Economy

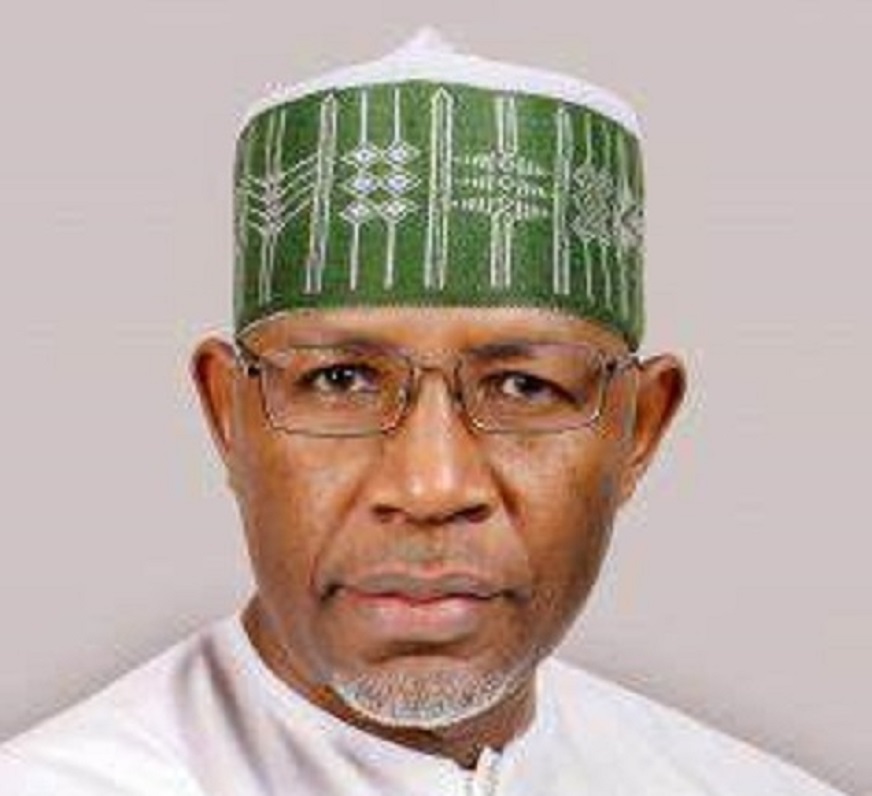

Capital Market Won’t Be Safe Haven for Money Laundering, Others—SEC DG

By Dipo Olowookere

The Director-General of the Securities and Exchange Commission (SEC), Mr Lamido Yuguda, has disclosed that efforts would be made to ensure that the Nigerian capital market would not be used by unscrupulous elements to finance terrorism, launder money and others.

In an interview over the weekend in Abuja, he said the apex regulatory agency for the country’s capital market would apply zero tolerance to money laundering, terrorism and proliferation financing violations.

“We must all ensure that we continue with the implementation of the revised Capital Market Master Plan (CMMP), alongside the implementation of other initiatives. Over the years, we have relied on the support of CAMMIC, Technical Committees and Working Groups in the implementation of the Master Plan.

“In line with the RCMMP, we will review and align the structure and scope of work of the various technical committees and working groups to ensure seamless implementation of the plan and continue to rely on the stakeholders,” he stated.

The SEC boss assured that in protecting investors and creating an enabling environment for fit-and-proper capital market operators to thrive, the commission will prioritize its planned increase of on-site inspections and improved collaboration with Trade Groups and other relevant stakeholders.

In the interview, he also expressed the firm belief that the Nigerian capital market, being an organized and specialized financial market that drives capital mobilization through domestic savings and foreign capital inflows, was well positioned for the realization of the objectives of the 2023 budget of fiscal consolidation and Transition.

Mr Yuguda disclosed that the Nigerian equities market ended 2022 on a positive note as the NGX All-Share Index (ASI), which started at 42,716.40 points, ended at 2022 at 51,251.06 points, indicating a 19.98 per cent growth.

As for the FMDQ Securities Exchange, despite the headwinds in the economy, it recorded a marginal increase in total market turnover to N199.88 trillion from N198.93 trillion in 2021.

He attributed the headwinds to high inflationary pressure, which forced the Central Bank of Nigeria (CBN) to push interest rates higher.

“Last year, the Nigerian economy faced several challenges, including worsening inflation, rising unemployment, huge fiscal deficit, insecurity, and floods.

“Additionally, oil theft and volatility in oil prices led to difficulties in foreign exchange management. In an attempt to tame inflation, the CBN raised the monetary policy rate four times during the year, increasing the cost of financing for businesses and dampening corporate activity and performance.

“Despite these challenges, the Nigerian economy grew by 3.52 per cent (year-on-year) in real terms, driven mainly by the services sector, which recorded a growth of 5.69 per cent and contributed 56.27 per cent to the aggregate GDP,” he stated.

Mr Yuguda disclosed that for the safety and security of the capital market and to address the deficiencies in Nigeria’s Mutual Evaluation Report (MER), the commission had issued new AML/CFT regulations and guidelines, which mandate CMOs to comply with stringent reporting obligations, such as application of RBS by reporting entities, screening of clients against United Nation’s Sanction List before onboarding, and continuous monitoring of clients among others.

He commended the capital market community for their unwavering commitment, which has played a crucial role in the commission’s efforts to build a robust capital market, adding that their contributions and support have been instrumental to driving progress in the capital market and the country.

Economy

FG Targets Credit Access For 50% Workers By 2030

By Adedapo Adesanya

The Vice President, Mr Kashim Shettima, inaugurated the Board of the Nigerian Consumer Credit Corporation (CREDICORP) and gave a 50 per cent access target for workers, saying consumer credit was critical to Nigeria’s ambition of becoming a one-trillion-dollar economy by 2030.

According to him, President Bola Tinubu established the CREDICORP to build a trusted credit infrastructure, provide catalytic capital to lower borrowing costs, and help Nigerians overcome long-standing cultural resistance to credit.

Speaking on Thursday in Abuja when he inaugurated the board on behalf of the President, the Vice President, in a statement by his spokesman, Mr Stanley Nkwocha, said that the quality of life of Nigerians cannot improve without closing the gap between access to capital and human dignity.

“A civil servant who earns honestly does not have to chase sudden wealth just to buy a vehicle, or save for ten years to buy one. A young professional should not remain in darkness simply because solar power must be paid for all at once,” the Vice President said.

VP Shettima disclosed that in just one year of operations, CREDICORP has disbursed over ₦37 billion in consumer credit to more than 200,000 Nigerians, with over half of them accessing formal credit for the first time.

The Vice President said the organisation was specifically tasked with building credit infrastructure to bridge the trust gap between lenders and borrowers, providing wholesale capital and credit guarantees through its portfolio company.

“Ultimately, these critical jobs of CREDICORP will enable access to consumer credit to at least 50 per cent of working Nigerians by 2030,” he said.

The Vice President explained that the new board’s role was not ceremonial as they are custodians of the organisation’s mission, adding that the long-term strength of the institution would depend on their “vigilance, integrity, sacrifice, and commitment.”

He directed Board members to uphold Public Service Rules, the Board Charter, and all applicable governance frameworks, warning that accountability and stewardship of public resources were non-negotiable.

The Chairman of CREDICORP, Mr Aderemi Abdul, expressed appreciation to President Tinubu for his vision behind the formation of CREDICORP and for the confidence reposed in them, noting that the establishment of the corporation marked an important step towards strengthening the nation’s financial architecture.

He assured President Tinubu that the board understands its responsibility and will guide the institution to deliver meaningful benefits to Nigerians.

For his part, Mr Uzoma Nwagba, Managing Director/CEO of CREDICORP, recalled watching President Tinubu say 20 years ago that consumer credit is one of the major tools that will improve the lives of Nigerians.

He noted that over the past 18 months, the institution has benefited more than 200,000 Nigerians, including students.

He assured that the presidential vision behind CREDICORP would not be taken lightly, as the team considers their appointments a unique, once-in-a-lifetime opportunity.

Other members of the board inaugurated include Mrs Olanike Kolawole, Executive Director, Operations; Mrs Aisha Abdullahi, Executive Director, Credit and Portfolio Management; Mr Armstrong Ume-Takang (MD, MoFI), Representative of MoFI; Mrs Bisoye Coke-Odusote (DG, NIMC), Representative of NIMC; and Mr Mohammed Naziru Abbas, Representative of FMITI.

Others are Mr Marvin Nadah, Representative of FCCPC; Mrs Chinonyelum Ndidi, Representative of the Federal Ministry of Finance; Mr Mohammed Abbas Jega, Independent Director; and Mrs Toyin Adeniji, Independent Director.

Economy

NASD OTC Exchange Rallies 0.23% as Nipco Leads Six Advancers

By Adedapo Adesanya

Six price gainers helped the NASD Over-the-Counter (OTC) Securities Exchange retain its stay in green territory after a 0.23 per cent appreciation on Thursday, February 26.

The price gainers were led by Nipco Plc, which added N25.00 to close at N278.00 per share compared with the previous day’s N253.00 per share, NASD Plc rose by N5.13 to N56.41 per unit versus N51.28 per unit, FrieslandCampina Wamco Nigeria Plc expanded by N2.24 to N102.44 per share from N100.00 per share, Afriland Properties Plc grew by 88 Kobo to N18.88 per unit from N18.00 per unit, 11 Plc increased by 35 Kobo to N277.00 per share from N276.65 per share, and Lagos Building Investment Company (LBIC) Plc gained 27 Kobo to close at N3.75 per unit versus N3.48 per unit.

On the flip side, Central Securities Clearing System (CSCS) Plc lost N1.75 to sell at N68.25 per share versus N70.00 per share, and Geo-Fluids Plc depreciated by 2 Kobo to N3.25 per unit from N3.27 per unit.

The weight of the advancers fortified the NASD Unlisted Security Index (NSI) by 9.21 points to 4,034.46 points from 4,025.25 points, and the market capitalisation soared by N5.51 billion to N2.413 trillion from Wednesday’s N2.408 trillion.

Yesterday, the transaction value jumped by 18.8 per cent to N102.8 million from N80.7 million, and the number of deals surged by 18,8 per cent to 38 deals from 32 deals, while the transaction volume went down by 84.9 per cent to 1.3 million units from 8.7 million units.

At the close of business, CSCS Plc was the most traded stock by value (year-to-date) with 34.2 million units worth N2.04 billion, followed by Okitipupa Plc with 6.3 million units sold for N1.1 billion, and Geo-Fluids Plc with 122.1 million units valued at N478.2 million.

Resourcery Plc remained as the most traded stock by volume (year-to-date) with 1.05 billion units exchanged for N408.7 million, trailed by Geo-Fluids Plc with 122.1 million worth N478.2 million, and CSCS Plc with 34.2 million units traded for N2.04 billion.

Economy

Naira Down Again at NAFEX, Trades N1,359/$1

By Adedapo Adesanya

The Naira further weakened against the Dollar in the Nigerian Autonomous Foreign Exchange Market (NAFEX) for the fourth straight session this week on Thursday, February 26.

At the official market yesterday, the Nigerian Naira lost N3.71 or 0.27 per cent to trade at N1,359.82/$1 compared with the previous session’s N1,356.11/$1.

In the same vein, the local currency depreciated against the Pound Sterling in the same market window on Thursday by N8.27 to close at N1,843.23/£1 versus Wednesday’s closing price of N1,834.96/£1, and against the Euro, it crashed by N8.30 to quote at N1,606.89/€1, in contrast to the midweek’s closing price of N1,598.59/€1.

But at the GTBank forex desk, the exchange rate of the Naira to the Dollar remained unchanged at N1,367/$1, and also at the parallel market, it maintained stability at N1,365/$1.

The continuation of the decline of the Nigerian currency is attributed to a surge in foreign payments that have outpaced the available Dollars in the FX market.

In a move to address the ongoing shortfall at the official window, the Central Bank of Nigeria (CBN) intervened by selling $100 million to banks and dealers on Tuesday.

However, the FX support failed to reverse the trend, though analysts see no cause for alarm, given that the authority recently mopped up foreign currency to achieve balance and it is still within the expected trading range of N1,350 and N1,450/$1.

As for the cryptocurrency market, major tokens posted losses over the last 24 hours as traders continued to de-risk alongside equities following Nvidia’s earnings-driven pullback, with Ripple (XRP) down by 2.7 per cent to $1.40, and Dogecoin (DOGE) down by 1.6 per cent to $0.0098.

Further, Litecoin (LTC) declined by 1.3 per cent to $55.87, Ethereum (ETH) slipped by 0.9 per cent to $2,036.89, Bitcoin (BTC) tumbled by 0.7 per cent to $67,708.21, Cardano (ADA) slumped by 0.6 per cent to $0.2924, and Solana (SOL) depreciated by 0.4 per cent to $87.22, while Binance Coin (BNB) gained 0.4 per cent to sell for $629.95, with the US Dollar Tether (USDT) and the US Dollar Coin (USDC) closing flat at $1.00 each.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn