Economy

Five Things to Look Out for in Tenancy Agreement

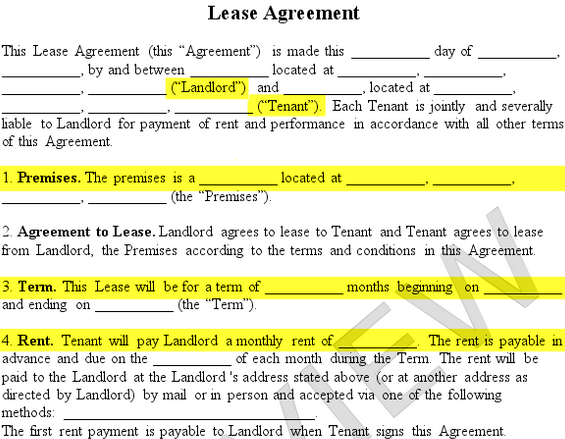

Finding an affordable property to rent/lease can be a real nightmare. Sometimes the stress of checking one property after another, perhaps for months, begins to culminate in a desperation—an eagerness to grab the first one that meets our criteria.

When eventually, we find a suitable one, we are often in such a hurry to move in that we do not take time to read and fully understand the terms and conditions contained therein or even insist long enough to have clauses that will favour us inserted into the agreement for fear of losing to other ‘faster’ bidders.

This negligence of the part of tenants can often end up leaving enough room for minor mistakes that can sometimes become so costly we’d wish we never leased/ rented a piece of real estate in the first place. So before you sign that rental documents, keep your eyes peel on.

Renovations

Before you quickly begin to renovate and fix the place to suite your taste, be sure to look at what the agreement says concerning renovation. If the landlord says you are free to renovate the place, be sure you get this in writing in the rental agreement. Otherwise, you may end up bearing the financial burden of restoring the place to its original condition when it’s time to move. You sure don’t want to part with multiples of hundreds of thousands of Naira just because you didn’t pay attention.

Rent and utilities

Some apartments for rent in houston tx may include some utilities as part of your rent, therefore the onus lies on you to read the agreement and take note of which ones, and how much. Some landlords will include stuffs like security as part of the rent and still expect you to continue paying for it on a monthly basis afterwards. So know what you have paid for and what you will still pay for.

Rent renewal

It is not hard to come across greedy landlords who can insert clauses that automatically disqualifies a tenant from keeping an apartment if their rent is not renewed in, say, three days. This is especially true when house owners are always on the lookout for tenants who are willing to pay more. Stories abound of tenants whose rent were increased by as much as N5 million (in this same Lagos), right after they had spent millions renovating the place. The tenant had to move out.

What will make the landlord kick you out

How do you move into an apartment without checking the agreement to find out what could earn you an eviction notice by tomorrow morning? This right here may not apply to face-me-i-face-you houses, but if you are doing a substantial sum of money to pay for an apartment, you need to have things clearly spelt out.

This is business, no informality

This happens frequently in low-cost housing scenarios. Landlord asks you to pay and promises to give receipt later, without any agreement of any sort. You pay and enter one chance. Never, I repeat, never do this, except you can transfer the money to his bank account and have receipt to show for it.

www.blog.hutbay.com/2016/09/28/five-things-to-look-out-for-in-a-rent-agreement/

Economy

NECA, CPPE Laud CBN’s 0.50% Interest Rate Cut

By Adedapo Adesanya

The Nigeria Employers’ Consultative Association (NECA) and the Centre for the Promotion of Private Enterprise (CPPE) have separately commended the Central Bank of Nigeria (CBN) for reducing the Monetary Policy Rate (MPR) from 27.0 per cent to 26.5 per cent at its 304th Monetary Policy Committee (MPC) meeting.

In reaction, NECA Director-General, Mr Adewale-Smatt Oyerinde, praised the decision in a statement, noting that the 50 basis-point cut is “a cautious but noteworthy signal” that authorities were responding to sustained pressures on businesses.

He said the marginal reduction might not immediately lower lending rates, but reflected “a gradual shift toward supporting growth without undermining price stability”.

According to him, the overall stance remained tight, with the Cash Reserve Ratio retained at 45 per cent and the liquidity ratio at 30 per cent.

He added that the asymmetric corridor around the MPR was also maintained, reinforcing a cautious monetary approach.

“With a substantial portion of deposits still sterilised, banks’ capacity to expand credit to the real sector may remain constrained in the near term,” he said.

Mr Oyerinde described the move as “a careful balancing act” aimed at moderating inflation without worsening pressures on businesses.

He noted that firms continued to grapple with high operating costs, exchange rate volatility and weakened consumer demand.

“Inflation, particularly in food, energy and transportation, remains a significant challenge to employers and households,” he said.

He stressed that the modest easing must be supported by coordinated fiscal and structural reforms to address supply-side constraints.

Such reforms, he said, should improve infrastructure and enhance productivity across key sectors of the economy.

Mr Oyerinde urged financial institutions to ensure the MPR reduction was gradually reflected in lending conditions for manufacturers and SMEs.

He affirmed that although the MPC had not fully relaxed its tightening stance, the rate cut signalled cautious optimism.

“Sustained improvements in inflation, exchange rate stability and investor confidence will determine scope for further easing that supports growth and employment,” he said.

On its part, the CPPE said the decision reflected improving macroeconomic fundamentals and a cautious shift from aggressive tightening.

The organisation noted that sustained disinflation, stronger external reserves, an improved trade balance and relative exchange-rate stability had created room for monetary easing.

It said the rate cut could boost investor confidence and support private-sector growth, but cautioned that weak monetary transmission might limit its impact on lending rates.

The CPPE identified high cash reserve requirements, elevated lending rates, government borrowing and structural banking costs as major constraints to effective transmission.

The group also stressed the need for fiscal consolidation, citing high public debt, persistent deficits and rising debt-service obligations as risks to macroeconomic stability.

According to the chief executive of CPPE, Mr Muda Yusuf, effective policy coordination and stronger transmission mechanisms were critical to unlocking investment and sustaining growth, lauding the CBN for what he described as a measured and data-driven policy adjustment.

The CPPE boss noted that the easing reflected strengthening macroeconomic performance, declining inflation, growing reserves, improved trade balance and enhanced foreign exchange stability.

Mr Yusuf added that for the benefits of monetary easing to be fully realised, authorities must strengthen transmission to ensure lower lending rates for the real sector and advance credible fiscal consolidation to safeguard stability.

He said that if supported by structural reforms and disciplined fiscal management, the current policy direction could unlock a stronger investment cycle and more durable economic growth.

Economy

NASD Index Falls 0.28% as Investors Lose N6.64bn

By Adedapo Adesanya

The NASD Over-the-Counter (OTC) Securities Exchange extended the negative start to the week by 0.28 per cent on Tuesday, February 24, with the market capitalisation down by N6.64 billion to close at N2.378 trillion versus Monday’s N2.384 trillion, and the NASD Unlisted Security Index (NSI) falling by 11.1 points to 3,974.80 points from 3,985.90 points.

At the session, transaction value skyrocketed by 1,706.3 per cent to N1.2 billion from the previous day’s N61.8 million, as the transaction volume increased by 59.1 per cent to 11.6 million units from 7.3 million units, and the number of deals expanded by 23.1 per cent to 48 deals from the preceding session’s 39 deals.

Central Securities Clearing System (CSCS) Plc remained the most active stock by value on a year-to-date basis with 33.7 million units exchanged for N2.0 billion, Okitipupa Plc was next with 6.2 million units traded for N1.1 billion, and Geo-Fluids Plc occupied the third position with 121.0 million units valued at N474.9 million.

Resourcery Plc emerged as the most traded stock by volume on a year-to-date basis with 1.05 billion units worth N408.7 million, followed by Geo-Fluids Plc with the sale of 121.0 million units for N474.9 million, and CSCS Plc with 33.7 million units worth N2.0 billion.

Yesterday, the market breadth was flat after the bourse finished with three price gainers and three price losers led by MRS Oil Plc, which shed N14.50 to close at N200.00 per share versus the previous day’s N214.50 per share, CSCS Plc depleted by N1.39 to N65.82 per unit from N67.21 per unit, and Geo-Fluids Plc depreciated by 1 Kobo to close at N3.30 per share versus Monday’s N3.31 per share.

The price gainers were led by FrieslandCampina Wamco Nigeria Plc, which improved its value by N1.60 to close at N95.00 per unit compared with the preceding session’s N93.40 per unit, Afriland Property Plc gained 83 Kobo to sell at N18.00 per share versus N17.17 per share, and First Trust Mortgage Bank Plc advanced by 13 Kobo to N1.45 per unit from N1.32 per unit.

Economy

Nigerian Exchange Sheds 0.92%

By Dipo Olowookere

The Nigerian Exchange (NGX) Limited depreciated by 0.92 per cent on Tuesday after the Central Bank of Nigeria (CBN) slashed the benchmark interest rate by 0.5 per cent to 26.50 per cent at the end of its first Monetary Policy Committee (MPC) meeting for 2026.

Sell-offs mainly occurred in the consumer goods and insurance sectors, shedding 4.74 per cent and 1.31 per cent, respectively.

However, bargain-hunting remained in the others, with the industrial goods index gaining 1.92 per cent, the banking counter grew by 1.23 per cent, and the energy sector soared by 0.15 per cent.

When the bourse ended for the session, the All-Share Index (ASI) gave up 1,779.03 points to close at 194,484.52 points compared with the previous day’s 196,263.55 points, and the market capitalisation declined by N1.142 trillion to N124.827 trillion from N125.969 trillion.

DAAR Communications depreciated by 10.00 per cent to N2.25, Tantalizers also declined by 10.00 per cent to N4.86, BUA Foods shrank by 9.99 per cent to N760.60, Ellah Lakes slumped 9.96 per cent to N10.40, and Japaul lost 9.95 per cent to trade at N3.80.

Conversely, Jaiz Bank appreciated by 10.00 per cent to N12.76, Infinity Trust Mortgage Bank went up by 9.83 per cent to N19.00, FCMB gained 9.72 per cent to close at N13.55, Fortis Global Insurance chalked up 9.09 per cent to finish at 72 Kobo, and Sterling Holdco grew by 7.50 per cent to N8.60.

A total of 27 stocks ended on the gainers’ chart and 40 stocks finished on the losers’ table, indicating a negative market breadth index and weak investor sentiment.

Yesterday, investors bought and sold 1.1 billion equities worth N53.4 billion in 72,218 deals compared with the 1.3 billion equities valued at N31.5 billion in 95,091 deals recorded a day earlier.

This showed that the value of transactions went up by 69.52 per cent, the volume of trades declined by 15.39 per cent, and a slip in the number of deals by 24.05 per cent.

During the session, Japaul was the most active stock with 102.4 million units worth N399.8 million, Access Holdings exchanged 97.9 million units valued at N2.6 billion, Fortis Global Insurance traded 75.2 million units for N54.1 million, Zenith Bank sold 67.6 million units valued at N6.2 billion, and FCMB transacted 46.4 million units worth N612.2 million.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn