Economy

Sustained Investment Critical to Nigeria’s Growth—PwC

By Dipo Olowookere

Latest report by PwC has revealed that sustained investment and reform are critical to realising growth potential in Nigeria and other emerging market economies.

It also said the long-term global economic power shift away from the established advanced economies is set to continue over the period to 2050, as emerging market countries continue to boost their share of world GDP in the long run despite recent mixed performance in some of these economies.

This is one of the key findings from the latest report from PwC economists on the theme of the World in 2050: The long view: how will the global economic order change by 2050? This presents projections of potential GDP growth up to 2050 for 32 of the largest economies in the world, which together account for around 85% of global GDP. These projections are based on the latest update of a detailed long-term global growth model first developed by PwC in 2006.

The report projects that the world economy could double in size by 2042, growing at an annual average real rate of around 2.5% between 2016 and 2050. This growth will be driven largely by emerging market and developing countries, with the E7 economies of Brazil, China, India, Indonesia, Mexico, Russia and Turkey growing at an annual average rate of around 3.5% over the next 34 years, compared to only around 1.6% for the advanced G7 nations of Canada, France, Germany, Italy, Japan, the UK and the US.

Dr Andrew S. Nevin Ph.D., PwC Nigeria’s Chief Economist and co-author of the report, commented that, “We will continue to see the shift in global economic power away from established advanced economies towards emerging economies in Asia and elsewhere. The E7 could comprise almost 50% of world GDP by 2050, while the G7’s share declines to only just over 20%.”

When looking at GDP measured at market exchange rates (MER), there is not quite such a radical shift in global economic power. But China still emerges as the largest economy in the world before 2030 and India is still clearly the third largest in the world by 2050.

But the spotlight will certainly be on the newer emerging markets as they take centre stage. By 2050, Indonesia and Mexico are projected to be larger than Japan, Germany, the UK or France, while Turkey could overtake Italy. In terms of growth, Vietnam, India and Bangladesh could be the fastest growing economies over the period to 2050, averaging growth of around 5% per year, which also shows how growth breaks down between population and GDP per capita.

Nigeria has the potential to move eight places up the GDP rankings to 14th by 2050, but it will only realise this potential if it can diversify its economy away from oil and strengthen its institutions and infrastructure.

Dr Andrew S. Nevin observed that, “Growth in many emerging economies will be supported by relatively fast-growing populations, boosting domestic demand and the size of the workforce. This will need, however, to be complemented with investments in education and improvement in macroeconomic fundamentals to ensure there are sufficient jobs for the growing number of young people in these countries.”

“In contrast to our previous 2015 edition, in which we projected Nigeria to be the fastest growing economy of the countries we modelled, Nigeria is now expected to be only the sixth fastest. This reflects the slowdown of the Nigerian economy over the last two years as a result of a fall in oil prices.

“In 2016, the economy officially slid into recession for the first time in recent years as key sectors contracted sharply across three quarters. Foreign exchange shortages and high inflation have hampered the growth of manufacturing and services, with administrative controls put in place by the Central Bank resulting in a reduction in foreign direct investment and foreign portfolio flows.”

The report said Nigeria will average around 2% annual growth to 2020, with growth then picking up speed in the decades following to average almost 4.5% p.a. between 2041 and 2050. Along with South Africa, Nigeria is one of the few to see a marked acceleration of annual average growth over the next few decades, as opposed to a moderation.

However, to support long-term sustainable growth, Nigeria needs to develop a broader-based economy, diversifying its exports to ensure its growth is not dampened by global price or demand shocks. Alongside this, Nigeria should develop its institutions and infrastructure, supporting long-term productivity growth.”

It identified five ways in which Nigeria can support inclusive growth which include:

Improving tax collection: Nigeria is a low-taxed economy compared to its peers with the tax-to-GDP ratio estimated at just 8%, the second lowest in Africa and the fourth lowest in the world. If these could be increased to the Sub-Saharan African economies’ average of 18% of GDP, Nigeria could potentially raise its tax revenues to around $104 billion. Higher tax revenues would reduce government borrowing and encourage financial institutions to offer funds at lower interest rates, thereby boosting the real economy.

Economic diversification: Nigeria’s potential advantages for future growth include a large consumer market, a strategic geographic location as a hub for Africa, and a young and entrepreneurial population. The first step in harnessing this opportunity requires deliberate efforts to improve value-adding activity in the non-oil economy, particularly in agriculture and the services sectors.

Corruption: If Nigeria reduces corruption, there is a significant opportunity to boost GDP levels. For example, if corruption in Nigeria could be reduced in the long-run to estimated levels in Malaysia, we estimate that annual GDP could rise by over $500 billion by 2030. Deliberate efforts to reduce corruption will complement the Nigerian government’s diversification drive.

Easing the constraints to business: A weak business environment is holding back Nigeria’s economic growth potential and slowing down the pace of development. Nigeria ranked 169th out of 190 countries in the World Bank’s 2017 Ease of Doing Business Index, lower than Niger, Madagascar and Sierra Leone. Other than protecting minority investors and getting credit, Nigeria ranks low on all other indicators and will need to particularly focus on improving electricity supply, simplifying the tax collection process and improving trading across borders so as to leverage its position as the hub of West Africa.

Increasing labour productivity: Nigeria has the advantage of a large workforce of over 70 million, but the majority are under-skilled. It is imperative to equip workers with the skills needed to keep pace with an economy in transition like Nigeria. Average productivity of a worker in Nigeria is very low at US$3.24/hr relative to US$19.68/hr in South Africa and US$29.34/hr in Turkey 14. Improvements in productivity will require investments to ensure a broad availability of good quality education as well as relevant vocational training to improve value-added activity across key sectors such as manufacturing and services.

Average incomes and Working-age populations

The report further noted that today’s advanced economies will continue to have higher average incomes – with the possible exception of Italy, all of the G7 continue to sit above the E7 in the rankings of GDP per capita in 2050. Emerging markets are projected to close the income gap gradually over time, but full convergence of income levels across the world is likely to take until well beyond 2050.

In addition, PwC economists project global economic growth to average around 3.5% per annum over the years to 2020, slowing down to around 2.7% in the 2020s, 2.5% in the 2030s, and 2.4% in the 2040s. This will occur as many advanced economies (and eventually also some emerging markets like China) experience a marked decline in their working-age populations. At the same time, emerging market growth rates will moderate as these economies mature and the scope for rapid catch-up growth declines. These effects are projected to outweigh the impact of emerging economies having a progressively higher weight in world GDP, which would otherwise tend to boost average global growth.

All of these portend challenges for policy makers. In order to realise their great potential, emerging economies must undertake sustained and effective investment in education, infrastructure and technology. The fall in oil prices from mid-2014 to early 2016 highlighted the importance of more diversified emerging economies for long-term sustainable growth. Underlying all of this is the need to develop the political, economic, legal and social institutions within emerging economies to generate incentives for innovation and entrepreneurship, creating secure and stable economies in which to do business.

According to Dr Andrew S. Nevin, “Policymakers across the world face a number of challenges if they are to achieve sustainable long-term economic growth of the kind we project in this report. Structural developments, such as ageing populations and climate change, require forward-thinking policy which equips the workforce to continue to make societal contributions later on in life and promotes low carbon technologies.

“Falling global trade growth, rising income inequality within many countries and increasing global geopolitical uncertainties are intensifying the need to create diversified economies which create opportunities for everyone in a broad variety of industries.”

Great opportunities for business with the right strategic mix of flexibility and patience

Emerging market development will create many opportunities for business. These will arise as these economies progress into new industries, engage with world markets and as their relatively youthful populations get richer. They will become more attractive places to do business and live, attracting investment and talent.

Emerging economies are rapidly evolving and often relatively volatile, however, so companies will need operating strategies that have the right mix of flexibility and patience to succeed in these markets. Case studies in the PwC report illustrate how businesses should be prepared to adjust their brand and market positions to suit differing and often more nuanced local preferences. An in-depth understanding of the local market and consumers will be crucial, which will often involve working with local partners.

Concluding, Dr Andrew S. Nevin said, “Businesses need to be patient enough to ride out the short-term economic and political storms that will inevitably occur from time to time in these emerging markets as they move towards maturity. But the numbers in our report make clear that failure to engage with these emerging markets means missing out on the bulk of the economic growth we expect to see in the world economy between now and 2050.

“For Nigeria, although we face some tough choices, the current episode represents a potential tipping point for positive change as the government becomes forced to address the sources of vulnerability in order to achieve inclusive growth and sustainable development.”

Economy

Flour Mills Supports 2026 Paris International Agricultural Show

By Modupe Gbadeyanka

For the second time, Flour Mills of Nigeria Plc is sponsoring the Paris International Agricultural Show (PIAS) as part of its strategies to fortify its ties with France.

The 2026 PIAS kicked off on February 21 and will end on March 1, with about 607,503 visitors, nearly 4,000 animals, and over 1,000 exhibitors in attendance last year, and this year’s programme has already shown signs of being bigger and better.

The theme for this year’s event is Generations Solution. It is to foster knowledge transfer from younger generations and structure processes through which knowledge can be harnessed to drive technological advancement within the global agricultural sector.

In his address on the inaugural day of the Nigerian Pavilion on February 23, the Managing Director for FMN Agro and Director of Strategic Engagement/Stakeholder Relations, Mr Sadiq Usman, said, “At FMN, our mission is Feeding and Enriching Lives Every Day.

“This is a mandate we have fulfilled through decades of economic shifts, rooted in a culture of deep resilience and constant innovation. We support this pavilion because FMN recognises that the next frontier of global Agribusiness lies in high-level technical exchange.

“We thank the France-Nigeria Business Council (FNBC), the organisers of the PIAS, and our fellow members of the Nigerian Pavilion – Dangote, BUA, Zenith, Access, and our partners at Creativo El Matador and Soilless Farm Lab— we are exceedingly pleased to work to showcase the true face of Nigerian commerce.”

Speaking on the invaluable nature of the relationship between Nigeria and France, and the FMN’s commitment to process and product innovation, Mr John G. Coumantaros, stated, “The France – Nigeria relationship is a valuable partnership built on a shared value agenda that fosters remarkable Intercontinental trade growth.

“Also, as an organisation with over six decades of transformational footprint in Nigeria and progressively across the African Continent, FMN has been unwaveringly committed to product and process innovation.

“Therefore, our continuous partnership with France for the success of the Paris International Agricultural Show further buttresses the thriving relationship between both countries.”

PIAS is one of the most widely attended agricultural shows, with thousands of people from across the world in attendance.

Economy

NEITI Backs Tinubu’s Executive Order 9 on Oil Revenue Remittances

By Adedapo Adesanya

Despite reservations from some quarters, the Nigeria Extractive Industries Transparency Initiative (NEITI) has praised President Bola Tinubu’s Executive Order 9, which mandates direct remittances of all government revenues from tax oil, profit oil, profit gas, and royalty oil under Production Sharing Contracts, profit sharing, and risk service contracts straight to the Federation Account.

Issued on February 13, 2026, the order aims to safeguard oil and gas revenues, curb wasteful spending, and eliminate leakages by requiring operators to pay all entitlements directly into the federation account.

NEITI executive secretary, Musa Sarkin Adar, called it “a bold step in ongoing fiscal reforms to improve financial transparency, strengthen accountability, and mobilise resources for citizens’ development,” noting that the directive aligns with Section 162 of Nigeria’s Constitution.

He noted that for 20 years, NEITI has pushed for all government revenues to flow into the Federation Account transparently, calling the move a win.

For instance, in its 2017 report titled Unremitted Funds, Economic Recovery and Oil Sector Reform, NEITI revealed that over $20 billion in due remittances had not reached the government, fueling fiscal woes and prompting high-level reforms.

Mr Adar described the order as a key milestone in Nigeria’s EITI implementation and urged amendments to align it with these reforms.

He affirmed NEITI’s role in the Petroleum Industry Act (PIA) and pledged close collaboration with stakeholders, anti-corruption bodies, and partners to sustain transparent management of Nigeria’s mineral resources.

Meanwhile, others like the Petroleum and Natural Gas Senior Staff Association of Nigeria (PENGASSAN) have kicked against the order, saying it poses a serious threat to the stability of the oil and gas industry, calling it a “direct attack” on the PIA.

Speaking at the union’s National Executive Council (NEC) meeting in Abuja on Tuesday, PENGASSAN President, Mr Festus Osifo, said provisions of the order, particularly the directive to remit 30 per cent of profit oil from Production Sharing Contracts (PSCs) directly to the Federation Account, could destabilise operations at the Nigerian National Petroleum Company (NNPC) Limited.

Mr Osifo firmly dispelled rumours of imminent protests by the union, despite widespread claims that the controversial executive order threatens the livelihoods of 10,000 senior staff workers at NNPC.

He noted, however, that the union had begun engagements with government officials, including the Presidential Implementation Committee, and expressed optimism that common ground would be reached.

Mr Osifo, who also serves as President of the Trade Union Congress (TUC), expressed concerns that diverting the 30 per cent profit oil allocation to the Federation Account Allocation Committee (FAAC), without clearly defining how the statutory management fee would be refunded to NNPC, could affect the salaries of hundreds of PENGASSAN members.

Economy

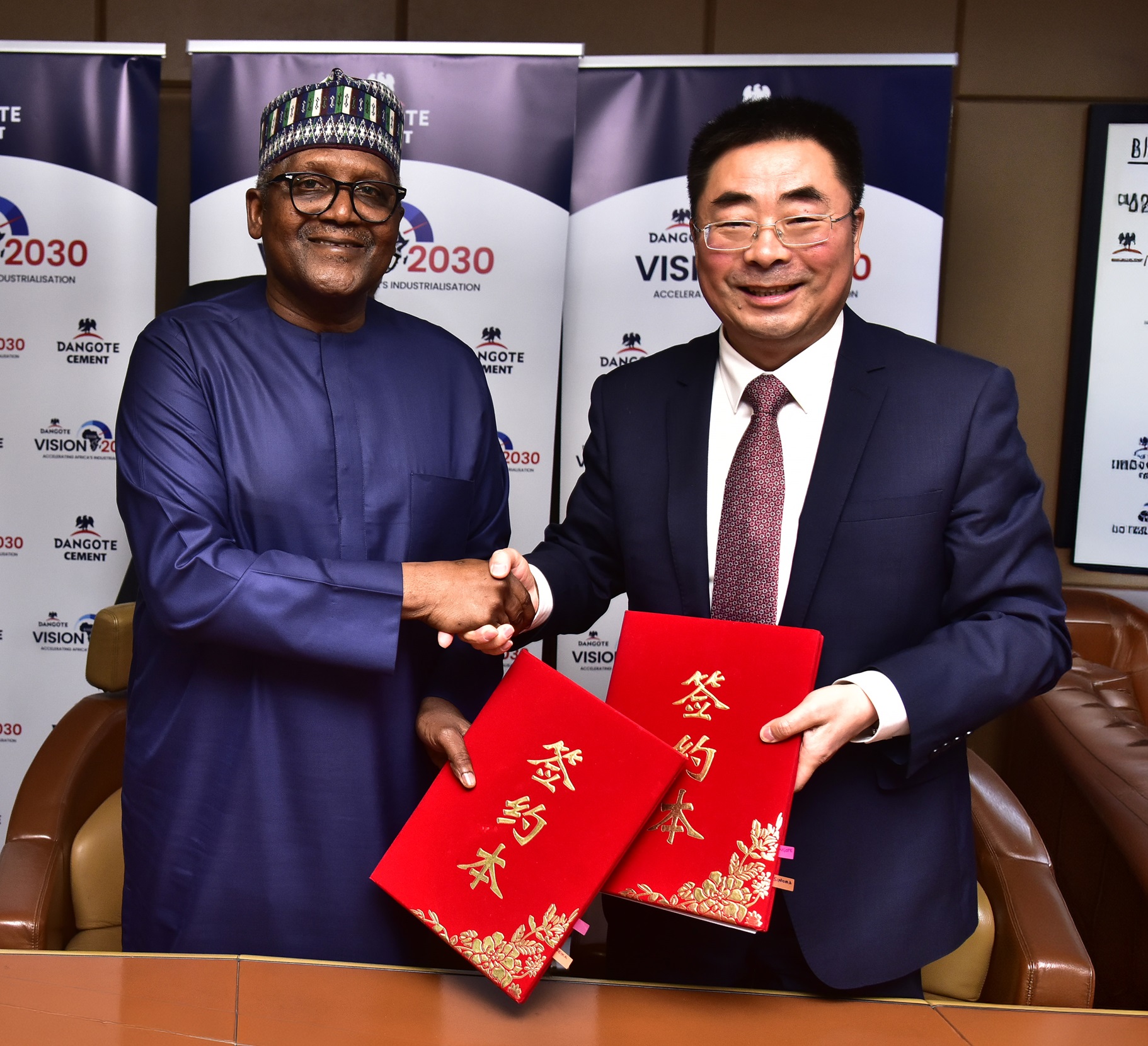

Dangote Cement Deepens Dominance, Export Activities With $1bn Sinoma Deal

By Aduragbemi Omiyale

To strengthen its domestic market dominance, drive its export activities, optimise existing operational assets and enhance production efficiency and capacity expansion, Dangote Cement Plc has sealed $1 billion strategic agreements with Sinoma International Engineering for cement projects across Africa.

The president of Dangote Industries Limited, the parent firm of Dangote Cement, Mr Aliko Dangote, disclosed that the deal reinforces the company’s long-term growth strategy and aligns with the broader aspirations of the Dangote Group’s Vision 2030.

According to him, Sinoma will construct 12 new projects and expand others for the cement organisation across Africa, helping to achieve 80 million tonnes per annum (MTPA) production capacity by 2030, while supporting the group’s overarching target of generating $100 billion in revenue within the same period.

Under the Strategic Framework Agreement, Sinoma will collaborate with Dangote Cement on the delivery of new plants, brownfield expansions, and modernisation initiatives aimed at strengthening operational performance across key markets.

The new projects include a new integrated line in Northern Nigeria with a satellite grinding unit, a new line in Ethiopia and other projects in Zambia/Zimbabwe, Tanzania, Sierra Leone and Cameroon. In Nigeria, Sinoma will also handle different projects in Itori, Apapa, Lekki, Port Harcourt and Onne.

The projects signal Dangote Cement’s sustained commitment to consolidating its leadership position within the African cement industry, while enhancing its competitiveness on the global stage.

Chairman of the Dangote Cement board, Mr Emmanuel Ikazoboh, during the agreement signing event in Lagos, explained that the new projects would enable the company to play a critical role in actualising Dangote Group’s Vision 2030.

The new projects, when completed, will increase Dangote Cement’s capacity and dominant position in Africa’s cement industry.

On his part, the Managing Director of Dangote Cement, Mr Arvind Pathak, said the agreement reflects the company’s determination to grow its investments across African markets to close supply gaps and support the continent’s infrastructural ambitions.

According to him, Dangote Cement is committed to making Africa fully self‑sufficient in cement production, creating more value and linkages, leading to increased economic activities and a reduction in unemployment.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn