Technology

Kaspersky Grows Revenue to $726m in 2018

By Dipo Olowookere

Kaspersky Lab continued to deliver stable growth in 2018 and increased its global unaudited IFRS revenue to a total of $726 million, representing a 4 percent year-on-year revenue increase.

During a year of evolving market conditions and continuous geopolitical pressure, the company achieved success as a result of the trust customers and partners place in the company and its leading cybersecurity solutions and services.

Among the strategic business areas that drove Kaspersky Lab’s growth in 2018 were Digital and Enterprise. The company saw an increase in digital sales (+4 percent) and strong growth of 16 percent in the enterprise segment, with 55 percent growth in non-endpoint products and services in particular.

Overall, the company secured healthy results in these business areas by delivering some of the best products and services in the industry, as well as new solutions and technologies that prevent, detect and respond to the most sophisticated cyberthreats.

Commenting on the year’s results, Eugene Kaspersky, CEO of Kaspersky Lab, said: “2018 was a crucial year for us. After all the challenges and unsubstantiated allegations we faced in 2017, we had a responsibility to show that the company and our people deserve the trust of our partners and customers, and in turn, to continue to clearly demonstrate and prove our leadership.

“Our continued positive financial results are proof of this, demonstrating that users prefer the best products and services on the market and support our principle of protecting against any cyberthreats regardless of their origin.”

Globally, the company’s performance was driven by robust results, especially in META (+27 percent), as well as in other regions, such as Russia, Central Asia and CIS (+6 percent), APAC (+6 percent) and Europe (+6 percent), while there was a slowdown in Latin America (-11 percent) mainly caused by currency devaluation in the region.

The challenging geopolitical situation resulted in an overall slowdown in the North American market, where sales decreased by 25 percent.

Despite these challenges, Kaspersky Lab maintained and developed its presence in the market, with an 8 percent increase in new licenses sales in digital.

In 2018, Kaspersky Lab advanced the progress of its Global Transparency Initiative by undertaking a number of significant actions.

Notably, the company began the relocation of its IT infrastructure to Switzerland and opened the first Transparency Center in Zurich. Kaspersky Lab also implemented an audit by one of the Big Four professional services firms of the company’s engineering practices around the creation and distribution of threat detection rule databases.

Today’s ultra-connected global landscape requires increased transparency from organisations, and this unique initiative demonstrates Kaspersky Lab’s clear commitment to assuring the integrity and trustworthiness of its solutions in the service of the customers.

Technology

MTN Nigeria Suffers 9,218 Fibre Cuts in 2025

By Adedapo Adesanya

MTN Nigeria has revealed that it experienced 9,218 fibre cuts in 2025, causing widespread network disruptions across the country.

The telecommunications giant also reported that 211 sites were affected by theft and vandalism as of November 30, 2025, impacting essential services relied upon by customers daily.

The company recorded a total of 1,624,263 customer complaints, all of which were resolved across various service channels during the year. Despite these challenges, MTN reached 85 million subscribers by September 2025.

The chief executive of the telco, Mr Karl Toriola, made these revelations in his latest post on LinkedIn, acknowledging the company’s responsibility for network performance and its efforts to improve the customer experience.

He stated that the services fell short of customers’ expectations and clarified that some of these gaps were shaped by real operational challenges such as fibre cuts, theft, and vandalism.

“Their impact is felt directly by customers and reflected in what they tell us. We take responsibility for the signals we receive and for how we respond to the realities that shape the customer experience on our network,” he said.

Regardless, Mr Toriola added that, “There is progress to be proud of. And we clearly still have work to do.”

“We are not where we want to be yet, but our commitment to putting the customer at the centre of everything we do remains constant.”

As MTN prepares to celebrate its 25th anniversary in 2026, Mr Toriola reaffirmed the company’s dedication to listening to customers, responding quickly to issues, and driving consistent service improvements.

Some other milestones announced include addressing 1,624,263 customer complaints across all communication channels as well as receiving best network recognition from Ookla, getting back to profitability, and declaring interim dividends to shareholders.

The report comes in the wake of a February 2025 initiative by the Federal Ministry of Works and the Federal Ministry of Communications, Innovation, and Digital Economy, which established a joint standing committee on the protection of fibre optic cables in Nigeria.

Technology

AI Legal Tech Firm Ivo Gets $55m for Contract Intelligence

By Dipo Olowookere

The sum of $55 million has been injected into an Artificial Intelligence (AI)-powered contract intelligence platform, Ivo, to support product development and scaling as the company deepens its reach across the hundreds of organizations that already rely on its product, including Uber, Shopify, Atlassian, Reddit, and Canva.

The Series B funding round comes after a year of substantial growth in product performance, customer adoption, and market traction to accelerate its mission of making contract intelligence available to every business.

Since its last funding round, Ivo has grown annual recurring revenue by 500 per cent, increased total customers by 134 per cent, and expanded adoption within the Fortune 500 by 250 per cent.

Business Post gathered that the latest funding support came from Blackbird, Costanoa Ventures, Uncork Capital, Fika Ventures, GD1 and Icehouse Ventures.

Ivo is purpose-built for in-house teams that need both reviews with surgical accuracy as well as visibility into their complete contract library.

The company’s AI-powered contract review solution, Ivo Review, allows users to complete reviews in a fraction of the time; customers report saving up to 75 per cent of the time that manual review would demand.

The product standardizes a company’s positions and precedents using playbooks built and implemented by lawyers. This means that every contract is reviewed accurately, consistently, and efficiently, critical for large and globally distributed teams.

“Our goal has always been to make interacting with contracts fast, accurate, and enjoyable. Every key relationship in a business is defined by an agreement, yet most organizations struggle to extract the insights inside them.

“Our focus is to give in-house teams a trustworthy solution that helps them work faster and gives them visibility into their contracts that was previously impossible,” the chief executive and co-founder of Ivo, Min-Kyu Jung, stated.

Also commenting, a Principal at Blackbird, Mr James Palmer, said, “In-house legal teams demand products that are deeply accurate and aligned to how they work. The most sophisticated teams are incredibly selective about the tools they trust.

“Ivo’s traction with some of the world’s best companies shows it consistently exceeds that bar. With exceptional product execution and an uncompromising quality bar, we believe Ivo is defining and leading the category.”

The Senior Manager for Contract Operations at Uber, Ms Kate Gardner, said, “Uber selected Ivo because it was intuitive to use, demonstrated a high level of accuracy, could work in multiple languages, and met its confidentiality requirements. Furthermore, the Ivo team was highly responsive to Uber’s needs.”

Technology

Nigeria Leads in AI for Learning, Entrepreneurship—Google

By Modupe Gbadeyanka

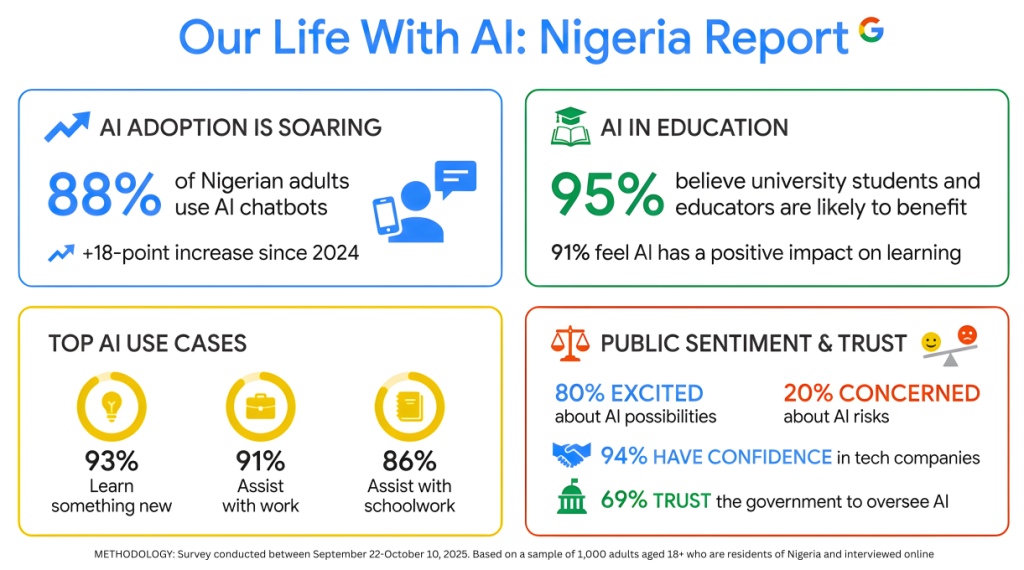

A new report released by global tech giant, Google, in collaboration with Ipsos, has revealed that Nigeria is writing the playbook on Artificial Intelligence (AI) as it leads in AI for learning and entrepreneurship.

In the study titled Our Life with AI: Helpfulness in the hands of more people, it was shown that Nigerians are using AI tools for everything from education to entrepreneurship at a remarkable rate, showing immense optimism for the technology’s future.

It was disclosed that about 88 per cent of Nigerian adults have used an AI chatbot, a huge 18-point jump from 2024, placing the West African country well ahead of the global average of 62 per cent.

It was also found out that while the top use for AI globally has shifted to learning, Nigerians are taking it a step further, using AI as a powerful tool for personal and professional development.

A staggering 93 per cent of Nigerians use AI to learn or understand complex topics, compared to 74 per cent globally, with 91 per cent using the tool to assist them with their work.

In addition, the research observed that 80 per cent of Nigerians are using AI to explore a new business or career change—nearly double the global average of 42 per cent.

Nigerians have overwhelmingly positive feelings about AI’s role in the classroom and beyond, seeing it as a game-changer for education, with 91 per cent feeling AI is having a positive impact on how we learn and access information versus 65 per cent globally.

The report showed that 95 per cent believe university students and educators are likely to benefit from AI, as 80 per cent of Nigerians are more excited about the possibilities of AI, versus just 20 per cent who are more concerned. Globally, the split is much closer at 53 per cent excited and 46 per cent concerned).

Commenting on the findings, the Communications and Public Affairs Manager for Google in West Africa, Taiwo Kola-Ogunlade, said, “It’s inspiring to see how Nigerians are creatively and purposefully using AI to unlock new opportunities for learning, growth, and economic empowerment.

“This report doesn’t just show high adoption rates; it tells the story of a nation that is actively shaping its future with technology, using AI as a tool to accelerate progress and achieve its ambitions. We’re committed to ensuring that AI remains a helpful and accessible tool for everyone.”

Business Post gathered that the research was conducted by Ipsos between September 22 and October 10, 2025, on behalf of Google.

For this survey, a sample of roughly 1,000 adults aged 18+ who are residents of Nigeria and were interviewed online, representing the country’s online population.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn