Economy

Best Copy Trade Broker in Nigeria 2022: A New Investment Option

If you reside in Nigeria and consider investing in a dynamic platform but you have no idea how to get started, we have an attractive solution for you.

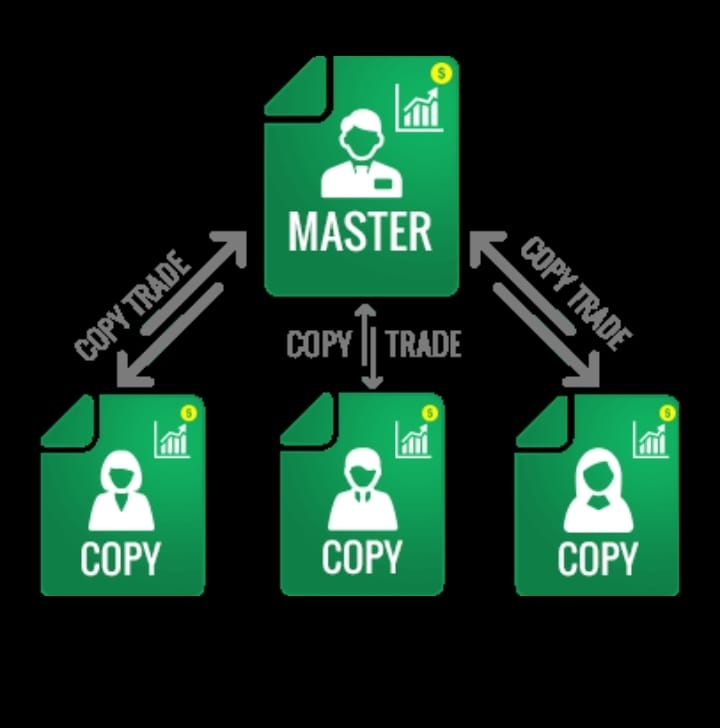

Digital investment platforms have become extremely popular and accessible nowadays. Investors from Nigeria can effortlessly access foreign exchange trading using a system called “Forex copy trading” or “Social trading.” By using this automated copy trading system, you can generate significant earnings.

Copy trading basically involves copying the trading strategies of professional traders. Also, this platform allows new investors to copy multiple successful traders, which allows you to diversify your portfolio and reduce investment risks.

Judging how popular copy trading has become, it’s definitely here to stay. According to a recent survey, the copy trading market is likely to expand to €70 billion by 2025 (at an annual growth rate of 48%).

To start copying trades, choose a reliable and proven platform and a transparent trading system to copy investment strategies. You can copy trading strategies with one click after checking out successful traders, their performance and trading history.

More Info About Copy Trading

As we’ve mentioned earlier, copy trading or social trading platforms enable investors to copy professional traders who have raked substantial earnings by implementing their trading strategies. Copy trading is an automated system, so copy trading is also called auto trading.

Copy Trading Forex System

You can invest through copy trading across all the major markets, such as FX, stocks, indices, and commodity markets. More than 85% of FX transactions include GBP/USD, EUR/USD, USD/CAD, USD/JPY, USD/CHF, AUD/USD, and NZD/USD.

Copy trading is one of the simplest ways to tap into the knowledge and expertise of seasoned traders and make a good income.

How Copy Trading Works in forex?

There are two ways of using the copy trading system.

- Copy trading strategies of successful traders and turn a profit

This option will be suitable for those investors who want to invest in a trading strategy and following successful traders.

Select the strategies to invest in.

Start copying these strategies to your investment account.

Get the same percentage of profit as the trader without having any expert knowledge in trading.

Benefits:

Easy to get started: The copy trading system is extremely user-friendly. You don’t need to be a professional trader and have deep knowledge of trading to start investing in the financial markets. You only need to copy the strategies of experienced traders.

Flexibility: All the trading strategies are available in RAMM (Risk Allocation Management Model) – the web-based platform for copy trading, or in the mobile app on iOS and Android devices.

Simplicity: Simply pick a desired strategy from the Strategy rating based on the strategy data such as profitability, age, commission%, number of followers, etc.

Full control of your funds: You do not need to transfer your money to some separate manager account. The funds are kept in your account. You can close your investment at any time.

Profit multiplication: A leading copy trading platform allows you to set a multiplier (factor parameter), which enables you to multiply your earnings up to 10 times or minimize your losses.

Transparency: You only pay commission to a trader if you make a profit by copying their strategy.

- Create trading strategies and make a profit when others copy them

This option is suitable for expert traders who can create strategies and earn from investors who pay fees for copying the strategy to their investment accounts.

Create trading strategies in a copy trading platform.

Earn from the investors’ profit when they copy your strategy.

You can earn up to 50 per cent of investors’ profit.

Advantages:

Attract investors hassle-free: The minimum initial deposit to open a copy trading account is $100. Such a low entry deposit attracts many investors.

Auto trading system: There is no need to add new investments in your strategy manually. The system is fully automated. It’ll do it for you.

Weekly payout: The auto trading system checks and calculates investment results weekly and transfers your earnings as a trader’s fee to your account.

You can decide the percentage of profit yourself: When creating a strategy, you can decide which percentage of investors’ profit you would like to receive as a commission.

Conclusion

It’s important to note that copy trading should not be seen as a way to make quick cash. Regardless of which trading platform you use, there is no such thing as a risk-free investment.

Although successful traders will serve as guides, investors should always try to improve their ability to evaluate risk, diversify to reduce losses to receive higher returns. Check out the AMarkets RAMM Copy Trading service in Nigeria. It has a user-friendly interface, easy to register, and provides excellent profit-making opportunities.

Economy

FAAC Disburses 1.727trn to FG, States Local Councils in December 2024

By Modupe Gbadeyanka

The federal government, the 36 states of the federation and the 774 local government areas have received N1.727 trillion from the Federal Accounts Allocation Committee (FAAC) for December 2024.

The funds were disbursed to the three tiers of government from the revenue generated by the nation in November 2024.

At the December meeting of FAAC held in Abuja, it was stated that the amount distributed comprised distributable statutory revenue of N455.354 billion, distributable Value Added Tax (VAT) revenue of N585.700 billion, Electronic Money Transfer Levy (EMTL) revenue of N15.046 billion and Exchange Difference revenue of N671.392 billion.

According to a statement signed on Friday by the Director of Press and Public Relations for FAAC, Mr Bawa Mokwa, the money generated last month was about N3.143 trillion, with N103.307 billion used for cost of collection and N1.312 trillion for transfers, interventions and refunds.

It was disclosed that gross statutory revenue of N1.827 trillion was received compared with the N1.336 trillion recorded a month earlier.

The statement said gross revenue of N628.972 billion was available from VAT versus N668.291 billion in the preceding month.

The organisation stated that last month, oil and gas royalty and CET levies recorded significant increases, while excise duty, VAT, import duty, Petroleum Profit Tax (PPT), Companies Income Tax (CIT) and EMTL decreased considerably.

As for the sharing, FAAC disclosed that from the N1.727 trillion, the central government got N581.856 billion, the states received N549.792 billion, the councils took N402.553 billion, while the benefiting states got N193.291 billion as 13 per cent derivation revenue.

From the N585.700 billion VAT earnings, the national government got N87.855 billion, the states received N292.850 billion and the local councils were given N204.995 billion.

Also, from the N455.354 billion distributable statutory revenue, the federal government was given N175.690 billion, the states got N89.113 billion, the local governments had N68.702 billion, and the benefiting states received N121.849 billion as 13 per cent derivation revenue.

In addition, from the N15.046 billion EMTL revenue, FAAC shared N2.257 billion to the federal government, disbursed N7.523 billion to the states and transferred N5.266 billion to the local councils.

Further, from the N671.392 billion Exchange Difference earnings, it gave central government N316.054 billion, the states N160.306 billion, the local government areas N123.590 billion, and the oil-producing states N71.442 billion as 13 per cent derivation revenue.

Economy

Okitipupa Plc, Two Others Lift Unlisted Securities Market by 0.65%

By Adedapo Adesanya

The NASD Over-the-Counter (OTC) Securities Exchange recorded a 0.65 per cent gain on Friday, December 13, boosted by three equities admitted on the trading platform.

On the last trading session of the week, Okitipupa Plc appreciated by N2.70 to settle at N29.74 per share versus Thursday’s closing price of N27.04 per share, FrieslandCampina Wamco Nigeria Plc added N2.49 to end the session at N42.85 per unit compared with the previous day’s N40.36 per unit, and Afriland Properties Plc gained 50 Kobo to close at N16.30 per share, in contrast to the preceding session’s N15.80 per share.

Consequently, the market capitalisation added N6.89 billion to settle at N1.062 trillion compared with the preceding day’s N1.055 trillion and the NASD Unlisted Security Index (NSI) gained 19.66 points to wrap the session at 3,032.16 points compared with 3,012.50 points recorded in the previous session.

Yesterday, the volume of securities traded by investors increased by 171.6 per cent to 1.2 million units from the 447,905 units recorded a day earlier, but the value of shares traded by the market participants declined by 19.3 per cent to N2.4 million from the N3.02 million achieved a day earlier, and the number of deals went down by 14.3 per cent to 18 deals from 21 deals.

At the close of business, Geo-Fluids Plc was the most active stock by volume on a year-to-date basis with a turnover of 1.7 billion units worth N3.9 billion, followed by Okitipupa Plc with the sale of 752.2 million units valued at N7.8 billion, and Afriland Properties Plc with 297.3 million units sold for N5.3 million.

In the same vein, Aradel Holdings Plc remained the most active stock by value on a year-to-date basis with the sale of 108.7 million units for N89.2 billion, trailed by Okitipupa Plc with 752.2 million units valued at N7.8 billion, and Afriland Properties Plc with a turnover of 297.3 million units worth N5.3 billion.

Economy

Naira Trades N1,533/$1 at Official Market, N1,650/$1 at Parallel Market

By Adedapo Adesanya

The Naira appreciated further against the United States Dollar at the Nigerian Autonomous Foreign Exchange Market (NAFEM) by N1.50 or 0.09 per cent to close at N1,533.00/$1 on Friday, December 13 versus the N1,534.50/$1 it was transacted on Thursday.

The local currency has continued to benefit from the Electronic Foreign Exchange Matching System (EFEMS) introduced by the Central Bank of Nigeria (CBN) this month.

The implementation of the forex system comes with diverse implications for all segments of the financial markets that deal with FX, including the rebound in the value of the Naira across markets.

The system instantly reflects data on all FX transactions conducted in the interbank market and approved by the CBN.

Market analysts say the publication of real-time prices and buy-sell orders data from this system has lent support to the Naira in the official market and tackled speculation.

In the official market yesterday, the domestic currency improved its value against the Pound Sterling by N12.58 to wrap the session at N1,942.19/£1 compared with the previous day’s N1,954.77/£1 and against the Euro, it gained N2.44 to close at N1,612.85/€1 versus Thursday’s closing price of N1,610.41/€1.

At the black market, the Nigerian Naira appreciated against the greenback on Friday by N30 to sell for N1,650/$1 compared with the preceding session’s value of N1,680/$1.

Meanwhile, the cryptocurrency market was largely positive as investors banked on recent signals, including fresh support from US President-elect, Mr Donald Trump, as well as interest rate cuts by the European Central Bank (ECB).

Ripple (XRP) added 7.3 per cent to sell at $2.49, Binance Coin (BNB) rose by 3.5 per cent to $728.28, Cardano (ADA) expanded by 2.4 per cent to trade at $1.11, Litecoin (LTC) increased by 2.3 per cent to $122.56, Bitcoin (BTC) gained 1.9 per cent to settle at $101,766.17, Dogecoin (DOGE) jumped by 1.2 per cent to $0.4064, Solana (SOL) soared by 0.7 per cent to $226.15 and Ethereum (ETH) advanced by 0.6 per cent to $3,925.35, while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) remained unchanged at $1.00 each.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism8 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking6 years ago

Banking6 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN