Banking

Access Bank Issues AfriGO Card to Customers for Robust Payment Ecosystem

By Aduragbemi Omiyale

Access Bank has become the first financial institution in Nigeria to successfully issue the first live card of Nigeria’s national card scheme called AfriGO Card.

The card system is a product of a financial services business affiliated with the Nigeria Inter-Bank Settlement System (NIBSS), AfriGOpay, and was designed to meet the needs of the Nigerian payment industry.

The scheme is championed by the Central Bank of Nigeria (CBN) and NIBSS to provide innovative solutions to users of financial services in Nigeria, Africa, and across the global markets.

The launch of AfriGO is another milestone in the development of a vibrant and rapidly expanding payments industry.

Consumers demand value in real-time, not just transactions, and with AfriGO, Access Bank says it can provide valuable card benefits, robust loyalty rewards, and a compelling incentive to utilize electronic payments rather than cash.

“It is with excitement that we announce that Access Bank, Nigeria’s largest retail bank with over 60 million customers, is the first financial institution in Nigeria to successfully issue the first live card of Nigeria’s national card scheme- AfriGO,” the Deputy Managing Director for Retail Banking at Access Bank, Mr Victor Etuokwu, said.

“The AfriGO Card has additional benefits because it is designed to facilitate the growth of Nigeria’s payment ecosystem, thereby supporting more tailored payment services.

“It will strengthen payment security, expand financial participation, guarantee data sovereignty, eliminate FX dependency, and provide Nigerians with several other benefits. Cardholders will enjoy increased affordability and more flexible payment options,” he added.

Speaking on the product launch, the Senior Retail Advisor at Access Bank, Mr Robert Giles, said, “The National card scheme operates locally, and it is tailored to the specific needs of the country. We have also recorded successful purchases on POS and ATMs, which began on March 14, 2023.

“Domestic ownership of a local card scheme eliminates demand on foreign exchange and reduces the cost of transacting. It will also help us partner with local fintechs and payment companies to build solutions on the AfriGO scheme that solve customers’ pain points.”

According to Premier Oiwoh, the MD/CEO of NIBSS, “The payments landscape in Nigeria has continued to evolve via seamless and convenient real-time electronic payment solutions driven by innovation and advancement in technology.

“The launch of our national domestic card scheme AfriGO is very timely; AfriGO will drive our financial inclusion goals amongst many benefits, and we are thrilled that Access Bank is the first bank in Nigeria to issue AfriGO cards to its customers.

“Access Bank has demonstrated the much-needed commitment to enhancing financial inclusion, and we urge other financial institutions to commence issuing AfriGO for more accessible and convenient payments for all Nigerians, regardless of their location or financial status.”

On her part, the Executive Director for NIBSS, Ms Aminu Maida, added, “With technological advancements, there are more options for payments, and the recently launched national domestic card scheme, AfriGO, gives us assured comfort on all financial transactions. We are excited that Access Bank is the first to key into our belief of AfriGO’s immense value to the Nigerian financial ecosystem.

Banking

We Now Pay Depositors of Failed Bank Within Days—NDIC

By Adedapo Adesanya

The Nigeria Deposit Insurance Corporation (NDIC) says depositors of failed banks in Nigeria can now access their insured funds within days.

The corporation said the development is a part of ongoing reforms aimed at strengthening confidence in the country’s financial system.

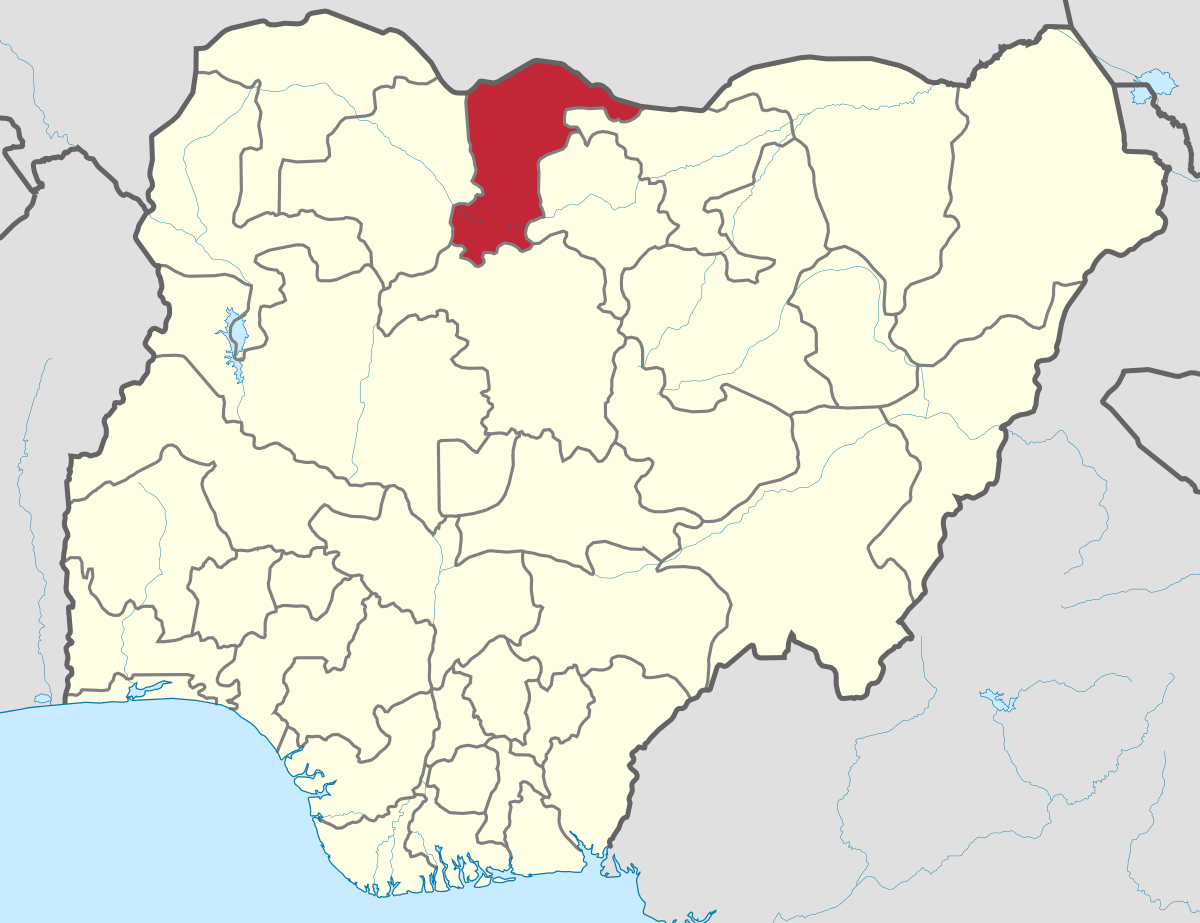

The chief executive of NDIC, Mr Thompson Sunday, disclosed this on Thursday at the NDIC Special Day of the 47th Kaduna International Trade Fair, noting that recent interventions had significantly improved the speed and efficiency of depositor compensation.

Represented by Mrs Regina Dimlong, the Assistant Director of Communications and Public Affairs, Mr Sunday said the corporation had successfully deployed the Bank Verification Number (BVN) system to facilitate prompt payments to customers of recently failed banks, including Heritage Bank Limited, Union Homes Plc and Aso Savings and Loans Plc.

“Depositors were paid within days of closure without the need to fill physical forms or visit NDIC offices.

“This is a part of our reform efforts to make depositor protection faster, simpler and more transparent,” he said.

According to him, the reforms were designed to restore public confidence in the banking system and prevent panic withdrawals, especially during periods of financial stress.

Mr Sunday explained that NDIC’s mandate spans deposit insurance, bank supervision, distress resolution and liquidation of failed banks, adding that the Corporation works closely with the Central Bank of Nigeria (CBN) to ensure early detection of risks in insured institutions.

He disclosed that in 2024, NDIC reviewed its deposit insurance framework, increasing coverage for depositors of Deposit Money Banks, Mobile Money Operators and Non-Interest Banks to N5 million, while customers of Microfinance Banks, Primary Mortgage Banks and Payment Service Banks are now covered up to N2 million.

He noted that the revised thresholds now guarantee full protection for about 99 per cent of depositors nationwide, particularly small savers and low-income earners.

The NDIC boss urged Nigerians to ensure their BVNs are properly linked to their bank accounts, stressing that this had become the primary channel for accessing insured deposits in the event of bank failure.

Banking

Nigeria Gets Permanent Seat on African Central Bank Board

By Adedapo Adesanya

Nigeria has secured a major strategic gain at the ongoing 39th African Union Summit, after securing a permanent seat on the board of the African Central Bank.

The Minister of Foreign Affairs, Mr Yusuf Tuggar, confirmed this at the summit on Friday, highlighting it as a significant milestone for both Nigeria and the West African region.

The African Central Bank (ACB) is one of the original five financial institutions and specialised agencies of the African Union (AU).

“Importantly, Nigeria has been given the hosting of the African Monetary Institute and the African Central Bank. Not only that, in today’s plenary, Nigeria was confirmed a seat on the board of the African Central Bank. This is huge,” he said.

He stated that the development represents a diplomatic breakthrough, mentioning that the move faced initial opposition from some member states.

“It is something that was initially resisted by some countries, so now we have a permanent seat on the African Central Bank board. It’s a major success,” he added.

This year’s summit carries the theme Assuring Sustainable Water Availability and Safe Sanitation Systems to Achieve the Goals of Agenda 2063, the sessions will focus on advancing continental commitments to sustainable water management and improved sanitation, critical pillars for health, agricultural productivity, and the broader development aspirations of the AU’s Agenda 2063 framework.

Beyond financial governance, Nigeria and the West African bloc also recorded progress in elections to the Peace and Security Council, the African Union’s highest decision-making body on conflict and security matters.

The delegation announced that “Côte d’Ivoire, Sierra Leone, and the Republic of Benin have been elected,” with Benin securing a fresh term while the other two countries were re-elected.

The Peace and Security Council also convened to deliberate on the situations in Sudan and Somalia. Nigeria voiced strong reservations over Sudan’s potential readmission into the continental body.

“Nigeria voiced its reservations about Sudan being readmitted because, as you know, there are two warring factions in Sudan,” Tuggar stated.

“We reminded the Peace and Security Council that we have to abide by the rules and regulations of the African Union. If there has been an unconstitutional change of government, then the country should not be allowed to participate, and that was carried.”

The summit also outlined its 2026 theme: water sustainability. The Nigerian representative underscored the country’s strategic and demographic significance in advancing that agenda.

“Nigeria was created out of the confluence of the River Niger and the River Benue. So water is very important,” he said.

“We are the largest country in Africa, with a population of 230 million people. We’re going to be 400 million in the next 24 years. So water is a source of life. It’s very important, and we’re playing a very pivotal role in implementing the programs that are being set for the theme of the year.”

Banking

Standard Bank Hosts 2nd African Markets Conference

By Modupe Gbadeyanka

The second African Markets Conference (AMC) will take place in Cape Town, South Africa, from Sunday, February to Tuesday, February 24, 2026.

The event, hosted by Standard Bank, will bring together global institutional investors, sovereign wealth funds, and African policymakers to catalyse the flow of capital into the continent’s most critical sectors.

The theme for this year’s edition is Mobilising Global Capital at Scale for Africa’s Growth and Development.

AMC 2026 will host a high-level delegation of decision-makers, ensuring that the dialogue leads to tangible commitments.

The conference will be structured around five high-impact pillars designed to move the needle on investment, including prioritising infrastructure as an asset class, accelerating the energy transition, deepening African capital markets and mobilising private capital, enabling intra-African trade and flows of capital, and addressing Africa’s sovereign debt and cost sustainability.

It is estimated that by 2050, Africa will add one billion people, more than half in cities, yet it invests only $75 billion of the $150 billion it needs annually for infrastructure. Standard Bank aims to use AMC 2026 to ensure that African priorities remain at the centre of the global financial discourse.

“This year’s engagement bridges the gap between policy ambitions and market realities. Africa urgently needs practical measures to deepen capital pools, improve market liquidity, and strengthen regulatory frameworks that give investors the confidence to deploy capital at scale.

“Mobilising capital is not just about funding projects; it is about building the foundation of a more balanced and inclusive global economy,” the chief executive of Corporate and Investment Banking at Standard Bank Group, Luvuyo Masinda, stated.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn