Economy

Trade Talks Uncertainty Weigh on Wall Street

Investors Hub

The major U.S. index futures are currently pointing to a lower opening on Monday, with stocks likely to give back ground following the rally seen last Friday.

Lingering concerns about the ongoing U.S.-China trade war may weigh on the markets ahead of the next round of high-level trade talks in Washington later this week.

Ahead of the talks, scheduled to begin on Thursday, a report from Bloomberg News said Chinese officials are signaling they?re increasingly reluctant to agree to the broad trade deal being pursued by President Donald Trump.

Citing people familiar with the discussions, Bloomberg said senior Chinese officials have indicated the range of topics they?re willing to discuss has narrowed considerably.

An offer from Chinese Vice Premier Liu He would purportedly not include reforming Chinese industrial policy or government subsidies.

The upcoming negotiations come as the trade war continues to hang over the economy, with a survey by the National Association for Business Economics showing 53 percent of economists see trade policy as the key downside risk to the economy.

The NABE said four out of five panelists believe that risks to the economic outlook are weighted to the downside, an increase from the 60 percent who held this view in June.

?The panel turned decidedly more pessimistic about the outlook over the summer, with 80% of participants viewing risks to the outlook as tilted to the downside,? said Survey Chair Gregory Daco, chief U.S. economist at Oxford Economics.

He added, ?The rise in protectionism, pervasive trade policy uncertainty, and slower global growth are considered key downside risks to U.S. economic activity.?

Following the significant rebound seen over the course of the trading day last Thursday, stocks showed another substantial move to the upside during trading last Friday. With the rally, the major averages further offset the steep losses posted last Tuesday and Wednesday.

The major averages finished the session just off their best levels of the day. The Dow soared 372.68 points or 1.4 percent to 26,573.72, the Nasdaq surged up 110.21 points or 1.4 percent to 7,982.47 and the S&P 500 spiked 41.38 points or 1.4 percent to 2,952.01.

For the week, the major averages turned in a mixed performance. While the Nasdaq rose by 0.5 percent, the S&P 500 fell by 0.3 percent and the Dow slid by 0.9 percent.

The rally on Wall Street came following the release of a closely watched Labor Department report showing weaker than expected job growth but an unexpected drop in the unemployment rate to a nearly 50-year low.

The mixed data seemed to serve the dual purpose of reinforcing expectations the Federal Reserve will continue cutting interest rates while at the same offsetting concerns about a potential recession.

The report said non-farm payroll employment rose by 136,000 jobs in September compared to economist estimates for an increase of about 145,000 jobs.

Meanwhile, the increases in employment in July and August were upwardly revised to 166,000 jobs and 168,000 jobs, respectively, reflecting the addition of 45,000 more jobs than previously reported.

The average monthly job growth has still slowed from 223,000 jobs per month in 2018 to 161,000 jobs per month so far in 2019.

The Labor Department also said the unemployment rate fell to 3.5 percent in September from 3.7 percent in August. Economists had expected to unemployment rate to remain unchanged.

With the unexpected decrease, the unemployment rate dropped to its lowest level since hitting a matching rate in December of 1969.

The unexpected drop in the unemployment rate came as a 391,000-person jump in the household survey measure of employment more than offset an 117,000-person increase in the size of the labor force.

Even with the unemployment rate hitting a nearly 50-year low, the report said average hourly employee earnings edged down by a penny to $28.09 in September after rising by 11 cents in August.

Compared to the same month a year ago, average hourly earnings were up by 2.9 percent in September, reflecting a notable slowdown from the 3.2 percent increase in August.

Citing headwinds from weaker global growth, trade uncertainty and the strong U.S. dollar, ING Chief International Economist James Knightley expects job growth to average closer to 120,000 for the rest of the year.

“This suggests pay growth is unlikely to accelerate markedly from here and with inflation picking up, the real wage growth story may not be as positive for spending power,” Knightley said. “All in all, it looks as though the Fed will need to step in with more policy easing to support the economy.”

Stocks saw further upside in afternoon trading after Fed Chairman Jerome Powell described the U.S. economy as “in a good place,” and said it is the central bank’s job to “keep it there as long as possible.”

Gold stocks moved sharply higher over the course of the trading session, driving the NYSE Arca Gold Bugs Index up by 2.1 percent. The rally by gold stocks came despite a modest decrease by the price of the precious metal.

Significant strength also emerged among semiconductor stocks, with the Philadelphia Semiconductor Index surging up by 1.9 percent.

Financial, housing, software, and healthcare stocks also saw considerable strength amid broad based buying interest on Wall Street.

Economy

Subscription for FGN Savings Bonds Opens for March 2026 at 13.9%

By Aduragbemi Omiyale

The Debt Management Office (DMO) has asked retail investors interested in investing in the FGN savings bonds to begin to talk to their financial advisers.

This is because subscription for the retail bonds for March 2026 has commenced and will close on Friday, March 6, according to a circular issued by the agency on Monday.

The debt office is selling two tenors of the debt instrument, with the shorter note maturing in two years’ time and the longer maturing a year later.

Details of the notice showed that the two-year paper is being offered at a coupon of 12.906 per cent, and the three-year paper at 13.906 per cent.

Both notes are sold at a unit price of N1,000, with a minimum subscription of N5,000 and in multiples of N1,000 thereafter, subject to a maximum subscription of N50 million. They can be purchased via approved stockbroking firms in Nigeria.

The FGN savings bond qualifies as a security in which trustees may invest under the Trustee Investment Act. It also serves as government securities within the meaning of the Company Income Tax Act (CITA) and the Personal Income Tax Act (PITA) for tax exemption for pension funds, amongst other investors.

It can be used as a liquid asset for liquidity ratio calculation for banks, and is listed on the Nigerian Exchange (NGX) Limited for trading at the secondary market.

The bond is backed by the full faith and credit of the Federal Government of Nigeria (FGN) and charged upon the general assets of the country.

Economy

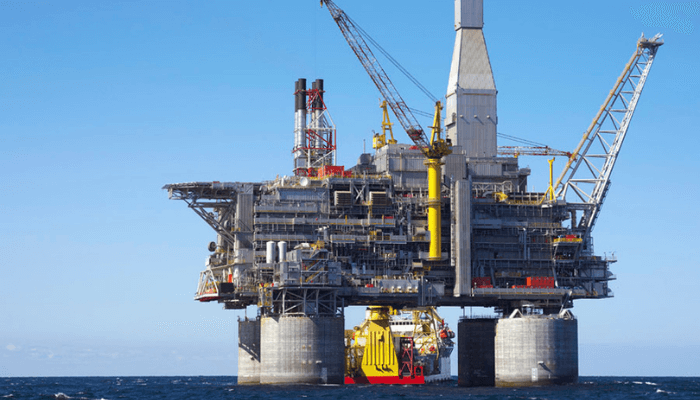

Nigeria Splits OPL 245 into Four Blocks for Eni, Shell

By Adedapo Adesanya

Nigeria has broken up the OPL 245 oil block into four new assets to be operated by Eni and Shell, potentially settling the future of the field at the centre of one of the oil industry’s biggest historic corruption trials.

According to Reuters, the agreement clears the way for the development of OPL 245, one of Nigeria’s biggest deepwater reserves that has remained untapped for almost three decades amid overlapping lawsuits in multiple countries.

The final contracts are expected to be signed starting Monday, the report said, citing a source familiar with the situation.

The Nigerian government had signalled for years that it was keen to find a solution that would bring the block into production. The source wished to remain anonymous as they are not authorised to comment on government policy before an official announcement.

Located in the Niger Delta’s deepwaters, the field has languished since its initial award in 1998 to Malabu Oil and Gas, a shadowy firm controlled by Mr Dan Etete, Nigeria’s oil minister at the time. The block is estimated to hold up to 9 billion barrels of oil equivalent in reserves—enough to rival Nigeria’s entire proven reserves if fully developed.

Mr Etete controversially awarded the lucrative licence to his own company for a nominal $20 million fee, sparking immediate controversy over conflicts of interest.

The saga escalated in 2011 when Malabu sold its rights to a Shell-Eni joint venture for $1.3 billion.

Italian and Nigerian prosecutors alleged that over $1 billion of that sum was siphoned off through bribes to politicians, middlemen, and Mr Etete himself, including hefty payments to then-President Goodluck Jonathan’s associates.

The two European energy giants and some of their former and current executives, including Eni CEO, Mr Claudio Descalzi, faced trial in Italy but all were acquitted in 2021, having denied all wrongdoing.

Shell and Eni have consistently denied wrongdoing, insisting the payments complied with due diligence.

The anti-graft agency, the Economic and Financial Crimes Commission (EFCC), has pursued parallel probes, recovering over $200 million in frozen funds, but progress stalled amid political shifts.

Operations at the Nigerian oil block have been halted for more than a decade by a series of trials and competing legal claims.

In 2023, the federal government withdrew civil claims totalling $1.1 billion against Eni, ending the long battle.

Economy

Dangote Refinery, NNPC Raise Petrol Pump Price by N100

By Modupe Gbadeyanka

The price of Premium Motor Spirit (PMS), otherwise known as petrol, has been increased by at least N100 per litre at the pump.

This followed the recent increase in the price of crude oil in the global market as a result of the bombardment of Iran by the United States and Israel over the weekend.

The air strikes killed the Supreme Leader of Iran, Mr Ayatollah Ali Khamenei, and several others.

Iran has responded by firing missiles at US facilities in some Gulf countries, including Saudi Arabia, Qatar, Kuwait, Bahrain, the UAE, and others.

Crude oil prices rose to about $80 per barrel on the market from about $70 per barrel before the Middle East crisis.

Oil marketers in Nigeria have responded to the tension and have raised the prices of petroleum products.

At most MRS Oil retail stations in Lagos, the new price notice showed an increase of about N100 per litre.

As of Monday, the price of PMS was N837 per litre, but on Tuesday morning, it had changed to N938 per litre, while at NNPC retail stations, it was N930 per litre instead of the previous N830 per litre.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn