Economy

Sustainable Business Practices: How Going Green Can Improve Your Bottom Line

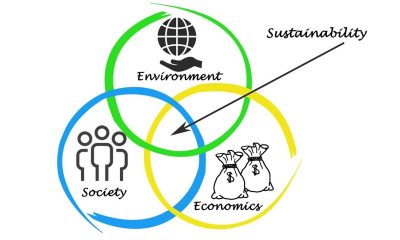

In a state-of-the-art business environment, sustainability isn’t always a moral vital but additionally a strategic gain. Companies that include inexperienced practices in their operations can experience considerable financial blessings. This article delves into how sustainable practices can definitely impact a company’s bottom line, focusing on the important legal elements that companies want to not forget.

The Economic Benefits of Sustainability

Implementing sustainable enterprise practices can result in numerous financial advantages, which include cost financial savings, advanced logo recognition, and admission to new markets. Here are some key blessings:

Cost Savings

One of the maximum immediate advantages of going inexperienced is fee savings. By decreasing waste, preserving energy, and optimizing useful resource use, organizations can appreciably lower their running fees.

- Energy Efficiency: Upgrading to power-green lights, heating, and cooling structures can lessen application bills.

- Waste Reduction: Implementing recycling packages and decreasing packaging can lower waste disposal prices.

- Water Conservation: Installing water-saving furniture and using water-green methods can lower water payments.

Enhanced Brand Reputation

Consumers are increasingly supporting firms that promote sustainability. A strong commitment to green practices improves reputation and consumer loyalty.

- Marketing Advantage: Companies that sell their sustainable practices can appeal to environmentally conscious customers.

- Customer Loyalty: Demonstrating a dedication to sustainability can foster more potent relationships with clients.

- Brand Differentiation: Sustainability can set a company apart from the competition, providing a completely unique selling point.

Access to New Markets

Sustainable practices can open up new enterprise opportunities and markets. For instance, organizations that adhere to inexperienced standards may qualify for government contracts or be desired by means of environmentally aware companions.

- Government Incentives: Many governments offer tax breaks and subsidies to corporations that put in force sustainable practices.

- Green Certifications: Achieving certifications like LEED or ISO 14001 can increase marketability.

- Partnership Opportunities: Businesses that prioritize sustainability might also find it less complicated to cooperate with different environmentally responsible companies.

Legal Aspects of Sustainability

The legal landscape is evolving to guide and put into effect sustainable enterprise practices. Understanding and complying with those legal requirements can help agencies avoid consequences and leverage incentives, in the end reaping rewards from their bottom line.

Compliance with Environmental Regulations

Businesses ought to comply with diverse environmental legal guidelines and regulations that govern pollutants, waste control, and resource use. Failure to conform can result in hefty fines and legal liabilities.

- Pollution Control: Laws which include the Clean Air Act and Clean Water Act within the U.S. Set limits on emissions and discharges. Companies should frequently monitor their emissions and ensure they stay within legal limits.

- Waste Management: Regulations like the Resource Conservation and Recovery Act (RCRA) require proper disposal and recycling of dangerous and non-dangerous waste. Non-compliance can cause significant fines and cleanup fees.

- Resource Use: Companies should adhere to legal guidelines governing the usage of herbal resources, which include water and minerals. This includes obtaining the essential allows and adhering to usage restrictions to save you from over-exploitation and ensure sustainability.

Green Certifications and Standards

Obtaining inexperienced certifications can provide legal and marketplace blessings. These certifications demonstrate compliance with excessive environmental standards and might enhance an enterprise’s credibility.

- LEED Certification: Recognizes buildings and spaces that meet excessive requirements of electricity efficiency and environmental layout. Compliance with LEED requirements frequently involves adhering to unique local construction codes and rules.

- ISO 14001: Specifies requirements for a powerful environmental control device (EMS). Certification can assist organizations in meeting legal and regulatory necessities extra systematically.

- B Corp Certification: Certifies organizations that meet high social and environmental performance standards. Achieving this certification can also involve legal restructuring to make sure dedication to sustainability desires.

Corporate Social Responsibility (CSR) and Legal Obligations

Corporate Social Responsibility (CSR) entails voluntary actions via companies to improve their social and environmental effect. While CSR is frequently visible as voluntary, it is able to also intersect with legal duties.

- Transparency and Reporting: Companies may be legally obligated to report their environmental effect. Laws, such as the EU Non-Financial Reporting Directive, require such disclosures from major corporations.

- Stakeholder Engagement: Engaging with stakeholders, consisting of investors and communities, can be part of legal and ethical duties. Companies may additionally want to demonstrate how they cope with stakeholder concerns about environmental practices.

- Sustainable Supply Chains: Ensuring that suppliers also adhere to environmental requirements can be a legal and ethical requirement. This includes accomplishing regular audits and making sure compliance with laws just like the UK Modern Slavery Act, which mandates transparency in supply chains.

Legal Framework and Market Opportunities

Implementing sustainable practices requires understanding and complying with legal frameworks that guide green initiatives. These laws help keep away from consequences and provide incentives that decorate sustainability and profitability. Many countries have legal guidelines for selling environmental sustainability, which groups have to follow to keep away from penalties and gain incentives.

- Environmental Protection Laws: These laws modify pollutants manipulate and herbal useful resource management, often requiring environmental effect checks for projects.

- Renewable Energy Incentives: Promoting the usage of renewable power resources, those laws regularly offer tax incentives for organizations that invest in green power, lowering operational charges and enhancing sustainability.

- Sustainable Development Goals: National strategies regularly consist of dreams for sustainable improvement and environmental safety, aligning enterprise practices with government support and incentives.

Business in the Dominican Republic provides unique prospects for companies pursuing sustainable practices. Green initiatives are encouraged by a favourable regulatory framework and market conditions. To be eligible for subsidies, companies must follow rules such as Environmental Law No. 64-00 and Renewable Energy Law No. 57-07.

The Business Case for Sustainability

Adopting sustainable business practices benefits each of the surroundings and profitability. Green businesses save charges, decorate their brand, and get admission to new markets. Compliance with sustainability legal guidelines avoids legal issues and leverages incentives. By integrating sustainability, businesses can thrive financially and also contribute to a greener future.

Economy

Terrahaptix Secures Additional $22m from Investors, Valuation Hits $100m

By Adedapo Adesanya

Nigerian defence technology startup, Terra Industries, has extended its funding round to $34 million after securing an additional $22 million from investors, making it a $100 million company.

The new capital round was led by venture firm Lux Capital, with injections from the chief executive officer of Lagos-based unicorn Flutterwave, Mr Gbenga Agboola, as well as angel investors such as American actor Jared Leto and Jordan Nel.

The company said in a statement on Monday that the round was completed in under two weeks.

This comes weeks after it raised $11.75 million in January. That funding round was led by 8VC founded by the co-founder of Palantir Technologies Inc., Mr Joe Lonsdale. Other investors included Valor Equity Partners, Lux Capital, SV Angel, Leblon Capital GmbH, Silent Ventures LLC, Nova Global and angel investors, including Mr Meyer Malka — the managing partner of Ribbit Capital.

Some of the investors in the new round included 8VC, Nova Global, Silent Ventures, Belief Capital, Tofino Capital, and Resilience17 Capital, founded by Flutterwave CEO.

Terrahaptix, founded by Mr Nathan Nwachukwu and Mr Maxwell Maduka, will use the new funding to expand Terra’s manufacturing capacity as it expands into cross-border security and counter-terrorism.

The extension also comes amid growing international expansion. Earlier this month, Terra announced a partnership with Saudi industrial giant AIC Steel to launch a manufacturing hub in Saudi Arabia focused on producing infrastructure security systems.

In the coming weeks, the company also plans to unveil a mega factory, an indication of the company’s growth and importance, particularly as the need for security has risen in recent years, as groups such as Islamic State and al-Qaeda are gaining ground in Africa, converging along a swathe of territory that stretches from Mali to Nigeria.

According to Mr Nwachuku, the initial $11.75 million raise created significant momentum for the company, enabling it to close the additional $22 million in just under two weeks.

He added that beyond capital, the investors were selected for their experience building similar hard-tech and defence-focused companies.

Economy

Analysts Predict 18% Inflation Rate for January 2026

By Adedapo Adesanya

Analysts have projected that Nigeria’s headline inflation could rise to about 18 per cent in January, defying the downward trend recorded in 2025.

The forecast comes ahead of the first Consumer Price Index (CPI) data release by the National Bureau of Statistics (NBS) of 2026 due on Monday.

Headline inflation closed December at 15.15 per cent year-on-year, while the annual average eased sharply to 23.33 per cent from 33.18 per cent in 2024.

According to analysts at Cowry Research, the recent CPI normalisation has created a lower base for January comparisons, making a temporary uptick in headline inflation likely in January and possibly February. It projects inflation to trend within the 17.8 per cent to 18.7 per cent range in 2026, driven by election-related spending pressures and fading base effects, even as structural reforms support a medium-term disinflation path.

Similarly, analysts at Quest Merchant Bank said the lower base effect could push January inflation to around 18 per cent to 19 per cent. They, however, expect inflation to resume a broadly disinflationary trajectory over the course of the year, supported by softer energy prices, stable exchange rate conditions and easing food costs.

Last year’s deceleration was driven largely by base effects after the stats office normalised its CPI computation methodology. Unlike previous rebasing exercises that used a single month as the base period, the agency calculated the base using the average of all months in 2024. The rebasing also involved reweighting several categories and expanding the inflation basket to 934 items from 740.

In December alone, the NBS published two separate inflation figures for December after the CPI methodology tweaking caused the headline rate to more than double.

Nigeria’s inflation data are closely monitored by the Central Bank of Nigeria (CBN) as it transitions toward an inflation-targeting monetary policy framework.

The CBN has already factored in the CPI rebasing and related computational issues in its three-year inflation forecast.

The apex bank is targeting a slowdown in inflation to around 13 per cent by next year, despite current price pressures and statistical adjustments.

The Monetary Policy Committee (MPC) will meet next week, and today’s inflation report will form the basis for whether there will be a cut or hold in the interest rates.

Economy

Deap Capital, Access Holdings, Zenith Bank Lead Activity Chart

By Dipo Olowookere

The trio of Deap Capital Management & Trust, Access Holdings, and Zenith Bank led the activity chart of the Nigerian Exchange (NGX) Limited last week.

In the five-day trading week, Customs Street posted a total turnover of 4.652 billion shares worth N193.326 billion in 286,751 deals compared with the 3.860 billion shares valued at N128.581 billion traded in 240,463 deals a week earlier.

According to data, financial services equities dominated the activity chart with 2.782 billion units sold for N74.063 billion in 104,325 deals, contributing 59.81 per cent and 38.31 per cent to the total trading volume and value, respectively.

Services stocks recorded the sale of 573.189 million units worth N7.177 billion in 28,784 deals, and consumer goods shares exchanged 317.667 million units valued at N24.027 billion in 33,280 deals.

Deap Capital, Access Holdings, and Zenith Bank accounted for 980.253 million shares worth N30.182 billion in 25,390 deals, contributing 21.07 per cent and 15.61 per cent to the total trading volume and value apiece.

Business Post reports that 79 equities appreciated versus 71 equities in the previous week, as 27 stocks depreciated versus 35 stocks in the previous week, while 42 shares closed flat, the same as the previous week.

Zichis was the best-performing stock after it gained 60.71 per cent to trade at N10.80, Union Dicon appreciated by 60.15 per cent to N20.90, DAAR Communications grew by 55.26 per cent to N2.95, Fortis Global Insurance rose by 50.00 per cent to 39 Kobo, and John Holt grew by 45.21 per cent to N10.60.

On the flip side, Abbey Mortgage Bank lost 26.42 per cent to quote at N11.00, Sovereign Trust Insurance shrank by 17.16 per cent to N2.80, Ecobank declined by 13.29 per cent to N45.00, SAHCO went down by 11.59 per cent to N135.00, and Austin Laz depleted by 11.11 per cent to N4.80.

Last week, the All-Share Index (ASI) and the market capitalisation appreciated by 6.16 per cent to 182,313.08 points and N117.027 trillion, respectively.

In the same vein, all other indices finished higher with the exception of the sovereign bond index, which fell by 0.01 per cent.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn