Economy

Regulators, Stakeholders Excited Over Investments and Securities Act 2025

By Adedapo Adesanya

In a major boost to capital market regulation in Nigeria, President Bola Tinubu recently assented to the Investments and Securities Bill (ISB) 2025, which repeals the Investments and Securities Act No. 29 of 2007 and enacts the Investments and Securities Act 2025.

This landmark legislation strengthens the legal framework of the Nigerian capital market, enhances investor protection, and introduces critical reforms to promote market integrity, transparency, and sustainable growth.

The news has sent ripples of excitement across the capital market landscape in the country as it will regulate the market to ensure capital formation, protect investors, maintain a fair, efficient, and transparent market, and reduce systemic risks.

The Act reaffirms the authority of the SEC as the apex regulatory authority of the Nigerian Capital Market, as well as to The Act also introduces transformative provisions to further align Nigeria’s market operations with international best practices.

According to the Director General of the SEC, Mr Emomoitimi Agama, said, “The Act enhances the regulatory powers of the SEC in a manner comparable to benchmark global securities regulators.” These enhanced powers and functions ensure full conformity with the requirements of IOSCO’s Enhanced Multilateral Memorandum of Understanding (EMMoU), enabling the SEC retain its “Signatory A” status and enhancing the overall attractiveness of the Nigerian capital market.

He said that other notable provisions of the ISA 2025 include the Classification of Exchanges and the inclusion of provisions on financial market infrastructures. The Act classifies Securities Exchanges into Composite and Non-composite Exchanges – A Composite Exchange is one in which all categories of securities and products can be listed and traded. At the same time, a Non-composite Exchange focuses on a singular type of security or product.

There are also new provisions on Financial Market Infrastructures, such as Central Counterparties, Clearing Houses, and Trade Repositories.

Other highlights of the Act are the Expansion of the definition and Understanding of Securities. The Act explicitly recognises virtual/digital assets and investment contracts as securities and brings Virtual Asset Service Providers (VASPs), Digital Asset Operators (DAOPs) and Digital Asset Exchanges under the SEC’s regulatory purview.

The Act introduces provisions for monitoring, managing, and mitigating systemic risk in the Nigerian capital market.

The Act expands the categories of issuers, as a key step towards the introduction of a wide range of innovative products and offerings as well as the facilitation of “commercial and investment business activities”, subject to the approval of the Commission and other controls stipulated in the Act.”

The SEC head disclosed that the Act contains a new Part which provides for the regulation of Commodities Exchanges and Warehouse Receipts. These provisions are essential to enable the development of the entire commodities ecosystem.

On the Issuance of Securities by Sub-Nationals and their Agencies, salient provisions of the Act addressed existing restrictions in respect of raising of funds from the capital market by Sub-Nationals to allow for greater flexibility in this regard.

He said that The Act introduces the mandatory use of Legal Entity Identifiers (LEIs) by participants in capital market transactions. This stipulation is designed to improve transparency in the conduct of securities transactions. It prohibits Ponzi Schemes and other unlawful investment schemes, while prescribing stringent jail terms and other sanctions for the promoters of such schemes.

In a bid to strengthen the Investments and Securities Tribunal, the Act amends some key provisions in the repealed ISA 2007 pertaining to the Composition of the Tribunal, constitution of the Tribunal, qualification and appointment of the Chief Registrar as well as the jurisdiction of the Tribunal to enhance the ability of the Tribunal to discharge its mandate optimally.

Mr Agama lauded the President’s assent as a transformative step for the capital market, saying that the ISA 2025 reflects a commitment to building a dynamic, inclusive, and resilient capital market.

“By addressing regulatory gaps and introducing forward-looking provisions, the new Act empowers the SEC to foster innovation, protect investors more efficiently and reposition Nigeria as a competitive destination for local and foreign investments. We commend all stakeholders within and outside the capital market community for their unwavering solidarity towards the achievement of this historic milestone and solicit their continued collaboration in respect of the effective implementation of the ISA 2025 for the benefit of our economy.”

“The SEC extends its profound appreciation to the National Assembly for its patriotism and dedication in enacting this new legal framework for the Nigerian capital market. The meticulous deliberations, extensive stakeholder engagements, and bi-partisan support demonstrated throughout the legislative process highlight the National Assembly’s resolve to foster economic growth and enhance investor confidence.

“We also commend the Honourable Minister of Finance and Coordinating Minister of the Economy of Nigeria as well as the Minister of State for Finance for their invaluable contributions to the realisation of this groundbreaking project. Their strategic guidance, policy expertise, and steadfast support have ensured that the ISA 2025 aligns with Nigeria’s broader economic objectives.”

On his part, Mr Oluropo Dada, the 13th President and Chairman of Council of the Chartered Institute of Stockbrokers (CIS) lauded the move.

“This Act is a testament to our collective commitment to advancing the capital market and securing its future as a catalyst for economic growth and prosperity,” adding that it made sure that the voices of market operators, investors, and financial experts were well represented.

“The enactment of the Investment and Securities Act 2024 underscores the government’s commitment to fostering transparency, efficiency, and stability in the country’s financial markets.” .

“As capital market professionals, we are confident that this Act will deepen market integrity, boost investor confidence, and expand the range of investment opportunities available to Nigerians and global investors alike.

“As we enter this new era of capital market transformation, I urge all stakeholders—regulators, market operators, investors, and policymakers—to continue working collaboratively to ensure the seamless implementation of the Act’s provisions.

“The Chartered Institute of Stockbrokers remains committed to providing the necessary professional expertise, advocacy, and capacity-building initiatives required to maximise the benefits of this law for all market participants,” he noted.

Economy

Subscription for FGN Savings Bonds Opens for March 2026 at 13.9%

By Aduragbemi Omiyale

The Debt Management Office (DMO) has asked retail investors interested in investing in the FGN savings bonds to begin to talk to their financial advisers.

This is because subscription for the retail bonds for March 2026 has commenced and will close on Friday, March 6, according to a circular issued by the agency on Monday.

The debt office is selling two tenors of the debt instrument, with the shorter note maturing in two years’ time and the longer maturing a year later.

Details of the notice showed that the two-year paper is being offered at a coupon of 12.906 per cent, and the three-year paper at 13.906 per cent.

Both notes are sold at a unit price of N1,000, with a minimum subscription of N5,000 and in multiples of N1,000 thereafter, subject to a maximum subscription of N50 million. They can be purchased via approved stockbroking firms in Nigeria.

The FGN savings bond qualifies as a security in which trustees may invest under the Trustee Investment Act. It also serves as government securities within the meaning of the Company Income Tax Act (CITA) and the Personal Income Tax Act (PITA) for tax exemption for pension funds, amongst other investors.

It can be used as a liquid asset for liquidity ratio calculation for banks, and is listed on the Nigerian Exchange (NGX) Limited for trading at the secondary market.

The bond is backed by the full faith and credit of the Federal Government of Nigeria (FGN) and charged upon the general assets of the country.

Economy

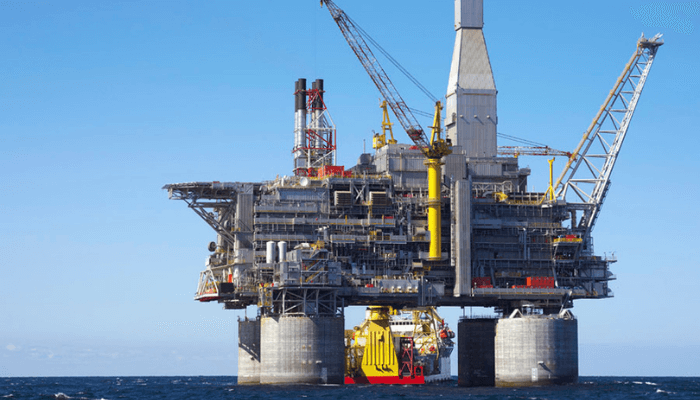

Nigeria Splits OPL 245 into Four Blocks for Eni, Shell

By Adedapo Adesanya

Nigeria has broken up the OPL 245 oil block into four new assets to be operated by Eni and Shell, potentially settling the future of the field at the centre of one of the oil industry’s biggest historic corruption trials.

According to Reuters, the agreement clears the way for the development of OPL 245, one of Nigeria’s biggest deepwater reserves that has remained untapped for almost three decades amid overlapping lawsuits in multiple countries.

The final contracts are expected to be signed starting Monday, the report said, citing a source familiar with the situation.

The Nigerian government had signalled for years that it was keen to find a solution that would bring the block into production. The source wished to remain anonymous as they are not authorised to comment on government policy before an official announcement.

Located in the Niger Delta’s deepwaters, the field has languished since its initial award in 1998 to Malabu Oil and Gas, a shadowy firm controlled by Mr Dan Etete, Nigeria’s oil minister at the time. The block is estimated to hold up to 9 billion barrels of oil equivalent in reserves—enough to rival Nigeria’s entire proven reserves if fully developed.

Mr Etete controversially awarded the lucrative licence to his own company for a nominal $20 million fee, sparking immediate controversy over conflicts of interest.

The saga escalated in 2011 when Malabu sold its rights to a Shell-Eni joint venture for $1.3 billion.

Italian and Nigerian prosecutors alleged that over $1 billion of that sum was siphoned off through bribes to politicians, middlemen, and Mr Etete himself, including hefty payments to then-President Goodluck Jonathan’s associates.

The two European energy giants and some of their former and current executives, including Eni CEO, Mr Claudio Descalzi, faced trial in Italy but all were acquitted in 2021, having denied all wrongdoing.

Shell and Eni have consistently denied wrongdoing, insisting the payments complied with due diligence.

The anti-graft agency, the Economic and Financial Crimes Commission (EFCC), has pursued parallel probes, recovering over $200 million in frozen funds, but progress stalled amid political shifts.

Operations at the Nigerian oil block have been halted for more than a decade by a series of trials and competing legal claims.

In 2023, the federal government withdrew civil claims totalling $1.1 billion against Eni, ending the long battle.

Economy

Dangote Refinery, NNPC Raise Petrol Pump Price by N100

By Modupe Gbadeyanka

The price of Premium Motor Spirit (PMS), otherwise known as petrol, has been increased by at least N100 per litre at the pump.

This followed the recent increase in the price of crude oil in the global market as a result of the bombardment of Iran by the United States and Israel over the weekend.

The air strikes killed the Supreme Leader of Iran, Mr Ayatollah Ali Khamenei, and several others.

Iran has responded by firing missiles at US facilities in some Gulf countries, including Saudi Arabia, Qatar, Kuwait, Bahrain, the UAE, and others.

Crude oil prices rose to about $80 per barrel on the market from about $70 per barrel before the Middle East crisis.

Oil marketers in Nigeria have responded to the tension and have raised the prices of petroleum products.

At most MRS Oil retail stations in Lagos, the new price notice showed an increase of about N100 per litre.

As of Monday, the price of PMS was N837 per litre, but on Tuesday morning, it had changed to N938 per litre, while at NNPC retail stations, it was N930 per litre instead of the previous N830 per litre.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn