Banking

Full List of PSSPs, Others NIBSS Ordered Banks to Remove from Transfer List

By Dipo Olowookere

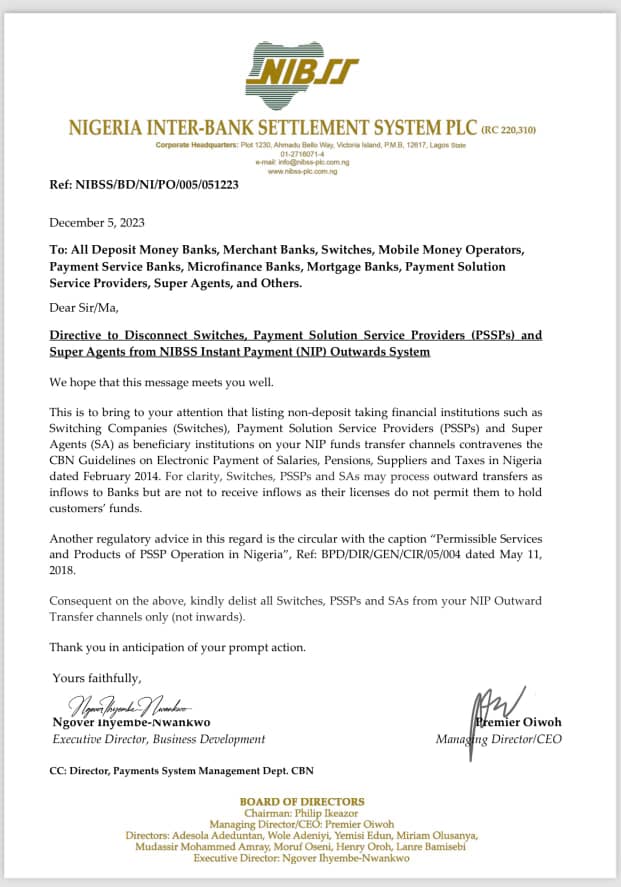

Some hours ago, news went viral that the Nigeria Inter-Bank Settlement System (NIBSS) Plc has directed Deposit Money Banks (DMBs) to take down all non-deposit financial institutions from their NIBSS Instant Payment (NIP) platform because they are not authorised to hold customers’ funds.

The circular, which was dated Tuesday, December 5, 2023, has generated mixed reactions as a few media platforms, excluding Business Post, listed some mobile money operators (MMOs) like Opay, PalmPay, and others are part of the financial technology (fintech) firms affected by the directive.

In the disclosure sighted by this newspaper, the NIBSS specifically said those not licensed to accept deposits are Super Agents, Switching Companies, and Payment Solution Service Providers (PSSPs).

A look at the website of the Central Bank of Nigeria (CBN) showed that 47 companies were issued licences by the CBN to operate as Super Agents, 75 firms were authorised by the apex bank to function as PSSPs, and 16 fintechs have the Switching and Processing licence.

Below is the full list, as obtained from the CBN, of the three categories of fintechs affected by the NIBSS directive;

SWITCHING & PROCESSING LICENCE CATEGORY

| S/NO | LICENCEE |

|---|---|

| 1. | Appzone Limited |

| 2. | Arca Payments Company Limited |

| 3. | Chamswitch Limited |

| 4. | Coralpay Technology Nigeria Limited |

| 5. | eTranzact International Limited |

| 6. | Flutterwave Technology Solutions Limited |

| 7. | Habaripay Limited |

| 8. | Hydrogen Payment Services Limited |

| 9. | Interswitch Limited |

| 10. | Network International |

| 11. | Paystack Payment Limited |

| 12. | Remita Payment Service Limited |

| 13. | Teamapt Limited |

| 14. | Terra Switching & Processing Company Limited |

| 15. | Unified Payment Services Limited |

| 16. | Xpress Payments Solution Limited |

i. PAYMENT SOLUTION SERVICE PROVIDER (PSSP) AUTHORISATION

| S/NO | LICENCEE |

|---|---|

| 1. | Afara Partners Limited |

| 2. | Angala Financial Technologies Limited |

| 3. | Appmart Integrated Limited |

| 4. | Appzone Limited |

| 5. | Artha Fintech Limited |

| 6. | Betastack Technology Limited |

| 7. | Bud Infrastructure Limited |

| 8. | Callphone Limited |

| 9. | Capricorn Digital Limited |

| 10. | CBI Technologies Ltd |

| 11. | Cellulant Nigeria Limited |

| 12. | Centric Gateway Limited |

| 13. | Ceviant Payments Nigeria Limited |

| 14. | Clane Company Nig. Ltd. |

| 15. | Cyberspace Limited |

| 16. | Demerge Nigeria Limited |

| 17. | Dot Financial Inclusion Technologies Limited |

| 18. | Easypay International Limited |

| 19. | Egole Pay Limited |

| 20. | Ercas Integrated Solutions Limited |

| 21. | E-Settlement Limited |

| 22. | Eyowo Integrated Payments Limited |

| 23. | Fincra Technologies Limited |

| 24. | Flutterwave Technology Solutions Limited |

| 25. | Fountain Payment Systems Solution |

| 26. | Gemspay Limited |

| 27. | Global Accelerex Limited |

| 28. | Gpay Instant Solution Limited |

| 29. | GTP Client Services Limited |

| 30. | Hellopay Africa Integrated Service Ltd. |

| 31 | ICAD Concord Limited |

| 32 | Infiniti Segments Limited |

| 33. | Irecharge Technology Innovations Limited |

| 34. | Irofit Technologies LimitedD |

| 35. | Itex Integrated Services Limited |

| 36. | Konetpay Nigeria Limited |

| 37. | Kora Payments |

| 38. | Leadremit Limited |

| 39. | Moneta Technology Ltd |

| 40. | Multigate Payment Limited |

| 41. | Netapps Technologies Limited |

| 42. | Netplusdotcom Nigeria Limited |

| 43. | Nomba Financial Services Limited (Formerly Cosmic Intelligence Lab Limited) |

| 44. | One Payment Limited |

| 45. | Onepipe.Io Services Ltd |

| 46. | Parkway Projects Limited |

| 47. | Payfixy Nigeria Limited (Formerly Innovate 1 Pay Limited) |

| 48. | Paylode Services Limited |

| 49. | Paysure Technologies Limited |

| 50. | Payu Payments Nigeria Limited |

| 51. | Pethahiah Rehoboth International Limited |

| 52. | Prophius Limited |

| 53. | Qrios Networks Limited |

| 54. | Redtech Limited |

| 55. | Resident Fintech Limited |

| 56. | Rexel Limited |

| 57. | Routepay Fintech Limited |

| 58. | Saanapay Corporate Investments Management Limited (SAANACORP) |

| 59. | Shago Payments Ltd |

| 60. | Simplify International Synergy Limited |

| 61. | Soft Alliance & Resources Limited |

| 62. | Spay Business Solutions Limited |

| 63. | Spout Payment Solutions |

| 64. | Stanbic Financial Services Limited |

| 65. | Swift Link-NZ Global Services Ltd. |

| 66. | Teinnovate Capital Limited |

| 67. | Unlimint Nigeria Ltd |

| 68. | Upperlink Limited |

| 69. | Vas2net Technologies Ltd |

| 70. | Venture Garden Nigeria Limited |

| 71. | Vestrapay Nigeria Limited |

| 72. | Voguepay Web Solution Limited |

| 73. | Waxed Mobile Nigeria Ltd |

| 74. | Waya Multilinks Technologies Limited |

| 75. | Woven Finance Limited |

SUPER-AGENT AUTHORISATION

| S/NO | LICENCEE |

|---|---|

| 1. | 3Line Card Management |

| 2. | 5554 Technologies Limited |

| 3. | Accelerex Networks Limited |

| 4. | Africa Mama Atm Limited |

| 5. | Africave Technologies Limited |

| 6. | Airtel Mobile Commerce Nigeria Limited (Airtel) |

| 7. | Allstream Information Technology Solutions Limited |

| 8. | Angala Financial Technologies Limited |

| 9. | Appmart Integrated Limited |

| 10. | ATN Wayya Limited |

| 11. | Betastack Technology Limited |

| 12. | C24 Limited |

| 13. | Callphone Limited |

| 14. | Capricorn Digital Limited |

| 15. | CBI Technologies Ltd |

| 16 | Cicoserve Payments Limited |

| 17. | Citiserve Limited |

| 18. | Clane Company Nig. Ltd. |

| 19. | Connectpoint Technology Solutions Limited. |

| 20. | Crowd Force Limited (Formerly Mobile Forms Limited). |

| 21. | Dot Financial Inclusion Technologies Limited. |

| 22. | Egole Pay Limited. |

| 23. | Errand P Limited. |

| 24. | E-Settlement Limited. |

| 25. | Fountain Payment Systems Solution. |

| 26. | Fucil Datatech Limited. |

| 27. | Gwills Payments Service Limited. |

| 28. | Infibranches Technology Limited. |

| 29. | Innovectives Limited. |

| 30. | Interswitch Financial Inclusion Services Limited. |

| 31. | Irofit Technologies Limited. |

| 32. | Itex Integrated Services Limited. |

| 33. | Kadick Integrated Limited. |

| 34. | Lukeport Nigeria Limited. |

| 35. | Microsystems Investment And Development Limited. |

| 36. | Moneymaster Limited. |

| 37. | Nigerian Postal Service (NIPOST) . |

| 38. | Nomba Financial Services Limited (Formerly Cosmic Intelligence Lab Limited) |

| 39. | Paycluster Technology Limited. |

| 40. | Paygo Limited. |

| 41. | Shago Payments Ltd. |

| 42. | Spout Payment Solutions. |

| 43. | Swift Link-Nz Global Services Ltd.. |

| 44. | Traction Payments Ltd.. |

| 45. | Vatebra Pay Limited.. |

| 46. | Waxed Mobile Nigeria Ltd.. |

| 47. | Y’ello Digital Financial Services.. |

Banking

Court Orders Final Forfeiture of N81m Stolen from Sterling Bank to FG

By Modupe Gbadeyanka

A Federal High Court sitting in Ikoyi, Lagos, has ordered the final forfeiture of N81.1 million to the Federal Government of Nigeria in favour of Sterling Bank.

The money was part of the N2.5 billion stolen by some customers of Sterling Bank and transferred to their own use as well as to the use of some third-party beneficiaries, owing to a system glitch experienced by the bank.

On October 2, 2025, the court granted an interim forfeiture order of the fund and also directed the publication of the same in a national newspaper for any interested party to show cause why the money should not be finally forfeited to the federal government.

When no one came forward to claim the money, Justice Yelim Bogoro on Monday, March 9, 2026, ordered the final forfeiture of the funds.

The matter was brought before the court by the Economic and Financial Crimes Commission (EFCC) after a petition from the financial institution on July 18, 2022.

The anti-graft agency, in its investigations, traced the stolen funds to various accounts, including that of a customer, Sulaiman Kehinde Ojora, who was one of the major beneficiaries of the monumental fraud.

Investigation further revealed that Sulaiman Kehinde Ojora fraudulently concealed the sum of N43.0 million in the account of his friend, Taiwo Oluwaseyi Alawode (Account No. 1233126860), domiciled in Access Bank, and the sum of N122.2 million in the account of his wife, Aminat Olatanwa Ojora (Account No. 0072889319), domiciled in Sterling Bank.

Banking

Parallex Bank Meets CBN’s N50bn Minimum Capital Requirement

By Adedapo Adesanya

Parallex Bank Limited said it has completed the recapitalisation requirement of the Central Bank of Nigeria, surpassing the N50 billion minimum capital threshold for regional commercial banks ahead of the March 31, 2026, deadline.

The feat reinforces the bank’s position as a financially resilient and strategically forward-looking institution within Nigeria’s evolving banking landscape while positioning it for accelerated growth.

The development now places Parallex Bank among financial institutions that have complied with the apex bank’s directive aimed at strengthening the capital base of deposit money banks, improving financial system stability, and enhancing the sector’s capacity to support economic growth.

Speaking on the development, Mr Olufemi Bakre, the managing director of the lender, said the milestone underscores the belief that excellence, when consistently pursued, delivers sustainable results.

He added that the strengthened capital position will enable Parallex Bank to expand its lending capacity, deepen financial inclusion, and continue delivering innovative, customer-focused financial solutions across various segments of the economy.

“With this strengthened capital position, Parallex Bank is better equipped to expand lending, deepen financial inclusion and continue delivering innovative, customer-focused banking solutions across the retail, SME and corporate segments of the economy,” he said.

The recapitalisation exercise, announced in March 2024 by the CBN, is expected to strengthen the resilience of Nigeria’s banking sector and enhance its capacity to support economic growth.

Mr Bakre commended the bank’s stakeholders, particularly the Board of Directors, for their strategic guidance, oversight, and timely support, which he said were instrumental in ensuring that the recapitalisation requirement was met within the stipulated timeframe.

According to him, the Board’s commitment to strong governance and long-term value creation provided the foundation for disciplined capital planning and effective execution across the institution.

Banking

Zedvance Eyes Disbursement of N250bn to Commercial Businesses in 2026

By Modupe Gbadeyanka

A leading provider of consumer and business financing solutions in Nigeria, Zedvance Finance Limited, intends to increase its lending to commercial entities in the country by 160 per cent in 2026.

Last year, it provided N96 billion loans to support enterprises across key sectors of the economy, including oil and gas, automotive, logistics, renewable energy, fintech, e-commerce, trade distribution value chains, agri-businesses and others.

This year, Zedvance, a subsidiary of Zedcrest Group, plans to push this amount higher to N250 billion across key economic sectors, including off-grid power, smart devices and home equipment, vehicle dealerships and mobility platforms, agribusiness and manufacturing, consumer and industrial goods distribution and hospitality.

This expansion reinforces its mission to accelerate enterprise growth by providing faster and broader access to credit across Africa.

“We are proud of our accomplishments so far, especially the impact we’ve made in sectors that are critical to economic development,” said the Managing Director of Zedcrest Group, Mr Adedayo Amzat.

“Through solar and asset on-lending, we have helped to expand energy access and improve income opportunities for gig workers by financing mobility asset platforms across Nigeria.

“Because our customers are at the heart of our business, we were intentional about designing our flagship product, Liquidity Solutions, to allow businesses to unlock faster credit delivery across all high-growth sectors. This has proven impactful as we continue to witness our clients record great successes,” Mr Amzat further said.

Leveraging its 11-year legacy, Zedvance’s Commercial Solutions business, launched in 2025, has in just one year become a major driver of credit expansion, achieving one of the highest loan disbursement rates among financial institutions, empowering thousands of local enterprises and boosting economic growth.

Through offerings such as working capital, invoice/PO financing, equipment and trade finance, and ecosystem-based solutions, Zedvance enables access to liquidity for buy-now-pay-later providers, asset acquisition, and cross-border credit lines for imports & exports, aiding business expansion and strengthening operational resilience in a dynamic economic environment.

On his part, the acting executive director for Commercial Solutions, Mr Ayooluwa Oladimeji, said Zedvance leverages technology, product innovation, deep sector expertise and risk-moderated structures to deploy diverse funding solutions, including multi-currency credit lines, BNPL facilities, and equipment financing across automotive, renewable energy, manufacturing, fintech, and trade distribution sectors.

“In 2025 alone, Zedvance Commercial Solutions business recorded tremendous growth, driven by strong partnerships and a rapidly expanding portfolio. We are proud to have supported a range of businesses, including Shekel Mobility, Tradegrid, Sapphire, CredPal and other ecosystem partners.

“Beyond these successes, our focus remains on strengthening credit access across Africa’s commercial ecosystems to enable businesses to scale with confidence and resilience,” he said.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn