Banking

FY 2017: Union Bank Gross Earnings up by 26% as NPL Ratio Hits 19.8%

By Dipo Olowookere

Union Bank of Nigeria Plc on Thursday finally released its financial statements for the year ended December 2017.

In the results, the lender grew its gross earnings by 26 percent to N163.8 billion from N126.6 billion achieved in 2016.

During the period under review, the profit before tax marginally went down to N15.5 billion from N15.7 billion in 2016, while the profit after tax declined to N14.6 billion from N15.4 billion in the previous year.

However, the company’s interest income rose by 25 percent to N124.5 billion from N99.7 billion in 2016, driven by the impact of Naira devaluation on the foreign currency denominated loan book, government securities yields and loan book re-pricing.

Furthermore, the net interest income increased by 3 percent to N66.7 billion from N65 billion in 2016 with the interest expense growing by 67 percent to N57.9 billion from N34.7 billion in 2016. This was buoyed by the challenging interest rate environment, as the yield curve remains elevated.

In the results, the bank’s non-interest income went up by 31 percent to N39.3 billion from N29.9 billion in 2016, driven by a combination of improved fee and commission income, trading income and more effective debt recovery machine.

In the period under review, operating expenses (OPEX) increased by 5 percent to N65.1 billion from N62 billion in 2016 despite a double-digit inflationary environment and the impact of devaluation on IT investments.

Also, the gross loans went up 5 percent to N560.7 billion from N535.8 billion as at December 2016, almost entirely due to the impact of Naira devaluation on the foreign currency denominated loan book.

Furthermore, customer deposits went up 22 percent to N802.4 billion from N658.4 billion as at December 2016, continuing its upward trajectory since 2016. The investments in customer-led products and the bank’s alternate channels, along with a strengthened brand, are delivering positive outcomes.

In the financial statements, the Non-Performing Loan (NPL) ratio increased to 19.8 percent from 6.9 percent in 2016, representing a 12.9 percent rise.

Managing Director of Union Bank, Mr Emeka Emuwa, commenting on the bank’s earnings, remained that, “Strengthening our capital base through the Rights Issue was key for the Bank in 2017. Notwithstanding the challenges a tightened economy presented, the rights issue was 20% oversubscribed.

“This overwhelming success is credited to strong shareholder and investor confidence in Union Bank’s immediate and longer-term plans. With sufficient capital buffers, we are now in pole position to execute our growth agenda from 2018 onwards.

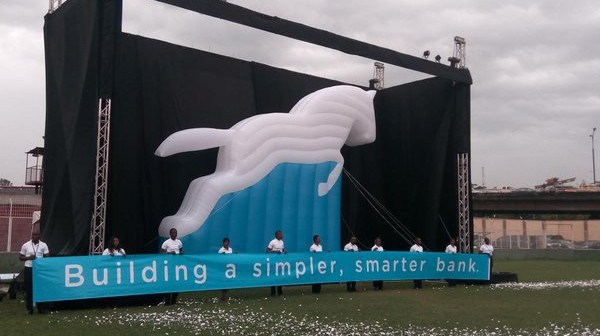

“Operationally, we continued to focus on growing our retail customer base and optimising customer experience with simpler, smarter banking solutions.

“We launched an upgraded suite of digital channels including UnionMobile, UnionOnline and our unique USSD banking code *826#, driving an increase in active subscribers above 100% on the mobile app and online banking platforms.

“Union Bank’s alternative banking platform remains the fastest growing in the industry. We continue to attract broad segments of new customers, adding 90% more new-to-bank customers in 2017 compared to 2016.

“Notwithstanding a fiercely competitive environment and reduced consumer purchasing power in the system, our new-to-bank customers and deepening share of wallet with existing customers have driven customer deposits up by 22% to N802 billion.

“Consequently, gross earnings are up by 26% to N164 billion. By the end of the year, our NPL Ratio stood at 19.8%. This reflects the residual effects of devaluation and a post-recession economy on our loan book, particularly in the oil and gas sector as well as a recent high court ruling in respect of a large real estate exposure, which we have appealed.

“While we have sufficient coverage and adequate capital buffers, we are aggressively focused on final resolution of key large exposures, which will have immediate positive impact on the NPL ratio, once resolved.

“In addition, we have strengthened our debt recovery teams with oversight from senior executives, and initiated necessary legal action against recalcitrant debtors. We are confident that this multi-pronged approach will bring the NPL ratio down steadily over the next few quarters.

“For 2018, our focus is on leveraging our capital and investments in talent and technology to accelerate growth across all business segments and improve enterprise value for all our stakeholders.”

“Also commenting, Chief Financial Officer of Union Bank, Oyinkan Adewale, stated that, “We grew our revenues by 26% in 2017, and notwithstanding double-digit inflation and the impact of Naira devaluation on foreign currency denominated costs, Group Cost Income Ratio is down to 61.5% from 65.3% in 2016.

“As a result of our successful rights issue, which was oversubscribed, we ended the year with CAR at 17.8%- well above regulatory requirements.

“Our coverage ratio was adequate at 103%, while our debt recovery efforts yielded good results with an increase of over 350% to N6 billion in the year.

“We continue to tighten our credit risk management and loan monitoring processes while pursuing an aggressive strategy to continue to grow our low-cost deposit base.

We closed the year with the Regulatory Risk Reserve at N71 billion, which exceeds the expected impact of International Financial Reporting Standards (IFRS) 9 adoption in 2018.”

Banking

Access Bank Opens Branch in Malta to Strengthen Europe-Africa Trade Ties

By Modupe Gbadeyanka

To strengthen Europe-Africa trade ties, Access Bank has opened a new branch in Malta. It will focus on international trade finance, employing approximately 30 people in its initial phase, with plans for controlled expansion over time.

It was learned that this Maltese branch was established by Access Bank UK Limited, the subsidiary of Access Bank Plc, which is also the subsidiary of Access Holdings Plc, which is listed on the Nigerian Exchange (NGX) Limited.

Access Bank Malta Limited commenced operations after obtaining a banking licence from the European Central Bank (ECB) and the Malta Financial Services Authority (MFSA).

Access Bank said the licence marks a transformative milestone in bolstering Europe-Africa trade flows.

Malta, a renowned international financial centre, and a gateway between the two continents, is strategically positioned to play a pivotal role in advancing commerce and fostering economic partnerships.

This strategic expansion into Malta enables The Access Bank UK Limited to leverage growing trade opportunities between Europe and Africa.

It underscores the organisation’s commitment to driving global trade, financial integration, and supporting businesses across these regions.

“By establishing operations in Malta, we will gain a foothold in a market that bridges European and North African economies, moving us one step closer to our goal of becoming Africa’s Gateway to the World.

“It further enhances our bank’s capacity to support clients with innovative solutions tailored to cross-border trade and investment opportunities,” the chief executive of Access Bank, Mr Roosevelt Ogbonna, stated.

“Europe has emerged as Africa’s leading trading partner, driven by initiatives such as the Economic Partnership Agreements between the EU and African regions and the African Continental Free Trade Area (AfCFTA).

“With Europe-Africa economic relations entering a new phase, The Access Bank Malta Limited is ideally positioned to deepen trade and meet the financing and banking needs of our clients in these expanding markets,” the chief executive of Access Bank UK, Mr Jamie Simmonds, commented.

Also speaking, the chief executive of Access Bank Malta, Renald Theuma, said, “Malta is uniquely positioned as a bridge between Europe and Africa, making it an ideal location for our subsidiary. This move allows The Access Bank Malta Limited to engage more closely with customers in Europe and deliver tailored financial solutions that drive growth and connectivity across both continents.”

Banking

Goldman Sachs, IFC Partner Zenith Bank, Stanbic IBTC, Others to Empower Women Entrepreneurs

By Adedapo Adesanya

The International Finance Corporation (IFC) and Goldman Sachs have announced a new partnership with African banks, including Nigeria’s Zenith Bank and Stanbic IBTC Nigeria to support the Goldman Sachs 10,000 Women initiative, a joint programme launched in 2008 to provide access to capital and training for women entrepreneurs globally.

The two Nigerian banks are part of nine financial institutions from across Africa which have agreed to join the 10,000 Women initiative committing to leverage the business education and skills tools the programme provides to create more opportunities for women entrepreneurs across the continent by providing access to business education.

Others banks include Stanbic Bank Kenya, Ecobank Kenya, Ecobank Cote d’Ivoire, Equity Bank Group, Banco Millenium Atlantico – Angola, Baobab Group, and Orange Bank.

Speaking on this, Ms Charlotte Keenan, Managing Director at Goldman Sachs said – “10,000 Women has had a powerful impact to date, but we know that there are more women to reach and more potential to be realized.

“We are delighted to partner with IFC to supercharge the growth of women-owned businesses across Africa, and mainstream lending to female business leaders. We remain committed to supporting entrepreneurs with the access to education and capital that they need to scale.”

Since 2008, the 10,000 Women initiative has provided access to capital and business training to more than 200,000 women in 150 countries.

“This expanded initiative marks a significant step forward in creating equitable economic opportunities for women in Africa, enabling them to build stronger, more resilient businesses and to realize their entrepreneurial goals,” said Ms Nathalie Kouassi Akon, IFC’s Global Director for Gender and Economic Inclusion.

Goldman Sachs’ 10,000 Women initiative complements the Women Entrepreneurs Opportunity Facility (WEOF), launched in 2014 by Goldman Sachs and IFC as the first-of-its-kind global facility dedicated to expanding access to capital for women entrepreneurs in emerging markets.

Banking

Development Bank of Nigeria Wins Financial Inclusion Leadership Award

By Aduragbemi Omiyale

In recognition of its unwavering commitment to fostering access to financing for Nigerian micro, small and medium enterprises (MSMEs), Development Bank of Nigeria Plc has been rewarded with the Financial Inclusion Leadership Award at the Champions of Inclusion Nigeria Financial Inclusion Awards.

This was at the 2024 International Financial Inclusion Conference (IFIC) organised by the Central Bank of Nigeria (CBN) in collaboration with the World Bank and other stakeholders.

The chief executive of the lender, Mr Tony Okpanachi, said the recognition affirms the company’s efforts in expanding access to financial services for MSMEs in Nigeria.

“We are honoured to receive the Financial Inclusion Leadership Award, which is a testament to our bank’s commitment to expanding access to financial services for all Nigerians. This award recognises our efforts to bridge the financial inclusion gap, particularly for a priority sector like the MSMEs.

“Additionally, this award is a validation of our strategic focus on driving financial inclusion for small businesses, and we are proud to be at the forefront of this initiative that drives that. We will continue to innovate and expand our financial inclusion programmes, ensuring that more Nigerian small and startup businesses have access to services,” he stated.

On his part, the Chief Operating Officer of DBN, Mr Bonaventure Okhaimo, said the accolade demonstrates the firm’s dedication to driving financial inclusion and economic growth in Nigeria.

“This award acknowledges our Bank’s innovative approach to widening opportunities for MSMEs in Nigeria to grow and scale their businesses,” he said.

“This award will motivate us to continue pushing the boundaries of financial inclusion, exploring more innovative solutions and partnerships to expand our reach and impact.

“We are committed to ensuring that more small businesses and startup enterprises in Nigeria have access to financial services, this award will further inspire us to accelerate our efforts in this regard,” he stated.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism8 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking6 years ago

Banking6 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN