Economy

How to Control the Risks in Trading?

Risk control is one of the dominant aspects to consider when trading. Of course, if you choose to trade with Exness MT4, the risks get reduced to a minimum. In any case, let’s cast a look at the key steps to take to minimize the risks and calculate their probability when you get into trading.

What’s Risk in Trading and Why You’d Control It Every Second

A trading risk (aka risk in trading) is presented by certain events in the forex market, to subsequently negatively affect the trader.

There may be some changes in the exchange that will ultimately lead to a loss of money.

There are strategies in the forex market that are based on risk management.

Risk at forex trading can be calculated using the following formulas. There are certain formulas and rules for determining risks, for example:

Risk per Trade = Purchase Cost — Stop

And this is the formula for calculating the risk for all trading capital, expressed as a percentage:

Risk = Expected losses in the trade / Equity x 100

This formula will help you comply with the basic rule of risk management, which allows you to risk no more than 2% of your trading capital (or portfolio) per trade.

Risk management is primarily a process of preliminary analysis of all transactions for possible risk and potential profit.

Before making a deal on the stock market (opening a position), the fundamental condition is to determine the risk arising from this.

Control over the risks, or simply risk management, largely determines the likelihood of a trader’s trading success in general, since it allows a competent approach to opening and maintaining positions under risk conditions.

Often, it is precisely the optimization of a position based on the level of risk that is acceptable for a trader that is the main criterion for successful trading.

Frequently, newbies, having no idea about risk management, overestimate the risks and lose their deposit, which often ends in frustration in trading.

Also, without working with risk management, it is extremely difficult to create a successful trading strategy.

Watch News and Stay up to Date

Being guided by fundamental analysis or simply watching news and staying up to date news plays the role of a ’fulcrum’:

- Following the publication of macroeconomic indicators

- Statements of the largest international and

- National financial organizations,

a trader is able to predict a decrease or increase in the rate of a particular currency. This is how all forex professionals work.

But even if a trader is not going to become a professional, he may well define for himself several sources of information that he will use to stay in the know.

The formula for success in the forex market is quite simple. To be in profit, it is necessary to

- Correctly interpret the information received

- Draw the correct conclusions from it, and

- React correctly by opening certain deals.

There are several basic information flows that a trader can use. The most convenient help is the financial news feed, which is equipped with all major online trading platforms.

As a rule, on this tape the specialists of the brokerage company or their partners—business news agencies post in real time all the news that are important for the Forex market.

Stay Stick to the Plan According to Budget

Sticking to the budget you planned is actually one of the fundamental parts of the control over your risks at the forex market.

There are several universal tips for applying risk management in trading that can help improve the trading efficiency of a trader who uses them correctly:

- Before starting trading, it is necessary to draw up a trading plan that describes in detail the trader’s behavior during the trading day, which helps to partially neutralize the emotional component of trading.

- Use only strong signals in trading. You shouldn’t try to trade from a reversal on every random correction.

- It is necessary to limit your losses in each trade and plan the expected profit using stop and take profit orders.

- Do not overexpose losing positions. Stop orders not only help to close a losing trade on time, they are also a kind of indicator of the correctness of the forecast. If the forecast has obviously not been confirmed, one cannot hope for a price rollback over time, otherwise one can get into the opposite trend position and lose the entire deposit.

- Do not try to trade aggressively, especially if you have no experience. It is not by chance that professional traders choose the risk threshold for a transaction at the level of 2% of the deposit—it is best to stick to it until you gain a certain experience in trading.

Each of the tips listed above is applied to the way you distribute your budget in the process of trading. Thus, planning your budget is paramount.

Take Profit-Stop Loss Points

A successful trading system consists of two parts:

- The first is the loss limitation, and

- The second one is the timely profit taking.

Sometimes traders’ strategies assume a strict ratio of the length of positions such as stop and take profit, for example, 1 to 3. Thus, a stop of 10 points will have a take profit of 30.

The ratio can be any, but you should not set too long take profits without a good reason—often the overestimation of price drivers leads to the fact that the trader does not record a solid profit, and the reversal occurs before reaching a long take.

At the same time, it should be remembered that in this case, the take profit must necessarily exceed the stop, since a rare strategy allows a trader to trade without losses, and short stops suggest that, for example, two losing trades can be compensated by one profitable one.

However, in many strategies, the exit point is determined in a different way. Signal trading is one example.

In accordance with this strategy, a trader enters a position by a signal and expects a return signal to exit. In such strategies, the ratio of possible profit and loss is quite large, since the price often passes a significant number of points before reaching the opposite signal.

However, this position has a significant disadvantage: sometimes the return signal is not received at all.

Another strategy involves placing profits near resistance levels, where the likelihood of a reversal is very high. Most often, this option is preferred by experienced traders who are able to correctly determine the levels.

Exnessgroup wishes you successful trading in 2022!

Economy

Nigeria’s Oil Production Drops 64,000b/d to 1.401m/d in April 2025

By Adedapo Adesanya

Nigeria’s average daily crude oil production declined by 64,000 barrels per day or 4.4 per cent to 1.401 million barrels per day in April 2025 from 1.465 million barrels per day recorded in the preceding month (March).

The Organization of Petroleum Exporting Countries (OPEC) April Monthly Oil Market Report revealed this, saying the numbers are based on direct communication from the producing countries.

The report also indicated that oil production fell by 6.6 per cent below OPEC’s 1.5 million barrels per day quota, and approximately 32 per cent belief of the country’s 2025 budget target of 2.06 million barrels per day.

Nigeria’s persistent shortfalls in meeting government production targets comes from challenges such as underinvestment and rampant oil theft, all contributing to suppressed output.

Nigeria’s oil production peaked at 2.5 million barrels decades ago and despite ambitious 3-4 million barrels promises by subsequent governments, the highest actualisation in recent times have been 1.8 million barrels per day.

The decline in oil production since then and the falling oil prices in the international market are likely to strain fiscal revenues, worsening budgetary pressures

Market analysts have pointed out that this will impact national reserves, thereby reducing the availability of resources for developmental spending.

While the government has no control over global oil prices, it can, to some extent, meet its OPEC production quota.

Therefore, the government must intensify efforts by enforcing stricter penalties for oil theft, while fostering greater collaboration with local communities.

Simultaneously, there is a need to attract investment in the sector by ensuring that regulatory bodies and the judiciary work together to provide an enabling environment for investment and modernisation of oil infrastructure.

Economy

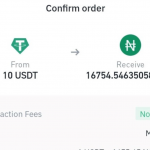

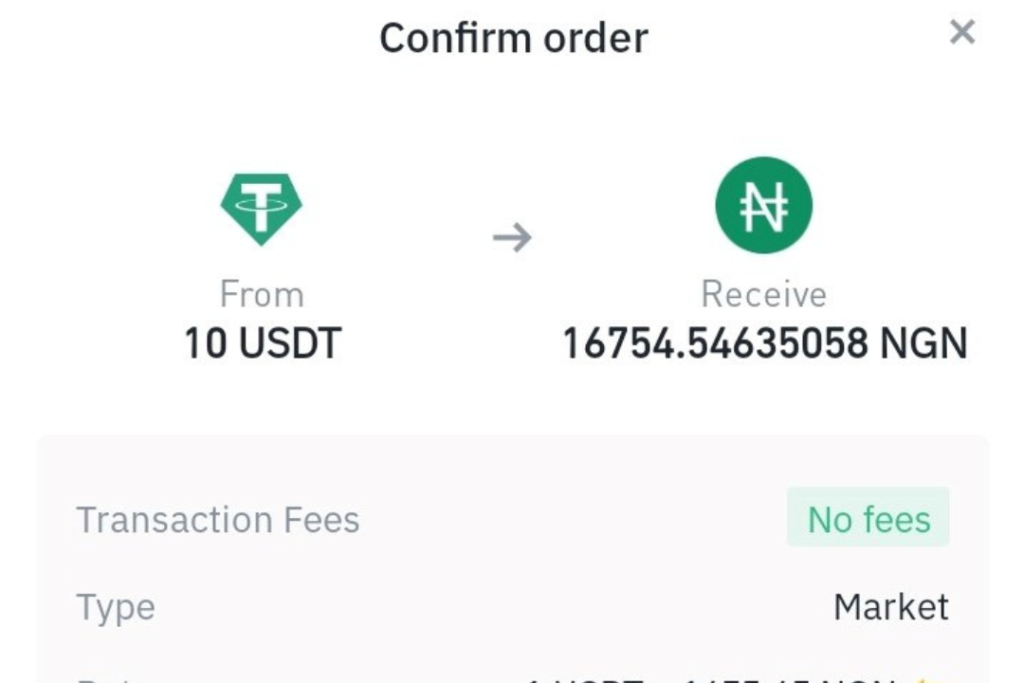

USDT/Naira Stablecoin Pair Emerges Most Traded on Crypto Exchanges

By Modupe Gbadeyanka

A new report has shown the wide adoption of digital currencies in Nigeria despite efforts by the authorities to discourage the use of crypto.

The Central Bank of Nigeria (CBN) has yet to lift the ban of crypto transactions through the banking system in the country after almost five years.

In a report made available to Business Post by a venture capital firm, Hashed Emergent, it was stated that the USDT/Naira stablecoin pair has become the most traded on centralized exchanges, with stablecoin transfers in Nigeria nearing $3 billion in the first quarter of 2024, signalling the practical adoption of blockchain for real-world challenges like inflation and cross-border payments.

Last year, Nigeria ranked second globally for crypto adoption, according to Chainalysis, with $59 billion in crypto value received—$24 billion of that in stablecoins.

Stablecoin trading has overtaken Bitcoin trading on centralized exchanges, reflecting changing behaviour: for many, crypto is not speculative—it’s practical; it is how people hedge against inflation, send money, and make real-world payments.

According to the report, national agencies and multiple state governments are already implementing blockchain-based solutions across areas like identity verification, land registries, education records, and healthcare systems.

These aren’t pilots; they’re operational systems designed to improve transparency, efficiency, and trust in public services.

However, integration into existing public infrastructure remains a key challenge. Many legacy systems lack the technical readiness or interoperability needed for seamless adoption, and institutional capacity gaps—such as limited digital skills and fragmented procurement processes—continue to slow implementation.

Without addressing these bottlenecks, the long-term impact of public sector blockchain adoption may remain limited despite early momentum.

Economy

ExxonMobil Plans $1.5bn Investment in Usan Deepwater Oil Field

By Adedapo Adesanya

ExxonMobil is planning a $1.5 billion investment in deepwater exploration and development of the Usan oilfield in Nigeria.

The Nigerian Upstream Petroleum Regulatory Commission (NUPRC) revealed this in a statement, noting that commitment will be implemented between this current quarter (Q2 2025) and 2027.

This announcement, it said, was made during a visit by ExxonMobil’s Managing Director in Nigeria, Mr Shane Harris, to the Commission’s Chief Executive of the NUPRC, Mr Gbenga Komolafe.

The company proposed a Final Investment Decision (FID) for late Q3 2025, subject to final Field Development Plan (FDP) approval as well as internal and partner funding approvals, the upstream regulator added.

According to the NUPRC, this is in addition to investment targeted at the accelerated development of the Owowo and Erha deepwater oil fields, amongst others.

Mr Harris, while speaking, stated that the planned capital deployment reflects ExxonMobil’s confidence in Nigeria’s upstream potential and its dedication to playing a pivotal role in the sector’s growth.

He also voiced ExxonMobil’s support for the NUPRC’s “Project 1 Million Barrels” initiative, which aims to increase Nigeria’s crude oil production to 2.4 million barrels per day in the medium term.

The initiative has gotten commitments from other oil firms operating in the country since it was floated last year.

On his part, the NUPRC Chief Executive, Mr Komolafe, welcomed the announcement, reaffirming the NUPRC’s role as a business enabler and pledging regulatory support to facilitate ExxonMobil’s operations.

Mr Komolafe highlighted the importance of sustained collaboration between regulators and investors to meet Nigeria’s production and energy security goals, highlighting compliance with the Domestic Crude Supply Obligation (DCSO) and the need for transparent pricing and accountability in the sector.

“The commission is committed to the implementation of Section 109 of the PIA, which addresses the subject of willing buyer, willing seller, and we urge producers to comply,” he stated.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN