Economy

International Lenders Warn on Capacity Constraints in Africa

By Dipo Olowookere

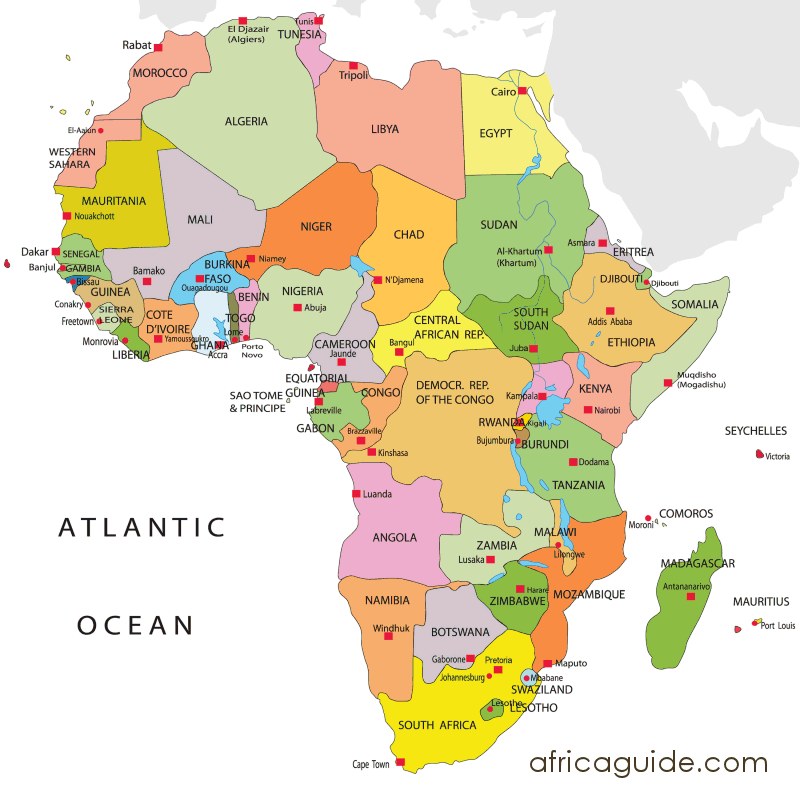

Global and African financial heads identified country risk as the biggest challenge to their ability to lend more to African countries. Speaking in Abidjan during a one-day forum on investment risks in Africa hosted by the African Trade Insurance Agency (ATI), experts acknowledged that the abundance of current liquidity in the market did nothing to alleviate the capacity constraints faced by most banks when doing business in Africa.

Lenders are bound by regulations that prevent them from lending significant amounts to sub-investment grade sovereigns, which is the case for most African countries.

Institutions such as ATI that can offer investment insurance can help to mitigate the risks and thereby bring added lending and investment capacity to African markets. Without an increased ceiling in limits, international lenders will continue to be constrained on the amounts they are able to lend both at the sovereign and corporate levels.

Experts attending the forum also noted positive movements in countries such as Ghana and Senegal for instance, which were recently put on positive watch by the rating agency S&P. This was largely based on the dividends anticipated from key infrastructure developments and investor-friendly policies. In Senegal, for example, the country has restructured its commercial laws, implemented a Public Private Partnership law that ensures all signed public contracts in the oil and gas sector are published and created a department of competition tasked with working hand in hand with investors.

Risk analysis experts at the conference cited Botswana, Côte d’Ivoire, Ethiopia, Rwanda and Zimbabwe as countries to watch in the coming months based on strong reserves in Botswana, political transitions in the case of Ethiopia and Zimbabwe, a strategy to transform its economy into a services hub in the case of Rwanda, and creating an enabling environment to attract investors in the case of Côte d’Ivoire.

Most government representatives at the meeting also noted their countries efforts to ramp up value addition in the agriculture sector along with an emphasis on removing barriers to trade within the continent.

Jean-Louis Ekra, the former President of Afreximbank observed that Africa is in fact moving in a different direction than the current protectionist tendencies of Western countries. In contrast, Africa is uniting under the banner of the African Continental Free Trade Area, which will become the world’s largest trade area.

While participants agreed that the risk perception in Africa is typically greater than the on-the-ground reality, they also recognized that making Africa less risky would require a concerted focus aimed at improving the overall business environment in order to address the risks that do exist.

According to a recent Moody’s report, 40 to 50 percent of defaults in developing markets are directly linked to country risks. During the forum, panellists discussed low-cost solutions that could help countries reduce their risk including ensuring fair adherence to existing regulations.

“One of our roles at ATI is to educate governments to make them aware of the elements that international investors consider in their assessment of country risks. If countries are made aware that any drastic changes they make to legislation, for instance, could be a key political risk factor, they may make better choices and create more fertile environments for the private sector,” commented John Lentaigne, ATI’s Chief Underwriting Officer. He added that “a stable investment climate can be demonstrably and directly linked to growth.”

Despite Africa’s perceived risks, ECGC, India’s export credit agency and international broker, BPL Global, who have a combined $142 billion worth of exposures, noted a relatively low claims and reasonable recovery experience in Africa.

Out of BPL’s $42 billion in current exposures which is insured with international investment risk providers 8 billion of this exposure is in Africa, where the company has historically recorded USD230 million in claims of which $123 million has subsequently been recovered.

International lenders and insurers commented on the importance of ATI’s participation to make projects bankable through its preferred creditor status and relationships with African governments. This was seen as ATI’s core value proposition.

In his address to participants, Pierre Guislain the Vice-President responsible for Private Sector, Infrastructure and Industrialization of the African Development Bank noted the Bank’s commitment to transform the relationship with ATI into a strategic partnership that can leverage its reach and help countries accelerate regional integration.

ATI, a multilateral investment and trade credit insurer posted record results in 2017 for the sixth consecutive year with $10 million in profits representing a 55 percent increase over 2016 and $2.4 billion in gross exposures.

Economy

FAAC Disburses 1.727trn to FG, States Local Councils in December 2024

By Modupe Gbadeyanka

The federal government, the 36 states of the federation and the 774 local government areas have received N1.727 trillion from the Federal Accounts Allocation Committee (FAAC) for December 2024.

The funds were disbursed to the three tiers of government from the revenue generated by the nation in November 2024.

At the December meeting of FAAC held in Abuja, it was stated that the amount distributed comprised distributable statutory revenue of N455.354 billion, distributable Value Added Tax (VAT) revenue of N585.700 billion, Electronic Money Transfer Levy (EMTL) revenue of N15.046 billion and Exchange Difference revenue of N671.392 billion.

According to a statement signed on Friday by the Director of Press and Public Relations for FAAC, Mr Bawa Mokwa, the money generated last month was about N3.143 trillion, with N103.307 billion used for cost of collection and N1.312 trillion for transfers, interventions and refunds.

It was disclosed that gross statutory revenue of N1.827 trillion was received compared with the N1.336 trillion recorded a month earlier.

The statement said gross revenue of N628.972 billion was available from VAT versus N668.291 billion in the preceding month.

The organisation stated that last month, oil and gas royalty and CET levies recorded significant increases, while excise duty, VAT, import duty, Petroleum Profit Tax (PPT), Companies Income Tax (CIT) and EMTL decreased considerably.

As for the sharing, FAAC disclosed that from the N1.727 trillion, the central government got N581.856 billion, the states received N549.792 billion, the councils took N402.553 billion, while the benefiting states got N193.291 billion as 13 per cent derivation revenue.

From the N585.700 billion VAT earnings, the national government got N87.855 billion, the states received N292.850 billion and the local councils were given N204.995 billion.

Also, from the N455.354 billion distributable statutory revenue, the federal government was given N175.690 billion, the states got N89.113 billion, the local governments had N68.702 billion, and the benefiting states received N121.849 billion as 13 per cent derivation revenue.

In addition, from the N15.046 billion EMTL revenue, FAAC shared N2.257 billion to the federal government, disbursed N7.523 billion to the states and transferred N5.266 billion to the local councils.

Further, from the N671.392 billion Exchange Difference earnings, it gave central government N316.054 billion, the states N160.306 billion, the local government areas N123.590 billion, and the oil-producing states N71.442 billion as 13 per cent derivation revenue.

Economy

Okitipupa Plc, Two Others Lift Unlisted Securities Market by 0.65%

By Adedapo Adesanya

The NASD Over-the-Counter (OTC) Securities Exchange recorded a 0.65 per cent gain on Friday, December 13, boosted by three equities admitted on the trading platform.

On the last trading session of the week, Okitipupa Plc appreciated by N2.70 to settle at N29.74 per share versus Thursday’s closing price of N27.04 per share, FrieslandCampina Wamco Nigeria Plc added N2.49 to end the session at N42.85 per unit compared with the previous day’s N40.36 per unit, and Afriland Properties Plc gained 50 Kobo to close at N16.30 per share, in contrast to the preceding session’s N15.80 per share.

Consequently, the market capitalisation added N6.89 billion to settle at N1.062 trillion compared with the preceding day’s N1.055 trillion and the NASD Unlisted Security Index (NSI) gained 19.66 points to wrap the session at 3,032.16 points compared with 3,012.50 points recorded in the previous session.

Yesterday, the volume of securities traded by investors increased by 171.6 per cent to 1.2 million units from the 447,905 units recorded a day earlier, but the value of shares traded by the market participants declined by 19.3 per cent to N2.4 million from the N3.02 million achieved a day earlier, and the number of deals went down by 14.3 per cent to 18 deals from 21 deals.

At the close of business, Geo-Fluids Plc was the most active stock by volume on a year-to-date basis with a turnover of 1.7 billion units worth N3.9 billion, followed by Okitipupa Plc with the sale of 752.2 million units valued at N7.8 billion, and Afriland Properties Plc with 297.3 million units sold for N5.3 million.

In the same vein, Aradel Holdings Plc remained the most active stock by value on a year-to-date basis with the sale of 108.7 million units for N89.2 billion, trailed by Okitipupa Plc with 752.2 million units valued at N7.8 billion, and Afriland Properties Plc with a turnover of 297.3 million units worth N5.3 billion.

Economy

Naira Trades N1,533/$1 at Official Market, N1,650/$1 at Parallel Market

By Adedapo Adesanya

The Naira appreciated further against the United States Dollar at the Nigerian Autonomous Foreign Exchange Market (NAFEM) by N1.50 or 0.09 per cent to close at N1,533.00/$1 on Friday, December 13 versus the N1,534.50/$1 it was transacted on Thursday.

The local currency has continued to benefit from the Electronic Foreign Exchange Matching System (EFEMS) introduced by the Central Bank of Nigeria (CBN) this month.

The implementation of the forex system comes with diverse implications for all segments of the financial markets that deal with FX, including the rebound in the value of the Naira across markets.

The system instantly reflects data on all FX transactions conducted in the interbank market and approved by the CBN.

Market analysts say the publication of real-time prices and buy-sell orders data from this system has lent support to the Naira in the official market and tackled speculation.

In the official market yesterday, the domestic currency improved its value against the Pound Sterling by N12.58 to wrap the session at N1,942.19/£1 compared with the previous day’s N1,954.77/£1 and against the Euro, it gained N2.44 to close at N1,612.85/€1 versus Thursday’s closing price of N1,610.41/€1.

At the black market, the Nigerian Naira appreciated against the greenback on Friday by N30 to sell for N1,650/$1 compared with the preceding session’s value of N1,680/$1.

Meanwhile, the cryptocurrency market was largely positive as investors banked on recent signals, including fresh support from US President-elect, Mr Donald Trump, as well as interest rate cuts by the European Central Bank (ECB).

Ripple (XRP) added 7.3 per cent to sell at $2.49, Binance Coin (BNB) rose by 3.5 per cent to $728.28, Cardano (ADA) expanded by 2.4 per cent to trade at $1.11, Litecoin (LTC) increased by 2.3 per cent to $122.56, Bitcoin (BTC) gained 1.9 per cent to settle at $101,766.17, Dogecoin (DOGE) jumped by 1.2 per cent to $0.4064, Solana (SOL) soared by 0.7 per cent to $226.15 and Ethereum (ETH) advanced by 0.6 per cent to $3,925.35, while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) remained unchanged at $1.00 each.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism8 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking6 years ago

Banking6 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN