Banking

Full List of PSSPs, Others NIBSS Ordered Banks to Remove from Transfer List

By Dipo Olowookere

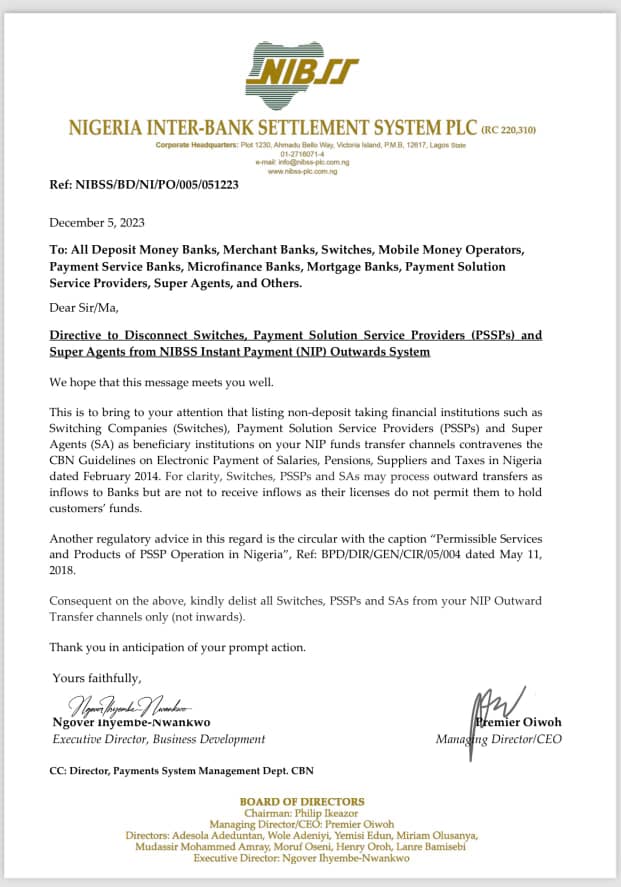

Some hours ago, news went viral that the Nigeria Inter-Bank Settlement System (NIBSS) Plc has directed Deposit Money Banks (DMBs) to take down all non-deposit financial institutions from their NIBSS Instant Payment (NIP) platform because they are not authorised to hold customers’ funds.

The circular, which was dated Tuesday, December 5, 2023, has generated mixed reactions as a few media platforms, excluding Business Post, listed some mobile money operators (MMOs) like Opay, PalmPay, and others are part of the financial technology (fintech) firms affected by the directive.

In the disclosure sighted by this newspaper, the NIBSS specifically said those not licensed to accept deposits are Super Agents, Switching Companies, and Payment Solution Service Providers (PSSPs).

A look at the website of the Central Bank of Nigeria (CBN) showed that 47 companies were issued licences by the CBN to operate as Super Agents, 75 firms were authorised by the apex bank to function as PSSPs, and 16 fintechs have the Switching and Processing licence.

Below is the full list, as obtained from the CBN, of the three categories of fintechs affected by the NIBSS directive;

SWITCHING & PROCESSING LICENCE CATEGORY

| S/NO | LICENCEE |

|---|---|

| 1. | Appzone Limited |

| 2. | Arca Payments Company Limited |

| 3. | Chamswitch Limited |

| 4. | Coralpay Technology Nigeria Limited |

| 5. | eTranzact International Limited |

| 6. | Flutterwave Technology Solutions Limited |

| 7. | Habaripay Limited |

| 8. | Hydrogen Payment Services Limited |

| 9. | Interswitch Limited |

| 10. | Network International |

| 11. | Paystack Payment Limited |

| 12. | Remita Payment Service Limited |

| 13. | Teamapt Limited |

| 14. | Terra Switching & Processing Company Limited |

| 15. | Unified Payment Services Limited |

| 16. | Xpress Payments Solution Limited |

i. PAYMENT SOLUTION SERVICE PROVIDER (PSSP) AUTHORISATION

| S/NO | LICENCEE |

|---|---|

| 1. | Afara Partners Limited |

| 2. | Angala Financial Technologies Limited |

| 3. | Appmart Integrated Limited |

| 4. | Appzone Limited |

| 5. | Artha Fintech Limited |

| 6. | Betastack Technology Limited |

| 7. | Bud Infrastructure Limited |

| 8. | Callphone Limited |

| 9. | Capricorn Digital Limited |

| 10. | CBI Technologies Ltd |

| 11. | Cellulant Nigeria Limited |

| 12. | Centric Gateway Limited |

| 13. | Ceviant Payments Nigeria Limited |

| 14. | Clane Company Nig. Ltd. |

| 15. | Cyberspace Limited |

| 16. | Demerge Nigeria Limited |

| 17. | Dot Financial Inclusion Technologies Limited |

| 18. | Easypay International Limited |

| 19. | Egole Pay Limited |

| 20. | Ercas Integrated Solutions Limited |

| 21. | E-Settlement Limited |

| 22. | Eyowo Integrated Payments Limited |

| 23. | Fincra Technologies Limited |

| 24. | Flutterwave Technology Solutions Limited |

| 25. | Fountain Payment Systems Solution |

| 26. | Gemspay Limited |

| 27. | Global Accelerex Limited |

| 28. | Gpay Instant Solution Limited |

| 29. | GTP Client Services Limited |

| 30. | Hellopay Africa Integrated Service Ltd. |

| 31 | ICAD Concord Limited |

| 32 | Infiniti Segments Limited |

| 33. | Irecharge Technology Innovations Limited |

| 34. | Irofit Technologies LimitedD |

| 35. | Itex Integrated Services Limited |

| 36. | Konetpay Nigeria Limited |

| 37. | Kora Payments |

| 38. | Leadremit Limited |

| 39. | Moneta Technology Ltd |

| 40. | Multigate Payment Limited |

| 41. | Netapps Technologies Limited |

| 42. | Netplusdotcom Nigeria Limited |

| 43. | Nomba Financial Services Limited (Formerly Cosmic Intelligence Lab Limited) |

| 44. | One Payment Limited |

| 45. | Onepipe.Io Services Ltd |

| 46. | Parkway Projects Limited |

| 47. | Payfixy Nigeria Limited (Formerly Innovate 1 Pay Limited) |

| 48. | Paylode Services Limited |

| 49. | Paysure Technologies Limited |

| 50. | Payu Payments Nigeria Limited |

| 51. | Pethahiah Rehoboth International Limited |

| 52. | Prophius Limited |

| 53. | Qrios Networks Limited |

| 54. | Redtech Limited |

| 55. | Resident Fintech Limited |

| 56. | Rexel Limited |

| 57. | Routepay Fintech Limited |

| 58. | Saanapay Corporate Investments Management Limited (SAANACORP) |

| 59. | Shago Payments Ltd |

| 60. | Simplify International Synergy Limited |

| 61. | Soft Alliance & Resources Limited |

| 62. | Spay Business Solutions Limited |

| 63. | Spout Payment Solutions |

| 64. | Stanbic Financial Services Limited |

| 65. | Swift Link-NZ Global Services Ltd. |

| 66. | Teinnovate Capital Limited |

| 67. | Unlimint Nigeria Ltd |

| 68. | Upperlink Limited |

| 69. | Vas2net Technologies Ltd |

| 70. | Venture Garden Nigeria Limited |

| 71. | Vestrapay Nigeria Limited |

| 72. | Voguepay Web Solution Limited |

| 73. | Waxed Mobile Nigeria Ltd |

| 74. | Waya Multilinks Technologies Limited |

| 75. | Woven Finance Limited |

SUPER-AGENT AUTHORISATION

| S/NO | LICENCEE |

|---|---|

| 1. | 3Line Card Management |

| 2. | 5554 Technologies Limited |

| 3. | Accelerex Networks Limited |

| 4. | Africa Mama Atm Limited |

| 5. | Africave Technologies Limited |

| 6. | Airtel Mobile Commerce Nigeria Limited (Airtel) |

| 7. | Allstream Information Technology Solutions Limited |

| 8. | Angala Financial Technologies Limited |

| 9. | Appmart Integrated Limited |

| 10. | ATN Wayya Limited |

| 11. | Betastack Technology Limited |

| 12. | C24 Limited |

| 13. | Callphone Limited |

| 14. | Capricorn Digital Limited |

| 15. | CBI Technologies Ltd |

| 16 | Cicoserve Payments Limited |

| 17. | Citiserve Limited |

| 18. | Clane Company Nig. Ltd. |

| 19. | Connectpoint Technology Solutions Limited. |

| 20. | Crowd Force Limited (Formerly Mobile Forms Limited). |

| 21. | Dot Financial Inclusion Technologies Limited. |

| 22. | Egole Pay Limited. |

| 23. | Errand P Limited. |

| 24. | E-Settlement Limited. |

| 25. | Fountain Payment Systems Solution. |

| 26. | Fucil Datatech Limited. |

| 27. | Gwills Payments Service Limited. |

| 28. | Infibranches Technology Limited. |

| 29. | Innovectives Limited. |

| 30. | Interswitch Financial Inclusion Services Limited. |

| 31. | Irofit Technologies Limited. |

| 32. | Itex Integrated Services Limited. |

| 33. | Kadick Integrated Limited. |

| 34. | Lukeport Nigeria Limited. |

| 35. | Microsystems Investment And Development Limited. |

| 36. | Moneymaster Limited. |

| 37. | Nigerian Postal Service (NIPOST) . |

| 38. | Nomba Financial Services Limited (Formerly Cosmic Intelligence Lab Limited) |

| 39. | Paycluster Technology Limited. |

| 40. | Paygo Limited. |

| 41. | Shago Payments Ltd. |

| 42. | Spout Payment Solutions. |

| 43. | Swift Link-Nz Global Services Ltd.. |

| 44. | Traction Payments Ltd.. |

| 45. | Vatebra Pay Limited.. |

| 46. | Waxed Mobile Nigeria Ltd.. |

| 47. | Y’ello Digital Financial Services.. |

Banking

Standard Bank Hosts 2nd African Markets Conference

By Modupe Gbadeyanka

The second African Markets Conference (AMC) will take place in Cape Town, South Africa, from Sunday, February to Tuesday, February 24, 2026.

The event, hosted by Standard Bank, will bring together global institutional investors, sovereign wealth funds, and African policymakers to catalyse the flow of capital into the continent’s most critical sectors.

The theme for this year’s edition is Mobilising Global Capital at Scale for Africa’s Growth and Development.

AMC 2026 will host a high-level delegation of decision-makers, ensuring that the dialogue leads to tangible commitments.

The conference will be structured around five high-impact pillars designed to move the needle on investment, including prioritising infrastructure as an asset class, accelerating the energy transition, deepening African capital markets and mobilising private capital, enabling intra-African trade and flows of capital, and addressing Africa’s sovereign debt and cost sustainability.

It is estimated that by 2050, Africa will add one billion people, more than half in cities, yet it invests only $75 billion of the $150 billion it needs annually for infrastructure. Standard Bank aims to use AMC 2026 to ensure that African priorities remain at the centre of the global financial discourse.

“This year’s engagement bridges the gap between policy ambitions and market realities. Africa urgently needs practical measures to deepen capital pools, improve market liquidity, and strengthen regulatory frameworks that give investors the confidence to deploy capital at scale.

“Mobilising capital is not just about funding projects; it is about building the foundation of a more balanced and inclusive global economy,” the chief executive of Corporate and Investment Banking at Standard Bank Group, Luvuyo Masinda, stated.

Banking

Fidelity Bank Shows Love to Ikoyi Correctional Centre Inmates

By Aduragbemi Omiyale

Inmates at the Ikoyi Correctional Centre in Lagos were recently full of joy when Fidelity Bank Plc donated some relief items to them.

The financial institution, through its Corporate Social Responsibility (CSR) initiative known as Fidelity Helping Hands Programme (FHHP), handed over various household tools and gift items to the leadership of the correctional facility as part of its efforts to support the rehabilitation and development of indigent persons in society.

The Chief Human Resources Officer of Fidelity Bank, Mr Charles Nwachukwu, reaffirmed the bank’s deep commitment to transforming lives and restoring hope, emphasising that true progress lies not only in financial growth but in extending compassion and opportunity to those that society often overlooks.

“At Fidelity Bank, we believe that every individual deserves a second chance. Our approach to Corporate Social Responsibility is rooted in empathy, standing with communities, uplifting the vulnerable, and opening doors for brighter futures.

“By supporting inmates today, we are setting them on the true path of rehabilitation, empowering them to return tomorrow as productive and confident members of society,” the banker said.

The Deputy Controller of Corrections at Ikoyi Custodial Centre, Mr Julius Ogueri, who could not hide his excitement over the gesture, appealed to Nigerians to avoid cybercrimes and stigmatisation of ex-inmates.

Highlighting the challenges faced by correctional facilities in Nigeria, Mr Ogueri noted that Ikoyi correctional center initially designed for 800 inmates, now houses over 3,000 inmates, with 396 convicted persons and 3,604 awaiting trial.

Whilst thanking the bank, the Deputy Controller also emphasised the importance of rehabilitation, citing examples of inmates who have pursued education and skills acquisition, including 72 inmates studying with the National Open University of Nigeria and 120 inmates who have benefited from WAEC and GCE support.

Business Post reports that through the FHHP, staff across Fidelity Bank branches nationwide identify crucial interventions needed in their immediate community and raise funds to execute them. The bank’s management then matches this contribution with an equal amount and disburses it for the selected project.

The visit to the Ikoyi Correctional Centre reinforces the lender’s unwavering commitment to meaningful community impact and demonstrates its strong dedication to advancing social responsibility and rehabilitation efforts across the society.

Banking

Ecobank Nigeria Introduces Business App for SMEs to Accelerate Growth

By Dipo Olowookere

A new digital banking platform created to help business owners in the country to eliminate delays, queues, and operational inefficiencies has been introduced by Ecobank Nigeria.

This mobile application is to strengthen the growth and sustainability of Small and Medium Enterprises (SMEs) across Nigeria, allowing them to manage payments, monitor transactions, oversee cash flow, and run day‑to‑day financial operations directly from their mobile devices.

The Ecobank Business app, now available on the Google Play Store and Apple App Store, cements the bank’s position as a dependable growth partner to SMEs across all sectors, delivering tools that help businesses manage better, grow faster, and operate more competitively in a digital economy. – Ecobank Business — Your Growth Partner.

The introduction of this initiative further reinforces Ecobank’s broader commitment to empowering SMEs through digital innovation, sector‑specific value propositions, and financial solutions like structured loans, trade support, guarantees, and equipment financing.

It also aligns with the lender’s push to re-energise dormant SME accounts, deepen market penetration, promote digital adoption, and scale value‑chain financing through partnerships with corporate anchors.

According to the Executive Director for Consumer and Commercial Bank at Ecobank Nigeria, Mr Kola Adeleke, the Ecobank Business App was developed to address the unique challenges faced by Nigeria’s diverse SME landscape.

Speaking at the unveiling in Lagos, he explained that the platform caters to traders, retailers, tech start-ups, online businesses, hospitality operators, farmers, agro‑processors, manufacturers, construction firms, professionals, social commerce entrepreneurs, schools, associations, and organisations that require transparent and efficient financial management.

Mr Adeleke noted that the app delivers faster payment collection for merchants and retailers, seamless digital transactions for online businesses, efficient vendor and staff management for hospitality players, timely payment solutions for agriculture value chains, and secure handling of bulk and high‑value transactions for manufacturers and construction firms.

He added that professionals such as lawyers and consultants can issue invoices and receive payments easily, while schools and associations can streamline fees, dues, and reporting from a single platform.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn