Economy

US Set To Return $458m Abacha Loot

By Modupe Gbadeyanka

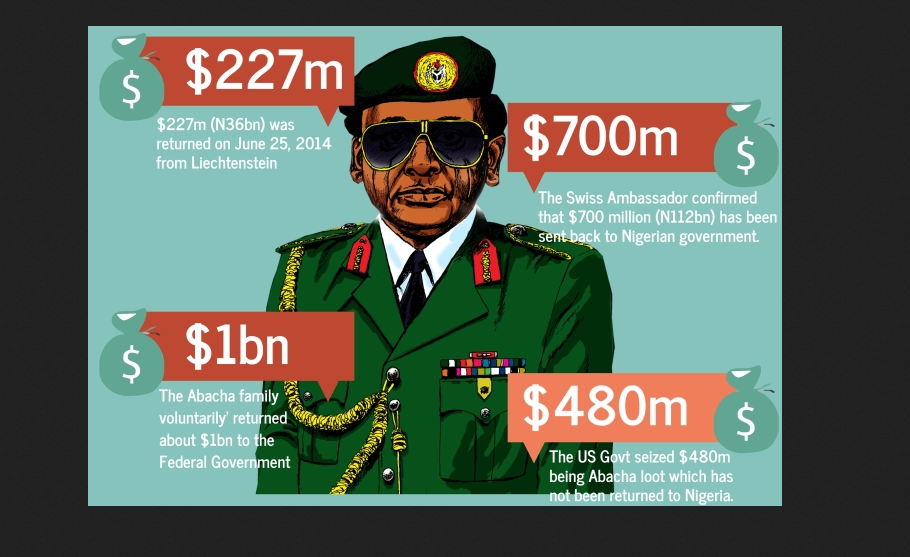

Special Adviser, Media and Publicity to the Attorney General of the Federation (AGF) and Minister of Justice, Alhaji Abubakar Malami, Comrade Salihu Othman Isah, has disclosed that United States of America is set to return to Nigeria, some public funds stashed in that country under the Sani Abacha administration valued at $458 million.

Comrade Isah made this known on Sunday.

According to him, in 2013, as part of the US’s Kleptocracy Asset Recovery Initiative, the US Department of Justice commenced a forfeiture proceeding to confiscate approximately $550 million that had been corruptly obtained by late General Abacha and his associates (the “Abacha Case”).

He disclosed that a portion of the funds valued at $458m had now been forfeited to the United States, adding that on December 17, 2015, the United States District Court for the District of Columbia entered final judgment forfeiting certain Abacha assets valued at $458 million.

He said the forfeiture proceeding on those assets had been concluded and the forfeited assets were ripe for repatriation to Nigeria.

Comrade Isah added that a US-Nigerian lawyer, Godson Nnaka, had filed an appeal against the judgment of forfeiture claiming to be entitled to a portion of the assets as compensation for legal services allegedly rendered to Nigeria.

The US however said the forfeited assets were not located in the United States and that only upon disposition of the appeal would it then have a final judgment upon which it could seek the retrieval of the forfeited assets which were frozen in multiple foreign jurisdictions and return same to Nigeria.

Economy

Naira Further Falls to N1.355/$1 at Official FX Market

By Adedapo Adesanya

The woes of the Nigerian Naira in the Nigerian Autonomous Foreign Exchange Market (NAFEX) further continued on Tuesday, February 24.

During the session, the domestic currency weakened against the United States Dollar by N6.13 or 0.45 per cent to N1,355.37/$1 from the N1,349.24/$1 it was traded in the previous trading day.

The local currency also moved southwards on Tuesday in the same market window against the Pound Sterling after it lost N6.39 to trade at N1,828.26/£1 versus Monday’s closing price of N1,821.87/£1, and against the Euro, it depreciated by N4.94 to close at N1,596.36/€1, in contrast to the preceding session’s N1,591.42/€1.

Similarly, the Naira crashed against the US Dollar at the GTBank FX counter yesterday by N4 to settle at N1,361/$1 versus the N1,357/$1 it was exchanged a day earlier, and at the parallel market, it remained unchanged at N1,365/$1.

The fall of the Naira coincided with the Central Bank of Nigeria (CBN) buying US Dollars from the market to slow down the rapid rise of the nation’s legal tender. Latest information showed that last week, the apex bank bought about $189.80 million to reduce excess Dollar supply and control how fast the Naira was gaining value.

The rationale was to keep foreign investors from pulling their money out of Nigeria’s fixed-income market. If they sell their investments, it could increase demand for US Dollars and lead to more Dollar outflow from the economy.

Meanwhile, Mr Yemi Cardoso, the Governor of the CBN, said Nigeria’s gross external reserves have risen to $50.45 billion – the highest level in 13 years, while speaking after the 304th meeting of the monetary policy committee (MPC) of the CBN held on February 23 and 24.

The committee also reduced interest rates by 50 basis points to 26.50 per cent from 27 per cent after inflation eased in January 2026.

As for the cryptocurrency market, losses on concerns by embattled software businesses that artificial intelligence (AI) tools will destroy their business models continued and overturned some rallies on Tuesday.

Binance Coin (BNB) lost 2.1 per cent to sell for $585.41, Cardano (ADA) dropped 1.8 per cent to trade at $0.2595, Dogecoin (DOGE) went down by 1.5 per cent to $0.0920, Bitcoin (BTC) shrank by 1.2 per cent to $64,098.80, Litecoin (LTC) slipped 1.1 per cent to $51.31, Ripple (XRP) slumped 0.6 per cent to $1.35, and Ethereum (ETH) declined by 0.4 per cent to $1,857.75.

However, Solana (SOL) appreciated by 0.2 per cent to sell at $78.95. while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) traded flat at $1.00 each.

Economy

Oil Slides as Iran Signals Willingness to Seal US Nuclear Deal

By Adedapo Adesanya

Oil depreciated on Tuesday after Iran said it was prepared to take any necessary steps to clinch a deal with the United States ahead of nuclear talks later this week, with Brent futures shedding 72 cents or 1.0 per cent to trade at $70.77 per barrel, and the US West Texas Intermediate (WTI) futures declining by 68 cents or 1.0 per cent to $65.63 a barrel.

Iran, the third-biggest crude producer in the Organisation of the Petroleum Exporting Countries (OPEC), and the US will hold a third round of nuclear talks on Thursday in Geneva, Switzerland.

America wants Iran to give up its nuclear programme, which the country has denied trying to develop an atomic weapon.

Meanwhile, Iran’s deputy foreign minister said on Tuesday that it was ready to take any necessary steps to reach a deal with the US.

However, the US State Department is pulling out non-essential government personnel and their families from its embassy in Beirut, Lebanon, as concerns mount about the risk of a military conflict with Iran.

The US has deployed a vast naval force near the Iranian coast ahead of possible strikes on the Islamic Republic. The American president, on February 19, said he was giving Iran about 10 to 15 days to make a deal.

Also, the US began collecting a temporary new 10 per cent global import tariff on Tuesday, but President Trump’s administration was working to increase it to 15 per cent, a development that has led to confusion after the country’s Supreme Court ruling.

On the supply front, trading houses and buyers of Venezuelan oil have chartered the first very large crude carriers to export from the South American country since a supply deal began between the US and Venezuela. This is set to speed up shipments from March while boosting deliveries to India.

The European Commission will submit a legal proposal to permanently ban Russian oil imports on April 15.

The American Petroleum Institute (API) estimated that crude oil inventories in the United States rose by 11.4 million barrels in the week ending February 20, after falling by 609,000 barrels in the week prior. Official data from the US Energy Information Agency (EIA) will be released later on Wednesday.

Economy

Nigeria to Export New Crude Grade Cawthorne in March

By Adedapo Adesanya

The Nigerian National Petroleum Company (NNPC) Limited is set to commence export of a new light, sweet crude grade known as Cawthorne from March 2026.

According to a report by Reuters, an NNPC spokesperson confirmed the development, describing it as part of efforts to increase output and consolidate Nigeria’s recent recovery in crude oil production.

The move aligns with Nigeria’s broader strategy to boost production after years of constraints caused by pipeline vandalism, crude theft, and unrest in oil-producing regions.

This follows the launch of two other new grades, Obodo in 2025 and Utapate in 2024, Nigeria, whic,h as Africa’s top oil exporter, seeks to strengthen its standing within the Organisation of the Petroleum Exporting Countries and its allies (OPEC+)

Cawthorne crude is scheduled for export in the third week of March and has an API gravity of 36.4, making it similar in quality to Nigeria’s Bonny Light, which is prized for high petrol and diesel yields.

According to Reuters, citing a trading source, the state oil national company issued a tender last week for cargo loading between March 24 and 25.

Analysts at Kpler noted that the new grade is expected to be exported via the Floating Storage and Offloading (FSO) vessel Cawthorne, which has a storage capacity of about 2.2 million barrels. The vessel is designed to enhance transportation and production from Oil Mining Lease (OML) 18 and nearby assets in the Eastern Niger Delta.

Kpler estimates that, based on storage capacity, Cawthorne could increase Nigeria’s crude and condensate output from roughly 1.65 million barrels per day to around 1.7 million barrels per day for the remainder of the year.

Nigeria’s crude oil production recently dropped from the OPEC+ quota of 1.5 million barrels per day, with output at 1.48 million barrels per day recorded in January, according to OPEC data.

Beyond increasing Nigeria’s crude offerings to the international market, the introduction of Cawthorne could also attract buyers seeking specific light, sweet crude qualities, buoy foreign exchange earnings, which would help strengthen government revenue and ease borrowing needs.

New crude grades are typically differentiated by sulfur content, API gravity, and production source, enabling producers to target specific refinery configurations and market segments.

In November 2024, NNPC officially launched the Utapate crude oil blend in the international market, describing it as a milestone for Nigeria’s export profile.

Earlier in July 2024, NNPC and its partner, Sterling Oil Exploration & Energy Production Company (SEEPCO), lifted the first 950,000-barrel cargo of Utapate crude, which was shipped to Spain.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn