance (IGI) Plc depreciated by 3 Kobo to 66 Kobo per share from 69 Kobo per share.

At the close of business, the NASD Unlisted Security Index (NSI) rose by 7.34 points to 3,630.11 points from 3,622.77 points and the market capitalisation grew by N4.39 billion to N2.171 trillion from N2.167 trillion.

A total of 287,618 units of securities exchanged hands on Friday compared with the previous day’s 1.9 million units of securities, indicating a decline in the volume of trades by 85.6 per cent.

The value of transactions, according to data, was down by 77.2 per cent to N3.1 million from N13.4 million, but the number of deals increased by 31.3 per cent to 21 deals from 16 deals.

Central Securities Clearing System (CSCS) Plc remained the most traded stock by value (year-to-date) with 15.4 million units exchanged for N623.0 million, followed by FrieslandCampina Wamco Nigeria Plc with 1.6 million units traded for N108.5 million, and Geo-Fluids Plc with 9.1 million units valued at N61.1 million.

CSCS Plc also ended the session as the most active stock by volume (year-to-date) with 15.4 million units sold for N623.0 million, followed by Mass Telecom Innovation Plc with 10.1 million units worth N4.1 million, and Geo-Fluids Plc with 9.1 million units valued at N61.1 million.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn