Economy

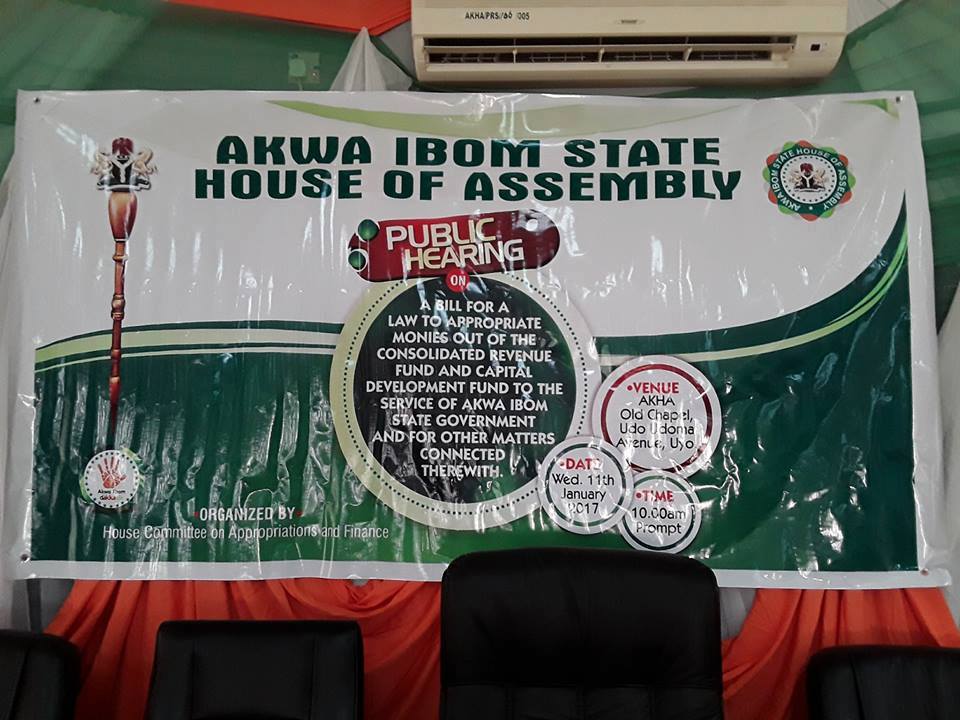

Akwa Ibom Assembly Holds Public Hearing on 2017 Budget

By Modupe Gbadeyanka

Speaker of the Akwa Ibom State House of Assembly, Mr Onofiok Luke, has disclosed that the House would be guided by current economic realities in its consideration of the 2017 budget sent to the assembly by the executive.

Declaring open a one day public hearing on the 2017 Appropriation Bill titled: A bill for a law to Appropriate monies out of the Consolidated Revenue Fund and Capital Development fund to the service of Akwa Ibom State Government, the Speaker who was represented by the Deputy Speaker, Mrs Felicia Bassey, said the 6th assembly which is christened the people’s assembly, will always involve the citizenry in all its legislative engagements.

“As you may already know, the 6th assembly has over the last 19 months established and sustained the culture of putting in place public hearings like this for the bills that we pass.

“I wish to emphasize that nothing passes through this house that we don’t get public input. We will look at the economic situation in the country and allow these realities guide our decisions on the components of the budget,” the Speaker said.

While commending members of the public for honouring the invitation of the House, Mr Luke explained that the essence of the public hearing was to give Akwa Ibom people an opportunity to contribute their inputs to the budget, saying the aim was to ensure that the people of the state were carried along in the budgeting process.

Addressing the gathering, Chairman, House Committee on Appropriation and Finance, Mr Usoro Akpanusoh, stated that the public hearing exercise has become a normal parliamentary practice introduced by the House in order to bring together members of the public for the purpose of collating inputs that would guide the lawmakers in the consideration of the budget.

“It has become a norm in Akwa Ibom State House of Assembly that budget hearing is held whenever we receive the state budget from the executive.”

He said the House is committed to ensuring accelerated passage of the budget to enable the state government implement its lofty programmes and projects as encapsulated in appropriation bill, 2017.

Commissioner for Finance, Mr Linus Nkan, and his counterpart in the ministry of Economic Development were on hand to brief the gathering on underlining assumptions of the 2017 budget proposal of the state government, as well as the development objectives of the Mr Udom Emmanuel led administration.

In their separate presentations, the Commissioners explained that the policy thrust of the 2017 appropriation bill is intended to improve the living standard of the people of the state.

In a good will message, State Chairman of the PDP, Mr Obong Paul Ekpo who scored the budget a hundred percent, said “PDP government means well for Akwa Ibom people”.

“I listened carefully to the details of the budget the details of the budget and I discovered that the budget encapsulates every facet of our lives”.

Memoranda were submitted by various stakeholders including the Chairman, Akwa Ibom State Council of Chiefs, Mr Owong Achianga, State NLC Chairman, Comrade Etim Ukpong, Chairman, Nigeria Union of Journalists (NUJ), Akwa Ibom State Council, Elder Patrick Albert, among other members of the society.

A representative of the civil society, Mr Tijah Bolton Akpan of ‘Policy Alert’ organisation, canvassed for a stronger oversight on TSA implementation in the state, and close supervision and monitoring of the implementation of the budget by MDA’s.

He stressed the need for the state to speed up the process of enacting and domesticating the fiscal responsibility and public procurement law.

Mr Joshua Eyo Asuquo of the Chartered Institute of Taxation in Nigeria (CITN), who also represented Association of Professional Bodies of Nigeria, advocated for an increase in monthly revenue projection from N2.3 billion as captured in the budget to N3 billion.

Economy

NASD OTC Securities Exchange Closes Flat

By Adedapo Adesanya

The NASD Over-the-Counter (OTC) Securities Exchange closed flat on Thursday, December 12 after it ended the trading session with no single price gainer or loser.

As a result, the market capitalisation remained unchanged at N1.055 trillion as the NASD Unlisted Security Index (NSI) followed the same route, remaining at 3,012.50 points like the previous trading session.

However, the activity chart witnessed changes as the volume of securities traded at the bourse went down by 92.5 per cent to 447,905 units from the 5.9 million units transacted a day earlier.

In the same vein, the value of securities bought and sold by investors declined by 86.6 per cent to N3.02 million from the N22.5 million recorded in the preceding trading day.

But the number of deals carried out during the session remained unchanged at 21 deals, according to data obtained by Business Post.

When trading activities ended for the day, Geo-Fluids Plc remained the most active stock by volume (year-to-date) with 1.7 billion units sold for N3.9 billion, Okitipupa Plc came next with 752.2 million units valued at N7.8 billion, and Afriland Properties Plc was in third place with 297.5 million units worth N5.3 million.

Also, Aradel Holdings Plc remained the most active stock by value (year-to-date) with 108.7 million units worth N89.2 billion, followed by Okitipupa Plc with 752.2 million units valued at N7.8 billion, and Afriland Properties Plc with 297.5 million units sold for N5.3 billion.

Economy

Naira Firms to N1,534/$1 at NAFEM, Crashes to N1,680/$1 at Black Market

By Adedapo Adesanya

The Naira appreciated against the United States Dollar at the Nigerian Autonomous Foreign Exchange Market (NAFEM) by N14.79 or 0.9 per cent to trade at N1,534.50/$1 compared with the preceding day’s N1,549.29/$1 on Thursday, December 12.

The strengthening of the domestic currency during the trading session was influenced by the introduction of the Electronic Foreign Exchange Matching System (EFEMS) by the Central Bank of Nigeria (CBN).

The implementation of the forex system comes with diverse implications for all segments of the financial markets that deal with FX, including the rebound in the value of the Naira across markets.

The system instantly reflects data on all FX transactions conducted in the interbank market and approved by the CBN; publication of real-time prices and buy-sell orders data from this system has lent support to the Naira at the official market.

Equally, the local currency improved its value against the British Pound Sterling by N3.91 to wrap the session at N1,954.77/£1 compared with the previous day’s N1,958.65/£1 and against the Euro, the Nigerian currency gained N2.25 to sell for N1,610.41/€1 versus N1,612.66/€1.

However, in the black market, the Naira crashed further against the US Dollar on Thursday by N10 to quote at N1,680/$1 compared with Wednesday’s closing rate of N1,670/$1.

Meanwhile, the cryptocurrency market majorly corrected after earlier gains as US President-elect Donald Trump reiterated his ambition to embrace crypto assets, but a bond market rout dragged risk assets lower.

Mr Trump said, “We’re going to do something great with crypto” while ringing the opening bell at the New York Stock Exchange, reiterating his ambition to embrace digital assets in the world’s largest economy and create a strategic bitcoin reserve.

Alongside, the European Central Bank trimmed its benchmark interest rates by 25 basis points and in its dovish policy statement hinted that more rate cuts were likely to happen.

The biggest loss was made by Cardano (ADA), which fell by 4.9 per cent to trade at $1.10, followed by Ripple (XRP), which slid by 4.1 per cent to $2.33 and Dogecoin (DOGE) recorded a value depreciation of 2.9 per cent to sell at $0.4064.

Further, Solana (SOL) slumped by 1.8 per cent to $225.89, Binance Coin (BNB) slipped by 1.3 per cent to $746.92, Bitcoin (BTC) declined by 0.6 per cent to $99,998.18, Ethereum (ETH) crumbled by 0.5 per cent to $3,909.43, and Litecoin (LTC) dipped by 0.3 per cent to $121.52, while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) remained unchanged at $1.00 each.

Economy

Oil Market Falls on Expected Increase in Supply Surplus

By Adedapo Adesanya

The oil market slumped on Thursday, pressured by an expected increase in supply, supported by rising expectations of a Federal Reserve interest rate cut.

The International Energy Agency (EIA) made a slight upward revision to its demand outlook for next year but still expected the oil market to be comfortably supplied, with Brent crude futures losing 11 cents or 0.15 per cent to trade at $73.41 per barrel and the US West Texas Intermediate (WTI) crude futures declining by 27 cents or 0.38 per cent to finish at $70.02 per barrel.

The IEA in its monthly oil market report increased its 2025 global oil demand growth forecast to 1.1 million barrels per day from 990,000 barrels per day last month, largely in Asian countries due to the impact of China’s recent stimulus measures.

At the same time, the IEA expects nations not in the Organisation of the Petroleum Exporting Countries and Allies (OPEC+) group to boost supply by about 1.5 million barrels per day next year, driven by the US, Canada, Guyana, Brazil and Argentina – more than the rate of demand growth.

On Wednesday, OPEC cut its demand growth forecast for 2024 for the fifth straight month.

The IEA said that, even excluding the return to higher output quotas, its current outlook is to a 950,000 barrels per day supply overhang next year, which is almost 1 per cent of the world’s supply.

The Paris-based agency said this would rise to 1.4 million barrels per day if OPEC+ goes ahead with its plan to start unwinding cuts from the end of next March.

Next year’s surplus could make it harder for OPEC+ to bring back production. The hike was earlier due to start in October 2024, but OPEC+ has delayed it amid falling prices.

Meanwhile, inflation rose slightly in November increasing the possibility of a US Federal Reserve rates cut again as the data fed optimism about economic growth and energy demand.

Support also came as crude imports in China grew annually for the first time in seven months in November, up more than 14 per cent from a year earlier.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism8 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking6 years ago

Banking6 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN