Brands/Products

Sparkle Nigeria Introduces SMS Alert Fees

By Modupe Gbadeyanka

Customers of Sparkle Nigeria, a financial technology (fintech) company owned by Mr Uzoma Dozie, the former Managing Director of the defunct Diamond Bank Plc, will start to pay for receiving notifications of their transactions on the platform.

A notice to customers disclosed that the payment for the alerts would commence from May 1, 2021, and it would be the standard N4 per SMS charged by GSM network providers in the country.

However, users of the platform were given the option to choose how they intend to be notified of every transaction carried out by them.

“We wanted to share this important update on changes to our transaction fees.

“Sparkle launched with the aim of leveraging technology and data to remove barriers and create simplicity.

“We extended this to how we keep you updated on the different activities that happen within your account.

Over the past year, SMS notifications have remained free, however, from May 1, 2021, Sparkle will begin charging for these alerts,” the notice seen by Business Post disclosed.

What this means

According to the company, this development means on the first day of each month, SMS charges from the previous month will be debited from the accounts of customers.

This charge is a flat fee of N4 per SMS received each month and users will not be charged for all other forms of account notifications like push notifications and email.

“But we have some sparkling news! We are giving you the freedom and flexibility to choose how you get notified.

“Simply go to more>> notifications >> select your notifications preference and you can choose to toggle off SMS notifications,” the disclosure explained.

Brands/Products

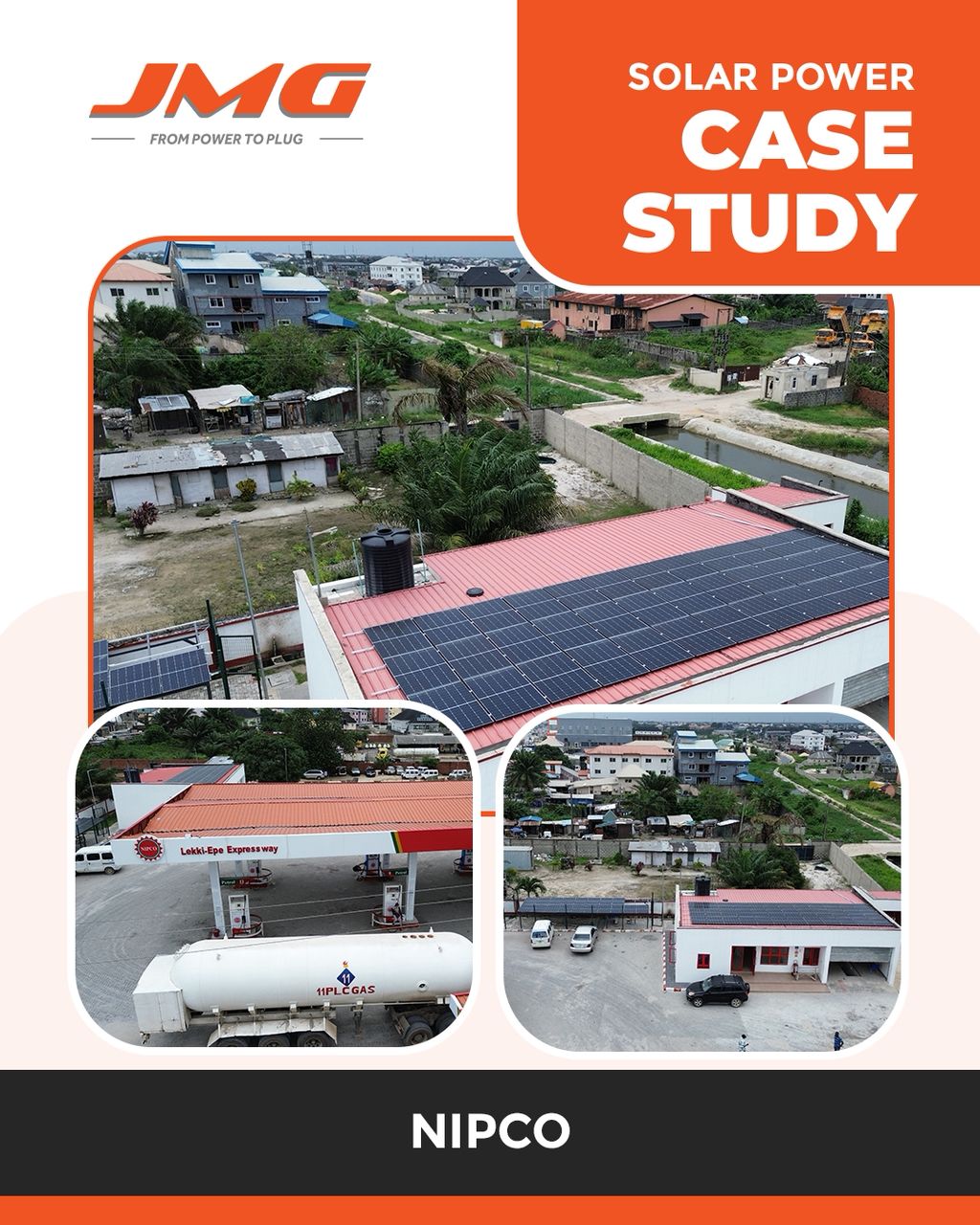

JMG Installs Solar Power Systems at Three NIPCO Fuel Stations

By Aduragbemi Omiyale

Nigeria’s trusted hybrid and integrated electromechanical energy provider, JMG Limited, has completed the installation of solar power systems at three key fuel stations of NIPCO Plc.

The clean energy source was installed at NIPCO’s petrol dispensing outlets in Gwagwalada Abuja, Lekki Lagos, and Mpape Abuja.

This will help the organisation eliminate diesel reliance, and unlock more than N44 million in annual energy cost savings.

The installations feature advanced hybrid systems, combining solar arrays, lithium battery storage, and smart inverters to provide 24/7 energy for fuel pumps, lighting, and office operations. Each site has reported zero use of electricity or generator power since the systems were installed.

The three NIPCO stations now run on an advanced hybrid solar system that combines high‑efficiency PV panels, intelligent lithium‑battery storage and smart inverters.

Since commissioning, the sites have operated with zero grid or generator power, providing silent, clean, uninterrupted electricity for pumps, lighting and administration.

“We are proud to help NIPCO lead the energy transition at the retail level.

“The scalable architecture can be sized to each location and has already delivered significant savings, about 88,535 kWh/year, N44.4 million in annual cost savings and a 43.8‑tonne reduction in CO₂ emissions,” the Head of JMG’s Hybrid Solar Division, Mr Abbass Hussein, stated, adding that, “Collaborating with NIPCO on this initiative demonstrates a practical pathway for other firms to reduce both emissions and energy expenses.”

Also commenting, NIPCO’s Station Manager at Gwagwalada, Mr Idoko Jacob, said, “The stations have not relied on electricity or generator power on bright-weather days since commissioning. The solar systems fully meet our daily energy needs during such periods. On days with poor weather, we supplement the solar system with generator power to ensure uninterrupted operations.”

Business Post gathered that the NIPCO Gwagwalada Station has a solar output of 42,450 kWh/year, annual savings of N15.6 million, and CO₂ reduction of 15,332.76 kg/year, with a system installed consisting of a 20kW Deye LV Hybrid Inverter, 26.8kWp Solar PV, and 51.2kWh Lithium Battery Storage.

The NIPCO Lekki Station has a solar output of 3,635 kWh/year, annual savings of N12 million, and CO₂ reduction of 13,130.1 kg/year, with a system installed consisting of a 25kW Must Hybrid Inverter, 22.95kWp Solar PV, and 76.8kWh Lithium Battery Storage.

As for the NIPCO Mpape Station, it has a solar output of 42,450 kWh/year, annual savings of N16.8 million, and CO₂ reduction of 15,332.76 kg/year, with a system installed consisting of a 20kW Deye LV Hybrid Inverter, 26.8kWp Solar PV, and 61.44kWh Lithium Battery Storage.

Brands/Products

MAGGI Unveils ‘Taste of Christmas’ Campaign

MAGGI, the culinary brand from Nestlé Nigeria, has announced the launch of its festive campaign, Taste of Christmas, designed to celebrate the sights, sounds, and flavours that define the Nigerian Christmas experience.

Central to the campaign is a collaboration with Nigeria’s fast-rising pop star Qing Madi and the renowned Loud Urban Choir, resulting in a new Christmas anthem titled Taste of Christmas.

Now available across all major music streaming platforms, the song blends contemporary sound with cultural warmth, evoking the joy of family, togetherness, and shared meals that characterize the season.

Extending beyond music, the Taste of Christmas campaign will roll out a curated series of festive recipes and culinary inspiration over a 12-day period. The collection features creative twists such as Coco Bongus, alongside beloved Nigerian classics, encouraging families to explore new flavours while enjoying MAGGI’s trusted range of seasonings.

Commenting on the campaign, the Category Manager for Culinary at MAGGI, Ms Funmi Osineye, said, “Christmas is a time when family, culture, and shared experiences come alive. With the Taste of Christmas campaign, we set out to create a platform that resonates strongly with today’s young adults while still celebrating the warmth of home. Partnering with Qing Madi and The Loud Urban Choir allows us to connect music and food in a way that feels authentic, modern, and deeply Nigerian.”

The campaign further reflects MAGGI’s commitment to celebrating home-grown talent, nurturing culinary creativity, and strengthening the role of food as a unifying force in Nigerian homes.

Consumers can access festive recipes, campaign content, and the Taste of Christmas anthem on MAGGI’s digital platforms and social media channels. Conversations around the campaign can be followed using #MAGGIChristmas.

MAGGI is a leading culinary brand from Nestlé Nigeria, committed to inspiring better cooking habits and bringing families together through delicious, nutritious meals.

Brands/Products

FG Suspension of Sachet Alcohol Ban Excites NECA

By Modupe Gbadeyanka

The decision of the federal government to suspend the ban on alcohol produced in sachets has been welcomed by the Nigeria Employers’ Consultative Association (NECA).

The Director-General of the group, Mr Adewale-Smatt Oyerinde, described it as a right step in the right direction because it respects existing National Assembly resolutions and restores regulatory clarity.

Recall that recently, the Office of the Secretary to the Government of the Federation (OSGF) ordered the suspension of the policy due to concerns raised by the House of Representatives Committee on Food and Drugs Administration and Control.

In a statement, the NECA chief said the immediate suspension of all enforcement actions relating to the proposed ban on sachet alcohol and 200ml PET bottle products, pending the conclusion of consultations and the issuance of a final policy directive, was good for the industry and the economy.

According to him, the sachet and PET segment of the alcoholic beverage industry accounts for a significant portion of the estimated N800 billion invested in the sector and supports thousands of direct and indirect jobs in manufacturing, packaging, logistics, wholesale and retail.

He stressed that in an economy already struggling with high unemployment and rising business costs, abrupt policy measures that threaten existing jobs and legitimate investments would be counterproductive.

“We fully acknowledge the need to address public health concerns, especially regarding children and young people, but the solutions must be evidence-based and carefully designed so as not to drive activities into the informal and unregulated economy or encourage illicit products.

“We are looking forward to a deepened consultation to enable the protection of jobs, livelihoods and legitimate investments, etc., while also ensuring that public health objectives are effectively and sustainably achieved,” Mr Oyerinde said.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn