Economy

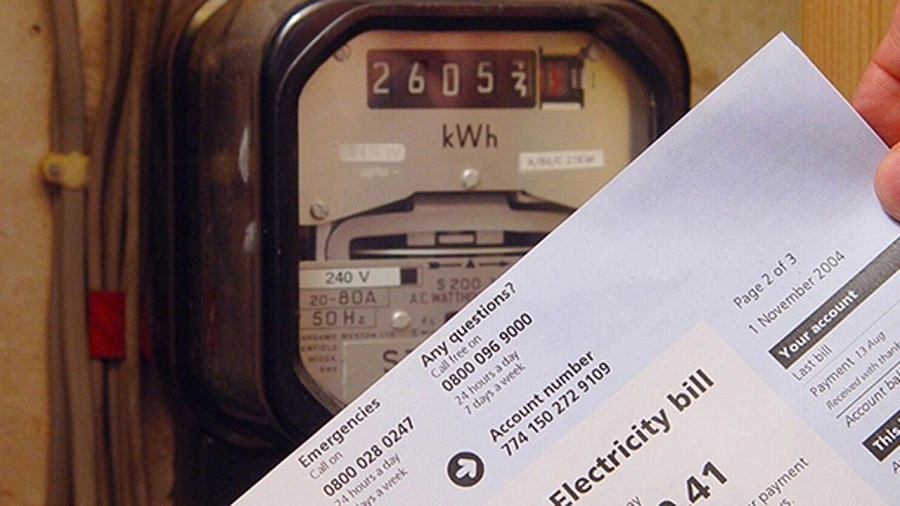

DisCos Reduce Number of Estimated Billing Customers by 16.3%

By Adedapo Adesanya

The National Bureau of Statistics (NBS) has said that the number of Electricity Distribution Companies (DisCos) customers in Nigeria increased by 1.4 per cent from 10.37 million in 2020 to 10.51 million in 2021.

The report, Nigeria Electricity Report 2021, focuses on energy billed, revenue generated, and customers by DISCOS under the reviewed period.

The report said the number of metered customers rose by 36.2 per cent from 3.51 million in 2020 to 4.77 million in 2021, causing the number of estimated billing customers to decrease by 16.3 per cent from 6.86 million in 2020 to 5.74 million in 2021.

It was disclosed that in total, the value of electricity billed in 2021 grew by 5.9 per cent from 22,042.28 Gigawatts (Gwh) in 2020 to 23,360.59 (Gwh) in 2021, while the total revenue collected by the discos stood at N761.17 billion, 44.5 per cent higher than the N526.77 billion achieved in 2020.

A breakdown showed that the Abuja Electricity Distribution Company (AEDC) recorded the highest number of metered customers in 2021 at 701,781, while Yola Electricity Distribution Company (YEDC) recorded the least with 65,098.

In terms of electricity supplied, Ikeja Electricity Distribution Company (IKEDC) recorded the highest in 2021 with 4,088.62 Gwh, while YEDC recorded the lowest at 422.00 Gwh.

Similarly, the highest revenue collected was by IKEDC with 155,012.01 million while the least collection was recorded in YEDC with 9,804.00m million.

More than 83 million Nigerians do not have access to grid electricity. This represents 43 per cent of the country’s population and makes Nigeria the country with the largest energy access deficit in the world.

The lack of reliable power is a significant constraint for citizens and businesses, resulting on annual economic losses estimated at N10.1 trillion, which is equivalent to about 2 per cent of GDP.

According to the now-discontinued World Bank Doing Business report for 2020, Nigeria ranked 171 out of 190 countries in getting electricity and electricity access is seen as one of the major constraints for the private sector.

To assist in mitigating this, the World Bank approved $500 million to support the government of Nigeria in improving its electricity distribution sector last year.

According to the global lender, the project will help boost electricity access by improving the performance of the DisCos through a large-scale metering programme.

In addition, the World Bank said financial support would be provided to private distribution companies only on achievement of results in terms of access connections, improved financial management and network expansion.

Economy

Naira Weakens to N1,547/$1 at Official Market, N1,670/$1 at Black Market

By Adedapo Adesanya

The euphoria around the recent appreciation of the Naira eased on Wednesday, December 11 after its value shrank against the US Dollar at the Nigerian Autonomous Foreign Exchange Market (NAFEM) by N5.23 or 0.3 per cent to N1,547.50/$1 from the N1,542.27/$1 it was valued on Tuesday.

It was observed that spectators’ activities may have triggered the weakening of the local currency in the official market at midweek as they tried to fight back and ensure the value of funds in foreign currencies strengthened.

The domestic currency was regaining its footing after the Central Bank of Nigeria (CBN) launched an Electronic Foreign Exchange Matching System (EFEMS) platform to tackle speculation and improve transparency in Nigeria’s FX market.

At midweek, the Nigerian currency depreciated against the Pound Sterling by N3.56 to close at N1,958.68/£1 compared with the preceding day’s N1,955.12/£1 and against the Euro, it slumped by 34 Kobo to trade at N1,612.66/€1, in contrast to the previous session’s N1,613.00/€1.

As for the black market segment, the Naira lost N45 against the American currency during the session to quote at N1,670/$1 compared with the N1,625/$1 it was traded a day earlier.

A look at the cryptocurrency market showed a recovery following profit-taking as the US Consumer Price Index report matched economist forecasts.

The news was enough to convince traders that the Federal Reserve is certain to trim its benchmark fed funds rate another 25 basis points at its meeting next week.

The move also saw Bitcoin (BTC), the most valued coin, return to the $100,000 mark as it added a 2.9 per cent gain and sold for $100,566.12.

The biggest gainer was Cardano (ADA), which jumped by 15.00 per cent to trade at $1.16, as Litecoin (LTC) appreciated by 10.4 per cent to sell for $121.76, and Ethereum (ETH) surged by 7.0 per cent to $3,929.30, while Dogecoin (DOGE) recorded a 6.7 per cent growth to finish at $0.4181.

Further, Binance Coin (BNB) went up by 5.2 per cent to $716.72, Solana (SOL) expanded by 4.6 per cent to $229.77, and Ripple (XRP) increased by 4.2 per cent to $2.43, while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) closed flat at $1.00 apiece.

Economy

Dangote Refinery Makes First PMS Exports to Cameroon

By Aduragbemi Omiyale

The Dangote Refinery located in the Lekki area of Lagos State has made its first export of premium motor spirit (PMS) just three months after it commenced the production of petrol.

In September 2024, the refinery produced its first petrol and began loading to the Nigerian National Petroleum Company (NNPC) on September 15.

However, due to some issues, the facility has not been able to flood the local market with its product, forcing it to look elsewhere.

In a landmark move for regional energy integration, Dangote Refinery has partnered with Neptune Oil to take its petrol to neighbouring Cameroon.

Neptune Oil is a leading energy company in Cameroon which provides reliable and sustainable energy solutions.

Dangote Refinery said this development showcases its ability to meet domestic needs and position itself as a key player in the regional energy market, adding that it represents a significant step forward in accessing high-quality and locally sourced petroleum products for Cameroon.

“This first export of PMS to Cameroon is a tangible demonstration of our vision for a united and energy-independent Africa.

“With this development, we are laying the foundation for a future where African resources are refined and exchanged within the continent for the benefit of our people,” the owner of Dangote Refinery, Mr Aliko Dangote, said.

His counterpart at Neptune Oil, Mr Antoine Ndzengue, said, “This partnership with Dangote Refinery marks a turning point for Cameroon.

“By becoming the first importer of petroleum products from this world-class refinery, we are bolstering our country’s energy security and supporting local economic development.

“This initial supply, executed without international intermediaries, reflects our commitment to serving our markets independently and efficiently.”

Economy

Strong Investor Sentiment Keeps NGX Index in Green Territory by 0.31%

By Dipo Olowookere

The Nigerian Exchange (NGX) Limited remained in the green territory on Wednesday after it rallied by 0.31 per cent on the back of sustained bargain-hunting activities by investors.

Business Post reports that all the key sectors of the market closed higher at midweek as a result of the renewed interest in local equities.

Data showed that the energy index appreciated by 2.59 per cent, the insurance space grew by 2.34 per cent, the industrial goods sector improved by 0.15 per cent, the banking counter expanded by 0.06 per cent, and the consumer goods industry rose by 0.04 per cent.

At the close of business, the All-Share Index (ASI) gained 302.71 points to settle at 98,509.68 points compared with Tuesday’s closing value of 98,206.97 points and the market capitalisation added N183 billion to close at N59.715 trillion versus the preceding day’s N59.532 trillion.

It was observed that the level of activity yesterday waned as the trading volume, value and number of deals decreased by 65.93 per cent, 49.22 per cent, and 12.70 per cent, respectively.

On Wednesday, a total of 320.1 million stocks valued at N6.5 billion were transacted in 7,943 deals, in contrast to the 939.4 million stocks worth N12.8 billion traded in 9,098 deals.

The busiest equity at midweek was eTranzact, which transacted 70.3 million units for N474.2 million, Universal Insurance traded 23.8 million units worth 8.1 million, Zenith Bank exchanged 21.2 million units valued at N933.5 million, FBN Holdings sold 18.6 million units worth N491.2 million, and UBA traded 14.0 million units valued at N465.8 million.

At the close of transactions, 34 shares ended on the gainers’ log and 17 shares finished on the losers’ chart, representing a positive market breadth index and strong investor sentiment.

Africa Prudential gained 10.00 per cent to quote at N14.30, Conoil also improved by 10.00 per cent to N352.00, and RT Briscoe expanded by 10.00 per cent to N2.42, as Golden Guinea Breweries jumped by 9.95 per cent to N7.18, while NEM Insurance grew by 9.74 per cent to N10.70.

However, Julius Berger lost 10.00 per cent to close at N155.25, Secure Electronic Technology shed 9.52 per cent to trade at 57 Kobo, Multiverse declined by 7.63 per cent to N5.45, Haldane McCall tumbled by 6.07 per cent to N4.95, and Honeywell Flour crashed by 5.62 per cent to N4.70.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism8 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking6 years ago

Banking6 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN