Economy

Fear Grips Participants As MMM Nigeria Stops Payment

By Modupe Gbadeyanka

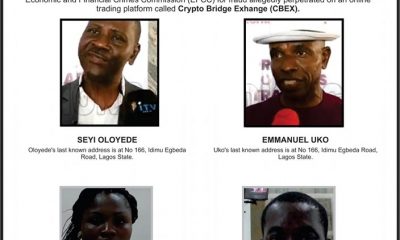

Operators of the controversial Ponzi scheme called MMM Nigeria have announced suspension of payments.

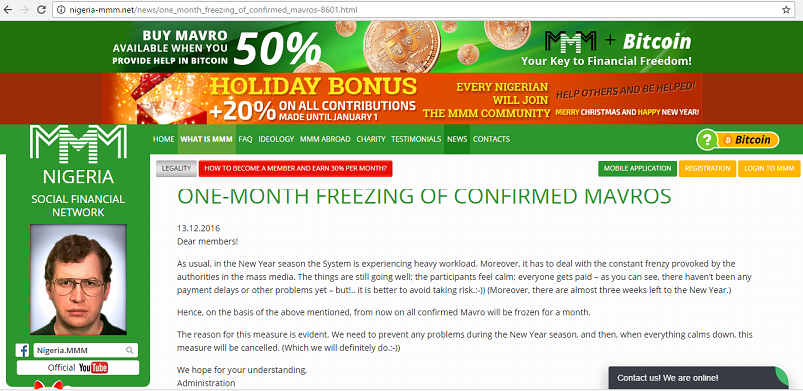

A message posted on MMM Nigeria’s website on Tuesday, December 12, 2016, which was seen by Business Post, explained that this will only happen for one month.

Already, the announcement has caused panic among participants in the country, who are confused and do not know if their money will go down the drain or not.

Before now, the Nigerian authorities had warned citizens not to subscribe to the Ponzi scheme because it is not registered by the government.

“Dear members!

“As usual, in the New Year season the System is experiencing heavy workload. Moreover, it has to deal with the constant frenzy provoked by the authorities in the mass media. The things are still going well; the participants feel calm; everyone gets paid – as you can see, there haven’t been any payment delays or other problems yet – but!.. it is better to avoid taking risk.:-)) (Moreover, there are almost three weeks left to the New Year.)

“Hence, on the basis of the above mentioned, from now on all confirmed Mavro will be frozen for a month.

“The reason for this measure is evident. We need to prevent any problems during the New Year season, and then, when everything calms down, this measure will be cancelled. (Which we will definitely do.:-))

“We hope for your understanding,

“Administration,” the message reads.

Investigations by Business Post reveal that Mavros are unit of pseudo-currency used by participants, which grow at a rate of 30 percent.

A confirmed Mavro refers to a pledged amount (Provide Help) that has been paid to another participant.

It was gathered that with the latest development, no participant can get help (withdraw the already paid money) until January 12, 2017 and also, no participant can Provide Help (pay money).

Economy

NMDPRA Grants Six Petrol Import Permits to Stabilise Market

By Adedapo Adesanya

The Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) has granted import permits for Premium Motor Spirit (PMS) or petrol to six depot owners and petroleum marketers.

This step comes as the federal government moved to ensure stability and balance in the country’s downstream fuel sector after it was widely reported that the country suspended the issuance of petrol import licenses for a second straight month

The regulator recently issued these permits to six importers, with each authorised to import approximately 30,000 metric tonnes of the fuel into the country to help cushion against the effects of escalating conflict in the Middle East.

This development also occurs against the backdrop of ongoing discussions about supply concentration, with recent data showing that the Dangote Petroleum Refinery supplied roughly 92 per cent of Nigeria’s petrol in February.

At present, the Dangote refinery is the sole facility in Nigeria producing petrol, while most modular refineries primarily focus on diesel output.

The Crude Oil Refineries Association of Nigeria (CORAN) also confirmed that none have been issued so far in March, signalling a shift towards prioritising local output. However, this has since changed, spurred by the latest development.

Industry statistics show that local refining provided an average of about 36.5 million litres per day that month, with imports adding roughly 3 million litres daily, resulting in a total supply of around 39.5 million litres per day.

According to reports, until recently, no petrol import permits had been issued under the current NMDPRA leadership, suggesting that the new approvals signal a deliberate policy shift to preserve supply diversity and adaptability as the domestic market continues to develop.

Nigeria’s average daily petrol consumption fell to 56.9 million litres per day in February 2026, down from 60.2 million litres in January.

In February, the Dangote Refinery supplied 36.5 million litres of petrol and 8 million litres of diesel to the local market, leaving a daily deficit of 20 million litres that was covered by previously imported stock.

According to NMDPRA, these volumes were sufficient, leading to its earlier decision to withhold import licenses.

Economy

State Visit: CPPE, LCCI Urge Tinubu to Pursue Trade Expansion with UK

By Adedapo Adesanya

The Centre for the Promotion of Private Enterprise (CPPE) and the Lagos Chamber of Commerce and Industry (LCCI) have called for trade expansion ahead of President Bola Tinubu’s state visit to the United Kingdom.

In separate communications, the organisations urged President Tinubu to deepen economic ties as he visits the UK on the invitation of the King of England, King Charles III. His state visit to the UK next week will mark Nigeria’s first such visit to the UK in 37 years, when Military President Ibrahim Babangida was head of state.

The chief executive of CPPE, Mr Muda Yusuf, said the planned visit by Mr Tinubu to the UK is significant on multiple fronts.

“At a time of shifting global alliances and economic realignments, the visit presents both opportunity and responsibility.

“It is expected that leading Nigerian business figures will accompany the President, creating a platform for expanding trade flows, deepening investment partnerships, promoting Nigeria as a destination for capital, and strengthening financial-sector linkages.

“The UK remains a major source of portfolio flows, development finance, and private-sector investment into Nigeria. Structured engagements during the visit could unlock opportunities in infrastructure, energy, financial services, technology, manufacturing, and agribusiness,” Mr Yusuf stated.

On her part, the Director General of the LCCI, Mrs Chinyere Almona, noted that the visit represents a historic opportunity to recalibrate Nigeria–UK relations from traditional diplomacy to focused economic diplomacy.

“At a time when Nigeria is implementing bold macroeconomic reforms, this visit should be leveraged to secure concrete commitments on trade expansion, long-term investment, and cooperation on the business environment.

“From the perspective of the Lagos Chamber of Commerce and Industry, the overriding objective should be to translate goodwill into measurable economic outcomes that strengthen Nigeria’s productive base and export capacity,” she said.

According to her, recent data underscore the strategic importance of the UK to Nigeria’s economy, noting that in Q3 2025, Nigeria recorded capital importation of approximately US$6.01 billion, representing a significant year-on-year surge.

“Notably, the United Kingdom emerged as Nigeria’s largest source of capital inflows, accounting for about US$2.94 billion, or nearly half of total inflows during the quarter. These inflows were driven predominantly by portfolio investment, particularly into the financial and banking sectors, reflecting renewed foreign investor confidence following Nigeria’s macroeconomic adjustments.

“On the trade front, total trade in goods and services between Nigeria and the UK stood at approximately £8 billion in the 12 months to mid-2025,” she said.

She said, however, that the relationship remains structurally imbalanced, with UK exports to Nigeria significantly exceeding Nigeria’s exports to the UK.

“Ultimately, the economic agenda of this state visit should be guided by Nigeria’s most pressing challenges: export diversification, inflation-induced cost pressures, infrastructure deficits, and the need for stable long-term capital,” Mrs Almona said in an interview with Nairametrics.

Economy

Preference for Foreign Currencies in Domestic Transactions Threat to Financial System—EFCC

By Dipo Olowookere

The Economic and Financial Crimes Commission (EFCC) has frowned on the use of foreign currencies for financial transactions in Nigeria, saying this could disrupt the nation’s stability.

The acting Zonal Director of the agency in Ilorin, Mrs Victoria Ugo-Ali, informed the Central Bank of Nigeria (CBN) that the EFCC chairman, Mr Ola Olukoyede, is determined to curb the increasing preference for foreign currencies in domestic transactions, describing the practice “as a serious threat to the stability of the nation’s financial system.”

Speaking during a courtesy visit to the Branch Controller of the Ilorin Branch of the central bank, Mr Monga Muhammed, on Tuesday, Mrs Ugo-Ali noted that “many economic and financial crimes are perpetrated through financial institutions,” stressing the importance of timely intelligence and reports on suspicious transactions.

She called on the apex bank to continue providing the commission with relevant financial intelligence that would aid investigations and help curb money laundering and other financial crimes.

She also reiterated that the growing preference for foreign currencies in local transactions undermines the value of the naira and weakens public confidence in the national currency.

In his response, Mr Muhammed commended the Zonal Director and the management team of the EFCC for the visit, promising to sustain and deepen the already cordial relationship between the two organisations.

He described the engagement as the first of its kind and expressed optimism that it would further strengthen the cooperation between both institutions.

“At our end here, we will continue to partner with you because we carry out complementary functions. While your duty is to tackle economic and financial crimes, our responsibility, primarily as the apex bank, is to stabilise the economy and regulate financial institutions. We will not fail in that regard,” he said.

The CBN Branch Controller further disclosed that the apex bank had put several measures in place to address naira abuse and the dollarisation of the economy.

According to him, the CBN has the capacity to track currency in circulation and would not hesitate to apply appropriate sanctions against individuals or organisations found trading illegally in the nation’s currency.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn