Economy

Nigeria’ll Save N8trn Yearly from Subsidy Removal, FX Unification—Oyedele

By Adedapo Adesanya

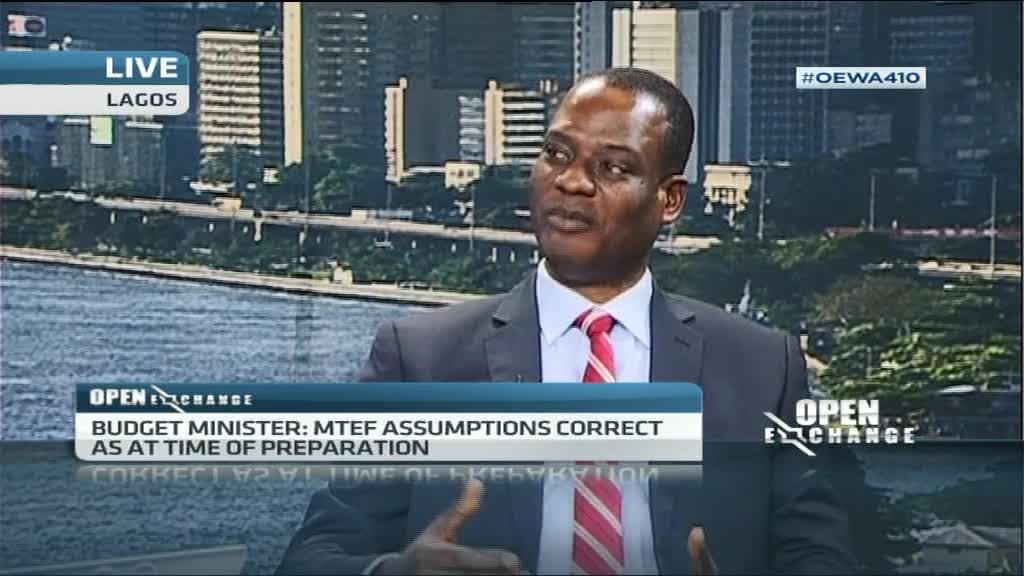

Nigeria will save N8 trillion annually from the fuel subsidy removal and exchange rate unification policies, according to projections offered by the Chairman of the Presidential Fiscal Policy and Tax Reforms Committee, Mr Taiwo Oyedele.

Mr Oyedele said this whole speaking during a panel session at the Lagos Chamber of Commerce and Industry 2024 Economic Outlook and Budget Analysis held on Tuesday.

He said, “The Nigerian people made sacrifices as a result of the fuel subsidy removal of the government; that is N4 trillion savings a year. We did naira floatation. It is not perfect. We are also saving another N4 trillion. So we are having about roughly N8 trillion transferred from the private pockets of the people to the government.”

He said it was critical for the government to spend the amount saved from the two policies to ease the suffering of the average Nigerian.

President Bola Tinubu had last year instituted both policies as an avenue to raise the much needed revenue and to block funds been haemorrhaged by the policies.

“So, what we are saying to the government is can we be intentional in spending this N8 trillion to make sure that it impacts the people most positively? Starting with the multidimensional poverty, why is it that more than 133 million people in Nigeria are living in multidimensional poverty?” he quipped.

“These are the conversations we are having now. We want to build a platform where we can track how these monies are being spent,” he added.

“In the committee, we tried to look at the most pressing issues we face as a country — inflation, forex instability, lack of investments. One of our recommendations is for the government to suspend some taxes. We call them nuisance taxes because they frustrate people, and we can’t even see the money in government treasury.”

According to Mr Oyedele, there is an urgent need to create digital opportunities for the Nigeria’s growing youthful population because the country has enough capacity to generate $20 billion annually from the technology sector.

Mr Oyedele also said there was an urgent need to promote exports, including services and intellectual property.

“Before you start exporting goods, you can export services and intangibles,” he said.

He also said that out of the $20 billion diaspora remittances recorded in 2023, more than 90 per cent of the funds did not arrive Nigeria in foreign currencies because of existing loopholes which allow middlemen to divert the foreign currencies and pay the recipients of the funds in Naira.

“For example, just asking Nigerian companies and businesses to pay taxes in Dollars is about $3.5 billion annually, but we sat and thought about it, and wondered how the idea came about.

“How does it help us, that a Nigerian company will go to the market to go and look for the little Dollars that is in Nigeria so it can use it to pay the government of Nigeria? So, just amend the law and you will take that pressure away.”

Economy

Champion Breweries Gets Shareholders’ Nod for N45bn Capital Injection

By Aduragbemi Omiyale

The board of Champion Breweries Plc can now go ahead to source N45 billion to inject into the business as part of its bold expansion drive.

The company received approval for this significant capital injection from shareholders at an Extraordinary General Meeting (EGM) held virtually on Thursday, July 24, 2025.

Recall that in 2024, EnjoyCorp Limited became the majority shareholder of the brewery company and since then, the firm has been on an upward trajectory, with its stock price rising at the Nigerian Exchange (NGX) Limited.

At the EGM, investors authorised the board to increase the share capital of the organisation to five billion shares, with fresh capital raise of N45 billion be raised by way of debt and bonds.

The proceeds will fund a landmark acquisition of key intellectual property and brand assets, underscoring Champion Breweries’ ambition to accelerate growth and strengthen its market leadership.

Under the resolutions passed, the capital raise will bolster the company’s balance sheet, enhance liquidity, and provide the financial flexibility required to execute an aggressive expansion and innovation programme.

Shareholders also endorsed the acquisition of select intellectual property and brand assets to broaden Champion Breweries’ portfolio, boost operational efficiency, and cement its position in Nigeria’s competitive beverage market.

The virtual EGM recorded robust shareholder participation, with voting conducted electronically and via proxy. In compliance with statutory requirements, the Register of Members was closed from July 7 to July 10, 2025, to facilitate seamless preparations.

The board expressed deep appreciation to shareholders for their unwavering support and reaffirmed its commitment to expanding operational capacity, broadening its product portfolio, and deploying capital prudently to deliver consistent returns while sustaining market leadership.

“We are extending our promotional reach with eco-friendly units already on the road. This capital raise empowers us to fast track growth, launch premium innovations, and deepen market presence, all while upholding our commitment to quality, sustainability, and long-term shareholder value,” the chairman of Champion Breweries, Mr Imo Abasi Jacob, stated.

Also, the Managing Director of the company, Mr Inalegwu Adoga, said, “Champion Breweries has consistently demonstrated resilience and potential, even as previous challenges required a stabilization phase. With this new era of industrial growth, we are poised to evolve beyond mere shelf presence to create meaningful market impact by positioning Champion Breweries as a driver of cultural and economic value.”

Economy

Nigeria to Dominate Refined Petroleum Products in West Africa

By Adedapo Adesanya

The federal government has reaffirmed its commitment to positioning Nigeria as the marketing hub for refined petroleum products across West Africa.

Speaking during his keynote address at the West African Refined Fuel Market Conference organised by the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) on Friday, the Minister of State for Petroleum Resources (Oil), Mr Heineken Lokpobiri, said recent developments will see the country dominate the market.

Speaking at the conference themed Creating a West African Reference Market for Oil & Gas Products the minister highlighted the government’s strategic drive to support refiners, marketers, and regulators in creating an enabling environment for seamless trading within the region.

“Our ambition is to ensure Nigeria becomes the centre of refined product marketing in West Africa. That is why we are giving continuous support to our refiners and stakeholders to stimulate growth and create a world-class trading ecosystem,” Mr Lokpobiri stated.

He noted that the government’s efforts to boost the midstream and downstream sectors are complemented by sustained progress in the upstream segment.

“We are witnessing considerable growth across the value chain, and this is no coincidence. It is the result of deliberate policy interventions,” he added.

The minister further commended President Bola Ahmed Tinubu for the bold step in removing fuel subsidy, describing it as a catalyst for downstream sector growth.

“The removal of petroleum subsidy is already triggering expansion in the market and encouraging private sector investment,” Mr Lokpobiri affirmed.

The Minister also applauded indigenous operators in the refining space, and further called on both local and international investors to seize the opportunity to invest in Nigeria’s refining sector.

“By expanding our refining capacity, we won’t just meet domestic demand, we will service the entire West African market and beyond,” he stressed.

Economy

NASD Market Cap Jumps 4.16% to N2.127trn in Week 30 of 2025

By Adedapo Adesanya

The NASD Over-the-Counter (OTC) Securities Exchange recorded a 4.16 per cent appreciation in the 30th trading week of 2025 despite closing with lesser price gainers than losers.

NASD Plc rose by 33 per cent to close at N33.25 per unit versus the preceding week’s N25.00 per unit, Central Securities Clearing System (CSCS) Plc added 30.2 per cent to settle at N49.47 per share compared with the earlier week’s N61.00 per share, AG Mortgage Plc improved by 21.1 per cent to N1.09 per unit from 90 Kobo per unit, Friesland Campina Wamco Nigeria Plc grew by 21.1 per cent to N73.84 per share from N61.00 per share, and Afriland Properties Plc surged by 20.6 per cent to N21.10 per unit from N17.50 per unit.

These stocks increased the market capitalisation of the bourse by N84.93 billion to N2.127 trillion from N2.042 trillion, and raised the NASD Unlisted Securities Index (NSI) by 145.05 points to 3,633,79 points from the 3,488.74 points it ended in Week 29.

In the five-day trading week, Food Concepts Plc slid by 4.7 per cent to N3.05 per share from N3.20 per share, UBN Property Plc declined by 3.5 per cent to N1.95 per unit from N2.02 per unit, Okitipupa Plc slid by 2.1 per cent to N234.50 per share from N239.50 per share, Nipco Plc lost 1.9 per cent to sell at N240.00 per unit versus N244.83 per unit, Lagos Building Investment Company (LBIC) Plc went down by 1.3 per cent to N3.08 per share from N3.12 per share, and Acorn Petroleum Plc dropped 0.8 per cent to N1.19 per unit from N1.20 per unit.

Last week, the total turnover by value jumped by 28.8 per cent to N559.6 million from N439.9 million, total volume of stocks rose by 1,002.7 per cent to 1.4 billion units from 127.4 million units, and the number of deals increased by 192.31 per cent to 228 deals from 78 deals.

The most traded stock by value was Industrial and General Insurance (IGI) Plc with N462 million, trailed by CSCS Plc with N30.2 million, Okitipupa Plc recorded N23.1 million, Friesland Campina Wamco Nigeria Plc posted N17.3 million, and Nipco Plc achieved N10.9 million.

By volume, IGI Plc also led with 1.4 billion units, UBN Property Plc closed with 2.5 million units, LBIC Plc recorded 0.77 million units, CSCS Plc quoted 0.63 million units, and Friesland Campina Wamco Nigeria Plc traded 0.24 million units.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology5 years ago

Technology5 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN