Economy

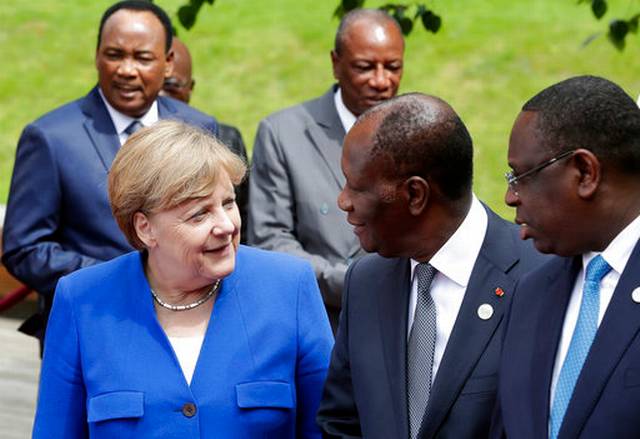

G20 Africa Summit Highlights Investment Openings

By Modupe Gbadeyanka

African leaders are in Berlin, German for this year’s G20 Africa Summit with focus on exploring new investment opportunities in the continent.

Also, participants are meeting to agree on how new incentives for more private‑sector investments, sustainable investments in public infrastructure and economic participation can be created through employment.

The leading economies want to use a conference being held in Berlin on 12 and 13 June under the German G20 Presidency to create new opportunities for sustainable economic growth, investments and stability in Africa.

“Africa has a very high profile in Berlin at the moment,” said Foreign Minister Sigmar Gabriel. Federal Chancellor Angela Merkel has invited representatives of African countries to the conference.

Economic development and population growth in Africa increasingly have a global impact, including on the neighbouring continent of Europe and on Germany. This is why the German Government made Africa one of the priorities of its G20 Presidency.

The German government is endeavouring to boost political and economic stability in Africa through the G20 Africa Partnership. It also aims to minimise the causes of forced and illegal migration and to foster Africa’s responsibility for itself.

Africa is also playing an important role at the Federal Foreign Office this week. Foreign Minister Gabriel met his Malian counterpart Abdoulaye Diop on Monday (12 June) on the margins of the conference. Further high‑level talks are planned.

Gabriel said this exchange is important. “More is needed if we want to take advantage of the opportunities that Africa can offer its people and us Europeans – more unity, more engagement and most importantly, better cooperation between state and society.”

Art is to serve as a role model for politics in this case. A concert at the Federal Foreign Office on Monday will symbolise the links between Europe and Africa. Welcome Africa – Cologne Meets Kenya is the title of a summer concert by Wolfgang Niedecken, founder of Cologne rock band BAP, and Kenyan singer Eric Wainaina.

Both musicians are not only known for their music, but also for their social engagement. Wolfgang Niedecken set up a support programme for former child soldiers in the Democratic Republic of the Congo with the children’s charity World Vision and Eric Wainaina is active in Kenya’s National Integrated Civic Education Programme and other projects.

Economy

Nigerian Stocks Further Lose 0.38% as Cautious Trading Persists

By Dipo Olowookere

The absence of a positive trigger left Nigerian stocks 0.38 per cent deeper in the bears’ territory on Friday, as investors embarked on cautious trading.

Two of the five major sectors tracked by Business Post finished in red on the last trading session of this week, with the industrial goods down by 2.44 per cent, and the energy down by 0.26 per cent due to profit-taking.

However, bargain-hunting raised the insurance sector by 1.52 per cent, the banking index increased by 0.79 per cent, and the consumer goods sector expanded by 0.28 per cent.

When the closing gong was struck yesterday, the All-Share Index (ASI) of the Nigerian Exchange (NGX) Limited crashed by 741.04 points to 192,826.77 points from 193,567.81 points, and the market capitalisation lost N476 billion to close at N123.763 trillion compared with the previous day’s N124.239 trillion.

According to data from Customs Street, Mecure gave up 9.97 per cent to trade at N75.85, Meyer depreciated by 9.90 per cent to N18.65, DAAR Communications crumbled by 9.83 per cent to N2.11, Champion Breweries staggered by 6.49 per cent to N18.00, and Dangote Cement crashed by 6.09 per cent to N779.00.

Conversely, Sovereign Trust Insurance gained 9.95 per cent to settle at N2.21, RT Briscoe improved by 9.93 per cent to N12.51, NGX Group expanded by 9.78 per cent to N124.00, Ellah Lakes surged by 9.70 per cent to N13.00, and Omatek chalked up 9.70 per cent to sell for N2.60.

A total of 44 shares finished on the gainers’ chart during the session, while 25 shares ended on the losers’ table, representing a positive market breadth index and strong investor sentiment.

The activity chart showed that 823.8 million stocks valued at N34.8 billion exchanged hands in 63,759 deals during the session versus the 868.5 million stocks worth N31.5 billion traded in 69,310 deals on Thursday.

This indicated that the value of transactions increased by 10.48 per cent, the volume of trades declined by 5.15 per cent, and the number of deals dipped by 8.01 per cent.

The busiest equity on Friday was Fortis Global Insurance, which sold 146.6 million units for N137.3 million, Zenith Bank transacted 79.4 million units valued at N7.1 billion, Japaul exchanged 57.2 million units worth N225.1 million, Jaiz Bank traded 49.5 million units valued at N589.3 million, and Access Holdings exchanged 44.8 million units worth N1.2 billion.

Economy

Nigeria’s Economy Expands 4.07% in Q4 2025

By Adedapo Adesanya

Nigeria’s economy, measured by gross domestic product (GDP), grew by 4.07 per cent (year-on-year) in real terms in the fourth quarter (Q4) of 2025.

The National Bureau of Statistics (NBS) announced the development in its latest GDP report for Q4 2025 on Friday.

The latest figure represents an improvement over the 3.76 per cent growth recorded in the corresponding period of 2024, signalling sustained recovery across key sectors of the economy. The growth rate was faster than the third quarter’s 3.98 per cent.

The report confirmed that Nigeria’s oil sector grew 6.79 per cent year-on-year and the non-oil part of the economy expanded by 3.99 per cent.

Nigeria’s average daily oil production stood at 1.58 million barrels per day in the final three months of 2025. That was lower than the third quarter’s output of 1.64 million barrels per day but higher than the 1.54 million barrels per day in the fourth quarter of 2024.

Breakdown of the data showed that the agriculture sector grew by 4.00 per cent in the fourth quarter of 2025. This marks a significant increase compared to the 2.54 per cent growth recorded in the same quarter of 2024, reflecting improved output and resilience in the sector.

The industry sector also recorded a stronger performance during the period under review. It grew by 3.88 per cent year-on-year, up from 2.49 per cent posted in the fourth quarter of 2024. The improvement suggests enhanced activity in manufacturing, construction, and related industrial sub-sectors.

The services sector maintained its position as a major growth driver, expanding by 4.15 per cent in Q4 2025. However, this was slightly lower than the 4.75 per cent growth recorded in the corresponding quarter of the previous year.

Overall, the 4.07 per cent GDP growth in the final quarter of 2025 underscores broad-based expansion across agriculture, industry, and services, despite a marginal moderation in services growth.

The Q4 performance provides further evidence of strengthening economic momentum, with improvements recorded in both agriculture and industry compared to the previous year.

Economy

Flour Mills Supports 2026 Paris International Agricultural Show

By Modupe Gbadeyanka

For the second time, Flour Mills of Nigeria Plc is sponsoring the Paris International Agricultural Show (PIAS) as part of its strategies to fortify its ties with France.

The 2026 PIAS kicked off on February 21 and will end on March 1, with about 607,503 visitors, nearly 4,000 animals, and over 1,000 exhibitors in attendance last year, and this year’s programme has already shown signs of being bigger and better.

The theme for this year’s event is Generations Solution. It is to foster knowledge transfer from younger generations and structure processes through which knowledge can be harnessed to drive technological advancement within the global agricultural sector.

In his address on the inaugural day of the Nigerian Pavilion on February 23, the Managing Director for FMN Agro and Director of Strategic Engagement/Stakeholder Relations, Mr Sadiq Usman, said, “At FMN, our mission is Feeding and Enriching Lives Every Day.

“This is a mandate we have fulfilled through decades of economic shifts, rooted in a culture of deep resilience and constant innovation. We support this pavilion because FMN recognises that the next frontier of global Agribusiness lies in high-level technical exchange.

“We thank the France-Nigeria Business Council (FNBC), the organisers of the PIAS, and our fellow members of the Nigerian Pavilion – Dangote, BUA, Zenith, Access, and our partners at Creativo El Matador and Soilless Farm Lab— we are exceedingly pleased to work to showcase the true face of Nigerian commerce.”

Speaking on the invaluable nature of the relationship between Nigeria and France, and the FMN’s commitment to process and product innovation, Mr John G. Coumantaros, stated, “The France – Nigeria relationship is a valuable partnership built on a shared value agenda that fosters remarkable Intercontinental trade growth.

“Also, as an organisation with over six decades of transformational footprint in Nigeria and progressively across the African Continent, FMN has been unwaveringly committed to product and process innovation.

“Therefore, our continuous partnership with France for the success of the Paris International Agricultural Show further buttresses the thriving relationship between both countries.”

PIAS is one of the most widely attended agricultural shows, with thousands of people from across the world in attendance.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn