Economy

NSE Falls to 5-Week Low as Index Dips Below 28,000

By Dipo Olowookere

The All-Share Index (ASI) of equities on the trading platform of Africa’s largest economy depreciated to its lowest level in 5 weeks on Monday after closing below the 28,000 psychological mark.

Business Post reports that the benchmark indicator went down yesterday by 294.90 points to settle at 27,772.19 points in contrast to the previous session’s 28,067.09 points.

The last time the ASI was in the 27,000 region was on January 7, 2020, when it ended at 27,586.93 points and moved to 28,562.48 points the next day after growing by 3.54 percent.

It was observed that the market lost 1.05 percent during Monday’s session on the back of sustained profit-taking majorly in the consumer goods space, which crashed the sector by 4.75 percent. The banking index depreciated by 0.54 percent, while the energy sector fell by 0.55 percent.

The strong performances of the insurance space, which rose by 0.86 percent and the industrial goods sector, which appreciated by 0.76 percent were not enough to lift the market.

The losses printed by the earlier mentioned three sectors reduced the market capitalisation yesterday by N154 billion to N14.464 trillion from N14.618 trillion.

The activity level was weak on Monday as the volume of transactions decreased by 34.14 percent to 200.2 million from 303.9 million, while the value of trades dropped 69.89 percent to N1.9 billion from N6.4 billion, with the number of deals crashing by 17.82 percent to 3,487 deals from 4,243 deals.

Business Post reports that the market breadth ended at equilibrium yesterday with 17 price gainers and 17 price losers, with Nestle Nigeria emerging as the heaviest price decliner as its stocks went down by N138 to finish at N1242 per unit.

MTN Nigeria lost N2 to close at N115 per share, Lafarge Africa depreciated by 25 kobo to settle at N15.05 per unit, GTBank depleted by 20 kobo to trade at N29.30 per share, while FBN Holdings decreased by 20 kobo to sell at N5.85 per unit.

On the gainers’ side, BUA Cement took charge with a price appreciation of 60 kobo to sell at N36 per share, while UPDC REIT rose by 20 kobo to close at N3.40 per unit.

NPF Microfinance Bank appreciated by 11 kobo to end at N1.23 per unit, Africa Prudential grew by 10 kobo to trade at N4.60 per share, while Law Union and Rock Insurance gained 9 kobo to trade at N1.20 per unit.

Economy

Subscription for FGN Savings Bonds Opens for March 2026 at 13.9%

By Aduragbemi Omiyale

The Debt Management Office (DMO) has asked retail investors interested in investing in the FGN savings bonds to begin to talk to their financial advisers.

This is because subscription for the retail bonds for March 2026 has commenced and will close on Friday, March 6, according to a circular issued by the agency on Monday.

The debt office is selling two tenors of the debt instrument, with the shorter note maturing in two years’ time and the longer maturing a year later.

Details of the notice showed that the two-year paper is being offered at a coupon of 12.906 per cent, and the three-year paper at 13.906 per cent.

Both notes are sold at a unit price of N1,000, with a minimum subscription of N5,000 and in multiples of N1,000 thereafter, subject to a maximum subscription of N50 million. They can be purchased via approved stockbroking firms in Nigeria.

The FGN savings bond qualifies as a security in which trustees may invest under the Trustee Investment Act. It also serves as government securities within the meaning of the Company Income Tax Act (CITA) and the Personal Income Tax Act (PITA) for tax exemption for pension funds, amongst other investors.

It can be used as a liquid asset for liquidity ratio calculation for banks, and is listed on the Nigerian Exchange (NGX) Limited for trading at the secondary market.

The bond is backed by the full faith and credit of the Federal Government of Nigeria (FGN) and charged upon the general assets of the country.

Economy

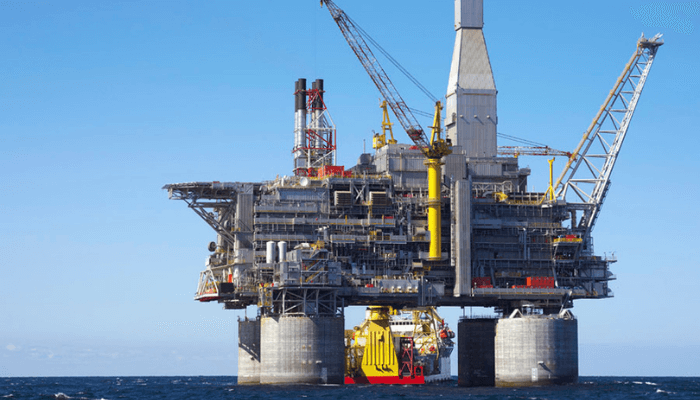

Nigeria Splits OPL 245 into Four Blocks for Eni, Shell

By Adedapo Adesanya

Nigeria has broken up the OPL 245 oil block into four new assets to be operated by Eni and Shell, potentially settling the future of the field at the centre of one of the oil industry’s biggest historic corruption trials.

According to Reuters, the agreement clears the way for the development of OPL 245, one of Nigeria’s biggest deepwater reserves that has remained untapped for almost three decades amid overlapping lawsuits in multiple countries.

The final contracts are expected to be signed starting Monday, the report said, citing a source familiar with the situation.

The Nigerian government had signalled for years that it was keen to find a solution that would bring the block into production. The source wished to remain anonymous as they are not authorised to comment on government policy before an official announcement.

Located in the Niger Delta’s deepwaters, the field has languished since its initial award in 1998 to Malabu Oil and Gas, a shadowy firm controlled by Mr Dan Etete, Nigeria’s oil minister at the time. The block is estimated to hold up to 9 billion barrels of oil equivalent in reserves—enough to rival Nigeria’s entire proven reserves if fully developed.

Mr Etete controversially awarded the lucrative licence to his own company for a nominal $20 million fee, sparking immediate controversy over conflicts of interest.

The saga escalated in 2011 when Malabu sold its rights to a Shell-Eni joint venture for $1.3 billion.

Italian and Nigerian prosecutors alleged that over $1 billion of that sum was siphoned off through bribes to politicians, middlemen, and Mr Etete himself, including hefty payments to then-President Goodluck Jonathan’s associates.

The two European energy giants and some of their former and current executives, including Eni CEO, Mr Claudio Descalzi, faced trial in Italy but all were acquitted in 2021, having denied all wrongdoing.

Shell and Eni have consistently denied wrongdoing, insisting the payments complied with due diligence.

The anti-graft agency, the Economic and Financial Crimes Commission (EFCC), has pursued parallel probes, recovering over $200 million in frozen funds, but progress stalled amid political shifts.

Operations at the Nigerian oil block have been halted for more than a decade by a series of trials and competing legal claims.

In 2023, the federal government withdrew civil claims totalling $1.1 billion against Eni, ending the long battle.

Economy

Dangote Refinery, NNPC Raise Petrol Pump Price by N100

By Modupe Gbadeyanka

The price of Premium Motor Spirit (PMS), otherwise known as petrol, has been increased by at least N100 per litre at the pump.

This followed the recent increase in the price of crude oil in the global market as a result of the bombardment of Iran by the United States and Israel over the weekend.

The air strikes killed the Supreme Leader of Iran, Mr Ayatollah Ali Khamenei, and several others.

Iran has responded by firing missiles at US facilities in some Gulf countries, including Saudi Arabia, Qatar, Kuwait, Bahrain, the UAE, and others.

Crude oil prices rose to about $80 per barrel on the market from about $70 per barrel before the Middle East crisis.

Oil marketers in Nigeria have responded to the tension and have raised the prices of petroleum products.

At most MRS Oil retail stations in Lagos, the new price notice showed an increase of about N100 per litre.

As of Monday, the price of PMS was N837 per litre, but on Tuesday morning, it had changed to N938 per litre, while at NNPC retail stations, it was N930 per litre instead of the previous N830 per litre.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn