Banking

Stanbic IBTC Says Loan-to-Deposit Ratio Hits 67.5%, NPL at 3.9%

By Dipo Olowookere

The Chief Executive Officer of Stanbic IBTC Holdings Plc, Mr Yinka Sanni, has described the performance of the company in the 2019 financial year as impressive.

Last week, the company released its audited financial statements for the year ended December 31, 2019 and the firm, a member of Standard Bank Group, declared a profit after tax of N75 billion, representing an increase over its year end 2018 profit after tax of N74.4 billion.

Also, profit before tax for the year ended December 31, 2019 was N90.9 billion, representing a 3 percent increase over 2018 figures which stood at N88.2 billion.

In addition, the company’s non-interest revenue also grew by 6 percent to N108.8 billion in 2019, from N102.6 billion which it recorded in 2018.

Stanbic IBTC Holdings Plc also reported growth in its total operating income, from N180.8 billion in 2018, to N186.6 billion in 2019, representing a 3 percent increase.

As at December 31, 2019, the total assets of the Stanbic IBTC Group stood at N1.876 trillion, reflecting a 13 percent increase, when compared to the value of the assets which was N1.663 trillion as at December 2018.

According to Mr Sanni, “Our financial results were largely in line with market guidance. We achieved double digit growth in both assets under management (AuM) and loans.”

The Stanbic IBRC chief said, “Loan-to-deposit ratio was 67.5 percent, above the regulatory minimum of 65 percent as at December 31, 2019. Non-performing loans ratio was 3.9 percent, similar level with prior year and within acceptable limit of 5 percent.”

Highlighting some of the growth areas in the full year audited group results, he noted that, “The Group’s total assets grew by 13 percent aided by the growth in loans and financial investments portfolio.”

“Our Personal & Business Banking division contributed to profit yet again with a significant improvement in profit after tax year-on-year. Cost of risk was 0.2 percent compared to the writeback in prior year due to a non-occurrence of a significant recovery, however, it is still well below our guidance of 3 percent.

“Our sustained focus on cost containment coupled with revenue growth during the year yielded an improvement in cost-to-income ratio of 50.4 percent from 52.9 percent in 2018,” he added.

While acknowledging that the regulatory and economic environment could sometimes be challenging, he stated that the company remained resolute in its target to emerge as Nigeria’s leading end-to-end financial solutions provider.

“While we look to 2020 with great optimism, we are fully aware of the challenging macro-economic and regulatory headwinds that we must contend with as we enter a new decade.

“Nonetheless, our strategic journey towards becoming the leading end-to-end financial solutions provider by 2023 continues as we leverage our universal capabilities whilst focusing on cost management, digitisation and client centricity in accelerating growth in 2020,” he stated.

Stanbic IBTC continues to benefit from its adoption of a digital strategy as well as operating a Holdings company structure which enables subsidiaries to cross-sell and also leverage expertise within the Group.

Banking

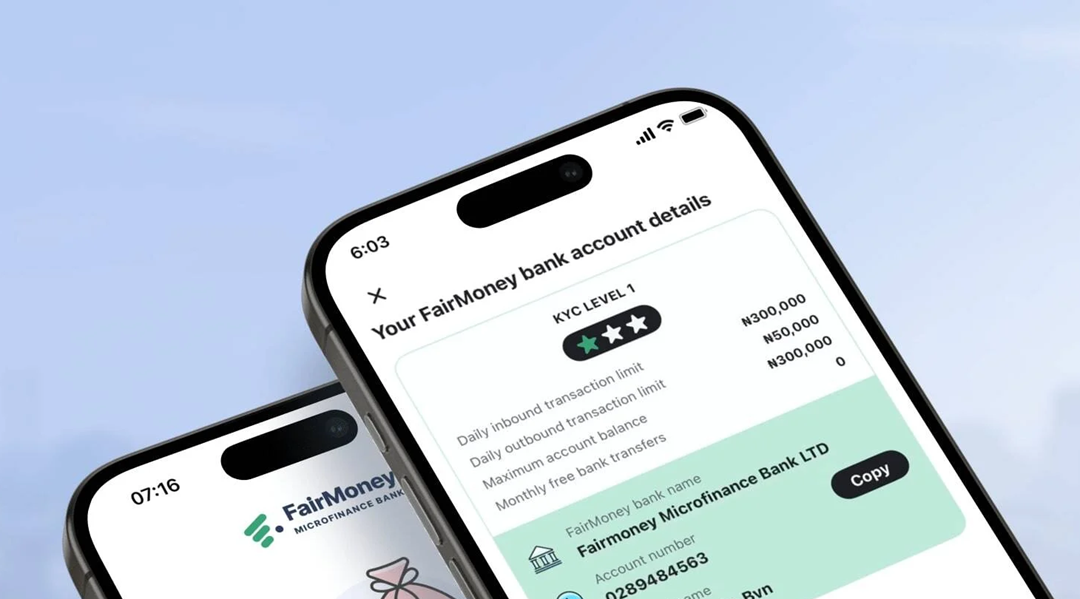

How FairMoney is Powering the Next Generation of Nigerian SMEs

SMEs are widely regarded as the engine of economic growth. According to the Small and Medium Enterprises Development Agency of Nigeria (SMEDAN), in 2025, Nigerian SMEs continued to anchor the economy, representing approximately 96% of all businesses. These enterprises contributed over 48% to Nigeria’s GDP and accounted for between 84% of total employment. However, while the vast majority of SMEs play a vital role in national development, only a small minority have access to formal credit or the financial literacy required to scale and meet eligibility requirements.

FairMoney Microfinance Bank (MFB), a leading technology-enabled bank in Nigeria, is supporting national financial inclusion objectives and bridging the gap by providing solutions that directly assist small and medium-sized enterprises (SMEs). It does this not only by providing access to financing but also by offering efficient payment processing options that help SMEs scale up financially.

Access to Capital

Securing a loan through FairMoney MFB offers a streamlined path for Nigerian SMEs to transform potential into performance. By prioritising digital speed and accessibility, the microfinance bank enables eligible business owners in Nigeria to secure up to ₦5,000,000 without physical collateral; however, access remains subject to credit assessment. This rapid disbursement creates a real opportunity for entrepreneurs to act on time-sensitive growth prospects, whether that means restocking inventory ahead of a peak season, fulfilling a sudden large-scale order, or upgrading essential equipment. To improve their eligibility for higher loan amounts, SMEs simply need to increase their engagement with the FairMoney ecosystem; banking and managing finances directly through the app after an initial application using their BVN and business details.

Beyond the Bank Statement

Alternative credit scoring is the engine that allows FairMoney MFB to leverage broader data sets to better inform credit decisions for a wider range of SME customers. FairMoney MFB doesn’t just look at a bank statement; it looks at potential. By utilising Alternative Credit Scoring powered by advanced data analytics and machine learning, FairMoney MFB assesses creditworthiness based on non-traditional data, such as app usage patterns, transaction velocity, and digital footprints – with customer consent and in accordance with Nigerian data protection requirements. This approach opens the door for businesses with limited formal financial histories to access real growth opportunities that were previously out of reach. For the Nigerian SME, this presents the opportunity to scale from small-scale survival to ambitious expansion, securing the funding necessary to innovate and compete based on the real-time strength of their operations.

Smarter Savings

True business growth requires a shift from simple borrowing to disciplined wealth management, and FairMoney MFB empowers SMEs with a suite of specialised products designed to ensure their capital works as hard as they do. Through FairTarget, entrepreneurs can define specific financial milestones, such as purchasing equipment or securing a larger office, and automate their progress toward reaching them. For operational liquidity, FairSave offers a high-interest savings account where funds remain accessible while earning daily interest, while FairLock provides long-term stability by allowing businesses to secure surplus funds at premium interest rates, protecting capital from impulsive spending. Together, these features transform FairMoney MFB from a lender into a comprehensive financial partner to SMEs that fosters both immediate scalability and long-term fiscal health.

POS Systems

FairMoney MFB’s Point of Sale (POS) systems provide Nigerian SMEs with a robust infrastructure to accept online, mobile, and in-person payments seamlessly. By transitioning from a cash-only model to a multi-channel payment system, businesses can significantly reduce operational risks such as theft and accounting errors while expanding their reach to a nationwide customer base. This digital shift unlocks real-life opportunities for growth. A local retailer can move beyond foot traffic to sell to customers across the country via the web, while service providers can offer “Pay with Transfer” or card options that cater to the growing demographic of cashless consumers.

Every digital transaction creates a verifiable financial trail within the FairMoney MFB app, which the bank uses to build a more accurate credit profile for the merchant. This means that simply by making it easier for customers to pay, SMEs could potentially improve their credit profile and gain access to more competitive pricing needed for long-term expansion.

Maintaining detailed financial records has transitioned from a best practice to a regulatory necessity for SMEs. The current landscape, influenced by the Nigeria Revenue Service (NRS), increasingly values verifiable digital records as a means of supporting eligibility assessments for small business tax holidays. Maintaining such records through record keeping can facilitate compliance with requirements for exemptions, such as the 0% Company Income Tax (CIT) rate for businesses with an annual turnover below ₦100 million. Without accurate, time-stamped digital trails, including structured e-invoices and clear transaction histories, SMEs risk not only losing these vital fiscal reliefs but also facing significantly sharper penalties for late filing or non-compliance.

Beyond tax, streamlined records bridge the information gap that often hinders access to credit; by presenting a “financial compass” of real-time cash flow and profitability, business owners can prove their creditworthiness to partners, turning their compliance into a strategic tool for securing the capital needed to scale in an increasingly formalised market. FairMoney MFB continues to serve as a dynamic partner in an SME’s journey toward long-term scalability and financial stability.

Banking

GTBank Offers Customers 2.95% on Quick Airtime Loan Via *737*90# Code

By Modupe Gbadeyanka

Customers of Guaranty Trust Bank (GTBank) Limited in need of quick airtime on their phones for payment later can now do so at an interest rate of 2.95 per cent.

The flagship banking franchise of GTCO Plc, in a statement, said this innovative digital solution gives customers instant access to airtime when they run out of call credit and have limited funds in their bank accounts, ensuring they can stay connected when it matters most.

The service known as the Quick Airtime Loan highlights GTCO’s evolution as a fully diversified financial services group.

Leveraging HabariPay’s Squad, the solution reinforces the group’s ecosystem proposition by bringing together banking, payment technology, and digital channels to deliver intuitive, one-stop experiences for customers.

The Quick Airtime Loan service was created to help customers address missed opportunities, disrupted plans, and lost connections, often at the very moment when funds are tight and options are limited.

The product offers users instant access to airtime on credit, directly from their bank.

With Quick Airtime Loan, eligible GTBank customers can access from N100 and up to N10,000 by dialling *737*90#. Available across all major mobile networks in Nigeria, the service will soon expand to include data loans, further strengthening its proposition as a reliable on-demand platform.

For years, the airtime credit market has been dominated by Telcos, where charges for this service are at 15 per cent, but GTBank is now changing the narrative by offering a customer-centric, bank-led digital alternative priced at 2.95 per cent.

Built on transparency, convenience and affordability, Quick Airtime Loan has the potential to broaden access to airtime, deliver meaningful cost savings for millions of Nigerians, and redefine how financial services show up in everyday life, not just in banking moments.

“Quick Airtime Loan reflects GTBank’s continued focus on delivering digital solutions that are relevant, accessible, and built around real customer needs.

“The solution underscores the power of a connected financial ecosystem, combining GTBank’s digital reach and lending expertise with the capabilities of HabariPay to deliver a smooth, end-to-end experience.

“By leveraging unique strengths across the Group, we can accelerate innovation, strengthen execution, and deliver a more integrated customer experience across all our service channels,” the Managing Director of GTBank, Ms Miriam Olusanya, commented.

Banking

UBA Taps $100bn Annual Diaspora Flows With New Platform

By Modupe Gbadeyanka

United Bank for Africa (UBA) Plc has introduced a diaspora platform designed to connect global Africans with investment and wealth opportunities.

This platform, according to the lender’s Head of Diaspora Banking, Mr Anant Rao, would be used to tap into the $100 billion diaspora remittance flows to Africa annually.

Mr Rao stated that the objective is to provide a platform that brings together offerings across the numerous needs of the global African, including banking and payments, investments, securities services, asset management, insurance, pensions, and real estate.

“Diaspora capital is not just a flow of funds — it is a strategic growth partner for Africa.

“Our role is to provide a trusted platform that converts capital into structured investment and shared prosperity across the continent,” he stated at the unveiling of this platform in Lagos recently.

Business Post gathered that this diaspora banking and investment platform will serve Africans living and working across the world and within the continent.

It was launched in collaboration with leading ecosystem partners, including United Capital, Africa Prudential, UBA Pensions, Afriland Properties, Heirs Insurance Group, and Avon Healthcare Limited.

“For decades, Africa’s engagement with its diaspora has focused largely on remittances. Today, we are moving beyond that. This platform represents a transition from simple money transfers to a financial ecosystem where Africans globally can bank, make payments, invest, protect their families, and build long-term wealth seamlessly,” Mr Rao further said.

It was learned that through this coordinated ecosystem, diaspora customers can access financial solutions across multiple sectors through a single trusted platform, enabling them to manage their financial lives and family commitments across borders with ease and transparency.

Also speaking, the Head of Marketing and Corporate Communications for UBA, Ms Alero Ladipo, noted that, “The modern African is a global citizen, mobile, ambitious, and deeply connected to home. Whether living in Africa, Europe, the Americas, or the Middle East, there must be a structured and secure financial connection back home. This platform ensures that Africans everywhere can remain economically connected to the continent with confidence and transparency.”

Partners within the ecosystem highlighted growing demand among diaspora Africans for structured investment opportunities, secure property ownership, insurance protection, and long-term financial planning.

United Capital showcased globally accessible investment products designed to deliver professionally managed and transparent wealth creation opportunities.

Afriland Properties emphasised structured and well-governed real estate investment pathways for diaspora clients.

Heirs Insurance highlighted protection solutions for life and assets, while Avon Healthcare Limited demonstrated healthcare access and insurance solutions for families across borders.

Africa Prudential and UBA Pension reinforced digital investment management and long-term pension savings solutions designed to support diaspora participation in African capital markets.

They all underscored a shared commitment to providing diaspora Africans with credible, transparent, and professionally managed financial pathways.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn