Economy

SERAP to Block FG’s Access to Unclaimed Dividends, Dormant Funds

By Adedapo Adesanya

The Socio-Economic Rights and Accountability Project (SERAP) has sent an open letter to President Muhammadu Buhari, calling for the federal government to halt plans to borrow about N895 billion worth of unclaimed dividends and funds in dormant accounts.

In a letter signed by its deputy director, Mr Kolawole Oluwadare, the group tackled the decision which was contained in the Finance Act, signed into law by Mr Buhari last month.

The act would allow the government to borrow unclaimed dividends and dormant account balances owned by Nigerians in any bank in the country.

SERAP wrote that borrowing unclaimed dividends and funds in dormant accounts amount “to an illegal expropriation, and would hurt poor and vulnerable Nigerians who continue to suffer under reduced public services and ultimately lead to unsustainable levels of public debt.”

It continued, “The right to property extends to all forms of property, including unclaimed dividends and funds in dormant accounts. Borrowing these dividends and funds without due process of law, and the explicit consent of the owners is arbitrary, and as such, legally and morally unjustifiable.

“The borrowing is neither proportionate nor necessary, especially given the unwillingness or inability of the government to stop systemic corruption in ministries, departments, and agencies (MDAs), cut waste, and stop all leakages in public expenditures. The borrowing is also clearly not in pursuit of public or social interest.

“The security of property, next to personal security against the exertions of government, is of the essence of liberty. It is next in degree to the protection of personal liberty and freedom from undue interference or molestation. Our constitutional jurisprudence rests largely upon its sanctity.”

The body challenged the President, noting that rather than pushing to borrow unclaimed dividends and funds in dormant accounts, “your government ought to move swiftly to cut the cost of governance, ensure review of jumbo salaries and allowances of all high-ranking political office holders, and address the systemic corruption in MDAs, as well as improve transparency and accountability in public spending.

“The borrowing also seems to be discriminatory, as it excludes government’s owned official bank accounts and may exclude the bank accounts of high-ranking government officials and politicians, thereby violating the constitutional and international prohibition of discrimination against vulnerable groups, to allow everyone to fully enjoy their right to property and associated rights on equal terms.

“SERAP is concerned that the government has also repeatedly failed and/or refused to ensure transparency and accountability in the spending of recovered stolen assets, and the loans so far obtained, which according to the Debt Management Office, currently stands at $31.98 billion.

“SERAP notes growing allegations of corruption and mismanagement in the spending of these loans and recovered stolen assets.

“We would be grateful if your government would drop the decision to borrow unclaimed dividends and funds in dormant accounts, and to indicate the measures being taken to send back the Finance Act to the National Assembly to repeal the legislation and remove its unconstitutional and unlawful provisions, including Sections 60 and 77, within 14 days of the receipt and/or publication of this letter.

“If we have not heard from you by then as to the steps being taken in this direction, the Registered Trustees of SERAP shall take all appropriate legal actions to compel your government to implement these recommendations in the public interest and to promote transparency and accountability in public spending.

“The government cannot lawfully enforce the provisions on Crisis Intervention Fund and Unclaimed Funds Trust Fund under the guise of a trust arrangement, as Section 44(2)[h] of the Nigerian Constitution 1999 [as amended] is inapplicable, and cannot justify the establishment of these funds.”

SERAP noted that while targeting the accounts of ordinary Nigerians, the Finance Act exempts official bank accounts owned by the federal government, state government or local governments or any of their ministries, departments or agencies.

“Our requests are brought in the public interest, and in keeping with the requirements of the Nigerian Constitution, the country’s international human rights obligations including under the African Charter on Human and Peoples’ Rights to which Nigeria is a state party, and which has been domesticated as part of the country’s domestic legislation.

“According to our information, your government has reportedly completed plans to borrow an estimated N895 billion of unclaimed dividends and funds in dormant accounts using the Finance Act 2020 you recently signed into law.

“Under the law, the government will be able to access and take without consent unclaimed dividends and funds in dormant accounts in any bank, on the basis of the vague and undefined ‘Crisis Intervention Fund,’ and patently unlawful ‘Unclaimed Funds Trust Fund’.

“The government is justifying the borrowing on the ground that it would improve access of the Federal Government to much-needed funds, and remove the burdens of foreign exchange and punitive loan conditions imposed by multilateral lenders.

“According to the Finance Act, the operation of the trust fund is to be supervised by the Debt Management Office (DMO) and governed by a governing council chaired by the finance minister and a co-chairperson from the private sector appointed by you.

“The Nigerian Constitution in Section 44(1) provides that, ‘no moveable property or any interest in an immovable property shall be taken possession of compulsorily and no right over or interest in any such property shall be acquired compulsorily in any part of Nigeria except in the manner and for the purposes prescribed by law.

“Similarly, Article 14 of the African Charter on Human and Peoples’ Rights, and Article 17 of the Universal Declaration of Human Rights guarantee the right to property and prohibit the arbitrary deprivation of the right. Thus, everyone is entitled to own property alone as well as in association with others.

“Respect for the right to property is important to improve the enjoyment of other basic human rights and to lift Nigerians out of poverty. The Nigerian Constitution and international human rights law limit the ability of any government to interfere with private property without any legal justifications.”

Economy

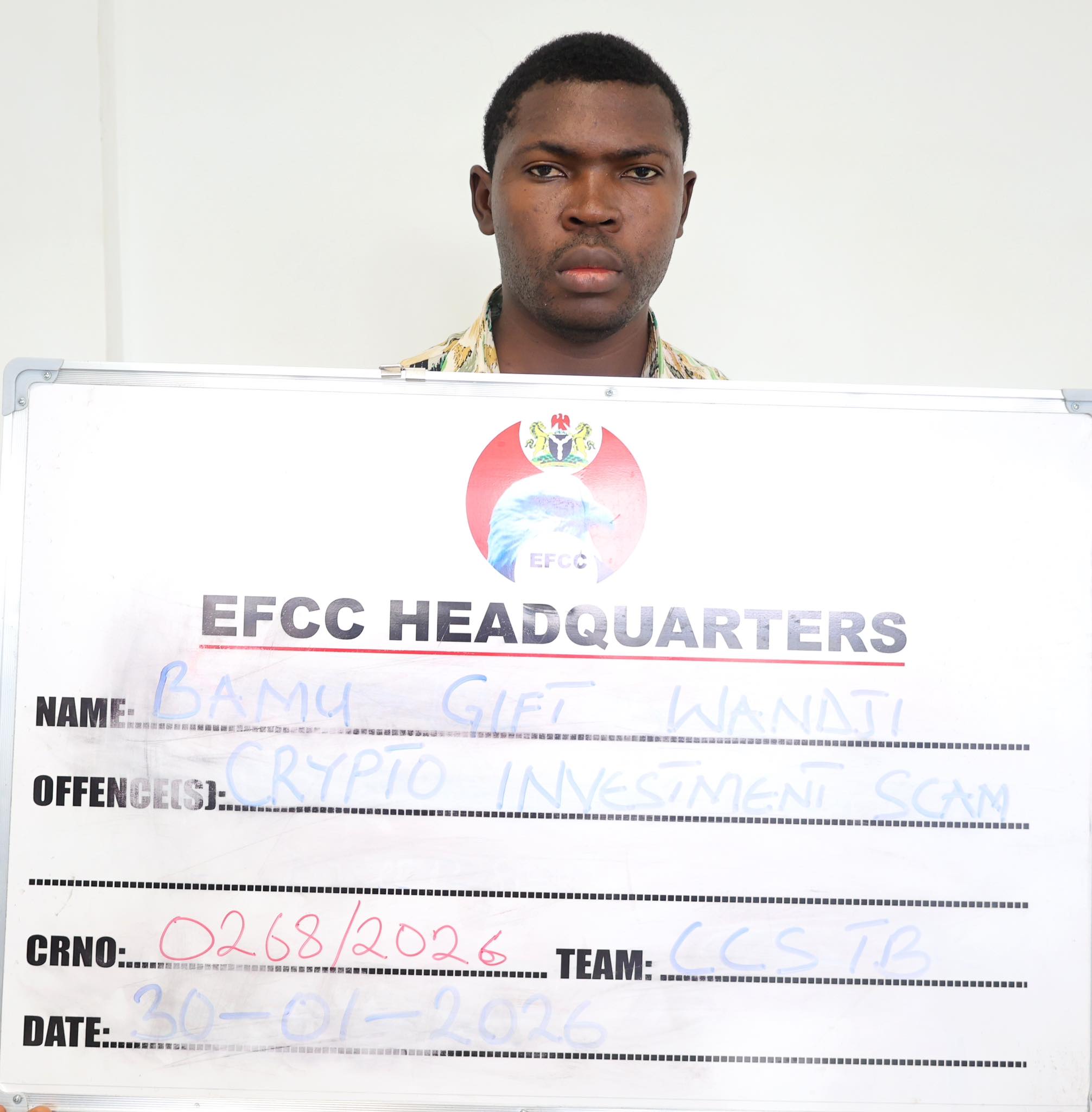

Crypto Investor Bamu Gift Wandji of Polyfarm in EFCC Custody

By Dipo Olowookere

A cryptocurrency investor and owner of Polyfarm, Mr Bamu Gift Wandji, is currently cooling off in the custody of the Economic and Financial Crimes Commission (EFCC).

He was handed over to the anti-money laundering agency by the Nigerian Security and Civil Defence Corps (NSCDC) on Friday, January 30, 2026, after his arrest on Monday, January 12, 2026.

A statement from the EFCC yesterday disclosed that the suspect was apprehended by the NSCDC in Gwagwalada, Abuja for running an investment scheme without the authorisation of the Securities and Exchange Commission (SEC), which is the apex capital market regulator in Nigeria.

It was claimed that Mr Wandji created a fraudulent crypto investment platform called Polyfarm, where he allegedly lured innocent Nigerians to invest in Polygon, a crypto token that attracts high returns.

Investigation further revealed that he also deceived the public that his project, Polyfarm, has its native token called “polyfarm coin” which he sold to the public.

In his bid to promote the scheme, the suspect posted about this on social media platforms, including WhatsApp, X (formally Twitter) and Telegram. He also conducted seminars in some major cities in Nigeria including Kaduna, Lagos, Port Harcourt and Abuja where he described the scheme as a life-changing programme.

Further investigation revealed that in October, 2025, subscribers who could not access their funds were informed by the suspect that the site was attacked by Lazarus group, a cyber attacking group linked to North Korea.

Further investigations showed that Polyfarm is not registered and not licensed with SEC to carry out crypto transactions in Nigeria. Also, no investment happened with subscribers’ funds and that the suspect used funds paid by subscribers to pay others in the name of profit.

Investigation also revealed that native coin, polyfarm coin was never listed on coin market cap and that the suspect sold worthless coins to the general public.

Contrary to the claim of the suspect that his platform was attacked, EFCC’s investigations revealed that the platform was never attacked or hacked by anyone and that the suspect withdrew investors’ funds and utilized the same for his personal gains.

The EFCC, in the statement, disclosed that Mr Wandji would be charged to court upon conclusion of investigations.

Economy

Nigerian Stocks Shed 0.09% on Mild Profit-Taking

By Dipo Olowookere

Profit-takers pounced on the Nigerian Exchange (NGX) Limited on Friday, weakening it by 0.09 per cent at the close of transactions.

Investors toned down on their hunger for Nigerian stocks during the last trading session of the week, with selling pressure mainly on the banking space, which shed 0.78 per cent.

The bourse crumbled despite the other sectors closing green, with the consumer goods up by 0.10 per cent, and the energy index up by 0.02 per cent, while the industrial index closed flat.

Livestock Feeds depreciated by 10.00 per cent to sell for N6.30, Learn Africa declined by 10.00 per cent to N8.10, Living Trust Mortgage Bank also slipped by 10.00 per cent to N4.05, Deap Capital gave up 9.97 per cent to trade at N9.39, and Industrial and Medical Gases lost 9.61 per cent to finish at N31.50.

On the flip side, Zichis appreciated by 9.97 per cent to N4.19, Abbey Mortgage Bank gained 9.94 per cent to quote at N9.40, RT Briscoe jumped by 9.93 per cent to N7.86, Haldane McCall grew by 9.90 per cent to N4.33, and Omatek increased by 9.87 per cent to N3.00.

Business Post reports that the market breadth index was positive despite the poor outcome, recording 33 price gainers and 31 price losers, representing strong investor sentiment.

The All-Share Index was down by 156.91 points during the session to 165,370.40 points from the 165,527.31 points achieved a day earlier, and the market capitalisation depleted by N184 billion to N106.153 trillion from N105.969 trillion.

Trading data showed that 687.4 million equities valued at N15.0 billion exchanged hands in 41,553 deals yesterday compared with the 691.4 million equities worth N15.4 billion traded in 38,665 deals on Thursday, implying a jump in the number of deals by 7.47 per cent, and a slip in the trading volume and value by 2.60 per cent, respectively.

The busiest stock on Friday was Veritas Kapital with 80.5 million units worth N197.0 million, Secure Electronic Technology transacted 79.3 million units valued at N87.5 million, Deap capital transacted 33.3 million units for N340.5 million, Access Holdings sold 31.0 million units valued at N703.0 million, and Zenith Bank exchanged 30.6 million units worth N2.2 billion.

Economy

NASD Exchange Rises 0.20%

By Adedapo Adesanya

The NASD Over-the-Counter (OTC) Securities Exchange appreciated by 0.20 per cent on Friday, January 30, supported by the gains achieved by two securities on the platform.

During the session, Okitipupa Plc went up by N15.70 to finish at N234.60 per share versus the previous day’s N218.90 per share and Paintcomm Investment Plc expanded by 5 Kobo to close at N11.05 per unit compared with the previous day’s N11.00 per unit.

It was observed that yesterday, there were three price losers led by Geo-Fluids Plc, which dropped 60 Kobo to sell at N5.75 per share versus N6.35 per share, Afriland Properties Plc declined by 35 Kobo to close at N13.65 per unit compared with Thursday’s closing price of N14.00 per unit, and Industrial and General Insurance (IGI) Plc depreciated by 3 Kobo to 66 Kobo per share from 69 Kobo per share.

At the close of business, the NASD Unlisted Security Index (NSI) rose by 7.34 points to 3,630.11 points from 3,622.77 points and the market capitalisation grew by N4.39 billion to N2.171 trillion from N2.167 trillion.

A total of 287,618 units of securities exchanged hands on Friday compared with the previous day’s 1.9 million units of securities, indicating a decline in the volume of trades by 85.6 per cent.

The value of transactions, according to data, was down by 77.2 per cent to N3.1 million from N13.4 million, but the number of deals increased by 31.3 per cent to 21 deals from 16 deals.

Central Securities Clearing System (CSCS) Plc remained the most traded stock by value (year-to-date) with 15.4 million units exchanged for N623.0 million, followed by FrieslandCampina Wamco Nigeria Plc with 1.6 million units traded for N108.5 million, and Geo-Fluids Plc with 9.1 million units valued at N61.1 million.

CSCS Plc also ended the session as the most active stock by volume (year-to-date) with 15.4 million units sold for N623.0 million, followed by Mass Telecom Innovation Plc with 10.1 million units worth N4.1 million, and Geo-Fluids Plc with 9.1 million units valued at N61.1 million.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn