Banking

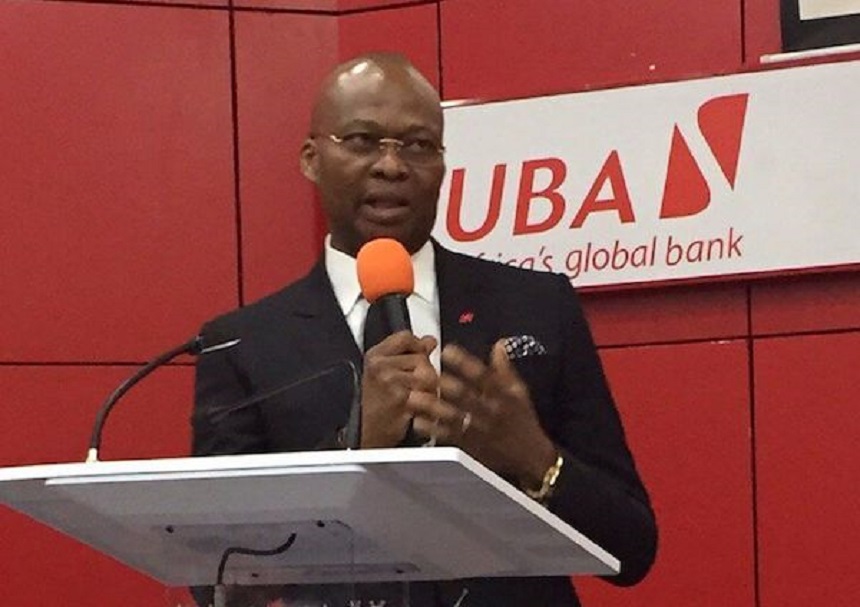

UBA Remains Financially Strong—Elumelu

**Shareholders Laud Management, Seek Better Results

By Modupe Gbadeyanka

Chairman of United Bank for Africa (UBA) Plc, Mr Tony Elumelu, says the pan-African financial institution remains financially strong despite the harsh operating environment.

Mr Elumelu, who once served as the Group Managing Director of the lender, made this disclosure on Monday at the bank’s 56th Annual General Meeting (AGM) held in Lagos.

The chairman said he was impressed with the strong growth and performance recorded by the lender last year, which saw improvements in both the top and bottom lines.

According to him, “Overall, our bank grew profit before tax by 16.1 percent to N105.3 billion.

“More importantly, the bank remains financially strong, our balance sheet is well protected and our commitment to exceeding regulatory requirements remains.”

He informed the shareholders that the bank recently “opened for operations in Mali, because that economy is a viable one and would contribute to our bottom-line.”

He said operations in “Mali will benefit from UBA’s presence there while UBA will also benefit from Mali.”

On his part, the GMD of UBA, Mr Kennedy Uzoka, assured shareholders of the management’s commitment to building a stronger brand.

According to him, “UBA has built a great brand that is recognised all over the world, and because of this, we have decided to be outside-focused rather than inside-focused.”

“Being outside focused means we are concentrating on putting our customers first in all we do by making sure that we do things from the customers’ standpoint,” he further said.

Meanwhile, shareholders of the financial institution have commended the staff, management and the board for putting up an impressive performance in 2017, which led to a better dividend payout.

Chairman of Progressive Shareholders Association of Nigeria, Mr Boniface Okezie, said at the AGM that, “I want to especially commend the management of UBA, especially the Chairman, Tony Elumelu, and GMD/CEO, Kennedy Uzoka, who have been managing activities of this great institution for the past two years.

“We the shareholders are impressed at results that you have recorded so far and the achievements that the bank has recorded under your leadership, especially the sterling contributions of our subsidiaries in Africa.

“We are especially impressed about what the bank has been doing in Africa. It has gone a long way to show that good things can come from Africa.

“UBA has showcased a high level of ingenuity in the banking space, and we are glad for how this is translating into gains for our business.

“And so, we the shareholders urge you to continue to do more and would advise Uzoka and his management team not to rest on their oars but to work harder in ensuring that this momentum is sustained and even surpassed in the coming year.”

Business Post reports that the board of UBA proposed the payment of total dividend per share of 85 kobo comprising of N0.20 interim dividend which was already paid by mid-2017 and a final dividend of 65 kobo which was ratified by shareholders during yesterday’s meeting.

Banking

OneDosh Raises $3m to Build Stablecoin-Powered Infrastructure for Cross-Border Payments

By Adedapo Adesanya

OneDosh, a fintech company focused on stablecoin-powered payments, has raised $3 million in pre-seed funding to develop infrastructure aimed at improving how individuals and businesses move money across borders.

The firm, co-founded in February 2025 by the trio of Mr Jackson Ukuevo, Mr Godwin Okoye, and Mr Babatunde Osinowo, was shaped by the founders’ firsthand experiences navigating blocked cards, frozen accounts, delayed international transfers, and currency restrictions while living and travelling globally. These challenges highlighted a consistent gap between the demand for seamless global payments and the systems available to support them.

Now, OneDosh operates in the United States and Nigeria, two active remittance corridors with strong demand for faster and more flexible payment solutions. Through our platform, users can transfer funds from the U.S. to Nigeria, hold value in stablecoins, and spend using stablecoin-powered cards compatible with Apple Pay and Google Pay, subject to network and regional availability.

Commenting on OneDosh’s mission, Mr Ukuevo said, “Millions of people are locked out of efficient cross-border payments because legacy systems are slow, expensive, and restrictive. OneDosh is building the infrastructure to change that, starting with the U.S.-Nigeria corridor and expanding from there. This funding helps us turn stablecoins into practical payment solutions for real people and businesses.”

“Beyond our current consumer-facing products, we are building payment infrastructure designed to connect wallets, cards, and markets into a single programmable system. Our approach focuses on enabling compliant, real-world use cases for stablecoins, particularly in regions where traditional cross-border payment systems remain costly or inefficient,” he added.

OneDosh’s founding team brings experience from organisations such as ZeroHash, Plaid, and Amazon, with backgrounds spanning payments infrastructure, compliance operations, and large-scale product development.

The pre-seed funding will be used to expand into additional payment corridors, deepen liquidity partnerships, and support senior team hires. These efforts are intended to boost capacity to support cross-border spending and settlement use cases as adoption of digital payment technologies continues to grow.

With the increasing interconnectedness of global commerce, OneDosh aims to contribute infrastructure designed to support faster, more accessible cross-border payments using stablecoins as a settlement layer.

Banking

EFCC Accuses Banks of Aiding N18.7bn Investment, Airline Discount Scams

By Modupe Gbadeyanka

One new generation bank and six financial technology (fintech) and microfinance banks have been accused of aiding fraudsters in defrauding Nigerians through fraudulent schemes.

This allegation was made by the Economic and Financial Crimes Commission (EFCC) while addressing the media in Abuja on Thursday.

The Director of Public Affairs of the EFCC, Mr Wilson Uwujaren, said these schemes involved about N18.7 billion fraudulent investment and airline discount scams.

He disclosed that in the airline discount fraud, fraudsters lure their victims to lose their hard-earned money by involving “a string of carefully devised airline discount information that any unsuspecting foreign traveller will fall for.”

“What they do is to advertise a discount system in the purchase of flight tickets of a particular foreign carrier. The payment module is designed in such a way that their victims would be convinced that the payment is actually made into the account of the airline. No sooner the payment is made than the passenger’s entire funds in his bank account are emptied,” he narrated to newsmen.

According to him, over 700 victims have fallen into the trap of fraudsters through the scheme with a total loss of N651.1 million to them.

Though the commission succeeded in recovering and returning N33.6 million to victims of the scam, Mr Uwujaren cautioned Nigerians to be more vigilant as foreign actors involved in the scheme are converting their illicit sleaze into cryptocurrency and moving them into safer destinations through Bybit.

Narrating the second scheme, the EFCC spokesman said it involved a company named Fred and Farid Investment Limited, simply called FF investment, which lured Nigerians into bogus investment arrangements.

He said over 200,000 victims have been defrauded in this regard, with about N18.1 billion raked in through nine companies offering diverse investment packages. .

In all, more than 900 Nigerians have been fleeced by fraudsters through the connivance of banks.

Mr Uwujaren claimed foreign nationals are behind the schemes, with three Nigerian accomplices who have been arrested and charged to court.

On the specific role of banks and fintechs in the schemes, two other directors of the EFCC, Abdulkarim Chukkol in charge of Investigations, and Mr Michael Wetcas in charge of Abuja Zonal Directorate, explained that, “a new generation bank and six fintechs and microfinance banks are involved in this. The financial institutions clearly compromised banking procedures and allowed the fraudsters to safely change their proceeds into digital assets and move into safe destinations”

“A total of N18,739, 999,027.35 had been moved through our financial system without due diligence of customers by the banks. It is worrisome that investigations by the commission showed that cryptocurrency transactions to the tune of N162 billion passed through a new generation bank without any due diligence. Investigations also showed that a single customer maintained 960 accounts in the new generation bank and all the accounts were used for fraudulent purposes.”

The EFCC called on regulatory bodies to bring financial institutions to compulsory compliance with regulations in the areas of Know Your Customers (KYC), Customer Due Diligence (CDD), Suspicious Transaction Reports (STRs) and others.

The agency charged regulatory bodies that Deposit Money Banks (DMBs), fintechs, MFBanks found to be aiding and abetting fraudsters should be suspended and referred to the EFCC for thorough investigation and possible prosecution.

It also warned that negligence and failure to monitor suspicious and structured transactions by banks would no longer be allowed, assuring that it will continue its work against money laundering by fraudulent actors.

Mr Uwujaren also tasked financial institutions to firm up their operational dynamics and save the nation from leakages and compromises bleeding the economy.

Banking

Nigeria Records Significant Decline in Payment Fraud Losses

By Adedapo Adesanya

The Nigeria Inter-Bank Settlement System (NIBSS) Plc has disclosed that electronic payment fraud losses declined significantly in 2025 due to coordinated actions by regulators, security agencies and industry operators.

Speaking at the 2026 Nigeria Electronic Fraud Forum (NeFF) Technical Kick-Off Session in Lagos, attended by regulators, banks, payment service providers, identity agencies and law enforcement agencies, the chief executive of NIBSS, Mr Premier Oiwoh, said the development showed the need to strengthen collaboration to sustain recent declines in electronic fraud and support deeper digital inclusion.

“The reduction in electronic payment fraud losses was recorded despite rising transaction volumes.

“We can only attribute this improvement to interventions by CBN, the Nigerian Financial Intelligence Unit (NFIU), security agencies and enhanced monitoring across the payments ecosystem,” he disclosed, noting, however, that internet banking and e-commerce remained the main fraud channels, with social engineering and insider-assisted fraud emerging as dominant trends.

The NIBSS boss said the gains recorded could only be sustained through stricter controls, stronger regulatory compliance and industry-wide collaboration.

He stressed zero tolerance for non-reporting of fraud, warning that weak reporting, poor identity verification and abuse of transaction limits continued to expose the system to risks.

Mr Oiwoh pointed out that the effective Know-Your-Customer (KYC) and Know-Your-Device (KYD) processes, supported by real-time validation of NIN and BVN, were critical to curbing fraud.

He added that stronger reporting requirements, joint industry action and a central “Persons of Interest” database—covering over 13,000 individuals—had improved detection and prevention.

He disclosed that the NIBSS was working with the CBN and other stakeholders on advanced AI-driven monitoring tools and a new national payment infrastructure to further strengthen fraud prevention and deepen financial inclusion.

Also speaking, the Deputy Governor, Financial System Stability, CBN, Mr Philip Ikeazor, said sustained cooperation under NeFF since 2011 had strengthened the resilience and security of Nigeria’s payments system.

Mr Ikeazor, represented by Mr Ibrahim Hassan, Director, Development Finance Institutions Supervision Department, said the sustained cooperation had reduced fraud losses in spite of rapid growth in digital transactions.

He highlighted industry achievements, including migration to EMV chip-and-PIN cards, two-factor authentication, enhanced transaction monitoring, centralised fraud reporting, and the integration of the Bank Verification Number (BVN) with the National Identification Number (NIN).

“Emerging threats such as social engineering, SIM-swap abuse, insider compromise and Authorised Push Payment (APP) scams require faster, integrated and proactive responses.

“The industry is committed to reducing fraud response times to under 30 minutes and to adopt enterprise-wide fraud management systems leveraging real-time analytics and shared intelligence,” the deputy governor said.

On her part, Mrs Rakiya Yusuf, Director, Payments System Supervision Department, CBN, and Chairman, Nigeria Electronic Fraud Forum (NeFF), urged continued coordinated action by regulators, banks, payment providers and law enforcement agencies.

Mrs Yusuf highlighted gains such as EMV chip-and-PIN migration, two-factor authentication, and improved identity management.

She warned that emerging threats required standardised frameworks, faster response times, and proactive use of ISO 20022 and analytics to sustain fraud reduction, expressing confidence that the forum’s deliberations would reinforce the foundations for a safer and more trusted digital financial ecosystem in Nigeria.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn