Economy

Dangote Cement Rakes N805b as Revenue, N204b Profit in 2017

**Declares N10.50k per share dividend

By Dipo Olowookere

One of the leading cement makers in the country, Dangote Cement, generated the sum of N805.6 billion as revenue in 2017, Business Post is reporting.

This information was made known in the company’s financial statements for the year ended December 31, 2017, released today on the Nigerian Stock Exchange (NSE).

In the firm’s earnings, it was disclosed that the amount made last year surpassed what was realized two years ago when Nigeria slipped into recession, N615.1 billion.

Business Post gathered from the financial statements that the revenue was buoyed by activities from Dangote Cement’s operations in Nigeria.

The company’s operations in Nigeria, its biggest market in Africa, contributed N552.4 billion to the total revenue generated last year, an increase from the N426.1 billion it raked two years ago.

However, the volume of cement sold in Nigeria in 2017 depreciated by 7 percent to 12.7 million tonnes from 15.1 million tonnes in 2016.

During the year under review, the cement manufacturer recorded a gross profit of N454.3 billion compared with N291.3 billion in 2016, while the selling and distribution expenses closed at negative N109.9 billion against negative N82.7 billion in 2016.

Its profit from operating activities grew by 66.7 percent to N304.2 billion last year from N182.5 billion two years ago.

Dangote Cement’s pre-tax profit closed at N289.6 billion in the period under review in contrast to N142.9 billion in the corresponding period, while the post-tax profit stood at N204.3 billion as at December 31, 2017 against N142.9 billion as at December 31, 2016.

The company’s total assets closed at N1.7 trillion in the 2017 financial year against N1.5 trillion in 2016, while the total liabilities stood at N884.5 billion last year compared with N803.6 billion two years ago.

In addition, the shareholders’ fund of Dangote Cement finished at N781.4 billion in 2017 in contrast to N725.5 billion in 2016.

Business Post reports that the firm’s Earnings Per Share (EPS) stood at N11.65k in the period under review compared with N8.78k two years ago.

Meanwhile, the board of Dangote Cement has proposed the payment of N10.50k per share dividend to its shareholders to be paid on June 21, 2018, a day after its Annual General Meeting (AGM) slated for the Civic Centre, Lagos by 11am.

Economy

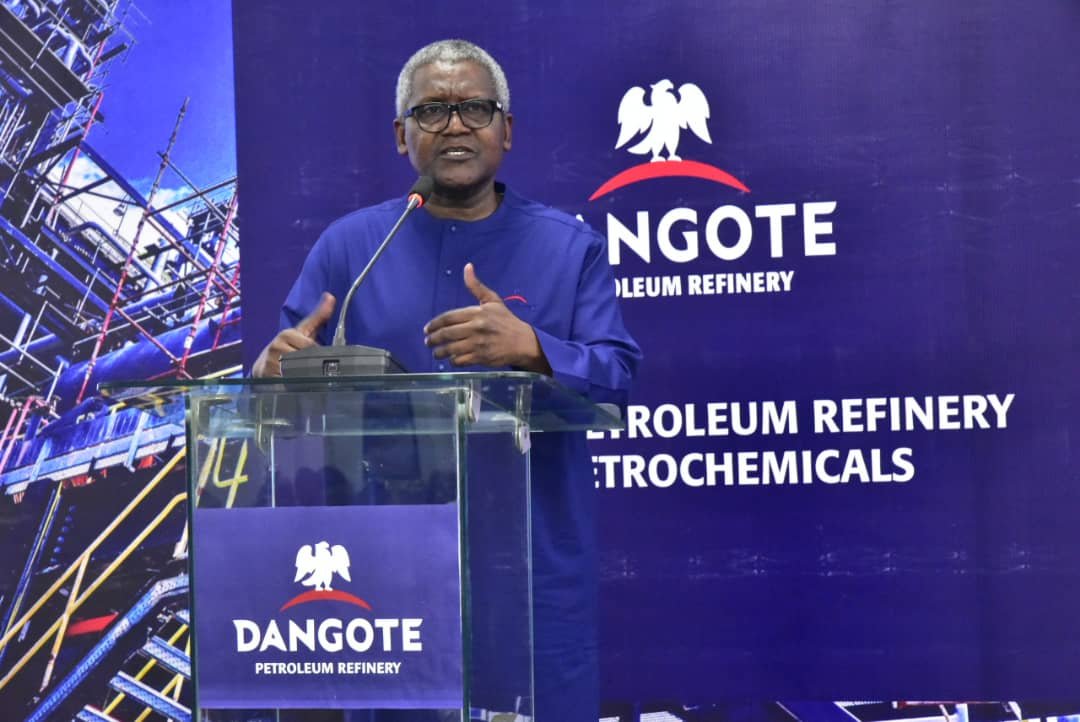

Dangote to Drive Africa’s Economic Expansion With Vision 2030

By Modupe Gbadeyanka

A new strategy designed to fast-track the industrialisation of Africa by strengthening economic self-sufficiency, and empowering its next generation has been announced by Dangote Industries Limited (DIL).

This scheme is known as the Vision 2030 and the main goal is to increase the production capacity of the cement arm of the conglomerate to approximately 90 million tonnes by 2030, positioning the organisation as one of the world’s most competitive cement producers.

The president of the firm, Mr Aliko Dangote, while speaking at a recent event in Lagos, reaffirmed that the company’s long-term direction is focused on building Africa’s capacity to feed itself, power its economy, and develop its people sustainably.

He also disclosed that in four years’ time, Dangote Industries Limited should be a $100 billion enterprise through sustained industrial expansion, cross-border investments, and strengthening Africa’s independence in strategic sectors such as energy, manufacturing, and infrastructure.

The businessman added that as part of its long-term commitment to developing African talent, the group came up with a N1 trillion ($600 million) education fund in December 2025.

“Our ambition goes far beyond building factories; we are building the structures that will enable Africa to feed itself, power its industries, and equip its people for long-term prosperity.

“Under this vision, we have announced the expansion of our petroleum refinery from 650,000 barrels per day to 1.4 million barrels per day, and our fertiliser plant to 12 million metric tonnes per annum. Our cement business is also on track to reach 90 million tonnes by 2030 — which means producing 50 percent more than the entire cement output of Saudi Arabia,” he said.

“Empowering the next generation is essential for building the Africa we envision. This fund is a major investment in the future of young Africans who will drive the continent’s transformation in the years to come,” he added.

Economy

NASD OTC Exchange Shrinks 0.05%

By Adedapo Adesanya

The NASD Over-the-Counter (OTC) Securities Exchange weakened by 0.05 per cent on Monday, January 19, with the market capitalisation declining by N1.1 billion to end N2.194 trillion from N2.195 trillion and the NASD Unlisted Security Index (NSI) down by 1.83 points to end at 3,667.22 points, compared with last Friday closing price of 3,669.05 points.

There were seven price movers, with four gainers and three losers led by FrieslandCampina Wamco Nigeria Plc, which dipped by N1.29 to N73.71 per share from N75.00 per share, Food Concepts Plc lost 31 Kobo to close at N2.75 per unit versus N3.06 per unit, and UBN Property Plc went down by 4 Kobo to N2.01 per share from N2.05 per share.

On the flip side, Central Securities Clearing System (CSCS) Plc led the gainers as it rose by N1.80 to settle at N41.80 per unit compared with last Friday’s rate of N40.00 per unit, Air Liquide Plc appreciated by N1.40 to N15.40 per share versus N14.00 per share, IPWA Plc improved its value by 15 Kobo to end at N1.63 per unit versus N1.48 per unit, and Geo-Fluids Plc added 14 Kobo to trade at N7.14 per share compared with the preceding trading day’s N7.00 per share.

Meanwhile, the volume of securities traded rose by 642.2 per cent to 2.7 million units from 364,080 units, the total value of securities jumped by 288.0 per cent to N18.2 million from N4.7 million, and the number of deals increased by 104.8 per cent to 43 deals from 21 deals.

CSCS Plc remained the most traded stock by value on a year-to-date basis with 3.2 million units valued at N126.9 million, trailed by MRS Oil Plc with 271,121 units worth N54.1 million, and Geo-Fluids Plc with 7.5 million units sold for N51.2 million.

The most traded stock by volume on a year-to-date basis was Geo-Fluids Plc with 7.5 million units exchanged for N51.2 million, followed by CSCS Plc with 3.2 million units traded for N126.9 million, and Industrial and General Insurance (IGI) Plc transacted 3.1 million units valued at N1.9 million.

Economy

Naira Loses N2.33 at NAFEX to Trade N1,420 Per Dollar

By Adedapo Adesanya

The Naira opened the week heading south against the US Dollar on Monday, January 19 in the Nigerian Autonomous Foreign Exchange Market (NAFEX) after it lost N2.33 or 0.16 per cent to sell for N1,420.28/$1 compared with the preceding trading day’s N1,417.95/$1.

Equally, the Nigerian Naira depleted against the Pound Sterling in the same market window during the session by N4.56 to close at N1,905.8/£1 compared with last Friday’s value of N1,901.32/£1 and depreciated against the Euro by N5.27 to quote at N1,652.78/€1 versus the preceding session’s N1,647.51/€1.

But at the GTBank FX desk, the domestic currency appreciated against the greenback yesterday by N3 to sell at N1,424/$1, in contrast to last Friday’s price of N1,427/$1, and at the black market, it remained unchanged at N1,485/$1.

The weakening of the Nigerian currency in the official market on Monday was driven by relatively higher demand than the available supply as the Central Bank of Nigeria (CBN) made no visible intervention.

Regardless, there are expectations that improved supply conditions from the apex bank will be readily available to keep the market within range supplemented by exporters’ and importers’ inflows in addition to non-bank corporate supply enhanced liquidity.

Nigeria has seen projections of a stronger economic or gross domestic product (GDP) growth and lower inflation in 2026, with these forecasts citing improved macroeconomic fundamentals and reform impacts.

The Chartered Institute of Bankers of Nigeria (CIBN) projected a single interest rate for the year, while it made further positive forecasts regarding the Nigerian economy.

Despite oil earnings fluctuations, Nigeria’s gross external reserves balance increased by $40.71 million to the previous day’s balance, bringing total reserves to $45.90 trillion.

In the cryptocurrency market, benchmarked tokens were largely down as renewed tariff threats between the US and Europe, tied to President Donald Trump’s comments on Greenland, have pushed investors back toward traditional safe havens. Gold and silver rallied, while cryptocurrencies underperformed.

Ethereum (ETH) declined by 2.3 per cent to $3,119.97, Bitcoin (BTC) slumped by 1.7 per cent to $90,940.76, Binance Coin (BNB) went down by 0.9 per cent to $915.39, Solana (SOL) dipped by 0.9 per cent to $131.81, Ripple (XRP) slipped by 0.2 per cent to $1.95, US Dollar Tether (USDT) slid by 0.1 per cent to $0.9990, and US Dollar Coin (USDC) lost 0.01 per cent to settle at $0.9997.

On the flip side, Cardano (ADA) jumped by 1.5 per cent to $0.3666, Litecoin (LTC) appreciated by 0.3 per cent to $70.17, and Dogecoin (DOGE) went up by 0.2 per cent to $0.1269.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn