Economy

Interest Rate Hike: Nigerians Will Start Paying Higher Prices, Manufacturers Warn

By Adedapo Adesanya

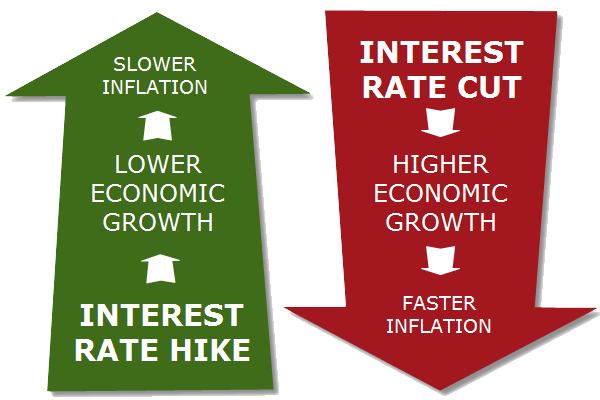

The Manufacturers Association of Nigeria (MAN) has said the recent increase of the Monetary Policy Rate by the Central Bank of Nigeria (CBN) will worsen the imminent recession in the manufacturing sector and negatively impact its operations in many ways.

MAN, in a statement on Thursday, said the MPR hike would also increase the cost of borrowing, which would further discourage investments in the sector.

It also said this would lead to a high cost of production which would lead to higher commodity prices and inventory of unsold manufactured products.

The statement read in part, “It is evident that the continuous and consistent increase in MPR is not yielding the desired growth in the economy. The Nigerian economy remains fragile and bedevilled with numerous challenges that inhibit growth.

“Therefore, the monetary authority needs to pay closer attention to rethink the policy mix, bearing in mind the parlous state of the economy, especially the effect of a high MPR on the manufacturing sector and the economy.

“The increase in MPR from 18 per cent to 18.5 per cent will certainly lead to an increase in lending rates and worsen the uncompetitiveness of the manufacturing sector. The Association has been clamouring for single-digit lending rates to allow manufacturers access to needed funds to boost the performance of the sector.

“This increase, like the previous ones, is evidence that the CBN is either unperturbed about the plight of the productive sector or is unable to fathom out a more creative policy mix that would reflate the sector.”

The CBN further increased the interest rate by 0.5 per cent to 18.50 per cent from 18 per cent in March at the 291st Monetary Policy Committee meeting.

The Governor of the apex bank, Mr Godwin Emefiele, stated that its investigation and research found that the country’s interest would have been higher but for its intervention by raising interest rates.

According to Mr Emefiele, Nigeria’s April inflation rate of 22.22 per cent would have been 30.48 per cent if the MPC had not raised the interest rate.

MAN had already announced that the manufacturing sector was in acute recession and was faced with a quadruple whammy of the sustained scarcity of naira, limited access to foreign exchange, high inflation, and a struggling economy.

These challenges have significantly impacted the industry, with the brewing sector suffering a massive decline of -169 per cent in profit before tax in the first quarter of 2023, a threat that could see it scale down its operations.

Also, the industry turnover for non-alcoholic beverages and tobacco declined by -15 per cent, while gross profit and profit before tax declined by -31 per cent and -96 per cent within the same period, respectively.

“The Naira scarcity and limited access to foreign exchange have exacerbated the continuing impact of systemic challenges such as high cost of operations, the multiplicity of taxes, limited electric power supply and infrastructural challenges.

“For instance, the Nigerian manufacturing sector recorded a 36 per cent downturn in profit margins from 2021 to 2022 and over 400 per cent increase in energy costs, further constraining the growth of the sector,” the association warned earlier this month.

Economy

LCCI Raises Eyebrow Over N15.52trn Debt Servicing Plan in 2026 Budget

By Adedapo Adesanya

The Lagos Chamber of Commerce and Industry (LCCI) has noted that the N15.52 trillion allocation to debt servicing in the 2026 budget remains a significant fiscal burden.

LCCI Director-General, Mrs Chinyere Almona, said this on Tuesday in Lagos via a statement in reaction to the nation’s 2026 budget of N58.18 trillion, hinging the success of the 2026 budget on execution discipline, capital efficiency, and sustained support for productive sectors.

She noted that the budget was a timely shift from macroeconomic stabilisation to growth acceleration, reflecting growing confidence in the economy.

She lauded its emphasis on production-oriented spending, with capital expenditure of N26.08 trillion, representing 45 per cent of total outlays, and significantly outweighing non-debt recurrent expenditure of N15.25 trillion.

According to Mrs Almona, this composition supports infrastructure development, industrial expansion, and productivity growth.

However, she explained that the N15.52 trillion allocation to debt servicing underscored the need for stricter borrowing discipline, enhanced revenue efficiency, and expanded public-private partnerships to safeguard investments that promote growth.

She added that a further review of the 2026 budget revealed relatively optimistic macroeconomic assumptions that may pose fiscal risks.

“The oil price benchmark of $64.85 per barrel, although lower than the $75.00 benchmark in the 2025 budget, appears optimistic when compared with the 2025 average price of about $69.60 per barrel and current prices around $60 per barrel.

“This raises downside risks to oil revenue, especially since 35.6 per cent of the total projected revenue is expected to come from oil receipts.

“Similarly, the oil production benchmark of 1.84 million barrels per day is significantly higher than the current level of approximately 1.49 million barrels per day.

“Achieving this may be challenging without substantial improvements in security, infrastructure integrity, and sector investment,” she said.

Mrs Almona said the exchange rate assumption of N1,512 to the Dollar, compared with N1,500 in the 2025 budget and about N1,446 per Dollar at the end of November, suggests expectations of a mild depreciation.

She said while this may support Naira-denominated revenue, it also increases the cost of imports, debt servicing, and inflation management, with broader macroeconomic implications.

The LCCI DG added that the inflation projection of 16.5 per cent in 2026, up from 15.8 per cent in the 2025 budget and a current rate of about 14.45 per cent, appeared optimistic, particularly in a pre-election year.

She also expressed concern about Nigeria’s historically weak budget implementation capacity, likely to be further strained by the combined operation of multiple budget cycles within a single year.

Looking ahead, Mrs Almona identified agriculture and agro-processing, manufacturing, infrastructure, energy, and human capital development as key drivers of growth in 2026.

She said that unlocking these sectors would require decisive execution—scaling irrigation and agro-value chains, reducing power and logistics costs for manufacturers, and aligning education and skills development with private-sector needs.

The LCCI head stressed the need to resolve issues surrounding the Naira for crude, increase the supply of oil to local refineries to boost local refining capacity and conserve the substantial foreign exchange used for fuel imports.

“Overall, the 2026 Budget presents a credible opportunity for Nigeria to transition from recovery to expansion.

“Its success will depend less on the size of allocations and more on execution discipline, capital efficiency, and sustained support for productive sectors.

Economy

Customs Street Chalks up 0.12% on Santa Claus Rally

By Dipo Olowookere

The Nigerian Exchange (NGX) Limited witnessed Santa Claus rally on Wednesday after it closed higher by 0.12 per cent.

Strong demand for Nigerian stocks lifted the All-Share Index (ASI) by 185.70 points during the pre-Christmas trading session to 153,539.83 points from 153,354.13 points.

In the same vein, the market capitalisation expanded at midweek by N118 billion to N97.890 trillion from the preceding day’s N97.772 trillion.

Investor sentiment on Customs Street remained bullish after closing with 36 appreciating equities and 22 depreciating equities, indicating a positive market breadth index.

Guinness Nigeria chalked up 9.98 per cent to trade at N318.60, Austin Laz improved by 9.97 per cent to N3.20, International Breweries expanded by 9.85 per cent to N14.50, Transcorp Hotels rose by 9.83 per cent to N170.90, and Aluminium Extrusion grew by 9.73 per cent to N16.35.

On the flip side, Legend Internet lost 9.26 per cent to close at N4.90, AXA Mansard shrank by 7.14 per cent to N13.00, Jaiz Bank declined by 5.45 per cent to N4.51, MTN Nigeria weakened by 5.21 per cent to N504.00, and NEM Insurance crashed by 4.74 per cent to N24.10.

Yesterday, a total of 1.8 billion shares valued at N30.1 billion exchanged hands in 19,372 deals versus the 677.4 billion shares worth N20.8 billion traded in 27,589 deals in the previous session, implying a slump in the number of deals by 29.78 per cent, and a surge in the trading volume and value by 165.72 per cent and 44.71 per cent apiece.

Abbey Mortgage Bank was the most active equity for the day after it sold 1.1 billion units worth N7.1 billion, Sterling Holdings traded 127.1 million units valued at N895.9 million, Custodian Investment exchanged 115.0 million units for N4.5 billion, First Holdco transacted 40.9 million units valued at N2.2 billion, and Access Holdings traded 38.2 million units worth N783.3 million.

Economy

Yuletide: Rite Foods Reiterates Commitment to Quality, Innovation

By Adedapo Adesanya

Nigerian food and beverage company, Rite Foods Limited, has extended warm Yuletide greetings to Nigerians as families and communities worldwide come together to celebrate the Christmas season and usher in a new year filled with hope and renewed possibilities.

In a statement, Rite Foods encouraged consumers to savour these special occasions with its wide range of quality brands, including the 13 variants of Bigi Carbonated Soft Drinks, premium Bigi Table Water, Sosa Fruit Drink in its refreshing flavours, the Fearless Energy Drink, and its tasty sausage rolls — all produced in a world-class facility with modern technology and global best practices.

Speaking on the season, the Managing Director of Rite Foods Limited, Mr Seleem Adegunwa, said the company remains deeply committed to enriching the lives of consumers beyond refreshment. According to him, the Yuletide period underscores the values of generosity, unity, and gratitude, which resonate strongly with the company’s philosophy.

“Christmas is a season that reminds us of the importance of giving, togetherness, and gratitude. At Rite Foods, we are thankful for the continued trust of Nigerians in our brands. This season strengthens our resolve to consistently deliver quality products that bring joy to everyday moments while contributing positively to society,” Mr Adegunwa stated.

He noted that the company’s steady progress in brand acceptance, operational excellence, and responsible business practices reflects a culture of continuous improvement, innovation, and responsiveness to consumer needs. These efforts, he said, have further strengthened Rite Foods’ position as a proudly Nigerian brand with growing relevance and impact across the country.

Mr Adegunwa reaffirmed that Rite Foods will continue to invest in research and development, efficient production processes, and initiatives that support communities, while maintaining quality standards across its product portfolio.

“As the year comes to a close, Rite Foods Limited wishes Nigerians a joyful Christmas celebration and a prosperous New Year filled with peace, progress, and shared success.”

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn