Banking

CBN Prohibits Use of Merchant POS Machines for Deposits, Withdrawals

By Aduragbemi Omiyale

The use of merchant point-of-sale (POS) terminals by supermarkets, stores and other small business owners for the deposits and withdrawals of funds has been prohibited by the Central Bank of Nigeria (CBN).

The apex bank, in an Exposure Draft of the Regulatory Framework for Agent Banking in Nigeria, said owners of merchant POS machines are not permitted to carry out cash-in, and cash-out transactions as such functions are for another category of agent banking operators.

In the draft, the bank, while listing a set of prohibited activities for agents, said, “Agents shall not use purchase option PoS Terminals for cash-in and cash-out transactions.”

It also said the agents permitted to accept cash deposits and withdrawals have a limit they must not go beyond.

The CBN emphasised that agents must not “accept deposit or allow withdrawal above an amount which shall be prescribed, from time to time, by the bank,” and must not “charge customers fees outside regulated fees regime.”

The central bank explained that it came up with these rules “in the exercise of the powers conferred on the bank by Section 2 (d) of the Central Bank of Nigeria Act, 2007 and Section 57 (2) of the Banks and Other Financial Institutions Act (BOFIA), Laws of the Federation of Nigeria, 2004.”

The guidelines cover the operations of agent banking and the licensing of super agents, provide minimum standards and requirements for the operation of agent banking in the country, as well as the roles and responsibilities of stakeholders involved in agent banking.

Banking

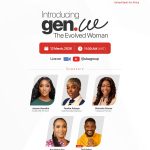

UBA Business Series to Spotlight Africa’s New Generation of Women Leaders

By Modupe Gbadeyanka

To celebrate women while also creating a platform where meaningful conversations around leadership, ambition and opportunity can take place, United Bank for Africa (UBA) Plc, will hold a special edition of its impactful quarterly UBA Business Series on Wednesday, March 12, 2026.

The event, themed gen w- ‘The Evolved Woman, will begin at 11 am at the UBA House, Lagos, and will be streamed live across all UBA digital platforms. Interested participants can register to attend virtually or in person via on.ubagroup.com/tfig.

The conversation will centre around women intensely forward, highlighting a new generation of women who are not simply seeking opportunities but confidently creating them. The discussion will explore how women today are shaping industries, leading businesses, and redefining success on their own terms.

A statement from the lender disclosed that this special UBA Business Series would bring together an array of accomplished female leaders and professionals who will share insights, experiences and practical strategies for navigating ambition, leadership and growth in today’s dynamic environment.

It will feature an inspiring line-up of speakers, including entrepreneur and founder of ORÍKÌ Group, Joycee Awosika; media personality & entrepreneur, Tomike Adeoye; entrepreneur and founder of Fine Funky, Olufunke Davies; and award-winning broadcaster, Ayo Mario-Ese. The conversation will be hosted by media personality and actor, Tobi Bakre.

Panellists will share their personal journeys and perspectives on navigating professional spaces, building resilient businesses, embracing authenticity and redefining leadership as women in a rapidly evolving global landscape.

“The modern African woman is evolving in remarkable ways. She is bold, visionary, and intentional about the spaces she occupies.

“Through this edition of the UBA Business Series, we want to celebrate women while also creating a platform where meaningful conversations around leadership, ambition and opportunity can take place,” the Group Head of Marketing and Corporate Communications for UBA, Ms Alero Ladipo, stated.

The quarterly UBA Business Series has become a key knowledge-sharing platform designed to equip entrepreneurs, professionals and business leaders with insights, tools and strategies needed to grow sustainable enterprises as well as navigate the evolving business landscape.

UBA is one of the largest employers in the financial sector on the African continent, with 25,000 employees group-wide and serving over 45 million customers globally.

Operating in 20 African countries, the United Kingdom, the United States of America, France and the United Arab Emirates, the bank provides retail, commercial and institutional banking services, leading financial inclusion and implementing cutting-edge technology.

Banking

CBN Affirms Strengthening of Alpha Morgan Bank’s Capital Base

By Aduragbemi Omiyale

The capitalisation of Alpha Morgan Bank has been affirmed by the Central Bank of Nigeria (CBN), reflecting the lender’s adherence to regulatory requirements and its strategic focus on strengthening its capital base to support sustainable growth, innovation and improved service delivery to customers.

This development marks an important milestone in the company’s growth journey and reinforces its commitment to building a strong, resilient, and future-ready financial institution.

With this milestone, Alpha Morgan Bank is well-positioned to continue expanding its footprint with its 14 approved branches across different states, while deepening inclusivity and enhancing the range of banking solutions available to individuals, businesses, and institutional clients nationwide.

As it enters the next phase of its journey, the institution said it would continue to scale its operation, invest in technology, expand its branch network and digital banking presence, whilst delivering reliable and satisfying banking experiences to its growing customer base.

The Managing Director of Alpha Morgan Bank, Mr Ade Buraimo, expressed the readiness of the financial institution to ensure compliance with regulatory requirements and a good governance framework, while delivering satisfying banking services along the long-term vision of the bank to become the best bank to work and a strong financial institution to reckon with.

“Capitalisation is more than a regulatory requirement; it is an opportunity to strengthen the institution for the future.

“The affirmation of Alpha Morgan Bank capitalisation reflects the work we have done to build a solid capital foundation that allows us to support businesses more effectively, expand financial access and continue delivering the level of service our customers expect,” Mr Buraimo said.

Banking

30 Banks Meet New Minimum Capital Requirements as Deadline Nears

By Modupe Gbadeyanka

The Central Bank of Nigeria (CBN) has confirmed that 30 banks have met its new minimum capital requirements ahead of the March 31, 2026, deadline.

In a notice on Friday night, the banking sector regulator disclosed that the remaining lenders were undergoing its verification and should be concluded before the deadline.

In the statement signed by its acting Director for Corporate Communications, Mrs Hakama Sidi Ali, the apex bank stated that the companies, which have already met the deadline, raised additional funds through the approved means, including rights issues, private placements, and initial public offerings (IPOs).

In 2024, the CBN asked banks operating in the country to raise their capital base from N25 billion set in 2004 to about N500 billion or less, depending on their area of coverage.

For lenders with an international licence, they were to have at least N500 billion as a capital base, while banks with a national licence were to have N200 billion. Regional and national merchant banks were told to raise their capital base to N50 billion, while national non-interest banks should have at least N20 billion, and regional non-interest banks are expected to have N10 billion.

In the update yesterday, the central bank said it was satisfied with the compliance level, noting that it took this step “to strengthen the resilience, stability, and long-term capacity of the financial system to support Nigeria’s economic development

“The Central Bank of Nigeria (CBN) introduced a recapitalisation programme for the banking sector in 2024 to strengthen the resilience, stability, and long-term capacity of the financial system to support Nigeria’s economic development.

“Since the introduction of the policy, banks across the industry have taken steps to strengthen their capital base in line with the revised regulatory requirements.

“As of March 6, 2026, the recapitalisation exercise is progressing steadily. Thirty banks have met the new minimum capital requirements applicable to their respective licence authorisations.

“In total, 33 banks have raised additional capital through rights issues, initial public offerings (IPOs), and private placements as part of the programme.

“The capital positions of the remaining banks are currently undergoing the central bank’s routine verification process ahead of final confirmation of compliance within the recapitalisation timeline.

“The CBN reiterates that the Nigerian banking system remains stable and sound. The recapitalisation programme remains firmly on track and will further strengthen the capacity of the banking sector to support households, businesses, and sustainable economic growth.

“The Central Bank of Nigeria will continue to maintain close supervisory engagement with regulated institutions to ensure full compliance with prudential and capital requirements,” the statement read.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn