Economy

KWIRS Generates N9.6bn in Q1 2021

By Modupe Gbadeyanka

A total of N9.6 billion was generated in the first quarter of 2021 by the Kwara State Internal Revenue Service (KWIRS). This is the highest ever collected by the agency without any extraordinary item at any quarter since its founding in 2016.

At a news briefing in Ilorin, the state capital on Tuesday, the executive chairman of the agency, Ms Shade Omoniyi, attributed this feat to the adoption of technology, the steady blockage of leakages within the tax administration system and the deliberate steps taken to tackle multiple taxations.

“KWIRS, since inception, has operated a manual tax administration system. This means the assessment and collection of relevant taxes payable to the state government from both KWIRS and other MDAs are on a contract basis.

“Despite this, the service has recorded steady IGR growth over the years. Upon its assumption of office in October 2019, the agency’s new management began working tirelessly to sustain this momentum. These efforts culminated in the IGR growth from N23 billion as of September 30 to N30.7 billion as of the end of the year, 2019.

“The service did not rest on its oars as various revenue and cost-cutting initiatives were immediately implemented to shore up the state IGR while it worked assiduously to automate its revenue and tax administration processes.

“The various revenue leakage blockages paid off when in quarter one of 2020, the service generated N7 billion. However, with the spread of the COVID-19 and subsequent lockdown of the state by the government towards the end of March and up until May, the state IGR plummeted to N2 billion.

“Given that the state’s economy was greatly affected by the lockdown and the state’s collection system was still contact-based as at this time, it was only to be expected that no serious activities would happen in the revenue space for that period.

“It is also known that Kwara State was one of the states who followed the COVID-19 protocols fully which is a main factor for the Q2 2020 revenue performance.

“In addition, you may recall that the state was adjudged as one of the highest in performance and proactiveness in the fight against COVID-19 on all indices by various monitoring entities.

“Recently, there was a similar feat of the government in the administration of the COVID-19 vaccination where the state topped all other states.

“Notwithstanding, with the gradual easing of the lockdown, revenue generation by the service again shot up to N4 billion in Q3 2020 and N6 billion in the Q4 of 2020.

“Thus, it is made obvious that the low IGR figures in Q2 and Q3 and consequent dip in 2020 IGR performance are solely attributable to the COVID-19 incidence and our contact-based collection which proved quite ineffective while the lockdown lasted. These observations were enumerated in the quarterly revenue collections reports released by the service in the year 2020.

“The service has since then not stopped working round the clock to recover lost grounds. Thus, in the first quarter of 2021, KWIRS recorded an IGR of N9,598,504,939.90, the highest so far in the history of the service without an extraordinary item.

“Having mapped out strategies to achieving its IGR target for the current fiscal year, the first quarter collections show steady and significant growth, month-on-month as indicated below: January (2,984,312,074.60); February3,058,746,474.21; March 3,555,446,391.09, totalling 9,598,504,939.90.

“This feat of KW-IRS in Q1, 2021 was a great improvement over the N6,227,099,973.42 raked in the last quarter of 2020.

“It is a reflection of the relentless efforts of the service in bringing seamlessness to tax administration through automation and introduction of online payment platforms to ease payment of all taxes.

“It is also a reflection of the Harmonized Bill recently introduced to serve the following benefits among others: calculates, consolidates and communicates all payable tax revenue and non-tax revenue as applicable to each eligible taxpayer in the State, within any assessment year; brings all eligible businesses into the tax net; stops illegal negotiations between taxpayers and collectors in the ministries or KWIRS offices and prevents diversion of funds; displays all taxes due for payment by a particular taxpayer to block most of the leakages and educates on double and multiple taxations by showing that a single entity or taxpayer could be charged to different revenue lines depending on nature of business.

“In addition to the Harmonized Bill, other initiatives have been introduced. This includes re-profiling of our taxpayers, making mandatory the submission of schedules along with remittances; carrying out prompt enforcement on recalcitrant taxpayers, expansion of ticketing model for the informal sector etc.

“The remarkable growth in the 2021 first quarter IGR is equally an indication that the Kwara State Government continues in its efforts to ensure the economic activities of the state recovers fast from the crippling effects of the COVID-19 pandemic.

“The KWIRS, in spite of the drive to increase IGR, has not introduced new taxes since the inception of the administration of Governor Abdulrahman Abdulrazaq; the required and legitimate taxes due are what is being paid by taxpayers and collected appropriately into the coffers of the state.

“All revenue lines of the MDAs in Kwara State are same as approved and as provided by existing relevant laws.

“KWIRS will continue to work to ensure improvement in revenue generation; veritable support for the federal allocation to ensure the state government meets its responsibilities and the desires of Kwarans.

“The agency will also continue its collaboration with all MDAs and stakeholders in the state for effective and efficient collection of all that is legally due from taxpayers.

“The service will strategically and systematically play its part by using most appropriate technology and committed workforce for the growth of revenue for the state.”

Economy

LIRS Shifts Deadline for Annual Returns Filing to February 7

By Aduragbemi Omiyale

The deadline for filing of employers’ annual tax returns in Lagos State has been extended by one week from February 1 to 7, 2026.

This information was revealed in a statement signed by the Head of Corporate Communications of the Lagos State Internal Revenue Service (LIRS), Mrs Monsurat Amasa-Oyelude.

In the statement issued over the weekend, the chairman of the tax collecting organisation, Mr Ayodele Subair, explained that the statutory deadline for filing of employers’ annual tax returns is January 31, every year, noting that the extension is intended to provide employers with additional time to complete and submit accurate tax returns.

According to him, employers must give priority to the timely filing of their annual returns, noting that compliance should be embedded as a routine business practice.

He also reiterated that electronic filing through the LIRS eTax platform remains the only approved method for submitting annual returns, as manual filings have been completely phased out. Employers are therefore required to file their returns exclusively through the LIRS eTax portal: https://etax.lirs.net.

Describing the platform as secure, user-friendly, and accessible 24/7, Mr Subair advised employers to ensure that the Tax ID (Tax Identification Number) of all employees is correctly captured in their submissions.

Economy

Airtel on Track to List Mobile Money Unit in First Half of 2026—Taldar

By Adedapo Adesanya

The chief executive of Airtel Africa Plc, Mr Sunil Kumar Taldar, has disclosed that the company is still on track to list its mobile money business, Airtel Money, before the end of June 2026.

Recall that Business Post reported in March 2024 that the mobile network operator was considering selling the shares of Airtel Money to the public through the IPO vehicle in a transaction expected to raise about $4 billion.

The firm had been in talks with possible advisors for a planned listing of the shares from the initial public offer on a stock exchange with some options including London, the United Arab Emirates (UAE), or Europe.

However, so far no final decisions have been made regarding the timing, location, or scale of the IPO.

In September 2025, the telco reportedly picked Citigroup Incorporated as advisors for the planned IPO which will see Airtel Money become a standalone entity before it can attain the prestige of trading on a stock exchange.

Mr Taldar, noted that metrics continued to show improvements ahead of the listing with its customer base hitting 52 million, compared to around 44.6 million users it had as of June 2025.

He added that the subsidiary processed over $210 billion in a year, according to the company’s nine-month financial results released on Friday.

“Our push to enhance financial inclusion across the continent continues to gain momentum with our Mobile Money customer base expanding to 52 million, surpassing the 50 million milestone. Annualised total processed value of over $210 billion in Q3’26 underscores the depth of our merchants, agents, and partner ecosystem and remains a key player in driving improved access to financial services across Africa.

“We remain on track for the listing of Airtel Money in the first half of 2026,” Mr Taldar said.

Estimating Airtel Money at $4 billion is higher than its valuation of $2.65 billion in 2021. In 2021, Airtel Money received significant investments, including $200 million from TPG Incorporated at a valuation of $2.65 billion and $100 million from Mastercard. Later that same year, an affiliate of Qatar’s sovereign wealth fund also acquired an undisclosed stake in the unit.

The mobile money sector in Africa is expanding rapidly, driven by a young population increasingly adopting technology for financial services, making the continent a key market for fintech companies.

Economy

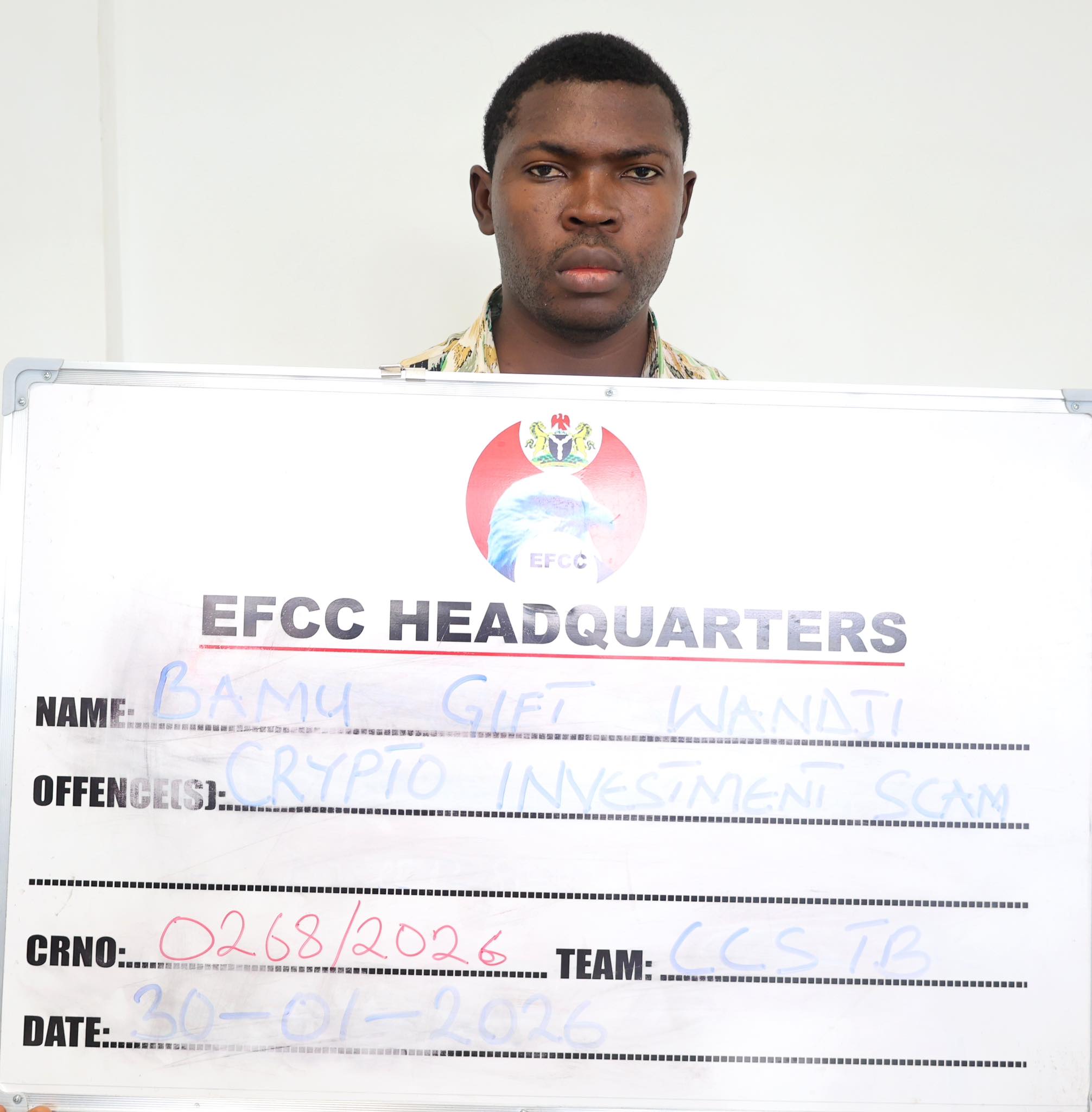

Crypto Investor Bamu Gift Wandji of Polyfarm in EFCC Custody

By Dipo Olowookere

A cryptocurrency investor and owner of Polyfarm, Mr Bamu Gift Wandji, is currently cooling off in the custody of the Economic and Financial Crimes Commission (EFCC).

He was handed over to the anti-money laundering agency by the Nigerian Security and Civil Defence Corps (NSCDC) on Friday, January 30, 2026, after his arrest on Monday, January 12, 2026.

A statement from the EFCC yesterday disclosed that the suspect was apprehended by the NSCDC in Gwagwalada, Abuja for running an investment scheme without the authorisation of the Securities and Exchange Commission (SEC), which is the apex capital market regulator in Nigeria.

It was claimed that Mr Wandji created a fraudulent crypto investment platform called Polyfarm, where he allegedly lured innocent Nigerians to invest in Polygon, a crypto token that attracts high returns.

Investigation further revealed that he also deceived the public that his project, Polyfarm, has its native token called “polyfarm coin” which he sold to the public.

In his bid to promote the scheme, the suspect posted about this on social media platforms, including WhatsApp, X (formally Twitter) and Telegram. He also conducted seminars in some major cities in Nigeria including Kaduna, Lagos, Port Harcourt and Abuja where he described the scheme as a life-changing programme.

Further investigation revealed that in October, 2025, subscribers who could not access their funds were informed by the suspect that the site was attacked by Lazarus group, a cyber attacking group linked to North Korea.

Further investigations showed that Polyfarm is not registered and not licensed with SEC to carry out crypto transactions in Nigeria. Also, no investment happened with subscribers’ funds and that the suspect used funds paid by subscribers to pay others in the name of profit.

Investigation also revealed that native coin, polyfarm coin was never listed on coin market cap and that the suspect sold worthless coins to the general public.

Contrary to the claim of the suspect that his platform was attacked, EFCC’s investigations revealed that the platform was never attacked or hacked by anyone and that the suspect withdrew investors’ funds and utilized the same for his personal gains.

The EFCC, in the statement, disclosed that Mr Wandji would be charged to court upon conclusion of investigations.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn