Economy

Top 5 Gift Card Trading Apps in Nigeria & Ghana

Selling gift cards online has become one of the fastest ways to turn unused cards into cash in Nigeria and Ghana. If you give someone a gift card they don’t need or can’t use, ŵdbest believe they’re looking for a gift card trading platform to sell it on.

When trading gift cards for Cedis or Naira, using the right app can make all the difference. There’s a myriad of gift card trading platforms out there claiming to be the best, but only a few actually live up to their claims. It makes it confusing to know which to trust.

That’s why this article exists.

Instead of guessing or testing random apps, we’ve broken down the top 5 gift card trading apps that Nigerians and Ghanaians actually use today. These platforms are fast, secure, and reliable.

Let’s walk through the best platforms you can use right now.

Best 5 Apps to Trade Gift Cards in Nigeria and Ghana

The best gift card trading apps in Nigeria and Ghana are Nosh, Tercescrow, Hook, Beekle, CardNJ.

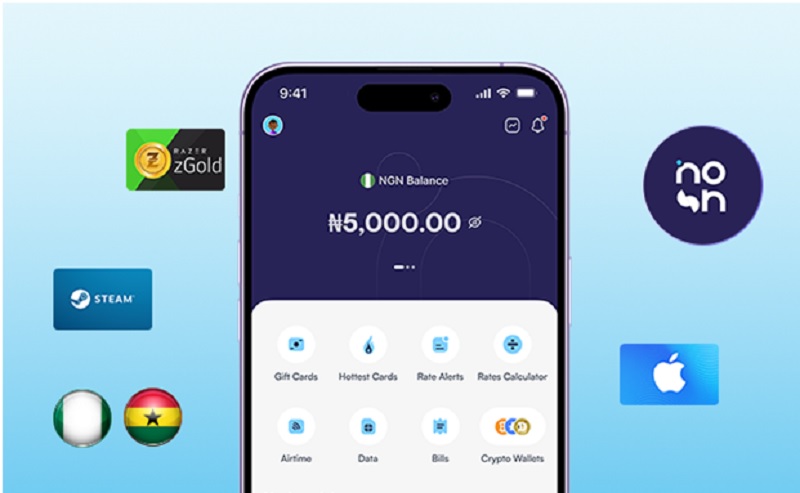

1. Nosh

It would be literally impossible to talk about leading platforms in the gift card trading industry without mentioning Nosh. It is one of the most trusted apps for anyone who wants to sell gift cards in Nigeria or exchange gift cards in Ghana.

Nosh has the best gift card rates in the market and transactions are processed very fast. With Nosh, you don’t have to wait hours to verify and trade your gift card. Payout is almost instant and you can withdraw to your bank or Momo account in seconds.

The moment you open the Nosh app, it feels different; clean interface, clear instructions, and no confusion. Even if it’s your first time trading, the process is straightforward. You simply enter the gift card details like the category, subcategory and amount, upload an image if it’s a physical card, and you’ll see the rate in real time. Once you confirm your trade, you’ll receive payment immediately.

Nosh accepts trading a wide range of gift cards including Apple, Steam, Amazon, Razer Gold, and many more. Additionally, with Nosh you can sell crypto, book flights, pay TV, cable & internet bills, top up data and airtime, and fund your bet wallet. The app is available on iOS, Android and via the web.

2. Tercescrow

Tercescrow is a solid gift card trading app if you want a simple and smooth trading experience. The app has an easy to use interface, good rates and processes transactions fast. You can trade a wide range of gift cards on the app, and get your payment on time without any delays.

Asides selling gift cards, you can buy gift cards as well. The platform is secure, and available for both iOS and Android devices.

3. Hook

Hook is another growing platform in the gift card trading space. The app supports trading several popular gift cards, and offers competitive gift card rates. The interface is clean and the platform itself is secure and easy to use. The app is available on both App store and Google Play store.

Hook’s smooth trading flow is one of its strengths. You upload your card details, wait for verification, and get paid once as soon as your card is verified. With this app, you can quickly and easily exchange your gift cards for Naira or Cedis.

4. Beekle

Another solid app to sell gift cards in Nigeria or Ghana is Beekle. This app appeals to users who are heavy on user experience. The platform is clean, visually simple, and easy to navigate. It supports most popular gift cards and offers good trading rates that change based on market conditions.

The process of trading gift cards on Beekle is simple. Once you upload your card details, you see how much you’ll be paid for it and you can then trade. After trading, the Naira or Cedis equivalent of your gift card will be credited to you. You can use Beekle on both iOS and Android devices.

5. CardNJ

CardNJ is another platform you can use to convert gift cards to Naira or Cedis. It’s a great option if you want an easy to use platform with seamless trading experience. The app supports a wide variety of gift cards and payouts are made fast.

CardNJ keeps everything simple: upload your card, confirm your trade, and get paid. The app is available on both App Store and Google play store.

Tips for Choosing a Gift Card Trading App to Use

Choosing the right app to sell your gift cards for Naira or Cedis can save you time, money, and stress. Here’s how to pick a gift card trading platform in Nigeria or Ghana that you can trust:

1. Start with the rates

Good rates make a big difference because the value of your gift card changes from app to app. Always compare rates before committing to a gift card trading platform, and choose the one with the best rates.

Nosh, for example, has an online gift card rate calculator you can use to check how much your gift card is worth, without going into the app.

2. Consider payment speed

Nobody wants to wait hours to get paid. A good trading app should process your card and send your money within minutes. If you notice many reviews or social media comments saying payments take too long, that’s a red flag.

3. Look at security

Since gift card trading involves money, you need an app that takes security seriously. Check if the platform is registered, verified, active on social platforms, and has Two-Factor authentication (2FA). Your information should be protected, trades should be handled securely, and funds should be safe.

4. Check customer support

Even the best apps can have hiccups. What matters is how fast support responds. Look for platforms with active customer service. Do they have a live chat option? Is there an hotline you can call? Is there a dedicated email for complaints? Do they respond on social media?

Apps like Nosh are known for 24/7 customer support and fast replies, which helps a lot if anything happens.

5. Read the reviews

Before downloading any app, take a moment to read what other users say. Reviews tell you what the app does well and where it struggles. If an app has too many complaints about payment issues, slow verification, or low rates, avoid it.

Frequently Asked Questions about Gift Card Trading Apps

- What is the best platform to trade gift cards in Nigeria?

Nosh is the best platform to sell gift cards in Nigeria because of its high rates, fast payments, strong security, and reliable customer support. Other great options include Beekle, Tercescrow, Hook and CardNJ.

- What gift card trading platform is the best in Ghana?

Nosh is the top choice for trading gift cards in Ghana. It offers fast payouts, high gift card rates and a seamless trading experience. Other good alternatives are Tercescrow, Hook, Beekle and CardNJ.

- What is the best gift card trading app in Nigeria with high rates?

Nosh consistently offers the best and highest rates for a wide variety of gift cards in Nigeria. The platform is transparent and you can check the rate of any gift card using the rate calculator.

- What gift cards can you sell in Ghana?

You can sell a wide variety of gift cards in Ghana on platforms like Nosh and Tercescrow. Popularly traded gift cards include Apple, Steam, Google Play, Amazon, Walmart, Sephora, etc.

- How can I sell gift cards in Nigeria and Ghana?

You can use Nosh to trade gift cards in Nigeria or Ghana. Download the Usenosh app, create an account, enter your gift card details, confirm your trade, and receive your payment in minutes.

Conclusion

With the right platform, you can convert your gift cards to cash easily and safely, whether you’re in Nigeria or Ghana.

From this list, Nosh remains the most reliable option thanks to its fast payments, high rates, excellent customer support, and easy interface. Other apps like Tercescrow, Hook, Beekle, and CardNJ also offer solid choices depending on your needs.

If you want smooth trades, instant payments, and peace of mind, you now know the best apps to use.

Economy

Unlisted Securities Shed 0.21% on Profit-taking

By Adedapo Adesanya

It was a bad day for the NASD Over-the-Counter (OTC) Securities Exchange on Monday, February 23, after it slumped 0.21 per cent at the close of business.

This pullback was influenced by profit-taking by investors in four securities, which overpowered the gains recorded by six others.

According to data, Central Securities Clearing System (CSCS) Plc dipped N3.79 to sell at N67.21 per unit compared with the previous N71.00 per unit, UBN Property Plc lost 13 Kobo to close at N1.98 per share versus N2.11 per share, Resourcery Plc fell 3 Kobo to 36 Kobo per unit from 39 Kobo per unit, and Geo-Fluids Plc depreciated 1 Kobo to close at N3.31 per share versus N3.32 per share.

As a result, the bourse’s market capitalisation went down by N5.04 billion to N2.384 trillion from N2.389 trillion, and the NASD Unlisted Security Index (NSI) decreased by 8.42 points to 3,985.90 points from 3,994.32 points.

Business Post reports that NIPCO Plc rose N23.00 to N253.00 per unit from N230.00 per unit, MRS Oil Plc added N14.50 to close at N214.50 per share versus N200.00 per share, FrieslandCampina Wamco Nigeria Plc grew by N1.85 to N93.40 per unit from N91.55 per unit, NASD Plc soared 40 Kobo to N51.28 per share from N50.88 per share, First Trust Mortgage Bank Plc advanced by 12 Kobo to N1.32 per unit from N1.20 per unit, and Food Concepts Plc improved by 6 Kobo to N3.76 per share from N3.70 per share.

As for the trading data, the volume of securities jumped 99.7 per cent to 7.3 million units from 3.7 million units, but the value depleted by 26.8 per cent to N61.8 million from N84.5 million, and the number of deals slipped 7.1 per cent to 39 deals from 42 deals.

At the close of trades, CSCS Plc was the most active stock by value (year-to-date) with 32.9 million units sold for N1.9 billion, followed by Geo-Fluids Plc with 120.6 million units valued at N473.4 million, and Resourcery Plc with 1.05 billion units exchanged for N408.7 million.

Resourcery Plc closed the session as the most active stock by volume (year-to-date) with 1.05 billion units worth N408.7 million, followed by Geo-Fluids Plc with 120.6 million units valued at N473.4 million, and CSCS Plc with 32.9 million units traded for N1.9 billion.

Economy

Customs Street Opens Week Bullish After 0.66% Surge

By Dipo Olowookere

The Nigerian Exchange (NGX) Limited ended the first trading session of the week on a positive note after it chalked up 0.66 per cent on Monday.

The gains recorded yesterday were boosted by the 3.42 per cent rise by the insurance sector, the 1.44 per cent surge by the banking index, and the 1.30 per cent leap by the industrial goods counter. They offset the 0.20 per cent loss posted by the energy sector and a 0.11 per cent decline suffered by the consumer goods industry.

Consequently, the All-Share Index (ASI) closed higher by 1,273.78 points to 196,263.55 points from 194,989.77 points, and the market capitalisation appreciated by N805 billion to N125.969 trillion from N125.164 trillion.

Business Post observed that investor sentiment turned bearish during the session after Customs Street ended with 34 price losers and 33 price gainers, representing a negative market breadth index.

Fortis Global Insurance gained 10.00 per cent to trade at 66 Kobo, Okomu Oil expanded by 10.00 per cent to N1,605.60, Fidson rose by 9.90 per cent to N95.50, NPF Microfinance Bank rose by 9.89 per cent to N6.89, and Infinity Trust Mortgage Bank jumped 9.84 per cent to N17.30.

On the flip side, The Initiates weakened by 10.00 per cent to N17.55, Deap Capital deflated by 9.97 per cent to N6.86, LivingTrust Mortgage Bank went down by 9.92 per cent to N5.90, Multiverse lost 9.92 per cent to close at N22.70 per cent, and Ellah Lakes shrank by 9.77 per cent to N11.55.

Yesterday, market participants traded 1.3 billion shares worth N31.5 billion in 95,091 compared with the 820.5 million shares valued at N28.3 billion in 63,507 deals last Friday, indicating an increase in the trading volume, value, and number of deals by 58.44 per cent, 11.31 per cent, and 49.73 per cent apiece.

Japaul ended the session as the busiest stock after selling 474.0 million units worth N2.0 billion, Chams traded 51.5 million units for N221.3 million, Jaiz Bank exchanged 48.3 million units for N566.9 million, Secure Electronic Technology transacted 46.3 million units worth N68.8 million, and Mutual Benefits sold 42.5 million units valued at N242.5 million.

Economy

Naira Further Crashes to N1,349/$1 at Official Market

By Adedapo Adesanya

The first trading day in the currency market in Nigeria ended bearish for the Naira as its value further weakened against the US Dollar in the Nigerian Autonomous Foreign Exchange Market (NAFEX) on Monday by N2.92 or 0.22 per cent to N1,349.24/$1 from the N1,346.32/$1 it was traded last Friday.

Also in the spot market, the Nigerian currency depreciated against the Pound Sterling by N6.62 during the trading day to close at N1,821.87/£1 versus the preceding session’s N1,815.25/£1, and lost N6.80 on the Euro to settle at N1,591.42/€1, in contrast to the previous rate of N1,584.62/€1.

At the GTBank forex desk, the Nigerian Naira crashed against the greenback yesterday by N1 to quote at N1,357/$1 versus the preceding session’s closing value of N1,356/$1, but in the black market, the Naira appreciated by N5 to close at N1,365/$1 compared with the preceding trading day’s N1,370/$1.

The Naira slide came amid renewed pressure as weekly inflows declined, as Bureaux De Change (BDC) operators were unable to purchase Dollars from banks two weeks after the Central Bank of Nigeria (CBN) reopened the official FX Market window to them.

It had been expected that BDCs would help to further deflate the parallel market premium, but according to reports, BDC operators had yet to commence FX purchases from commercial banks, two weeks after the apex bank said legitimate agents can access up to $150,000 from the banks.

There were no FX inflows from the CBN during the past week, according to a report by the research department of Coronation Merchant Bank.

Meanwhile, Nigeria’s external reserves, which provide the CBN with firepower to support the naira, rose to $48.77 billion as of February 19, 2026.

Meanwhile, the cryptocurrency market was in the red as a broader risk-off shift tied to an emerging “AI scare trade” in equities is weighing on crypto markets.

This is leading traders to sell, while the sharp liquidation events that typically attract dip buyers have seen no such move recently, with Bitcoin (BTC) down by 3.2 per cent to $62,901.86.

Further, Ethereum (ETH) depreciated by 2.5 per cent to $1,821.13, Cardano (ADA) slid 1.9 per cent to $0.2571, Litecoin (LTC) went down by 1.9 per cent to $50.45, Solana (SOL) shrank 1.8 per cent to $76.54, Dogecoin (DOGE) declined by 1.7 per cent to $0.0912, Ripple (XRP) slumped 1.2 per cent to $1.32, and Binance Coin (BNB) lost 0.6 per cent to sell for $589.88, while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) closed flat at $1.00 each.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn