Auto

ETAP Raises $1.5m to Expand Africa’s Car Insurance Services

By Adedapo Adesanya

ETAP, an insurtech startup that makes it easy to buy and claim insurance, says it has secured $1.5 million in pre-seed funding to drive the adoption of car insurance across Africa.

The pre-seed funding round was led by Mobility 54 (the Venture Capital arm of Toyota Tsusho and CFAO Group), with participation from Tangerine Insurance, Graph Ventures (invested in Clubhouse), Newmont, and other angel investors.

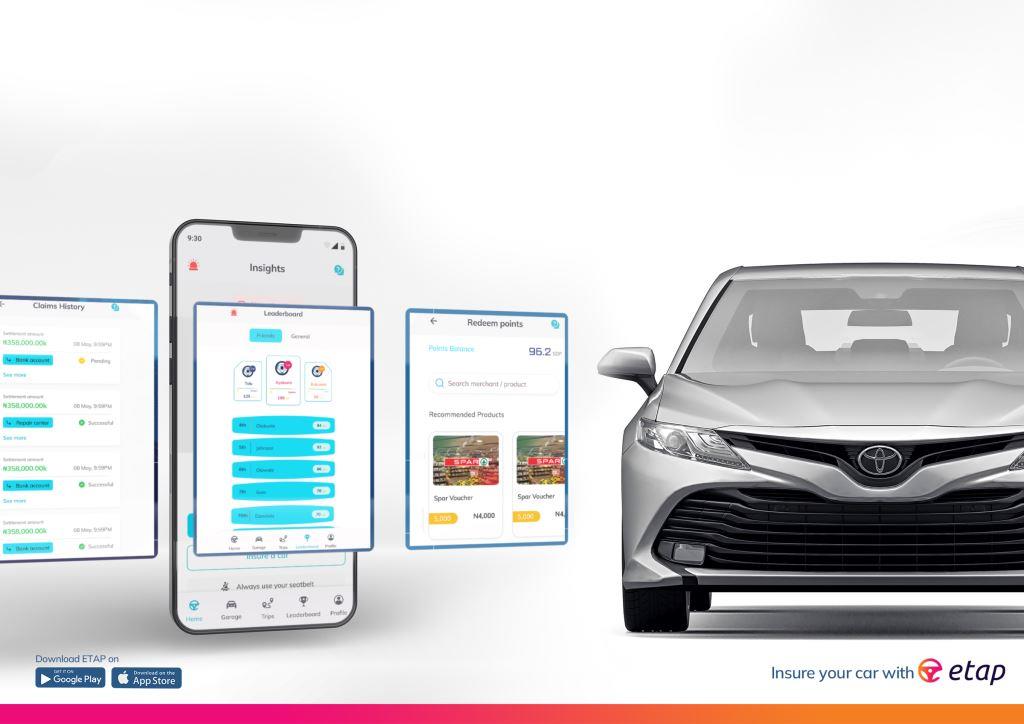

According to its Chief Executive Officer, Mr Ibraheem Babalola, the new funding will support the roll-out of ETAP’s game-changing app which allows drivers to buy insurance in 90 seconds, complete claims in three minutes or less and get rewarded for good driving and avoiding accidents.

Mr Babalola said that working with a wide range of automotive value chain players, ETAP would also explore other opportunities to deliver much-needed car insurance services to owners in other countries across the continent.

“In spite of the longstanding regulation, making car insurance compulsory, more than 100,000 car accidents were reported between January 2019 and December 2021, only one in five cars in Nigeria are currently insured.

“The complexities of buying and claiming insurance has led to widespread apathy for traditional insurance companies and products, with many car owners opting to go without insurance.

“With ETAP, the entire process of buying and claiming insurance happens exclusively on a smartphone, enabling a seamless and enjoyable insurance experience for users,” he said.

He said that ETAP uses machine learning to build intelligent risk profiles that determine appropriate premiums for each driver, allowing them to achieve lower premiums by driving safely.

“Using advanced telematics, the experience is gamified to improve driving behaviour and drivers can earn safe driving points that can be exchanged for shopping vouchers for the most in-demand retail outlets, fuel, cinema and concert tickets among others,” he said.

Mr Babalola said that drivers would have flexible coverage options, including daily, weekly, monthly, quarterly and annual plans depending on their needs.

“In the unfortunate event of an accident, they simply need to take a picture of the affected part of the car via the app and the artificial intelligence processes they claim based on previously uploaded images,” he said.

Mr Babalola said that the app came with geolocation tags, timestamps and other features to prevent fraudulent claims, as well as crash notification, emergency support and more.

“Since we launched in November 2021, ETAP has insured more than 130,000 individual trips and over 500,000 kilometres in car journeys, which represents more than eight times the total distance of paved roads in Nigeria.

“Just like any other digital service, we believe Nigerians should be able to buy and claim car insurance without having to ‘call a guy’.

“We also believe that rewarding good drivers can be a catalyst for better driving and making our roads safer.

“This is why we have created Africa’s most powerful car insurance app and we are excited to have raised these funds to bring more users on board,” Babalola said.

He said that many times, the process of buying and claiming insurance in Africa is so out of touch with the everyday reality of most people.

Mr Babalola said that ETAP would change the game and make the process just as enjoyable as any other experience that consumers access on the mobile phone.

On the part of the lead funder, Project Manager at Mobility 54, Mr Yumi Takagi, said, “ETAP is addressing many challenges that impact the automotive experience in Africa and we are excited to support and work with them to bring their innovation to more drivers across the continent.”

Mr Takagi said that he believed ETAP would engage with this important role and revolutionise the automotive insurance industry with its powerful technology.

Auto

InDrive Fetes Abuja Drivers in Ramadan Shukran Campaign

InDrive, a leading global ride-hailing platform operating in nine African countries, is celebrating Ramadan season with a targeted driver appreciation programme in Abuja, tagged’Ramadan Shukran campaign’, with active Muslim drivers on the platform to receive curated food hampers and personalised thank-you cards.

The initiative, designed to strengthen the company’s relationship with its driver community at a time when many are working long hours while observing the fast, is not based on financial incentives or performance-based rewards but on practical support for the month and a direct expression of appreciation for the role drivers play in the platform’s daily operations.

Four Abuja-based Muslim content creators who understand the social and religious considerations of the period have been delivering 200 hampers across key districts in the city. The hampers, which contain everyday Ramadan essentials to support suhoor and iftar, including staple foods and beverages commonly consumed during the fasting period, come in warm-toned Ramadan packaging and include a handwritten-style card from Indrive with the message “Shukran,” which means thank you.

Each creator is assigned a specific coverage area to ensure broad reach and local relevance, with deliveries taking place around prayer times and fasting schedules, which are captured with the participating drivers’ consent. The campaign, serving as a broader positioning goal to publicly recognise drivers through creator-led storytelling, will further reinforce inDrive’s people-first identity and increase awareness among drivers who are not currently on the platform.

The campaign reflects inDrive’s deliberate shift toward relationship-building through culturally relevant engagement during one of the most significant periods in the Muslim calendar.

Auto

Glovo Unveils New Road Safety Feature for Safety of Nigerian Riders

By Modupe Gbadeyanka

To enhance the safety of riders in Nigeria, a leading multicategory technology company, Glovo, has launched a new road safety feature on its mobile application.

The initiative was introduced in collaboration with the Federal Road Safety Corps (FRSC). It was designed to address key challenges in Nigeria’s fast-growing e-commerce and mobility ecosystem by implementing data-driven preventive measures to enhance road safety.

Also, Glovo has concluded plans with the FRSC to organise a road safety training. This has already been done in Lagos, with the training coming to Abuja on Friday, strengthening rider protection and road safety standards across Nigeria.

The Interim General Manager for Glovo Nigeria, Ms Reni Onafeko, said the new feature reflects the company’s long-term investment in safety, innovation, and responsible business growth in Nigeria.

Ms Onafeko explained that the feature combines advanced technology with structured training to ensure safer roads for riders and the broader public, highlighting the feature’s voluntary opt-in nature, explaining that riders can use it to improve their safety.

“The launch of this new feature reflects our commitment to building a culture of prevention rather than reaction. By equipping riders with real-time data about their riding behaviour, we are empowering them to make safer decisions every day. This initiative is about protection, education, and continuous improvement.

“Our approach combines innovation, partnership, and human-centred design. We are not just introducing a feature; we are reinforcing our responsibility to protect the people who power our platform every day.

“By working closely with regulators and organising safety training for riders, we are contributing to safer roads and a more sustainable ecosystem in Nigeria,” she stated.

In his remarks, the Senior Special Assistant to the Lagos State Governor on Transportation Education and Innovation, Mr Oluwatobi Idowu, noted that the training was a good initiative by Glovo Nigeria, urging riders to take advantage of the unique opportunity to familiarise themselves with the necessary safety rules while driving.

On his part, the Assistant Corps Commander for the Lagos Sector Command of the FRSC, Mr Philip Ogah, who represented the Lagos State Sector Commander, Mr Kehinde G. Hamzat, commended Glovo Nigeria for facilitating a refresher course for riders.

He noted that the training was necessary to help riders be really conscious about their safety, stating that it was better for them to be equipped with such interactive safety tools.

“There are levels of preparation before driving on the road. As a rider, learning is key and a continuous process. This kind of training makes you more informed as you drive.

“As a technological platform, it is good to see that Glovo keeps on ensuring that riders are trained to have a better usage of and better behaviour on Nigerian roads,” the FRSC chief in Lagos stated.

Also speaking, the Head of Operations at Glovo Nigeria, Oluwaseun Okugboye-Bello, explained that the introduction of the safety feature on the Glovo app has become an essential new addition for riders’ self-improvement while collaborating with the platform, noting that it was incorporated into the app to protect riders, commuters, and pedestrians.

At the end of the training session, certificates were presented to 70 participants.

Auto

LAMATA to Boost Red Line Rail Capacity With 24 New Coaches

By Adedapo Adesanya

The Lagos Metropolitan Area Transport Authority (LAMATA) has announced plans to deploy 24 new coaches to boost the capacity of the Red Line rail by the third quarter of 2026.

In a Wednesday statement signed by its Head of Corporate Communications, LAMATA said it acknowledged recent reports and social media footage highlighting passenger discomfort on the Oyingbo-Agbado train service due to technical issues affecting the air conditioning system.

It noted that the plan to provide the 24 new coaches forms part of its long-term strategy to enhance capacity, comfort and service reliability.

“We sincerely apologise to our valued commuters for the heat and inconvenience experienced during their journey.

“As part of our long-term strategy to enhance capacity, comfort, and service reliability, LAMATA is pleased to announce the expected delivery and operationalisation of additional rolling stock by the third quarter of 2026.

“The new acquisition will comprise three train sets, each with eight coaches, bringing a total of 24 additional coaches to strengthen the existing fleet and improve passenger experience across the Red Line corridor,” the organisation stated.

The statement further revealed that the agency has deployed a technical team to diagnose and resolve the cooling system’s failure to return affected coaches to optimal operating conditions.

“In the immediate term, our technical and engineering teams have been deployed to diagnose and resolve the root cause of the cooling system failure. Restoration works are ongoing, and efforts are being intensified to return the affected coaches to optimal operating condition as swiftly as possible.

“LAMATA remains firmly committed to delivering safe, efficient, and world-class rail services. We continue to take proactive measures to minimise technical disruptions and improve overall service quality.

“We appreciate the patience, understanding, and continued support of the public as we complete these essential repairs. The comfort, safety, and well-being of all passengers remain central to our operations,” the statement concluded.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn