Banking

Why we Can’t Pay Dividend to Shareholders Now–Ecobank

By Modupe Gbadeyanka

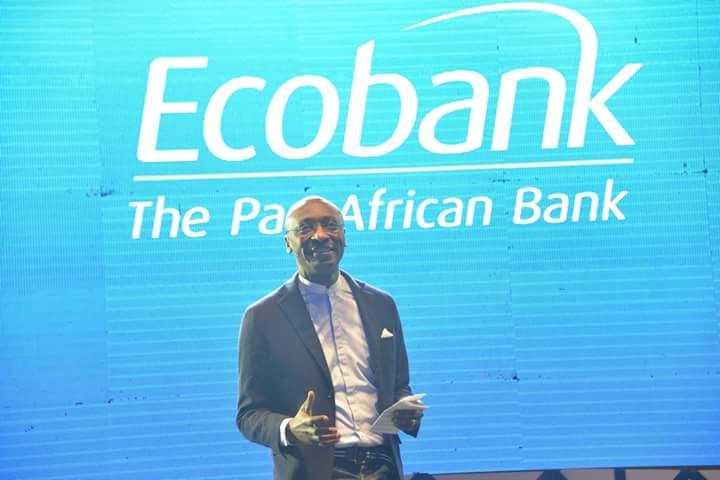

Chairman of Ecobank Transnational Incorporated (ETI), parent company of the Ecobank Group, Mr Emmanuel Ikazoboh, has explained why the board of directors of the company did not propose the payment of dividend to shareholders in the 2018 business year.

Speaking at the Annual General Meeting (AGM) of the lender in Togo, the Chairman said noted that the board decided to halt the payment of dividend as a result of the impending regulatory capital requirements of the group and the need to build the holding company’s liquidity buffers.

According to him, the decision was in the best interest of the company, assuring shareholders to expect reward from the bank as a soon as the financial institution has a strong balance sheet and solid capital base.

“We assure you that while this was a hard decision, it was taken in the best interest of the company. We want to make sure we attend to the capital needs of all our subsidiaries before can start paying dividends,” the Chairman said at the meeting.

Mr Ikazoboh further assured shareholders of the company that efforts are being intensified to sustain the positive performance recorded by the financial institution going forward.

After posting a loss in 2016, Ecobank bounced back into profit in 2017 and consolidated on that performance in 2018 by growing its profit after tax by 46 percent to N136 billion.

The Chairman said the results reflected the continued discipline in cost management, commitment to risk management and the ongoing clean-up of the bank’s credit portfolio, saying the efficiency or cost-to-income ratio has steadily improved to 61.5 percent in 2018 despite tepid revenue growth.

He said: “Our capital levels remain adequate. The Group’s Base II/III Capital Adequacy Ratio of 13.6 percent is above the regulatory limit and each of our subsidiaries is meeting its capital commitments as well.

“However, your board believes that in the near-term, to meet our planned growth initiatives, and to ensure that we win in key countries such as Nigeria and Kenya, we will need to boost capital levels through a combination of fresh equity injections and the reinvestments of profits.”

Also speaking, the Group Chief Executive Officer of the bank, Mr Ade Ayeyemi, described the company’s financial results in 2018 as remarkable in many ways, saying it reflects the meaningful and significant progress they made in the execution of “our Roadmap to Leadership strategy”.

“It also demonstrates the commitment, hard work and contribution of Ecobankers towards ensuring our sustainable foundation for growth,” Mr Ayeyemi said.

Banking

Access Bank Opens Branch in Malta to Strengthen Europe-Africa Trade Ties

By Modupe Gbadeyanka

To strengthen Europe-Africa trade ties, Access Bank has opened a new branch in Malta. It will focus on international trade finance, employing approximately 30 people in its initial phase, with plans for controlled expansion over time.

It was learned that this Maltese branch was established by Access Bank UK Limited, the subsidiary of Access Bank Plc, which is also the subsidiary of Access Holdings Plc, which is listed on the Nigerian Exchange (NGX) Limited.

Access Bank Malta Limited commenced operations after obtaining a banking licence from the European Central Bank (ECB) and the Malta Financial Services Authority (MFSA).

Access Bank said the licence marks a transformative milestone in bolstering Europe-Africa trade flows.

Malta, a renowned international financial centre, and a gateway between the two continents, is strategically positioned to play a pivotal role in advancing commerce and fostering economic partnerships.

This strategic expansion into Malta enables The Access Bank UK Limited to leverage growing trade opportunities between Europe and Africa.

It underscores the organisation’s commitment to driving global trade, financial integration, and supporting businesses across these regions.

“By establishing operations in Malta, we will gain a foothold in a market that bridges European and North African economies, moving us one step closer to our goal of becoming Africa’s Gateway to the World.

“It further enhances our bank’s capacity to support clients with innovative solutions tailored to cross-border trade and investment opportunities,” the chief executive of Access Bank, Mr Roosevelt Ogbonna, stated.

“Europe has emerged as Africa’s leading trading partner, driven by initiatives such as the Economic Partnership Agreements between the EU and African regions and the African Continental Free Trade Area (AfCFTA).

“With Europe-Africa economic relations entering a new phase, The Access Bank Malta Limited is ideally positioned to deepen trade and meet the financing and banking needs of our clients in these expanding markets,” the chief executive of Access Bank UK, Mr Jamie Simmonds, commented.

Also speaking, the chief executive of Access Bank Malta, Renald Theuma, said, “Malta is uniquely positioned as a bridge between Europe and Africa, making it an ideal location for our subsidiary. This move allows The Access Bank Malta Limited to engage more closely with customers in Europe and deliver tailored financial solutions that drive growth and connectivity across both continents.”

Banking

Goldman Sachs, IFC Partner Zenith Bank, Stanbic IBTC, Others to Empower Women Entrepreneurs

By Adedapo Adesanya

The International Finance Corporation (IFC) and Goldman Sachs have announced a new partnership with African banks, including Nigeria’s Zenith Bank and Stanbic IBTC Nigeria to support the Goldman Sachs 10,000 Women initiative, a joint programme launched in 2008 to provide access to capital and training for women entrepreneurs globally.

The two Nigerian banks are part of nine financial institutions from across Africa which have agreed to join the 10,000 Women initiative committing to leverage the business education and skills tools the programme provides to create more opportunities for women entrepreneurs across the continent by providing access to business education.

Others banks include Stanbic Bank Kenya, Ecobank Kenya, Ecobank Cote d’Ivoire, Equity Bank Group, Banco Millenium Atlantico – Angola, Baobab Group, and Orange Bank.

Speaking on this, Ms Charlotte Keenan, Managing Director at Goldman Sachs said – “10,000 Women has had a powerful impact to date, but we know that there are more women to reach and more potential to be realized.

“We are delighted to partner with IFC to supercharge the growth of women-owned businesses across Africa, and mainstream lending to female business leaders. We remain committed to supporting entrepreneurs with the access to education and capital that they need to scale.”

Since 2008, the 10,000 Women initiative has provided access to capital and business training to more than 200,000 women in 150 countries.

“This expanded initiative marks a significant step forward in creating equitable economic opportunities for women in Africa, enabling them to build stronger, more resilient businesses and to realize their entrepreneurial goals,” said Ms Nathalie Kouassi Akon, IFC’s Global Director for Gender and Economic Inclusion.

Goldman Sachs’ 10,000 Women initiative complements the Women Entrepreneurs Opportunity Facility (WEOF), launched in 2014 by Goldman Sachs and IFC as the first-of-its-kind global facility dedicated to expanding access to capital for women entrepreneurs in emerging markets.

Banking

Development Bank of Nigeria Wins Financial Inclusion Leadership Award

By Aduragbemi Omiyale

In recognition of its unwavering commitment to fostering access to financing for Nigerian micro, small and medium enterprises (MSMEs), Development Bank of Nigeria Plc has been rewarded with the Financial Inclusion Leadership Award at the Champions of Inclusion Nigeria Financial Inclusion Awards.

This was at the 2024 International Financial Inclusion Conference (IFIC) organised by the Central Bank of Nigeria (CBN) in collaboration with the World Bank and other stakeholders.

The chief executive of the lender, Mr Tony Okpanachi, said the recognition affirms the company’s efforts in expanding access to financial services for MSMEs in Nigeria.

“We are honoured to receive the Financial Inclusion Leadership Award, which is a testament to our bank’s commitment to expanding access to financial services for all Nigerians. This award recognises our efforts to bridge the financial inclusion gap, particularly for a priority sector like the MSMEs.

“Additionally, this award is a validation of our strategic focus on driving financial inclusion for small businesses, and we are proud to be at the forefront of this initiative that drives that. We will continue to innovate and expand our financial inclusion programmes, ensuring that more Nigerian small and startup businesses have access to services,” he stated.

On his part, the Chief Operating Officer of DBN, Mr Bonaventure Okhaimo, said the accolade demonstrates the firm’s dedication to driving financial inclusion and economic growth in Nigeria.

“This award acknowledges our Bank’s innovative approach to widening opportunities for MSMEs in Nigeria to grow and scale their businesses,” he said.

“This award will motivate us to continue pushing the boundaries of financial inclusion, exploring more innovative solutions and partnerships to expand our reach and impact.

“We are committed to ensuring that more small businesses and startup enterprises in Nigeria have access to financial services, this award will further inspire us to accelerate our efforts in this regard,” he stated.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism8 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking6 years ago

Banking6 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN