Economy

FAAC: FG, States, LGs Share N655.18b in January

By Modupe Gbadeyanka

A total of N655.18 billion was shared by the Federal, State and Local Governments in the month of January 2018 from the federation account.

The money was disbursed to the three tiers of government by the Federation Account Allocation Committee (FAAC).

According to the National Bureau of Statistics (NBS), the shared allocation was from the revenue generated in December 2017.

It comprised N538.51 billion from the Statutory Account and N83.96 billion from Valued Added Tax (VAT).

Also N14.713 billion and N16.055 billion were distributed as FOREX Equalisation while an excess bank charges of N1.938 billion recovered was also distributed.

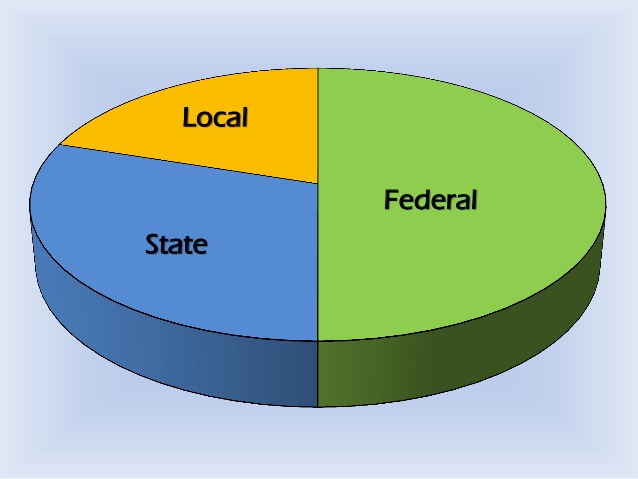

Federal Government received a total of N278.73 billion from the N655.18 billion shared, while states received a total of N175.55 billion and Local Governments received N132.48 billion.

In addition, the sum of N51.74 billion was shared among the oil producing states as 13 percent derivation fund.

According to the stats office, revenue generating agencies such as Nigeria Customs Service (NCS), Federal Inland Revenue Service (FIRS) and Department of Petroleum Resources (DPR) received N4.12 billion, N7.44 billion and N3.10 billion respectively as cost of revenue collections.

Further breakdown of revenue allocation distribution to the Federal Government of Nigeria (FGN) revealed that the sum of N240.98 billion was disbursed to the FGN consolidated revenue account; N5.06 billion shared as share of derivation and ecology; N2.53 billion as stabilization fund; N8.50 billion for the development of natural resources; and N5.83 billion to the Federal Capital Territory (FCT) Abuja.

Economy

Brent Climbs to $71 on Fears of US Military Action Against Iran

By Adedapo Adesanya

The price of Brent crude oil grade went up by 0.14 per cent or 10 cents to $71.76 per barrel on Friday as investors worried about US military action against Iran, as President Donald Trump presses the Islamic Republic to halt nuclear weapon development.

However, the US West Texas Intermediate (WTI) crude oil grade finished at $66.39 a barrel after going down by 4 cents or 0.06 per cent.

The market awaited developments in the struggle between Iran and the US after President Trump said, “We have to make a meaningful deal, otherwise bad things happen,” referring to Iran.

The main concern for the crude oil market is that military activity will lead to a supply disruption if Iran decides to block shipping in the Strait of Hormuz. About 20 per cent of the world’s oil consumption passes through that waterway. Conflict in the area could limit oil entering the global market and push up prices.

There is the fear that a potential US military campaign in Iran could disrupt shipping in the Middle East are also adding upward pressure on supertanker rates.

Traders and investors ramped up purchases of call options on Brent crude in recent days, betting on higher prices.

Also supporting oil were reports of falling crude stocks and limited exports in the world’s biggest oil-producing and exporting countries. US crude inventories dropped by 9 million barrels as refining utilisation and exports climbed, an Energy Information Administration (EIA) report showed on Thursday.

Markets were also considering the impact of ample supply, with talks of the Organisation of the Petroleum Exporting Countries and its allies (OPEC+) leaning towards a resumption in oil output increases from April.

Eight OPEC+ producers – Saudi Arabia, Russia, the United Arab Emirates, Kazakhstan, Kuwait, Iraq, Algeria and Oman will meet on March 1. The eight members raised production quotas by about 2.9 million barrels per day from April to the end of December 2025, equating to about 3 per cent of global demand, and froze further planned increases for January through March 2026 because of seasonally weaker consumption.

Meanwhile, the oil market shrugged off a US Supreme Court decision ruling unconstitutional President Trump’s use of a law to levy tariffs in national emergencies.

Economy

PENGASSAN Kicks Against Tinubu’s Executive Order on Oil, Gas Revenues

By Adedapo Adesanya

The Petroleum and Natural Gas Senior Staff Association of Nigeria (PENGASSAN) has faulted the Executive Order signed by President Bola Tinubu on oil and gas revenues.

President Tinubu this week signed the Executive Order, titled The Upstream Petroleum Operations Cost Efficiency Incentives Order (2025), to safeguard and enhance oil and gas revenues for the Federation, curb wasteful spending, eliminate duplicative structures in the sector, and redirect resources for the benefit of the Nigerian people.

However, at a press conference in Abuja, PENGASSAN president, Mr Festus Osifo, argued that the tax incentives granted to oil companies by the President may not help in the reduction of cost if insecurity is not addressed.

“The Executive Order signed by the President yesterday is a direct attack on the provisions of the Petroleum Industry Act (PIA)—specifically Sections 8, 9, and 64,” Mr Osifo said.

“What the President has done is use an Executive Order to set aside a law of the Federal Republic of Nigeria. This is deeply troubling. What signal are we sending to investors and the international community?

“We are effectively telling them that the law of the land can be set aside by a simple executive decree. This is an aberration and should never have happened.”

According to a statement by the presidential spokesperson, Mr Bayo Onanuga, the President signed the EO in pursuance of Section 5 of the Constitution of the Federal Republic of Nigeria (as amended).

The Executive Order is anchored on Section 44(3) of the Constitution, which vests ownership, control, and derivative rights in all minerals, mineral oils, and natural gas in, under, and upon any land in Nigeria—including its territorial waters and Exclusive Economic Zone—in the Government of the Federation.

The directive seeks to restore the constitutional revenue entitlements of the federal, state, and local governments, which were removed in 2021 by the Petroleum Industry Act (PIA).

According to Mr Onanuga, the PIA created structural and legal channels through which substantial Federation revenues are lost via deductions, sundry charges, and fees.

Under the current PIA framework, NNPC Limited retains 30 per cent of the Federation’s oil revenues as a management fee on Profit Oil and Profit Gas derived from Production Sharing Contracts, Profit Sharing Contracts, and Risk Service Contracts. Additionally, the company retains 20 per cent of its profits for working capital and future investments.

The federal government considers the additional 30 per cent management fee unjustified, as the 20 per cent retained earnings are already sufficient to support NNPC Limited’s functions under these contracts.

Moreover, NNPC Limited also retains another 30 per cent of profit oil and profit gas under the Frontier Exploration Fund, as stipulated in sections 9(4) and (5) of the PIA.

Economy

Customs to Fast-Track Cargo Clearance at Lekki Deep Sea Port

By Adedapo Adesanya

The Comptroller-General of the Nigeria Customs Service (NCS), Mr Adewale Adeniyi, has unveiled a Green Channel initiative at the Lekki Deep Sea Port as part of efforts to simplify cargo clearance, reduce delays, and improve operational efficiency for port users.

The launch marks a major step in customs’ drive to enhance trade facilitation through technology and stakeholder collaboration.

Speaking at the event in Lagos, Mr Adeniyi said the initiative was introduced by the Lekki Deep Sea Port and approved by NCS management to address persistent challenges in container stacking and examination at major ports, which often slow cargo processing.

“This particular intervention helps to move containers right from the vessel into a dedicated place where customers can have access. And between the time the container moves from the vessel to this particular place, it is tracked,” he said.

The customs boss explained that the Green Channel is designed to ensure seamless cargo movement through a dedicated corridor with minimal bureaucratic obstacles, enabling faster turnaround time for importers and other stakeholders.

He described the initiative as a product of mutual trust between the agency and its stakeholders, stressing that compliance and cooperation are essential to its success.

“What we have done today is a product of the kind of trust that we have invested in our stakeholders and the confidence that we also have in them, that they would do this in the spirit of compliance and trade facilitation,” he said.

Mr Adeniyi added that beyond easing port operations, the Green Channel supports Nigeria’s broader economic objective of building a more competitive trade environment, noting that the initiative is expected to reduce the cost and time required to do business, ultimately boosting revenue generation for the service.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn