Economy

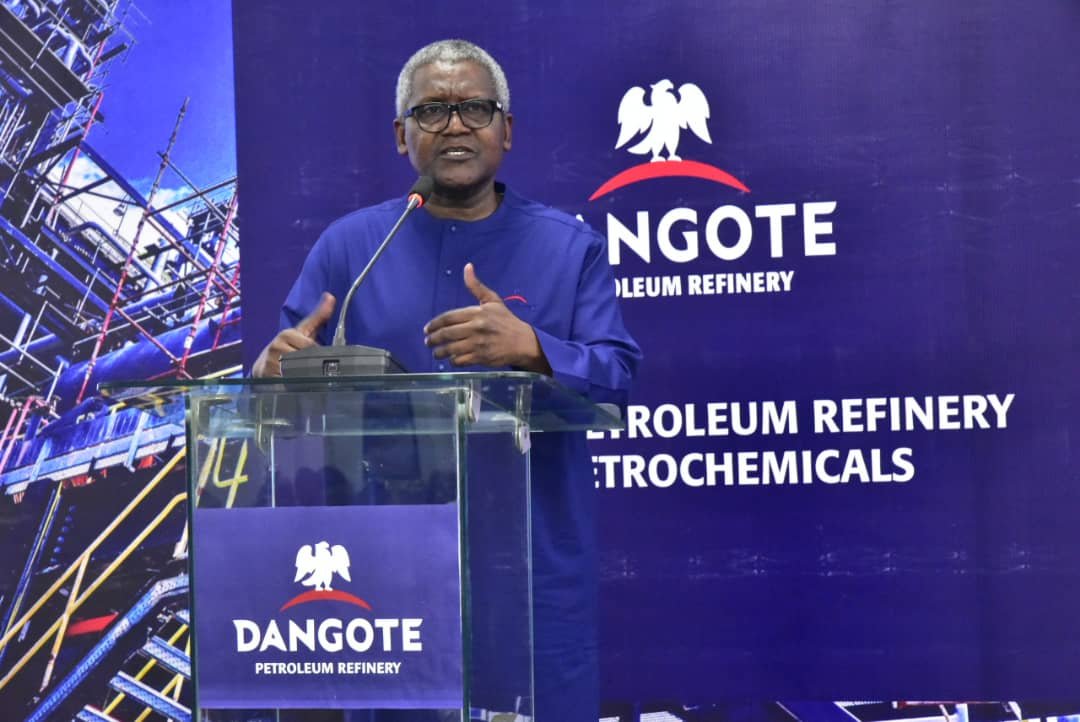

Dangote Refinery to be Ready Q1 2022, to Get Crude Oil in Naira

**Gets N100bn from CBN

By Adedapo Adesanya

The Central Bank of Nigeria (CBN) has supported projects undertaken by Nigerian and Africa’s richest person, Mr Alike Dangote, with N100 billion.

The Governor of the CBN, Mr Godwin Emefiele, disclosed this on Saturday when he inspected the sites of Dangote Refinery, Petrochemicals Complex Fertiliser Plant and Subsea Gas Pipeline at Ibeju Lekki, Lagos.

He explained that the intervention was to support Nigerian business. He further said that the first shipment of Urea from the Dangote Fertiliser Plant would begin in March to help boost agriculture in the country.

In addition, the nation’s chief bank disclosed that arrangements have been made to enable the Dangote Refinery to sell refined crude to Nigeria in Naira when it commences production.

The CBN Governor noted that the $15 billion projects being constructed by the Dangote Group would save Nigeria from expending about 41 per cent of its foreign exchange on the importation of petroleum products.

Mr Emefiele said, ”Based on agreement and discussions with the Nigerian National Petroleum Corporation (NNPC) and the oil companies, the Dangote Refinery can buy its crude in Naira, refine it, and produce it for Nigerians’ use in Naira.

“That is the element where foreign exchange is saved for the country becomes very clear.

“We are also very optimistic that by refining this product here in Nigeria, all those costs associated with either demurrage from import, costs associated with freight will be totally eliminated.

“This will make the price of our petroleum products cheaper in Naira.

“If we are lucky that what the refinery produces is more than we need locally you will see Nigerian businessmen buying small vessels to take them to our West African neighbours to sell to them in Naira.

“This will increase our volume in Naira and help to push it into the Economic Community of West African States as a currency,” Mr Emefiele added.

The head of the banking sector regulator expressed optimism that the refinery would be completed by the first quarter of 2022, adding that this would put an end to the issue of petrol subsidy in the country.

“I am saying that by this time next year, our cost of import of petroleum products for petrochemicals or fertiliser will be able to save that which will save Nigeria’s reserve.

“It will help us so that we can begin to focus on more important items that we cannot produce in Nigeria today,” Mr Emefiele noted.

On his part, Mr Dangote said that the fertiliser and petrochemicals plants were capable of generating $2.5 billion annually while the refinery would serve Nigeria and other countries across the world.

He said the projects would create jobs for Nigerians and build their capacity in critical areas of the oil and gas industry.

Mr Dangote thanked President Muhammadu Buhari and the CBN governor for their support toward the completion of the projects.

He said: “I will like to thank the president personally for helping us and assisting us in making sure that we are now back on track.

“Mr President personally wrote a letter to the president of China and asked them to bring the expatriates that we don’t have so that we can continue work.

“During the coronavirus, you will remember that we had one or two cases when it started and everybody ran away from the site but right now we are beginning to bring people back and we have about 30,000 people now.

“The good part of it is that we have learnt a lot also and there are a lot of Nigerians that just need small training and they are doing extremely well.

”So now we only need a small number of people coming from abroad just to give that training.”

He used the opportunity to call for the speedy passage of the Petroleum Industry Bill (PIB) currently before the National Assembly to maximise the opportunities in the Nigerian oil and gas sector.

Economy

MRS Oil, Two Others Raise NASD Bourse Higher by 0.52%

By Adedapo Adesanya

Demand for hot stocks, including MRS Oil Plc, buoyed the NASD Over-the-Counter (OTC) Securities Exchange by 0.52 per cent on Tuesday, December 23.

The energy company was one of the three price gainers for the session as it chalked up N19.69 to sell at N216.59 per share versus the previous day’s value of N196.90 per share.

Further, FrieslandCampina Wamco Nigeria Plc gained N2.95 to close at N56.75 per unit versus N53.80 per unit and Golden Capital Plc appreciated by 84 Kobo to N9.29 per share from Monday’s N8.45 per share.

Consequently, the market capitalisation went up by N10.95 billion to N2.125 trillion from N2.125 trillion and the NASD Unlisted Security Index (NSI) rose by 18.31 points to 3,570.37 points from 3,552.06 points.

Yesterday, the NASD bourse recorded a price loser, the Central Securities Clearing System Plc (CSCS), which gave up 17 Kobo to close at N33.70 per unit against the previous trading value of N33.87 per unit.

The volume of securities traded at the session went down by 97.6 per cent to 297,902 units from the previous day’s 12.6 million units, the value of securities decreased by 98.5 per cent to N10.5 million from N713.6 million, and the number of deals remained flat at 32 deals.

By value, Infrastructure Credit Guarantee Company (InfraCredit) Plc ended as the most actively traded stock on a year-to-date basis with 5.8 billion units exchanged for N16.4 billion. This was followed by Okitipupa Plc, which traded 178.9 million units valued at N9.5 billion, and MRS Oil Plc with 36.1 million units worth N4.9 billion.

In terms of volume, also on a year-to-date basis, InfraCredit Plc led the chart with a turnover of 5.8 billion units traded for N16.4 billion. Industrial and General Insurance (IGI) Plc ranked second with 1.2 billion units sold for N420.7 million, while Impresit Bakolori Plc followed with the sale of 536.9 million units valued at N524.9 million.

Economy

NGX All-Share Index Soars to 153,354.13 points

By Dipo Olowookere

It was another bullish trading session for the Nigerian Exchange (NGX) Limited as it closed higher by 0.59 per cent on Tuesday.

The market further rallied due to continued interest in large and mid-cap stocks on the exchange by investors rebalancing their portfolios for the year-end.

Yesterday, Aluminium Extrusion sustained its upward trajectory after it further appreciated by 9.96 per cent to N14.90, as Austin Laz gained 9.81 per cent to close at N2.91, Custodian Investment improved by 9.69 per cent to N38.50, and First Holdco soared by 9.35 per cent to N50.30.

Conversely, Royal Exchange declined by 7.22 per cent to N1.80, Champion Breweries shrank by 6.57 per cent to N15.65, NASCON lost 5.36 per cent to trade at N105.05, Sovereign Trust Insurance depreciated by 5.28 per cent to N3.77, and Japaul went down by 4.51 per cent to N2.33.

At the close of business, 29 shares ended on the gainers’ table and 27 shares finished on the losers’ log, representing a positive market breadth index and bullish investor sentiment.

This raised the All-Share Index (ASI) by 895.06 points to 153,354.13 points from 152,459.07 points and lifted the market capitalisation by N579 billion to N97.772 trillion from the previous day’s N97.193 trillion.

VFD Group finished the day as the busiest stock after it recorded a turnover of 192.0 million units worth N2.1 billion, GTCO exchanged 63.5 million units valued at N5.6 billion, Access Holdings traded 49.8 million units for N1.0 billion, First Holdco sold 45.8 million units valued at N2.3 billion, and Secure Electronic Technology transacted 38.3 million units worth N28.4 million.

In all, market participants bought and sold 677.4 million units valued at N20.8 billion in 27,589 deals compared with the 451.5 million units worth N13.0 billion traded in 33,327 deals on Monday, showing an improvement in the trading volume and value by 50.03 per cent and 60.00 per cent apiece, and a shortfall in the number of deals by 17.22 per cent.

Economy

Naira Firms up to N1,449 Per Dollar at Official Market

By Adedapo Adesanya

The Naira rallied against the United States Dollar in the Nigerian Autonomous Foreign Exchange Market (NAFEX) on Tuesday, December 23 by N6.57 or 0.45 per cent to N1,449.99/$1 from the previous day’s N1,456.56/$1.

The domestic currency also improved its value against the Pound Sterling in the official market during the session by N1.30 to sell for N1,956.03/£1 compared with the preceding session’s N1,957.33/£1 and gained N2.94 on the Euro to close at N1,707.65/€1, in contrast to the previous session’s closing price of N1,710.59/€1.

In the same vein, the Nigerian Naira appreciated against the US Dollar by N5 at the GTBank FX counter to sell for N1,465/$1 versus the previous day’s N1,470/$1 but remained unchanged at N1,485/$1 in the black market window.

Sentiment in the FX market continued to improve with market operators attributing the appreciation to increased supply in the official market, supported by sustained interventions from the Central Bank of Nigeria (CBN) and the impact of recent reforms.

Improved liquidity from exporters and foreign portfolio investors has also contributed to easing pressure on the local currency, helping to stabilise trading conditions during the festivities.

Analysts noted that the Naira’s performance has helped narrow the spread between the official and parallel market rates, a development seen as supportive of investor confidence and business planning. This relative stability has reduced short-term volatility risks and encouraged more orderly price discovery in the FX market.

Meanwhile, the cryptocurrency market was down yesterday as analysts suggest tax-loss harvesting and low liquidity are contributing to the action in crypto as the year ends. That means investors selling their underwater positions to realize losses, lowering their tax liabilities.

Some analysts remain cautiously optimistic about a potential rally, though significant recovery is not expected until liquidity returns in January.

Dogecoin (DOGE) crumbled by 3.1 per cent to $0.1281, Solana (SOL) slumped by 2.9 per cent to $121.92, Cardano (ADA) fell by 2.7 per cent to $0.3582, Ethereum (ETH) slid by 2.2 per cent to $2,926.25, and Ripple (XRP) depreciated by 2.1 per cent to $1.85.

Further, Binance Coin (BNB) lost 2.0 per cent to sell for $838.21, Bitcoin (BTC) declined by 1.4 per cent to $86,933.97, and Litecoin (LTC) went down by 0.2 per cent to $76.33, while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) traded at $1.00 apiece.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn