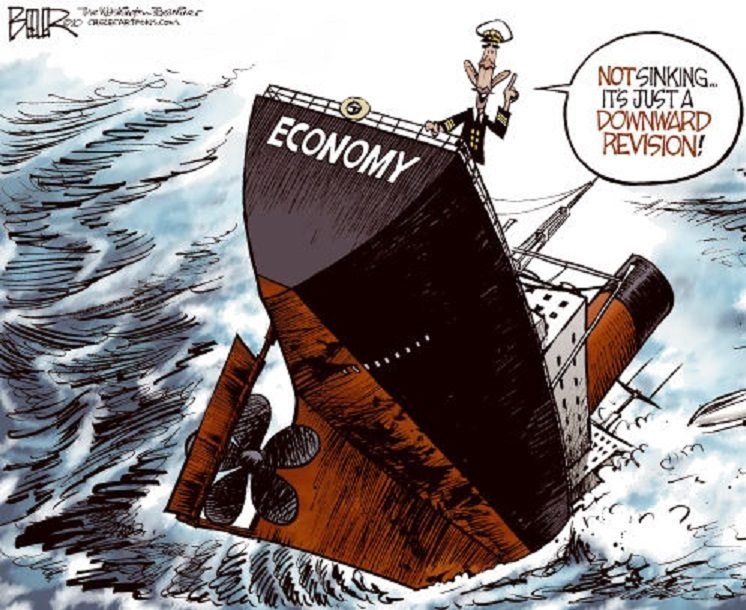

Economy

The Growth and Growth of Family-Owned Businesses: the Two Key Pillars of Success

By Kyra Motley and Chelsea Turner

Africa has seen an exponential growth of family-owned businesses (FOBs) in recent years, aligned with a fast-growing ultra-high-net-worth population – a trend that is set to continue on an upward trajectory.

This is particularly true of Nigeria. Nigeria has the largest population in Africa and is a landscape where family businesses are prominent and contribute significantly to the country’s economy. Here, FOBs contribute over $200 billion to the Nigerian economy and one out of two Nigerian businesses is a family business.

FOBs are typically resilient, exemplified by their resistance to recent inflationary pressures experienced in the Nigerian economy. Having experienced a number of challenges as they become established, family businesses are now ripe for growth, pending the stabilisation of the economic climate in the region.

Nigeria is one of the recently coined “Big 5” wealth markets in Africa, which together hold over 90% of the continent’s billionaires, and Africa’s population of high-net-worth individuals is predicted to rise by 42% in the next decade.

Therefore, at a countrywide level, the importance of these businesses to the economy cannot be underestimated, nor their wider contributions to the success of surrounding communities at a local level.

Good governance: a critical pillar for sustainable success

Given family businesses are a staple to the economy, it is therefore cause for concern that only 58% have a form of governance structure, and only 6% have dispute resolution procedures in place. Furthermore, in 2021, only 25% had succession plans and 9% had a family constitution, figures which are unlikely to have shifted notably in this time.

Family businesses must equip themselves with a governance framework to enable the business to progress further. A family constitution can ensure a clear goal for the family business and protect continuity for the business that spans beyond some of the family members themselves. This pre-emptive planning can provide beneficial opportunities for family members to settle into their roles before the practical elements of their positions are required. Another useful tool is shareholder agreements, which can ensure clarity on how the success of the business is maintained, providing peace of mind for families who may be concerned about the challenges to come and changes to follow.

Implementing a forward-thinking governance framework will benefit younger generations, who may themselves progress and lead the business forward. These generations may require specific skills or qualifications to enable them to lead with confidence.

These considerations are inherently important given it is an unfortunate fact that many of these family businesses, which are so important to Africa’s economy, do not manage to survive beyond the third generation.

Securing success through effective succession

The importance of effective succession planning should not be underestimated in combatting the challenges family businesses will undoubtedly encounter, and ensuring there is continued prosperity and success for these businesses and the region as a whole.

The challenges faced by family businesses are not inherently distinct from the challenges non-family businesses face. Family businesses do not hold a unique immunity to the challenges of economic instability, inflation, corruption, and terrorism that exist. These features are also not distinct to Nigeria and are faced by many other businesses globally.

However, in conjunction with these adverse influences, family businesses have a multitude of other considerations. Family businesses, just like every other family, will have disputes between family members. However, these disputes are susceptible to being strained, and complications can arise from contrasting management perspectives, concerns for the business, and dealing with business demands.

Furthermore, families are not fixed, instead altering substantially with time, growing with new generations, and coping with the loss of older generations. Legacy is an important aspect to consider, to withstand the changes and fluctuations of modern times, but most importantly so businesses can thrive through these changes.

The prospect of succession planning can be an aspect that family businesses avoid, yet this can cause significant instability – planning ahead can eradicate some of these fears and threats. Focusing too heavily on the present, without a lens for future generations, can result in these hard efforts being unrealised in the future.

In the unfortunate event someone in the family business becomes unable to continue running the business, there should be a plan in place that clearly sets out the steps that should be taken – these may involve drafting Wills for family members, or potentially establishing a trust structure to ensure shareholdings are passed efficiently.

These considerations are often postponed, yet incapacity and death can, unfortunately, strike suddenly and preparing for moments such as these hold the key to the business’s success and survival.

Ultimately, family businesses have a critical role to play in the Nigerian economy and with the right approaches and frameworks in place, they have the potential to propel their established success forward for generations to come.

Kyra Motley is a Partner at Boodle Hatfield, and Chelsea Turner is a Trainee Solicitor at Boodle Hatfield

Chelsea Turner

Economy

NASD Bourse Rebounds as Unlisted Security Index Rises 1.27%

By Adedapo Adesanya

The NASD Over-the-Counter (OTC) Securities Exchange expanded for the first session this week by 1.27 per cent on Wednesday, February 25.

This lifted the NASD Unlisted Security Index (NSI) above 4,000 points, with a 50.45-point addition to close at 4,025.25 points compared with the previous day’s 3,974.80 points, as the market capitalisation added N30.19 billion to close at N2.408 trillion versus Tuesday’s N2.378 trillion.

At the trading session, FrieslandCampina Wamco Nigeria Plc grew by N5.00 to trade at N100.00 per share compared with the previous day’s N95.00 per share, Central Securities Clearing System (CSCS) Plc improved by N4.18 to sell at N70.00 per unit versus N65.82 per unit, and First Trust Mortgage Bank Plc increased by 14 Kobo to trade at N1.59 per share compared with the previous day’s N1.45 per share.

However, the share price of Geo-Fluids Plc depreciated by 27 Kobo at midweek to close at N3.27 per unit, in contrast to the N3.30 per unit it was transacted a day earlier.

At the midweek session, the volume of securities went down by 25.3 per cent to 8.7 million units from 11.6 million units, the value of securities decreased by 92.5 per cent to N80.7 million from N1.2 billion, and the number of deals slipped by 33.3 per cent to 32 deals from the preceding session’s 48 deals.

At the close of business, CSCS Plc remained the most traded stock by value on a year-to-date basis with 34.1 million units exchanged for N2.0 billion, trailed by Okitipupa Plc with 6.3 million units traded for N1.1 billion, and Geo-Fluids Plc with 122.0 million units valued at N478.0 million.

Resourcery Plc ended the trading session as the most traded stock by volume on a year-to-date basis with 1.05 billion units valued at N408.7 million, followed by Geo-Fluids Plc with 122.0 million units sold for N478.0 million, and CSCS Plc with 34.1 million units worth N2.0 billion.

Economy

Investors Lose N73bn as Bears Tighten Grip on Stock Exchange

By Dipo Olowookere

The bears consolidated their dominance on the Nigerian Exchange (NGX) Limited on Wednesday, inflicting an additional 0.09 per cent cut on the market.

At midweek, the market capitalisation of the domestic stock exchange went down by N73 billion to N124.754 trillion from the preceding day’s N124.827 trillion, and the All-Share Index (ASI) slipped by 114.32 points to 194,370.20 points from 194,484.52 points.

A look at the sectoral performance showed that only the consumer goods index closed in green, gaining 1.19 per cent due to buying pressure.

However, sustained profit-taking weakened the insurance space by 3.79 per cent, the banking index slumped by 2.07 per cent, the energy counter went down by 0.24 per cent, and the industrial goods sector shrank by 0.22 per cent.

Business Post reports that 25 equities ended on the gainers’ chart, and 54 equities finished on the losers’ table, representing a negative market breadth index and weak investor sentiment.

RT Briscoe lost 10.00 per cent to sell for N10.35, ABC Transport crashed by 10.00 per cent to N6.75, SAHCO depreciated by 9.98 per cent to N139.35, Haldane McCall gave up 9.93 per cent to trade at N3.99, and Vitafoam Nigeria decreased by 9.93 per cent to N112.50.

Conversely, Jaiz Bank gained 9.95 per cent to settle at N14.03, Okomu Oil appreciated by 9.93 per cent to N1,765.00, Trans-nationwide Express chalked up 9.77 per cent to close at N2.36, Fortis Global Insurance moved up by 9.72 per cent to 79 Kobo, and Champion Breweries rose by 5.39 per cent to N17.60.

Yesterday, 1.4 billion shares worth N46.2 billion were transacted in 70,222 deals compared with the 1.1 billion shares valued at N53.4 billion traded in 72,218 deals a day earlier, implying a rise in the trading volume by 27.27 per cent, and a decline in the trading value and number of deals by 13.48 per cent and 2.76 per cent, respectively.

Fortis Global Insurance ended the session as the busiest stock after trading 193.7 million units for N152.7 million, Zenith Bank transacted 120.7 million units worth N11.1 billion, Japaul exchanged 114.8 million units valued at N407.0 million, Ellah Lakes sold 98.4 million units worth N999.2 million, and Access Holdings traded 63.1 million units valued at N1.7 billion.

Economy

Naira Extends Losing Streak, Falls to N1,356/$1 at NAFEX

By Adedapo Adesanya

A 74 Kobo or 0.05 per cent decline was recorded by the Naira against the United States Dollar in the Nigerian Autonomous Foreign Exchange Market (NAFEX) on Wednesday, February 25, trading at N1,356.11/$1 compared with the N1,355.37/$1 it was traded on Tuesday.

The Nigerian currency also further depreciated against the Pound Sterling during the session in the official market by N6.70 to settle at N1,834.96/£1 versus the preceding day’s rate of N1,828.26/£1, and against the Euro, it tumbled by N4.94 to quote at N1,598.59/€1 compared with the previous session’s N1,596.36/€1.

In the same vein, the Nigerian Naira lost N6 against the Dollar at the GTBank forex desk to close at N1,367/$1, in contrast to N1,361/$1 it was exchanged a day earlier, and in the parallel market, it traded flat at N1,365/$1.

The continuation of the decline of the local currency has been tied to the Central Bank of Nigeria (CBN) buying US Dollars from the market to slow the rapid rise of the Naira.

The apex bank bought about $189.80 million to reduce excess Dollar supply and control how fast the Naira was gaining value.

The monetary policy committee (MPC) of the CBN on Tuesday reduced interest rates by 50 basis points to 26.50 per cent from 27 per cent after inflation eased in January 2026, a move analysts say is the best not to unsettle FX market, especially the Foreign Portfolio Investors (FPI_ inflows which have anchored much of the recent supply and weakened the recently restored monetary credibility.

“The 50bps move therefore provides a clear directional signal while still keeping overall monetary conditions restrictive, indicating the start of a shallow, data-dependent easing cycle rather than a radical shift to accommodative policy,” said Mr Kayode Akindele, CEO, Coronation Capital and Head, Coronation Research in an email.

As for the cryptocurrency market, benchmarked tokens rebounded in double digits, driven by bearish positioning and thin liquidity rather than by clear fundamental catalysts, with Cardano (ADA) growing by 16.2 per cent to $0.3015, and Solana (SOL) appreciating by 12.3 per cent to $88.66.

Further, Ethereum (ETH) surged 11.9 per cent to $2,076.66, Litecoin (LTC) expanded by 11.5 per cent to $57.15, Dogecoin (DOGE) rose by 11.5 per cent to $0.1025, Binance Coin (BNB) advanced by 7.6 per cent to $629.76, Ripple (XRP) jumped 7.2 per cent to $1.45, and Bitcoin (BTC) added 6.4 per cent to sell for $68,136.72, while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) remained unchanged at $1.00 apiece.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn