Economy

Equity Market Ready for Recovery

By FSDH Research

There are indications that the Nigerian equity market is ready for a recovery in the year 2017 after three consecutive years of decline. The equity market, as measured by The Nigerian Stock Exchange All Share Index (NSEASI), depreciated by 16.14%, 17.36% and 6.17% in 2014, 2015 and 2016 respectively.

As at April 28, 2017 the NSEASI had lost 4.15% of its value. The major factors responsible for the poor performance of the equity market in the last three years are: weak macroeconomic performance, inconsistent policies, weak corporate earnings and portfolio realignment from equities to fixed income securities.

However, looking at the strong growth in the unaudited results that quoted companies released for the period January – March 2017 and the improvement in the macroeconomic environment, we believe the equity market is ready for a recovery in 2017.

As at April 27, 2017, 62 quoted companies had released their unaudited quarterly results for the period January – March 2017.

The total turnover of these companies increased by 41% from N1,450billion in 2016 to N2,042bilion in 2017.

The Profit Before Tax (PBT) increased by 45% from N257billion in 2016 to N373billion in 2017 while the Profit After Tax increased by 29% from N240billion in 2016 to N310billion in2017.

The recent increase in the crude oil price and production and subsequent increase in the external reserves have helped to stabilise the foreign exchange market – a major concern of the foreign investors. The increase in the supply of foreign exchange to meet the input requirements of manufacturing companies should increase their production activities and revenue in the current financial year.

The fiscal and the monetary authorities are implementing policies that should inspire investors’ confidence in the Nigerian economy and market.

Our survey shows that most investors did a lot of portfolio realignment -moving from equities to fixed income securities. The main reason for this was the lacklustre performance of equities in the face of attractive yields on fixed income securities.

The data from the National Pension Commission (PenCom) on the allocation of the Pension Fund Assets as at February 2017 shows that the weight of the pension fund assets on domestic equity dropped consistently from 2014 to 2017.

The weight stood at 13.7%, 10.4%, 8.6% and 7.5% in February 2014, 2015, 2016 and 2017 respectively. These figures are lower than PenCom’s approved pension fund assets allocation weight to equities, an indication that there is room for pension fund assets to allocate more funds to equities.

PenCom stipulates the maximum weights of equities in the investment portfolio of pension assets as follows: Fund I: 30%; Fund II: 25%, Fund III: 10% and Fund IV: 5%. Any pension contributor can make a formal request to join Fund I. Fund II is for active contributors who are below the age of 49 years. Fund III is for active contributors who are 50 years and above while Fund IV is strictly for retirees.

The analysis of the equity transactions on the NSE in the last three years shows investors’ apathy for equity investment.

According to the NSE, the value of equity transactions from foreign and domestic investors declined between 2014 and 2016.

Foreign transactions were N1.54trillion, N1.03trillion and N0.52trillion in 2014, 2015 and 2016 respectively while Domestic transactions were N1.14trillion, N0.88trillion and N0.63trillion in 2014, 2015 and 2016 respectively.

Although the relative size of foreign investors’ participation in the equity market declined between 2014 and 2016 (58%, 54% and 45% in 2014, 2015 and 2016 respectively), the share of foreign investors’ participation was higher than domestic investors’ participation between 2014 (Foreign: 58% and Domestic: 42%) and 2015 (Foreign: 54% and Domestic: 46%).

The foreign investors’ participation in 2016 at 46% was lower than domestic investors’ participation at 54%.

The uncertainties surrounding the foreign exchange policies and the difficulties to access foreign exchange to repatriate capital and profit led to the withdrawal of foreign investors from the market. The stability in the macroeconomic environment and the strong earnings of quoted companies should attract the needed liquidity into the market. Consequently, the equity market should record a strong recovery in the year 2017.

Source: FSDH Research

Economy

Stanbic IBTC Insurance Triumphs at 2025 Risk Analyst Awards

By Modupe Gbadeyanka

A subsidiary of Stanbic IBTC Holdings Plc, Stanbic IBTC Insurance, has continued to showcase institutional excellence, becoming one of Nigeria’s top-performing insurers.

At the 2025 Risk Analyst Insurance Brokers Performance Review Awards, the underwriting firm won the Life Insurance category for its operational discipline, prompt claims settlement, and partnership-driven approach that fosters long-term confidence with clients and brokers.

The organisers were impressed with the company’s performance in life insurance, which reflects the broader institutional direction of Stanbic IBTC Holdings, which is building resilient, trusted, and high-performing financial institutions that contribute to Nigeria’s economic growth and the development of the insurance sector.

“At Stanbic IBTC Insurance, trust is built through reliable performance, timely claims settlement, and service that supports customers when it matters most. This recognition reflects the quality of service we provide for our clients and partners.

“We are honoured to receive this accolade and will continue to raise standards across the industry,” the chief executive of Stanbic IBTC Insurance, Akinjide Orimolade, stated.

Also commenting, the chief executive of Stanbic IBTC Holdings, Mr Chuma Nwokocha, said, “We are proud of this achievement, which highlights the strength of our insurance business and the broader Stanbic IBTC Group’s focus on building strong, enduring institutions.

“Stanbic IBTC Insurance continues to set benchmarks in professionalism, client service, and operational excellence; reinforcing our role as a trusted partner to individuals and businesses across Nigeria.”

Every year, Risk Analyst Insurance Brokers Limited, which organises the event, carries out an annual assessment of insurance underwriters by evaluating partners based on key criteria, including claims settlement efficiency, service delivery, responsiveness, and broker–underwriter collaboration.

The initiative aims to promote accountability, raise service standards, and strengthen trust across Nigeria’s insurance ecosystem.

The 2025 performance of Stanbic IBTC Insurance highlights its role as a dependable and credible underwriting partner in the market.

Economy

Lagos Unveils Roadmap to Establish West Africa’s International Financial Hub

By Adedapo Adesanya

Nigeria’s commercial nerve centre, Lagos State, has announced plans to establish West Africa’s premier International Financial Centre to unlock international investment, innovation, and sustainable growth.

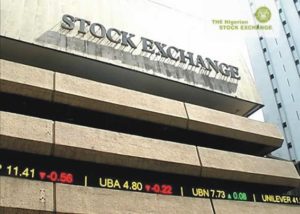

TheCityUK, in partnership with the UK Government, Lagos State Government, Lagos International Financial Centre Council (LIFCC), and EnterpriseNGR, on Monday unveiled a landmark report, Establishing an International Financial Centre in Lagos (LIFC), Nigeria, outlining a strategic roadmap to achieve the goal.

The establishment of a Lagos International Financial Centre aligns with Nigeria’s Agenda 2050 and the Lagos State Development Plan 2052 to deliver long-term economic prosperity, deepen financial markets, and attract productive global investment.

According to a statement, the project is hinged on a public-private partnership bringing visionary leadership from the government together with private sector companies seeking to tap into Nigeria’s young, dynamic market to deliver economic growth.

The unveiling was done at the State House Marina with guests including Lagos State Governor, Mr Babajide Sanwo-Olu, British Deputy High Commissioner Mr Jonny Baxter, and EnterpriseNGR Board Chairman and CEO, Mr Aigboje Aig-Imoukhuede and Mr Obi Ibekwe.

Lagos International Financial Centre Council will support Nigeria’s ambition to become an upper-middle-income country by 2050, driving inclusive growth, reducing poverty, and creating high-value jobs, especially for Nigeria’s talented youth, as per the report, adding that it will benefit from the strong UK-Nigerian co-operation, building on best practices and global benchmarks to align the LIFC with international standards.

The report proposes creating an independent International Financial Centre in Lagos to enhance regulatory clarity, simplify tax and policy frameworks, and boost investor confidence. It recommends an initial focus on Green and Sustainable Finance, FinTech and Innovation, and Commodities and Capital Markets, supported by strong governance, legal reforms, stakeholder collaboration, and targeted talent development.

Speaking on this, Governor Sanwo-Olu said, “Lagos is fully committed to the birth of the International Financial Centre. We know that it is a veritable means of supporting seamless trading and to enhance competitiveness of financial markets.

“As Nigeria’s largest economic and financial centre, Lagos plays a critical role in driving the nation’s capital markets. We need to create an ecosystem that will help to facilitate investment flows, enhance market liquidity, and promote financial literacy.

“The LIFC initiative will not only strengthen our market infrastructure but also unlock new opportunities for public-private partnerships in technology and capital market development. It will support seamless trading, attract foreign investment and enhance the competitiveness of financial markets.”

On his part, Mr Jonny Baxter, British Deputy High Commissioner, commented, “The launch of the Lagos International Financial Centre report reflects the deepening of the UK-Nigeria partnership, combining Lagos’s comparative strengths with UK expertise. Anchored in clear, evidence‑based analysis and launched at a pivotal moment in Nigeria’s reform journey, the LIFC has the potential to unlock major domestic and international investment, deepen capital markets, create jobs, and drive sustainable economic growth across the country, not just in Lagos State.”

Mrs Nicola Watkinson, Managing Director, International, TheCityUK, said, “Nigeria is a high-growth, dynamic and large market and the Lagos International Financial Centre could be vital to its future. By building a modern, integrated business and regulatory environment and financial ecosystem, the LIFC will support the attraction of global and domestic capital, deepen domestic markets, facilitate innovation in FinTech and green finance, and create high‑value jobs for Nigeria’s youth.

“Supporting the development of Lagos as an international financial centre is a clear example of how the UK and Nigeria are deepening their strategic partnership.”

Economy

Nigeria Now Consolidating Reforms for Economic Stability—Edun

By Adedapo Adesanya

The Minister of Finance and Coordinating Minister of the Economy, Mr Wale Edun, has stressed that Nigeria was now consolidating its macroeconomic reforms to sustain economic stability in an increasingly volatile global environment.

The Minister spoke at a high-level panel on Fiscal Policy in a Shock – Prone World at the ongoing Al Ula conference for Emerging Market Economies in Riyadh, Saudi Arabia.

“Nigeria’s macroeconomic and fiscal reforms are working. Momentum must be maintained, and the benefits channelled towards long-term growth and resilience,” he stated.

He said the government is also leveraging digital tools to improve revenue assurance, while deepening fiscal and monetary coordination and promoting realistic budgeting practices to ensure durable fiscal discipline.

He noted that despite accounting for a significant share of global growth, population and natural resources, emerging economies remain under-represented in global financial decision-making.

Mr Edun also highlighted the growing strategic importance of Gulf nations in the evolving global economic landscape.

He said countries in the Gulf are increasingly shaping global trade routes, investment flows and sources of capital, making them critical partners for emerging economies such as Nigeria.

The finance minister stressed Nigeria’s commitment to building stronger partnerships that promote a more inclusive and equitable global financial system.

He said Nigeria was positioning itself to engage constructively with global partners to support reforms that unlock growth, stability and shared prosperity.

Mr Edun’s call comes amid mounting global economic pressures. Many emerging economies are grappling with high debt levels, elevated inflation, volatile capital flows and tightening global financial conditions.

Rising interest rates in advanced economies have increased debt-servicing costs, while currency volatility has strained fiscal and external balances across Africa and other developing regions.

Global trade is also facing increased fragmentation due to geopolitical tensions, supply chain disruptions and protectionist tendencies.

These trends have disproportionately affected emerging markets that depend heavily on trade, foreign investment and access to international finance.

For Nigeria, the push for a global economic reset aligns with ongoing domestic reforms aimed at stabilising the macroeconomic environment.

The country has embarked on exchange rate reforms, fiscal consolidation and efforts to attract long-term investment to support growth and job creation.

Mr Edun has repeatedly argued that without reforms to the global financial system, domestic policy efforts in emerging economies risk being undermined by external shocks.

At the Al Ula conference, he reiterated that a more balanced global system would enhance resilience, improve access to finance and support sustainable development.

He said Nigeria would continue to engage in global policy conversations to ensure that emerging economies are not only rule-takers but active shapers of the new global economic order.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn