Banking

Panic as Report Suggests Heritage Bank Nears Total Collapse

By Modupe Gbadeyanka

All seems not to be well with Heritage Bank at the moment as a report released by a reputable business news platform, Proshare Nigeria, is suggesting that the bank is a walking corpse.

Already, some customers of the financial institution are contemplating taking their hard-earned funds from the lender to a safer place.

Below is the full report.

Three months ago Proshare had cause to commit resources to investigate and produce an hitherto unpublished Confidential Report on Heritage Banking Company Limited, in direct response to the promptings of the advisory board members who wanted to know the true state of the bank which had another financial institution handling clearing operations for it at some time.

By this time, and curiously; it wasn’t such a big news that some of the bank depositors had experienced recurring challenges with withdrawals and staff exits did little to help matters. Yet, the restraint was important in order to ensure and support financial system stability as well as give the institution an opportunity to execute its resolution strategies without hindrance. After all, the institutional frameworks were in place to protect depositors and the system in general.

The task involved a lot of stakeholder engagements including sources we understood to be in a position to recognize, appreciate and make informed decisions. The revelations offered little comfort from history to, interventions up to the current state. We limited ourselves however to facts, data and evidence and submitted the report.

Further to the completion of this initial review, and in the interest of giving the financial system an opportunity to resolve the bank’s challenges through normal regulatory intervention and management effort at recapitalizing the institution or determination of the banks going concern status through a merger and acquisition (M&A) arrangement; the report remained private.

The burden of a moral hazard however appeared a bigger burden than tolerable or envisaged, especially given the evident ‘sailors survival’ approach that appears to have kicked in as seen through senior management exit, non-improving conditions, non-progressing talks around mergers and acquisitions; and recapitalization plans.

It has become compelling to highlight concerns about the bank formally; with the hope that ‘some intervention’ can happen to alter the trajectory of an inevitability. and remove the spectre of a bank waiting to die that overshadows the institution, unfortunately.

Proshare’s investigation into the bank revealed a few major concerns related to corporate governance and operational stability/sustainability. The primary issues included, but were not limited to the following:

- The acquisition of Enterprise Bank which is turning out to be a major strategic error;

- HBL’s non-performing loans (NPLs) portfolio, which are amongst the most challenged in the industry. Impairment charges in H1 2018 was estimated at N37.5bn but by year end, we extrapolated that the figure should settle around N634.5m;

- The bank posted an operating loss before tax of N38.5bn in H1 2018 and a loss of N4.4bn in the unaudited figures for the month of December 2018;

- The bank’s leverage has been a major sore point for management. The banks debt to equity ratio was -0.17. The negative value reflected negative shareholders fund which could be impaired by as much as $1bn;

- Equity capital has been virtually wiped out by accumulated losses, a legacy issue;

- The bank’s regular recourse to the CBN’s short term borrowing window highlights persistent liquidity resolution issues;

- Corporate governance has been a challenge as a number of the bank’s directors have allegedly been involved in a series of poor performing insider loan transactions, and little known about such resolutions (if any);

- The bank’s 2018 unaudited financial figures shows a dire situation in several operational metrics; and

- The bank has not been engaged in direct cheque clearing for a while, HBL’s instruments have been cleared through a third party first tier bank which got a full CBN guarantee against clearing loses.

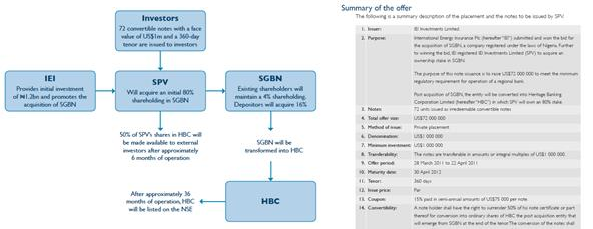

IEI’s Pound of Flesh

It is instructive to recall how this sorry pass all began. Records indicated that Heritage Bank was in a difficult place from the start. It’s managing director and chief promoter, Ifie Sekibo, was the former Executive Vice Chairman (EVC) of International Energy Insurance (IEI) Plc from where a sizable amount of the acquisition money for the old SGBN was raised. Sekibo has been in a stretch of back and forth with the Board of his former company on this subject, as the directors of the company insist that Heritage Bank should be considered as part of the assets of the Insurance group; going as far as alleging that Sekibo had invested the insurers money in the bank without the approval of then Board members; or indicating/stating IEI’s consideration in the bank acquisition, if any.

The matter of using IEI resources to acquire the former Societe Generale Bank of Nigeria (SGBN) which was renamed Heritage Banking Company Limited has been the subject of a longstanding Economic and Financial Crime Commission (EFCC) investigation and continues to hound the bank’s CEO till date. Our background work on the matter then, enabled us to sight documentations that lends credence if not validity to the role played by IEI as reflected in presentations made to its board.

Source: What Happened To The N8bn Raised by IEI Plc in 2007? – Shareholders – Proshare, May 11, 2015

Mr. Sekibo has over the past few years tried to work out an amicable settlement with the IEI Group and directors, but matters are still fluid with necessary concessions being made on both parts. That said, the CEO’s travails still continue as he has had to deal with a few other issues concerning related-party transactions that have crystallized and left the bank’s books in a difficult position.

Weak Governance and Control

Heritage Bank’s problems have most certainly not been about Sekibo, alone. Far from it, the bank’s Board of directors (including former directors) has created a permissive culture that led to this.

Heritage Bank’s erstwhile chairman was also known to have used the banks tills to acquire two electricity distribution licenses’ the underlying cash flow difficulties of the businesses were subsequently and promptly transmitted to the bank, resulting in large repayment defaults. Indeed the loans have become ‘hardcore’ non-performing assets sitting on the bank’s books and creating both liquidity and profitability difficulties.

Managers of the bank, particularly branch managers, were in the past profligate in granting authorized and unauthorized loans to associates. Temporary overdrafts (TODs) routinely skipped repayment dates while structured loans also habitually missed the terms of the loan indenture, resulting into phantom profits and worsening liquidity.

Huge public sector deposits were beauties turned into beasts. The introduction of the Treasury Single Account (TSA) policy by the federal government in 2015 subsequently left the bank’s Asset and Liability Management (ALM) position in tatters.

The TSA policy did four things to undermine the bank’s fiscal stability:

- Sharply reduced the bank’s deposits;

- Significantly raised the banks cost of Funds (CoF);

- Reduced the bank’s ability to give short term loans; and

- Weakened the bank’s already fragile profitability.

Since the bank was already nurtured on a culture of entitlement, finding strategic options to wriggle from, under the weight of government policy and patronage became impossible.

Heritage Bank’s narrow retail base and its poor quality risk assets put inevitable pressure on profitability and liquidity. To compound matters, the bank’s internal control and compliance functions appears to have operated under a cloud of breaches than in the protection of standard corporate governance requirements, as directors willy-nilly violated single obligor limits. The poor internal control and audit process and administration at the bank thus complicated an already combustible bad loan and poor liquidity situation.

Coup de Foudre (Unintended Consequence)

As a way out of its myriad of challenges, the bank fell in love with another entity, committing a tragic error. In a bold but ill-digested move, Heritage Bank decided to acquire the Asset Management Company of Nigeria’s (AMCON’s) legacy deposit money institution, Enterprise Bank, this was the decision that let all the evil spirits out of Pandora’s box. The acquisition of Enterprise Bank was the classic example of a Cobra Effect or a situation where a cure becomes worse than the original disease.

The decision to acquire Enterprise Bank for N56bn in 2014 resulted in unintended consequence. At the time, the bank’s Board rationale in acquiring Enterprise Bank from AMCON was to rapidly expand the retail end of HBL’s operations and reduce its cost to income ratio based on representations that informed their decision. That gambit has proven to be a disaster and a cautionary tale on acquiring distressed banks unfortunately.

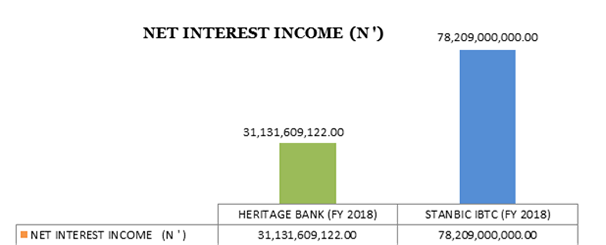

The Enterprise Bank wedlock, as consummated, turned into a fiasco as it added a further two hundred (200) branches to the banks operations and cut interest expense while improving net interest income (see chart 1 below). This led to the following outcomes:

- A sudden and significant rise in the bank’s bad debt to asset ratio;

- A leap in the bank’s debt provisioning or loan impairment requirements;

- A major rise in operational costs;

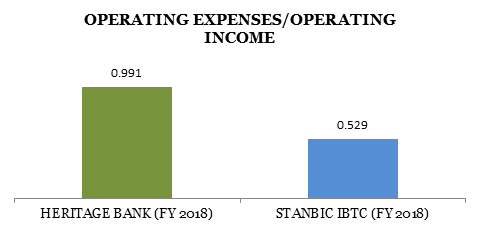

- A rise in the banks cost to income ratio (99% in FY 2018, as against the 53% of a bank like StanbicIBTC). (See chart 2 below);

- Stretching human capacity by lifting managers to their highest levels of administrative and technical (in)competence (The Peter Principle); and

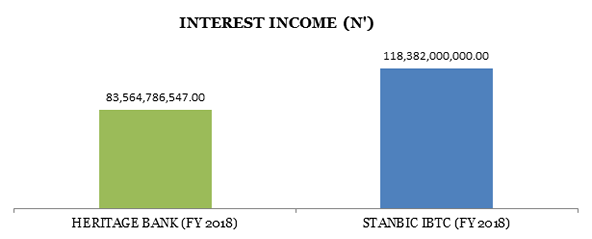

- Low Interest Income (as a result of slowing lending activities, (see chart 3) and high interest expense (as a result of a relatively low retail customer base, (see chart 4).

Chart 1 Net Interest Income FY2018, Heritage Bank and StanbicIBTC Bank

Source: Reported Financials Submitted / Estimated

Chart 2 Operating Expenses/Income FY2018,Heritage Bank and StanbicIBTC Bank

Source: Reported Financials Submitted / Estimated

Chart 3 Interest Income FY2018, Heritage Bank and StanbicIBTC Bank

Source: Reported Financials Submitted / Estimated

Biting into the Heritage Saga – What The Report Says

To understand the nexus between weak corporate governance, hubris, regulatory indulgence and Heritage Bank, the reader can send an email to re******@********ng.com for a copy of the report.

The report is an attempt at a holistic look at the banks realities and lays bare the challenges that occur when individuals and institutions fail to live up to the exacting standards that are required to turn fragile ideas into enduring legacies.

The report was carried out as an intervention guidance to prompt action from the various parties and interested entities; all in the overall interest of the financial system.

To protect the financial system from contagion, the Central Bank of Nigeria (CBN) may need to move into the affairs of Heritage Bank and any of three actions are now plausible:

- Wind up the institution with shareholders losing their money (as things stand today shareholder’s funds have been completely eroded) while depositors resort to the National Deposit Insurance Corporation (NDIC) for part recovery of deposited funds;

- Find fresh investors interested in the institution and intermediate a best effort basis sale of exiting shareholder interest and recapitalization of the institution as a going concern; and

- Liquidation of the institution and the running of the bank under a new franchise as a legacy institution managed by AMCON and available for purchase by third party investors.

The preferred solution would appear to be either the second or third options.

The second option would be of particular preference as it would not involve heavy ‘menu cost’ by way of rebranding but would involve a new ownership – Board of Directors and management staff. The fresh capital inflow would eliminate the need for initial treasury support from public coffers and would likely result in fresh/foreign capital inflows which would be beneficial for the local currency while also protecting domestic employment. This approach would appear plausible given that the CBN recently gave out new licenses to start up banks; premised on their understanding that there exist room for new entrants with fresh ideas and approach.

The CBN would however have to work fast if Heritage Bank is not to be a blight on the Governors no-failure record.

From indicators received, there is a small window to achieve a technical resolution of the Heritage Bank situation, lest it could find itself taking remedial action(s) at a much higher economic cost later than it would now.

Heritage banks weak liquidity, impaired shareholder funds and high loan impairment, according to analysts, needs action not tolerance. The time to act is now!

Source: Proshare Nigeria

NOTE: Only the first two paragraphs of this story were written by Business Post.

Banking

CIBN to Back ACAMB on Professional Development, Industry Advocacy

By Modupe Gbadeyanka

The Chartered Institute of Bankers of Nigeria (CIBN) has promised to support the ambitious plans of the Association of Corporate and Marketing Professionals in Banks (ACAMB).

At a meeting between the leaderships of the two organisations on Tuesday, the president of CIBN, Professor Pius Deji Olanrewaju, said it was impressed with the capability development and the undergraduate mentorship schemes of ACAMB under its leader, Mr Jide Sipe.

The CIBN chief commended the forward-thinking vision of the group, saying it had raised standards across Nigeria’s banking sector.

“ACAMB’s support has given CIBN and the banking sector brand equity,” he said, praising the association’s record in reputation management. recalling ACAMB’s role in addressing crises within the sector, describing the partnership as strategic and beneficial.

He further pledged support for ACAMB’s 30th anniversary in September 2026, its AGM, and other programmes, including fundraising initiatives.

“I want to assure you that everything you have presented today has been clearly noted and will be acted upon.

“We are fully committed to working closely with you so as to translate these discussions and vision into measurable progress. Our shared goal is to strengthen the sector, protect its reputation, and enhance its public image in a meaningful and lasting way.

“This meeting discussed various initiatives and reforms crucial for the future of our industry, including the need for continuous training and adaptation to new programs,” Mr Olanrewaju stated.

Speaking at the meeting, the president of ACAMB described the visit as a crucial first step in his tenure, aimed at contributing significantly to giving flight to his vision and that of ACAMB.

“When we assumed office, one of the first things we agreed on was the need to visit key stakeholders.

“However, before reaching out more broadly, we felt it was important to begin with our primary constituency and core stakeholders. We want them to understand the direction we are taking and to support the work we are doing, so that ACAMB can achieve greater success than it has in the past.

“We couldn’t have properly started our tenure without this very important meeting with the CIBN,” Mr Sipe stated

He introduced the newly constituted ACAMB Exco, which includes the 2nd Vice President, Morolake Phillip-Ladipo; General Secretary, Olugbenga Owootomo; Assistant General Secretary, Ademola Adeshola; Publicity Secretary, Abiodun Coker; and Executive Secretary, Fadekemi Ajakaiye.

Banking

All Set for Second HerFidelity Apprenticeship Programme

By Modupe Gbadeyanka

Registration for the second HerFidelity Apprenticeship Programme (HAP 2.0) organised by Fidelity Bank Plc has commenced.

The Divisional Head of Product Development at Fidelity Bank, Mr Osita Ede, informed newsmen that the initiative was designed to empower women with sustainable entrepreneurship skills.

The lender created the flagship women-empowerment initiative to equip women with practical, income‑generating skills and structured pathways to entrepreneurship.

“HerFidelity Apprenticeship Programme 2.0 reflects our commitment to continuous improvement. Having evaluated feedback from the first edition, we have returned with stronger partnerships and deeper mentorship programmes to ensure that women acquire not just skills, but sustainable economic opportunities,” he said.

“At the heart of the programme is guided, real‑world learning. Participants will undergo intensive apprenticeship training under reputable institutions and industry experts across select fields such as hair styling, shoe making, auto mechatronics, and interior decoration,” Mr Ede added.

He noted that HerFidelity Apprenticeship Programme 2.0 goes beyond skills acquisition by offering participants a wide range of business advisory services. These include business and financial literacy training, mentorship support throughout the apprenticeship journey, access to Fidelity Bank’s women‑focused and SME financial solutions, as well as guidance on business formalisation and growth strategies.

Further emphasising the bank’s vision, Mr Ede said, “By integrating structured mentorship with entrepreneurial development, Fidelity Bank is positioning women not just as trainees, but as future employers, innovators, and economic contributors within their communities. This aligns with our mandate to help individuals grow, businesses thrive, and economies prosper.”

Banking

The Alternative Bank Opens New Branch in Ondo

By Modupe Gbadeyanka

A new branch of The Alternative Bank (AltBank) has been opened in Ondo State as part of the expansion drive of the financial institution.

A statement from the company disclosed that the new branch would support export-oriented agribusinesses through Letters of Credit and commodity-backed trade finance, ensuring that local producers can scale beyond state borders.

For SMEs, the bank is introducing robust payment rails, asset financing for equipment and inventory, and supply chain-backed facilities that strengthen working capital without trapping businesses in interest-based debt cycles.

The Governor of Ondo State, Mr Lucky Aiyedatiwa, represented by his Chief of

Staff, Mr Olusegun Omojuwa, at the commissioning of the branch, underscored the importance of financial institutions in economic development.

“The pivotal role of financial institutions to economic growth and development of any economy cannot be overemphasised. It provides access to capital, supporting small and medium-scale enterprises and encouraging savings.

“Therefore, I have no doubt in my mind that the presence of The Alternative Bank in Ondo State will deepen financial services, create employment opportunities and stimulate economic activities across various sectors,” he said.

In her remarks, the Executive Director for Commercial and Institutional Banking (Lagos and South West) at The Alternative Bank, Mrs Korede Demola-Adeniyi, commended the state government’s leadership and outlined the lender’s long-term vision for Ondo State.

“As Ondo State steps into its next fifty years, and into the future anchored on the sustainable development championed during the recent anniversary celebrations, The Alternative Bank is here to be the financial engine for that vision. We didn’t come to Akure to hang banners. We came to fund work, farms, shops, and factories.”

With Ondo State’s economy anchored largely on agriculture, particularly cocoa production, poultry farming, and other cash crops, alongside a growing SME and trade ecosystem, AltBank is deploying sector-specific financing solutions tailored to these strengths.

For cocoa aggregators, processors and poultry operators, the bank will provide production financing, facility expansion support, machinery lease structures, and structured trade facilities under its joint venture and cost-plus financing models, with transaction cycles of up to 180 days for commodity trades and longer-term structured asset financing for equipment and infrastructure.

The organisation is a notable national non-interest bank with a physical network now surpassing 170 locations, deploying capital to solve real-world challenges through initiatives such as the Mata Zalla project, which saw to the training of hundreds of women as electric tricycle drivers and mechanics.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn