Economy

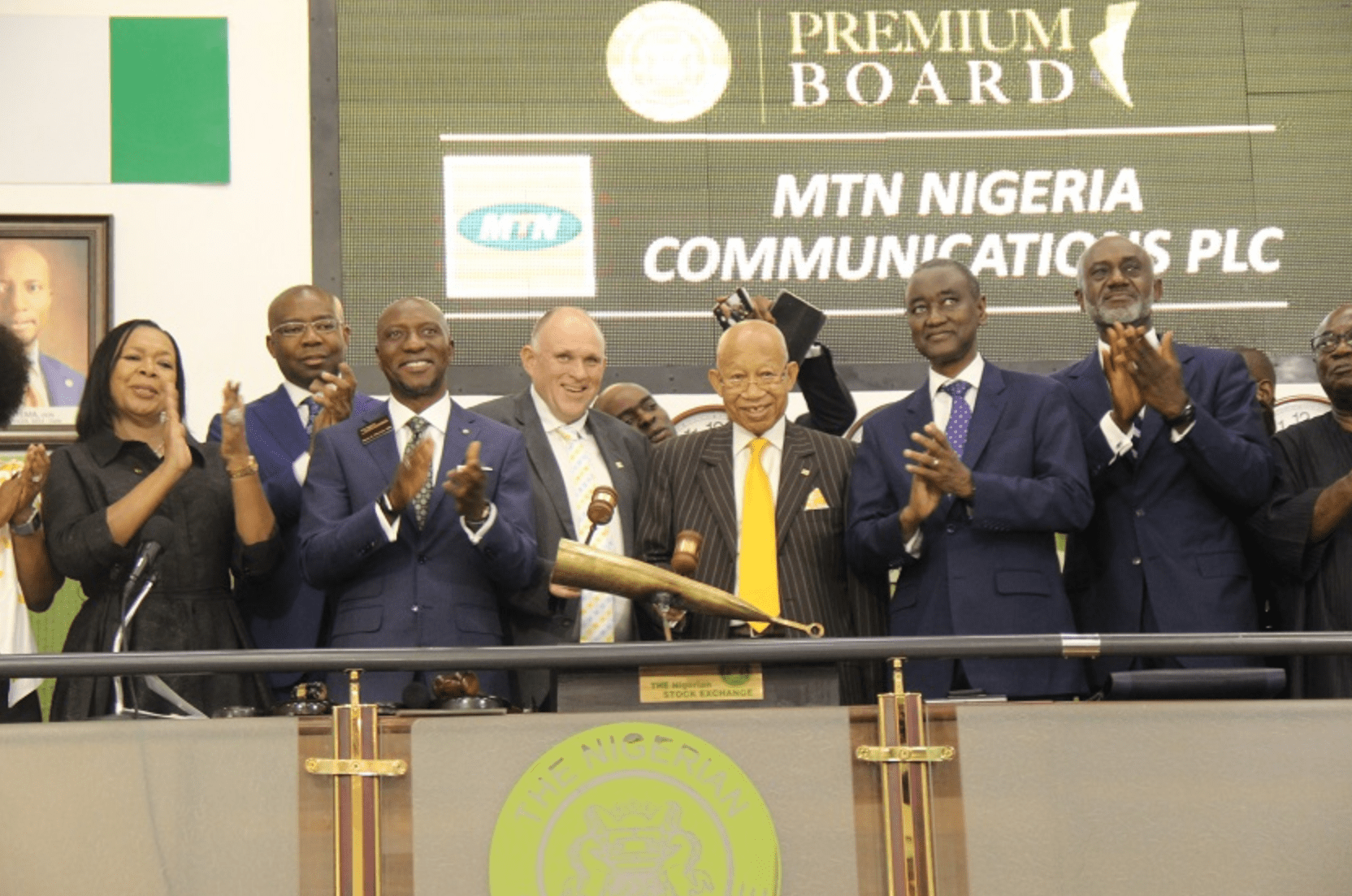

Is MTN Nigeria Currently Underpriced or Overpriced?

By United Capital Research

Some days ago, MTN Nigeria Plc published its FY-18 financial report, indicating that revenue grew by 17.1 percent year-on-year to N1.0 trillion while profit after tax surged 79.7 percent year-on-year to N145.7 billion.

This spurred buying interest on the stock in the last two trading days.

Also, the telco paid N50.0 billion and N111.6 billion as dividends in 2017 and 2018, translating to a dividend per share (DPS) of N2.5 and N5.5 at a payout ratio of c.70 percent over the period.

In Q1-2019, MTN Nigeria reported a revenue growth 13.2 percent year-on-year to N282.1 billion. If annualized, this translates to N1.13 trillion by FY-2019.

As such, EPS and BVPS numbers both seem likely to settle at c.N9.5 per share.

At a dividend payout of 80 percent (compared to 70 percent average in 2017 and 2018), we estimate DPS at c. N7.6 which implies a dividend yield of 5.7 percent.

Again, ROE was 87.7 percent in 2018, which is consistent with expected ROE of +90 percent for 2019.

In terms of valuation, we look at the Enterprise Value to EBITDA (EV/EBI TDA) multiple for MTN Nigeria, this came to 6.3x, below 6.9x average for peers across the Middle East and African Markets. The implied fair price using EV/EBITDA model came to N145.

However, by Price to Earnings multiples (P/E), MTN Nigeria has a PE of 13.9x compared to 20.4x for peers, implying a fair price of N194.50k per share.

Overall, our blended valuation model sees MTN Nigeria at N171.70k per share, indicating that MTN Nigeria is underpriced at current price with a 25.7 percent upside potential.

Economy

Tinubu to Present 2025 Budget of N47.9trn to NASS December 17

By Aduragbemi Omiyale

On Tuesday, December 17, 2024, President Bola Tinubu will present the 2025 budget to a joint session of the National Assembly.

The size of the 2025 Appropriation Bill is about N47.9 trillion and would be presented to the parliament for approval.

Speaking at the plenary on Thursday, December 12, 2024, the President of the Senate, Mr Godswill Akpabio, said the presentation by Mr Tinubu would be at the chamber of the House of Representatives.

However, it is not certain if the lawmakers will pass the budget before December 31 to allow for a recent budget cycle of January to December.

Recall that on December 3, the senate approved the Medium Term Expenditure Framework and Fiscal Strategy Paper (MTEF/FSP) for 2025 to 2027.

This was after the President presented this the National Assembly on November 19 ahead of the consideration of the 2025 budget proposal.

In the MTEF/FSP, the government said it planned to borrow about N9.22 trillion from local and foreign sources to finance the budget deficit.

It pegged the crude oil benchmark at $75 per barrel and a daily oil production of 2.06 million barrels at an exchange rate of N1,400 to $1, and a targeted gross domestic product (GDP) growth rate of 6.4 percent.

At the plenary today, Mr Akpabio informed his colleagues that, “The President has made his intention known to the National Assembly to present the 2025 budget to the joint session of the National Assembly on December 17, 2024.”

Economy

Nigeria Adds 150,000 b/d Crude Production in November 2024

By Adedapo Adesanya

Nigeria added 150,000 barrels per day to its crude production in November 2024 as it continues to pursue an ambitious 2 million barrels per day target.

According to the Organisation of the Petroleum Exporting Countries (OPEC), Nigeria’s oil production rose to 1.48 million barrels per day in November, up from 1.33 million barrels per day the previous month.

In its Monthly Oil Market Report (MOMR), OPEC revealed that at 1.48 million barrels per day, it is the continent’s leading oil producer, surpassing Algeria’s 908,000 barrels per day and Congo’s 268,000 barrels per day.

Business Post reports that OPEC doesn’t account for condensates, which Nigeria’s accounts for in its broader 2 million barrels per day target.

Despite the surge in production levels, Nigeria is still under producing its 1.5 million barrels per day output quota under a deal involving OPEC and 10 other producers known as OPEC+.

OPEC said it relied on primary data gotten through direct communication, noting that secondary sources reported 1.417 million barrels per day as Nigeria’s crude production in November — up from 1.4 million barrels per day in October.

The data also shows that OPEC’s total oil production among its 12 members rose by 104,000 barrels per day in the month under review.

According to secondary sources, the total of the 12 OPEC countries’ crude oil production averaged 26.66 million barrels per day in November 2024.

“Crude oil output increased mainly in Libya, Iran, and Nigeria, while production in Iraq, Venezuela, and Kuwait decreased”, OPEC said.

“At the same time, total non-OPEC DoC crude oil production averaged 14.01 mb/d in November 2024, which is 219 tb/d higher, m-o-m. Crude oil output increased mainly in Kazakhstan and Malaysia,” the organisation added.

In a related development, OPEC trimmed its 2024 and 2025 oil demand growth forecasts for the fifth time this year.

Now, the cartel expects the world’s oil demand growth at 1.61 million barrels per day from the previously 1.82 million barrels per day.

For 2025, OPEC says the world oil demand growth forecast is now at 1.45 million barrels per day, a 900,000 barrels per day cut from the previously expected 1.54 million barrels per day.

On the changes, OPEC says that the downgrade for this year owes to more bearish data received in the third quarter of 2024 while the projections for next year relate to the potential impact that will arise from US tariffs.

Economy

Afriland Properties, Geo-Fluids Shrink OTC Securities Exchange by 0.06%

By Adedapo Adesanya

The duo of Afriland Properties Plc and Geo-Fluids Plc crashed the NASD Over-the-Counter (OTC) Securities Exchange by a marginal 0.06 per cent on Wednesday, December 11 due to profit-taking activities.

The OTC securities exchange experienced a downfall at midweek despite UBN Property Plc posting a price appreciation of 17 Kobo to close at N1.96 per share, in contrast to Tuesday’s closing price of N1.79.

Business Post reports that Afriland Properties Plc slid by N1.14 to finish at N15.80 per unit versus the preceding day’s N16.94 per unit, and Geo-Fluids Plc declined by 1 Kobo to trade at N3.92 per share compared with the N3.93 it ended a day earlier.

At the close of transactions, the market capitalisation of the bourse, which measures the total value of securities on the platform, shrank by N650 million to finish at N1.055 trillion compared with the previous day’s N1.056 trillion and the NASD Unlisted Security Index (NSI) went down by 1.86 points to wrap the session at 3,012.50 points compared with 3,014.36 points recorded in the previous session.

The alternative stock market was busy yesterday as the volume of securities traded by investors soared by 146.9 per cent to 5.9 million units from 2.4 million units, as the value of shares transacted by the market participants jumped by 360.9 per cent to N22.5 million from N4.9 million, and the number of deals increased by 50 per cent to 21 deals from 14 deals.

When the bourse closed for the day, Geo-Fluids Plc remained the most active stock by volume (year-to-date) with 1.7 billion units valued at N3.9 billion, followed by Okitipupa Plc with 752.2 million units worth N7.8 billion, and Afriland Properties Plc 297.5 million units sold for N5.3 million.

Also, Aradel Holdings Plc, which is now listed on the Nigerian Exchange (NGX) Limited after its exit from NASD, remained the most active stock by value (year-to-date) with 108.7 million units sold for N89.2 billion, trailed by Okitipupa Plc with 752.2 million units valued at N7.8 billion, and Afriland Properties Plc with 297.5 million units worth N5.3 billion.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism8 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking6 years ago

Banking6 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN